Answered step by step

Verified Expert Solution

Question

1 Approved Answer

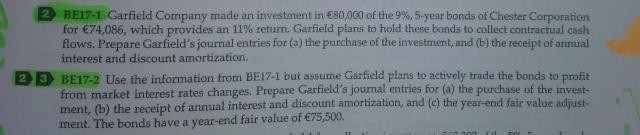

2 BE17-1 Garfield Company made an investment in 80,000 of the 9%, 5year bonds of Chester Corporation for 74,086, which provides an 11% return. Garfield

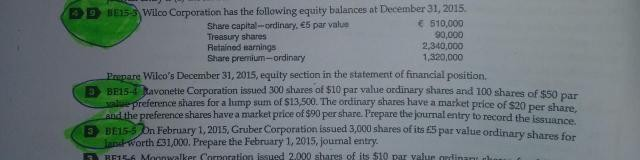

2 BE17-1 Garfield Company made an investment in 80,000 of the 9%, 5year bonds of Chester Corporation for 74,086, which provides an 11% return. Garfield plans to hold these bonds to collect contractual cash flows. Prepare Garfield's journal entries for (a) the purchase of the investment, and (b) the receipt of annual interest and discount amortization, 2 D BE17-2 Use the information from BE17-1 but assume Garfield plans to actively trade the bonds to profit from market interest rates changes. Prepare Garfield's journal entries for (a) the purchase of the invest- ment, (b) the receipt of annual interest and discount amortization, and the year-end fair value adjust- ment. The bonds have a year-end fair value of 75,500. DD 155 Wilco Corporation has the following equity balances at December 31, 2015. Share capital --ordinary, 5 par value 510,000 Treasury shares 90,000 Retained marnings 2,300,000 Share premium-ordinary 1,320,000 Prepare Wilco's December 31, 2015, equity section in the statement of financial position. BE15-4 havonette Corporation issued 300 shares of slopar value ordinary shares and 100 shares of $50 par walua preference shares for a lump sum of $13.500. The ordinary shares have a market price of $20 per share, and the preference shares have a market price of $90 per share. Prepare the journal entry to record the issuance. E1-5 Pon February 1, 2015, Gruber Corporation issued 3,000 shares of its 5 par value ordinary shares for lasworth 31,000. Prepare the February 1, 2015, journal entry BETE Mornwalker Caracation issued 2.000 stures of its 510 par value adina

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started