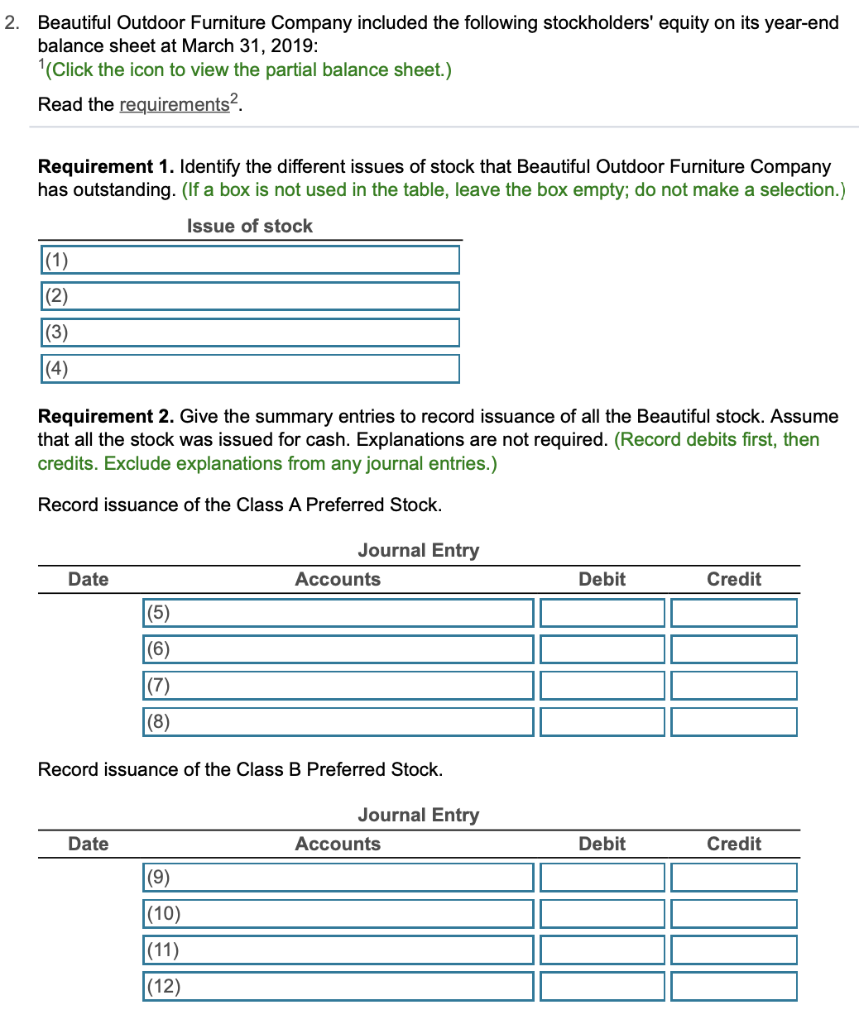

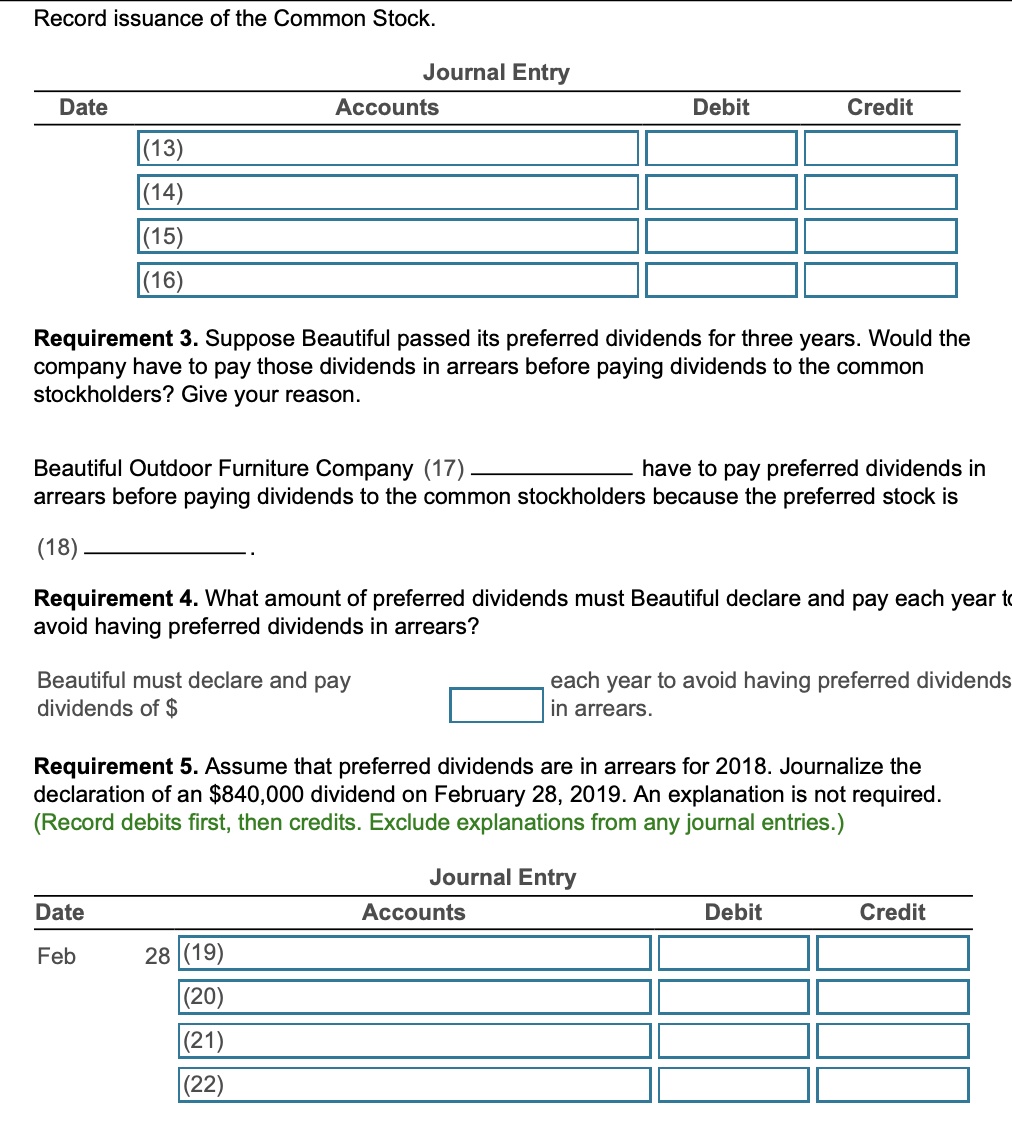

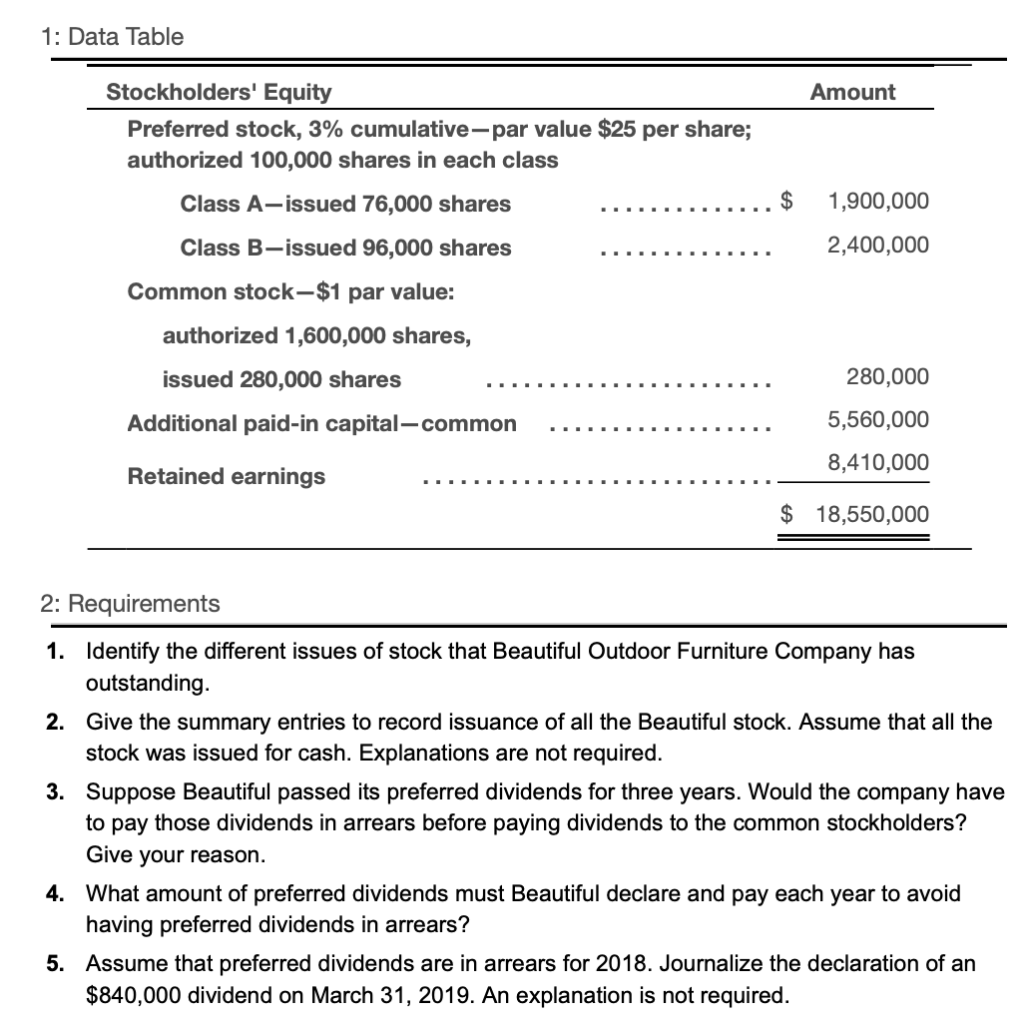

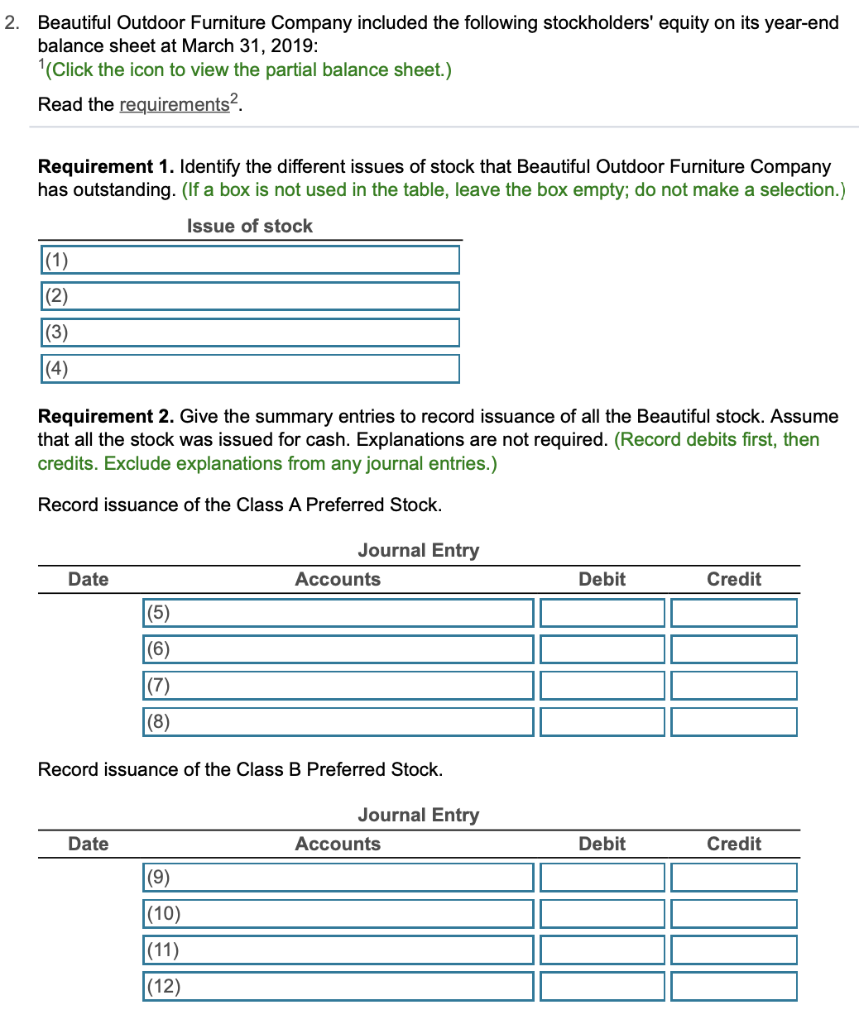

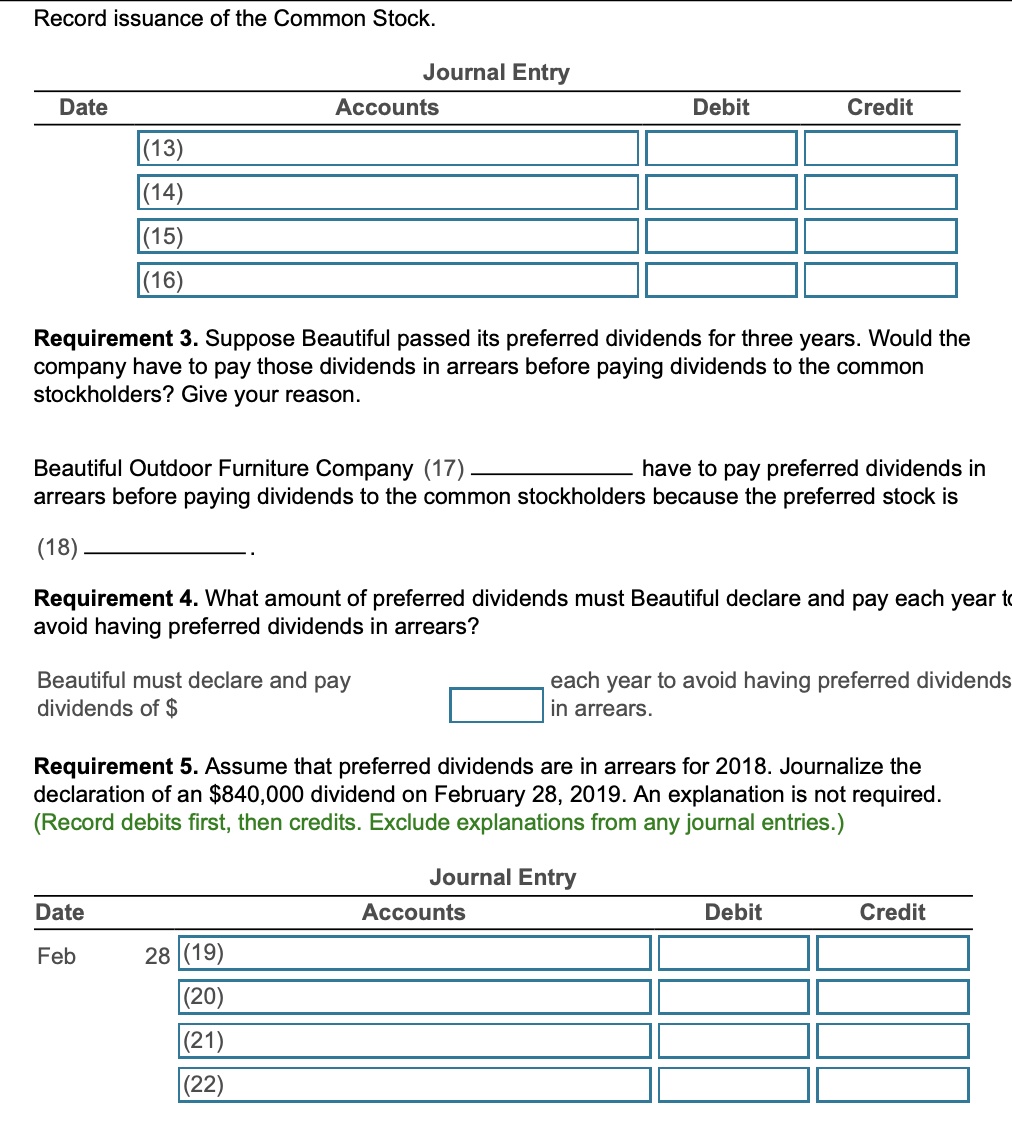

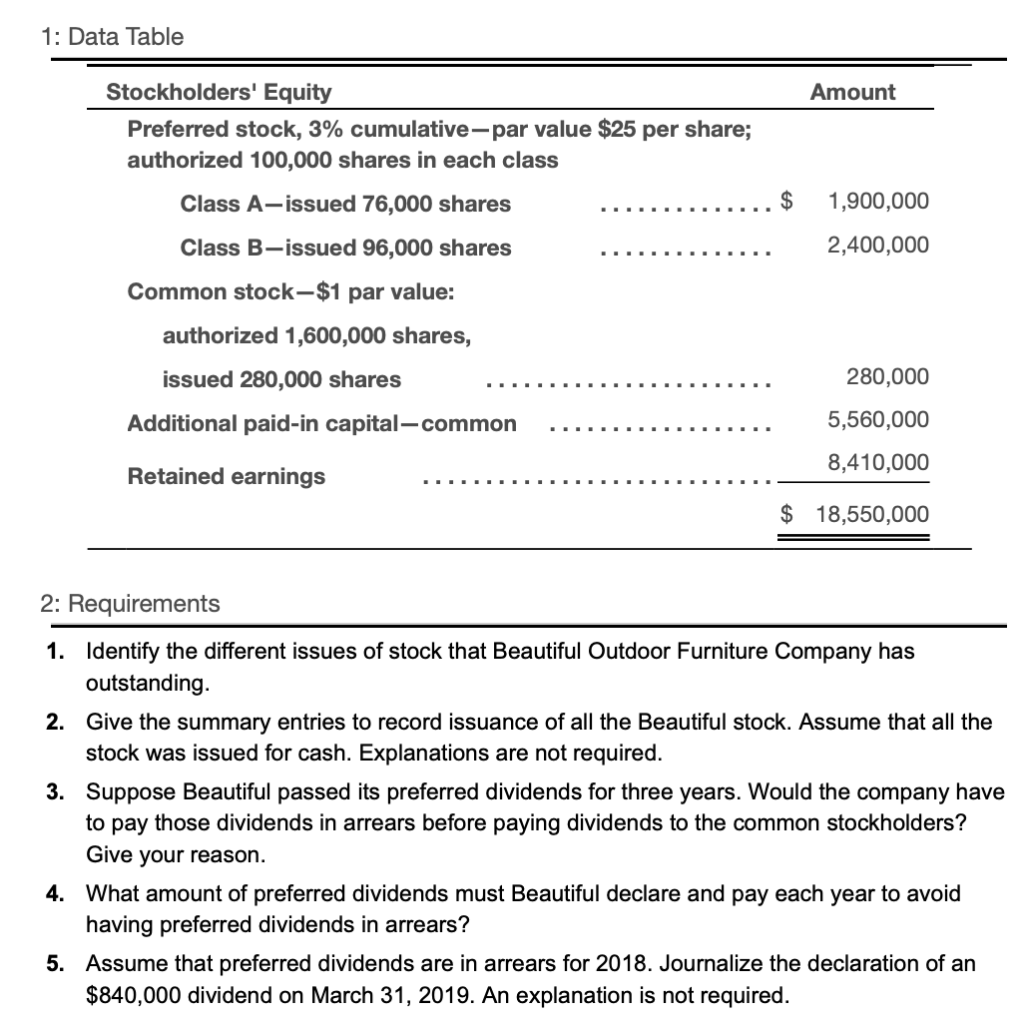

2. Beautiful Outdoor Furniture Company included the following stockholders' equity on its year-end balance sheet at March 31, 2019: (Click the icon to view the partial balance sheet.) Read the requirements Requirement 1. Identify the different issues of stock that Beautiful Outdoor Furniture Company has outstanding. (If a box is not used in the table, leave the box empty; do not make a selection.) Issue of stock (1) (2) (3) (4) Requirement 2. Give the summary entries to record issuance of all the Beautiful stock. Assume that all the stock was issued for cash. Explanations are not required. (Record debits first, then credits. Exclude explanations from any journal entries.) Record issuance of the Class A Preferred Stock. Journal Entry Accounts Date Debit Credit (5) (6) (7) (8) Record issuance of the Class B Preferred Stock. Journal Entry Accounts Date Debit Credit (9) (10) (11) (12) Record issuance of the Common Stock. Journal Entry Accounts Date Debit Credit (13) (14) (15) (16) Requirement 3. Suppose Beautiful passed its preferred dividends for three years. Would the company have to pay those dividends in arrears before paying dividends to the common stockholders? Give your reason. Beautiful Outdoor Furniture Company (17) have to pay preferred dividends in arrears before paying dividends to the common stockholders because the preferred stock is (18) Requirement 4. What amount of preferred dividends must Beautiful declare and pay each year to avoid having preferred dividends in arrears? Beautiful must declare and pay dividends of $ each year to avoid having preferred dividends in arrears. Requirement 5. Assume that preferred dividends are in arrears for 2018. Journalize the declaration of an $840,000 dividend on February 28, 2019. An explanation is not required. (Record debits first, then credits. Exclude explanations from any journal entries.) Journal Entry Accounts Date Debit Credit Feb 28 (19) (20) (21) (22) 1: Data Table Amount $ 1,900,000 2,400,000 Stockholders' Equity Preferred stock, 3% cumulative-par value $25 per share; authorized 100,000 shares in each class Class A-issued 76,000 shares Class B-issued 96,000 shares Common stock-$1 par value: authorized 1,600,000 shares, issued 280,000 shares Additional paid-in capital-common 280,000 5,560,000 8,410,000 Retained earnings $ 18,550,000 2: Requirements 1. Identify the different issues of stock that Beautiful Outdoor Furniture Company has outstanding. 2. Give the summary entries to record issuance of all the Beautiful stock. Assume that all the stock was issued for cash. Explanations are not required. 3. Suppose Beautiful passed its preferred dividends for three years. Would the company have to pay those dividends in arrears before paying dividends to the common stockholders? Give your reason. 4. What amount of preferred dividends must Beautiful declare and pay each year to avoid having preferred dividends in arrears? 5. Assume that preferred dividends are in arrears for 2018. Journalize the declaration of an $840,000 dividend on March 31, 2019. An explanation is not required. (1) Class A cumulative preferred stock O Class B cumulative preferred stock O Class A noncumulative preferred stock O Class A noncumulative preferred stock O Convertible common stock O Common stock (2) a O Class A cumulative preferred stock Class B cumulative preferred stock O Class A noncumulative preferred stock Class A noncumulative preferred stock O Convertible common stock O Common stock (3) O O Class A cumulative preferred stock O Class B cumulative preferred stock O Class A noncumulative preferred stock O Class A noncumulative preferred stock O Convertible common stock O Common stock (4) O O Class A cumulative preferred stock O Class B cumulative preferred stock O Class A noncumulative preferred stock O Class A noncumulative preferred stock O Convertible common stock O Common stock (5) O Additional Paid-in Capital - Common O Cash O Class A Preferred Stock O Retained Earnings Class B Preferred Stock Common Stock O Dividends Payable, Common O Dividends Payable, Preferred ) Oo (6) O O Additional Paid-in Capital-Common O Cash O Class A Preferred Stock O Retained Earnings Class B Preferred Stock Common Stock O Dividends Payable, Common O Dividends Payable, Preferred (7) O O Additional Paid-in Capital - Common O Cash O Class A Preferred Stock O Retained Earnings Class B Preferred Stock O Common Stock Dividends Payable, Common Dividends Payable, Preferred (8) O O Additional Paid-in Capital-Common O Cash O Class A Preferred Stock O Retained Earnings Class B Preferred Stock O Common Stock O Dividends Payable, Common O Dividends Payable, Preferred (9) O O Additional Paid-in Capital-Common O Cash O Class A Preferred Stock O Retained Earnings Class B Preferred Stock O Common Stock O Dividends Payable, Common O Dividends Payable, Preferred (10) O O Class B Preferred Stock B O Additional Paid-in Capital - Common O Common Stock O Cash Dividends Payable, Common O Class A Preferred Stock O Dividends Payable, Preferred O Retained Earnings (11) O Class B Preferred Stock Additional Paid-in Capital - Common O Common Stock O Cash Dividends Payable, Common Class A Preferred Stock Dividends Payable, Preferred O Retained Earnings (12) O O B Class B Preferred Stock Additional Paid-in Capital - Common Common Stock O Cash Dividends Payable, Common O Class A Preferred Stock A Dividends Payable, Preferred O Retained Earnings (13) O O Class B Preferred Stock Additional Paid-in Capital - Common Common Stock O Cash Dividends Payable, Common O Class A Preferred Stock Dividends Payable, Preferred O Retained Earnings (14) O O Class B Preferred Stock Additional Paid-in Capital - Common Common Stock O Cash O Dividends Payable, Common Class A Preferred Stock Dividends Payable, Preferred O Retained Earnings (15) O O B Class B Preferred Stock Additional Paid-in Capital - Common Common Stock O Cash Dividends Payable, Common O Class A Preferred Stock O Dividends Payable, Preferred O Retained Earnings (16) O O Class B Preferred Stock Additional Paid-in Capital - Common Common Stock O Cash O Dividends Payable, Common O Class A Preferred Stock Dividends Payable, Preferred O Retained Earnings (17) Owould O would not (18) O convertible cumulative O non-cumulative OOO (19) O O Additional Paid-in Capital - Common O Cash O Common Stock O Dividends Payable, Common O Retained Earnings O Dividends Payable, Class A Preferred O Dividends Payable, Class B Preferred O Preferred Stock (20) O Additional Paid-in Capital - Common Cash Common Stock Dividends Payable, Common Dividends Payable, Class A Preferred Dividends Payable, Class B Preferred O Preferred Stock Retained Earnings (21) O O Additional Paid-in Capital - Common Cash Common Stock Dividends Payable, Common Dividends Payable, Class A Preferred Dividends Payable, Class B Preferred O Preferred Stock Retained Earnings (22) O Additional Paid-in Capital - Common Cash Common Stock Dividends Payable, Common Dividends Payable, Class A Preferred Dividends Payable, Class B Preferred O Preferred Stock Retained Earnings