Answered step by step

Verified Expert Solution

Question

1 Approved Answer

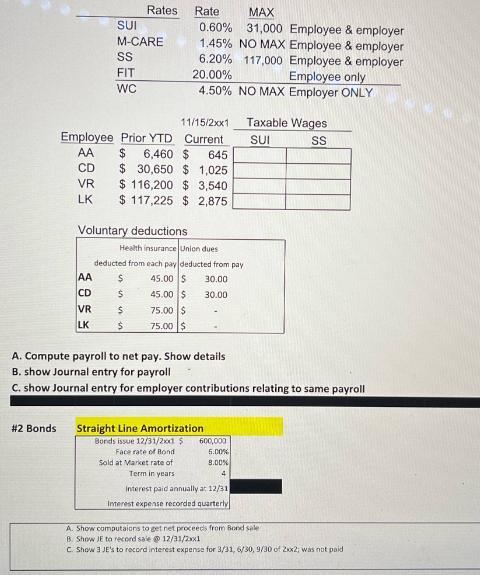

#2 Bonds VR LK AA CD SUI M-CARE SS FIT WC 11/15/2xx1 Employee Prior YTD Current AA CD VR LK Rates Voluntary deductions $

#2 Bonds VR LK AA CD SUI M-CARE SS FIT WC 11/15/2xx1 Employee Prior YTD Current AA CD VR LK Rates Voluntary deductions $ 6,460 $ 645 $ 30,650 $1,025 $116,200 $3,540 $ 117,225 $ 2,875 Rate: MAX 0.60% 31,000 Employee & employer 1.45% NO MAX Employee & employer 6.20% 117,000 Employee & employer 20.00% Employee only 4.50% NO MAX Employer ONLY $ $ $ Health insurance Union dues deducted from each pay deducted from pay 45.00 $ 30.00 30.00 45.00 $ 75.00 $ 75.00 $ A. Compute payroll to net pay. Show details B. show Journal entry for payroll C. show Journal entry for employer contributions relating to same payroll Taxable Wages SUI SS Straight Line Amortization Bonds issue 12/31/2x1 $ 600,000 Face rate of Bond 5.00% Sold at Market rate of 8.00% Term in years 4 Interest paid annually at 12/31 Interest expense recorded quarterly A. Show computaions to get net proceeds from Bond sale B. Show JE to record sale @ 12/31/2xx1 C. Show 3 JE's to record interest expense for 3/31, 6/30, 9/30 of 2xx2; was not paid

Step by Step Solution

★★★★★

3.41 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION A Compute payroll to net pay Employee AA Taxable wages 6460 SUI 060 6460 0006 3876 MCARE 145 6460 00145 9377 SS 620 6460 0062 40012 Health in...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started