Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Required: (a) Explain the rationale for using the pool method to calculate depreciation for assets that cost less than $5,000 or have Adjusted Tax Value

Required:

Required: - (a) Explain the rationale for using the pool method to calculate depreciation for assets that cost less than $5,000 or have Adjusted Tax Value (ATV) of $5,000 or less.

- (b) Calculate the depreciation loss for Lucky’s business for the income tax year ended 31 March 2022. Use the pool method where appropriate. Show all relevant workings.

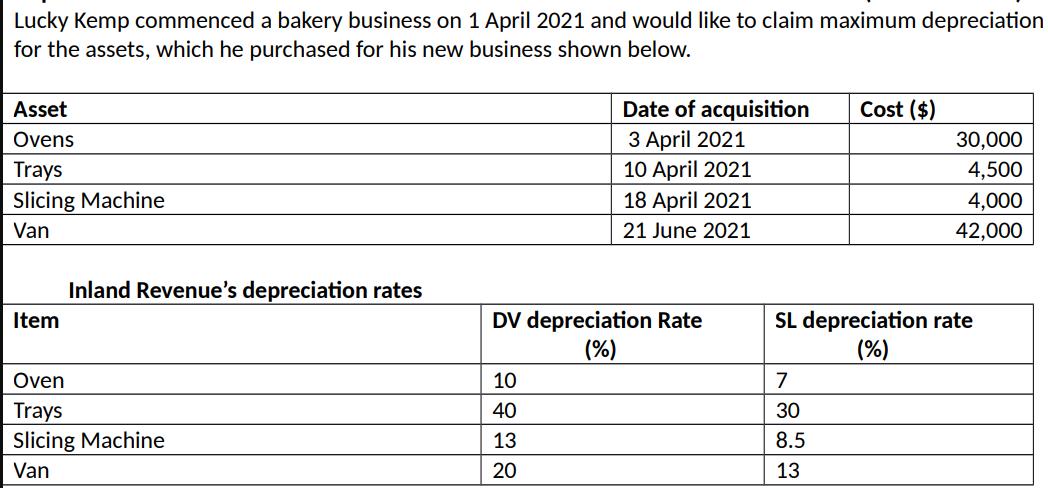

Lucky Kemp commenced a bakery business on 1 April 2021 and would like to claim maximum depreciation for the assets, which he purchased for his new business shown below. Asset Ovens Trays Slicing Machine Van Item Inland Revenue's depreciation rates Oven Trays Slicing Machine Van Date of acquisition 3 April 2021 10 April 2021 18 April 2021 21 June 2021 DV depreciation Rate (%) 10 40 13 20 Cost ($) 7 30 8.5 13 30,000 4,500 4,000 42,000 SL depreciation rate (%)

Step by Step Solution

★★★★★

3.47 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION a The rationale for using the pool method to calculate depreciation for assets that cost less than 5000 or have an Adjusted Tax Value ATV of ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started