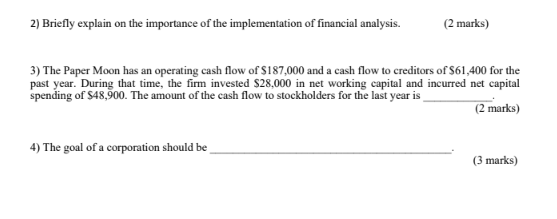

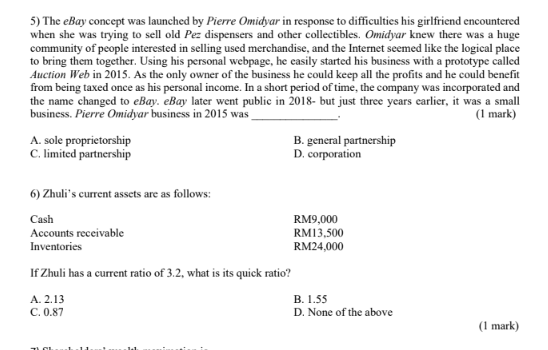

2) Briefly explain on the importance of the implementation of financial analysis. (2 marks) 3) The Paper Moon has an operating cash flow of $187,000 and a cash flow to creditors of $61,400 for the past year. During that time, the firm invested $28,000 in net working capital and incurred net capital spending of $48,900. The amount of the cash flow to stockholders for the last year is (2 marks) 4) The goal of a corporation should be (3 marks) 5) The eBay concept was launched by Pierre Omidyar in response to difficulties his girlfriend encountered when she was trying to sell old Pez dispensers and other collectibles. Omidyar knew there was a huge community of people interested in selling used merchandise, and the Internet seemed like the logical place to bring them together. Using his personal webpage, he easily started his business with a prototype called Auction Web in 2015. As the only owner of the business he could keep all the profits and he could benefit from being taxed once as his personal income. In a short period of time, the company was incorporated and the name changed to eBay. eBay later went public in 2018- but just three years earlier, it was a small business. Pierre Omidyar business in 2015 was (1 mark) A. sole proprietorship B. general partnership C. limited partnership D. corporation 6) Zhuli's current assets are as follows: Cash RM9,000 Accounts receivable RM13,500 Inventories RM24,000 If Zhuli has a current ratio of 3.2, what is its quick ratio? A. 2.13 B. 1.55 C. 0.87 D. None of the above (1 mark) 2) Briefly explain on the importance of the implementation of financial analysis. (2 marks) 3) The Paper Moon has an operating cash flow of $187,000 and a cash flow to creditors of $61,400 for the past year. During that time, the firm invested $28,000 in net working capital and incurred net capital spending of $48,900. The amount of the cash flow to stockholders for the last year is (2 marks) 4) The goal of a corporation should be (3 marks) 5) The eBay concept was launched by Pierre Omidyar in response to difficulties his girlfriend encountered when she was trying to sell old Pez dispensers and other collectibles. Omidyar knew there was a huge community of people interested in selling used merchandise, and the Internet seemed like the logical place to bring them together. Using his personal webpage, he easily started his business with a prototype called Auction Web in 2015. As the only owner of the business he could keep all the profits and he could benefit from being taxed once as his personal income. In a short period of time, the company was incorporated and the name changed to eBay. eBay later went public in 2018- but just three years earlier, it was a small business. Pierre Omidyar business in 2015 was (1 mark) A. sole proprietorship B. general partnership C. limited partnership D. corporation 6) Zhuli's current assets are as follows: Cash RM9,000 Accounts receivable RM13,500 Inventories RM24,000 If Zhuli has a current ratio of 3.2, what is its quick ratio? A. 2.13 B. 1.55 C. 0.87 D. None of the above (1 mark)