Answered step by step

Verified Expert Solution

Question

1 Approved Answer

2. Brigette Corporation sells refurbished photocopiers to Canadian-based businesses. Brigette 8 marks also provides installation and and on-going maintenance services for a wide variety of

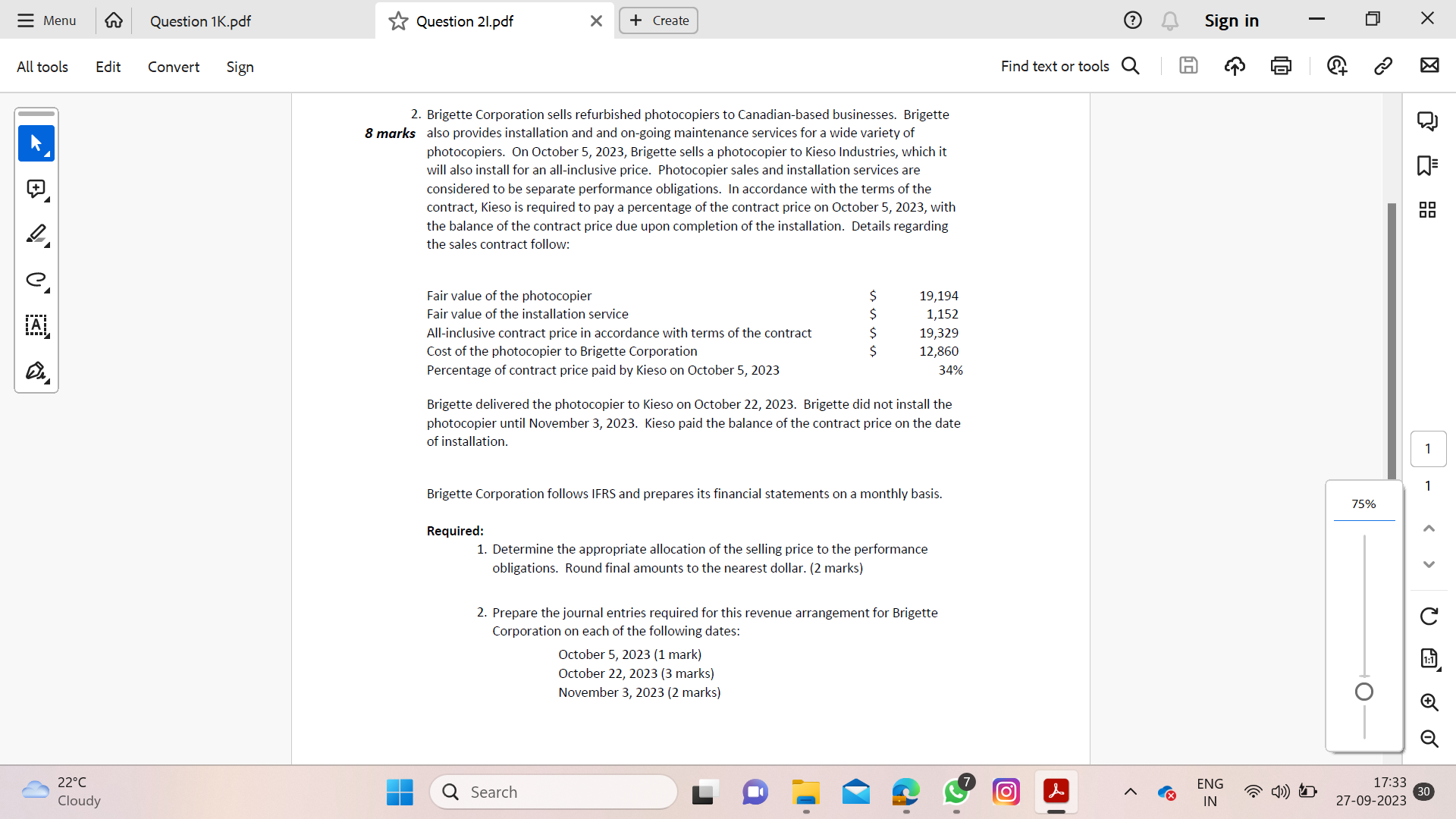

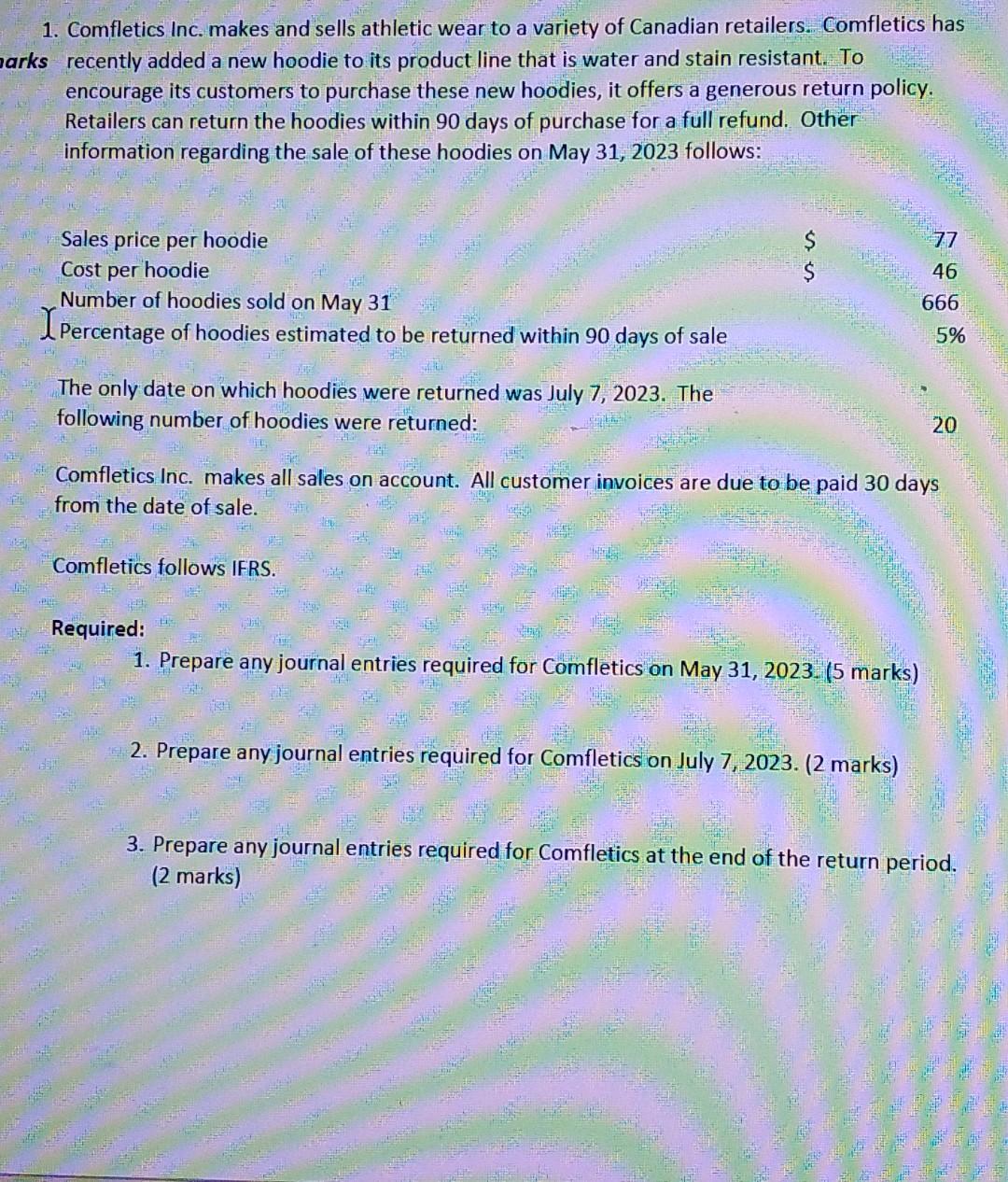

2. Brigette Corporation sells refurbished photocopiers to Canadian-based businesses. Brigette 8 marks also provides installation and and on-going maintenance services for a wide variety of photocopiers. On October 5, 2023, Brigette sells a photocopier to Kieso Industries, which it will also install for an all-inclusive price. Photocopier sales and installation services are considered to be separate performance obligations. In accordance with the terms of the contract, Kieso is required to pay a percentage of the contract price on October 5, 2023, with the balance of the contract price due upon completion of the installation. Details regarding the sales contract follow: Brigette delivered the photocopier to Kieso on October 22, 2023. Brigette did not install the photocopier until November 3, 2023. Kieso paid the balance of the contract price on the date of installation. Brigette Corporation follows IFRS and prepares its financial statements on a monthly basis. Required: 1. Determine the appropriate allocation of the selling price to the performance obligations. Round final amounts to the nearest dollar. (2 marks) 2. Prepare the journal entries required for this revenue arrangement for Brigette Corporation on each of the following dates: October 5, 2023 (1 mark) October 22, 2023 (3 marks) November 3, 2023 (2 marks) 1. Comfletics Inc. makes and sells athletic wear to a variety of Canadian retailers. Comfletics has recently added a new hoodie to its product line that is water and stain resistant. To encourage its customers to purchase these new hoodies, it offers a generous return policy. Retailers can return the hoodies within 90 days of purchase for a full refund. Other information regarding the sale of these hoodies on May 31, 2023 follows: Sales price per hoodie Cost per hoodie Number of hoodies sold on May 31 $$77466665% The only date on which hoodies were returned was July 7,2023 . The following number of hoodies were returned: 20 Comfletics Inc. makes all sales on account. All customer invoices are due to be paid 30 days from the date of sale. Comfletics follows IFRS. Required: 1. Prepare any journal entries required for Comfletics on May 31, 2023. (5 marks) 2. Prepare any journal entries required for Comfletics on July 7, 2023. (2 marks) 3. Prepare any journal entries required for Comfletics at the end of the return period. (2 marks) 2. Brigette Corporation sells refurbished photocopiers to Canadian-based businesses. Brigette also provides installation and and on-going maintenance services for a wide variety of photocopiers. On October 5, 2023, Brigette sells a photocopier to Kieso Industries, which it will also install for an all-inclusive price. Photocopier sales and installation services are considered to be separate performance obligations. In accordance with the terms of the contract, Kieso is required to pay a percentage of the contract price on October 5,2023 , with the balance of the contract price due upon completion of the installation. Details regarding the sales contract follow: Brigette delivered the photocopier to Kieso on October 22, 2023. Brigette did not install the photocopier until November 3, 2023. Kieso paid the balance of the contract price on the date of installation. Brigette Corporation follows IFRS and prepares its financial statements on a monthly basis. Required: 1. Determine the appropriate allocation of the selling price to the performance obligations. Round final amounts to the nearest dollar. ( 2 marks) 2. Prepare the journal entries required for this revenue arrangement for Brigette Corporation on each of the following dates: October 5, 2023 (1 mark) October 22, 2023 (3 marks) November 3, 2023 ( 2 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started