Answered step by step

Verified Expert Solution

Question

1 Approved Answer

2. Buffer against Losses: The current ratio shows the margin of safety available to cover the loss on sale or realisation of non-cash current assets.

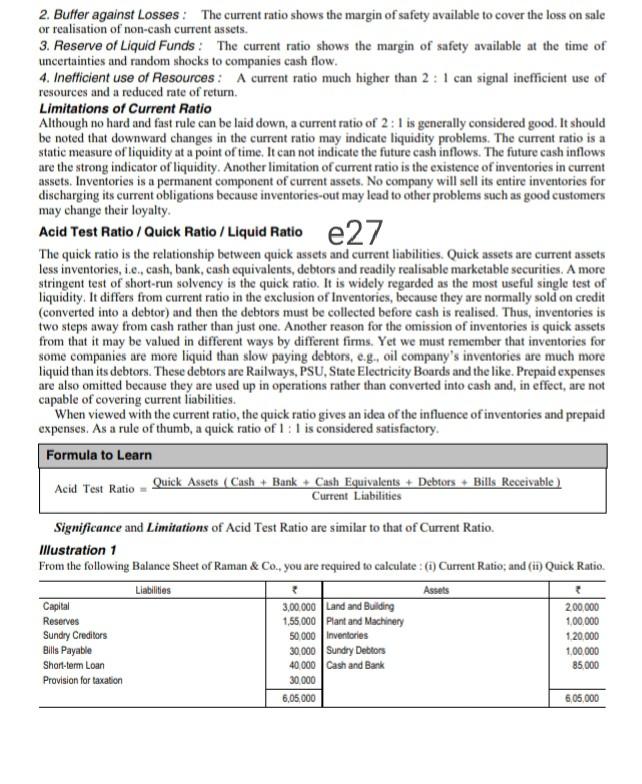

2. Buffer against Losses: The current ratio shows the margin of safety available to cover the loss on sale or realisation of non-cash current assets. 3. Reserve of Liquid Funds : The current ratio shows the margin of safety available at the time of uncertainties and random shocks to companies cash flow. 4. Inefficient use of Resources : A current ratio much higher than 2 : 1 can signal inefficient use of resources and a reduced rate of return. Limitations of Current Ratio Although no hard and fast rule can be laid down, a current ratio of 2:1 is generally considered good. It should be noted that downward changes in the current ratio may indicate liquidity problems. The current ratio is a static measure of liquidity at a point of time. It can not indicate the future cash inflows. The future cash inflows are the strong indicator of liquidity. Another limitation of current ratio is the existence of inventories in current assets. Inventories is a permanent component of current assets. No company will sell its entire inventories for discharging its current obligations because inventories-out may lead to other problems such as good customers may change their loyalty. Acid Test Ratio / Quick Ratio / Liquid Ratio e27 The quick ratio is the relationship between quick assets and current liabilities. Quick assets are current assets less inventories, i.e., cash, bank, cash equivalents, debtors and readily realisable marketable securities. A more stringent test of short-run solvency is the quick ratio. It is widely regarded as the most useful single test of liquidity. It differs from current ratio in the exclusion of Inventories, because they are normally sold on credit (converted into a debtor) and then the debtors must be collected before cash is realised. Thus, inventories is two steps away from cash rather than just one. Another reason for the omission of inventories is quick assets from that it may be valued in different ways by different firms. Yet we must remember that inventories for some companies are more liquid than slow paying debtors, c.g. oil company's inventories are much more liquid than its debtors. These debtors are Railways, PSU, State Electricity Boards and the like. Prepaid expenses are also omitted because they are used up in operations rather than converted into cash and, in effect, are not capable of covering current liabilities. When viewed with the current ratio, the quick ratio gives an idea of the influence of inventories and prepaid expenses. As a rule of thumb, a quick ratio of 1:1 is considered satisfactory. Formula to Learn Acid Test Ratio - Quick Assets (Cash + Bank Cash Equivalents + Debtors Bills Receivable ) Current Liabilities Significance and Limitations of Acid Test Ratio are similar to that of Current Ratio. Illustration 1 From the following Balance Sheet of Raman & Co., you are required to calculate : (i) Current Ratio, and (ii) Quick Ratio. Liabilities Assets Capital 3,00.000 Land and Building 200.000 Reserves 1,55,000 plant and Machinery 100.000 Sundry Creditors 50.000 Inventories 120,000 ells Payable 30,000 Sundry Debtors 100 000 Short-term Loan 40.000 Cash and Bank Provision for taxation 30.000 6,05,000 6,05,000 85.000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started