Answered step by step

Verified Expert Solution

Question

1 Approved Answer

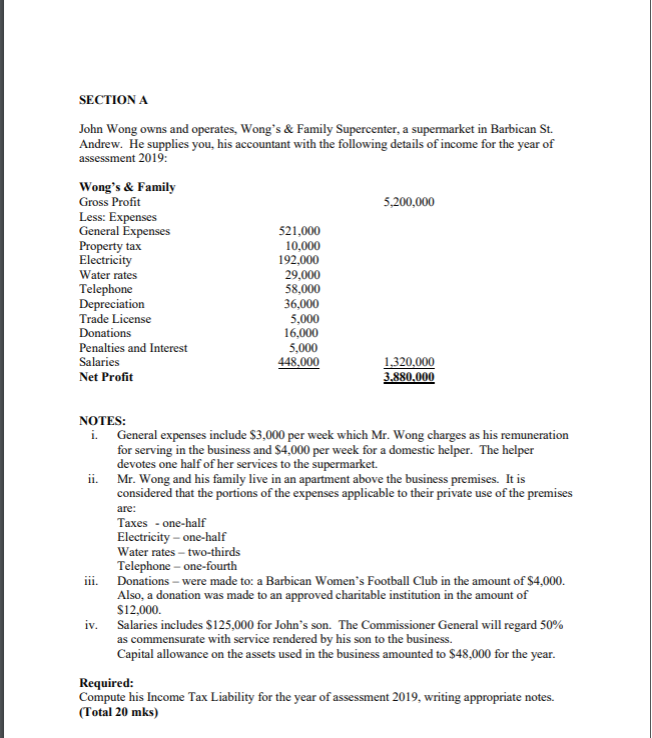

SECTION A John Wong owns and operates, Wong's & Family Supercenter, a supermarket in Barbican St . Andrew. He supplies you, his accountant with the

SECTION A

John Wong owns and operates, Wong's & Family Supercenter, a supermarket in Barbican St

Andrew. He supplies you, his accountant with the following details of income for the year of

assessment :

Wong's & Family

Gross Profit

Less: Expenses

General Expenses

Property tax

Electricity

Water rates

Telephone

Depreciation

Trade License

Donations

Penalties and Interest

Salaries

Net Profit

NOTES:

i General expenses include $ per week which Mr Wong charges as his remuneration

for serving in the business and $ per week for a domestic helper. The helper

devotes one half of her services to the supermarket.

ii Mr Wong and his family live in an apartment above the business premises. It is

considered that the portions of the expenses applicable to their private use of the premises

are:

Taxes onehalf

Electricity onehalf

Water rates twothirds

Telephone onefourth

iii. Donations were made to: a Barbican Women's Football Club in the amount of $

Also, a donation was made to an approved charitable institution in the amount of

$

iv Salaries includes $ for John's son. The Commissioner General will regard

as commensurate with service rendered by his son to the business.

Capital allowance on the assets used in the business amounted to $ for the year.

Required:

Compute his Income Tax Liability for the year of assessment writing appropriate notes.

Total mks

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started