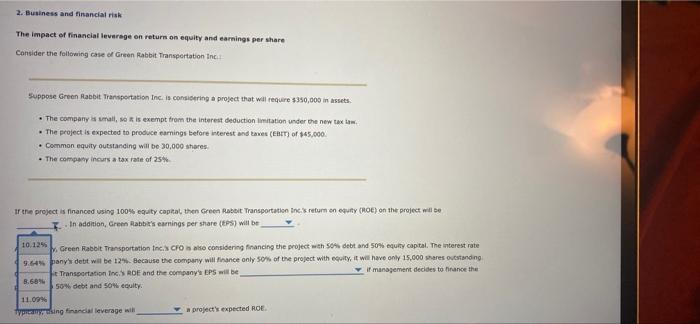

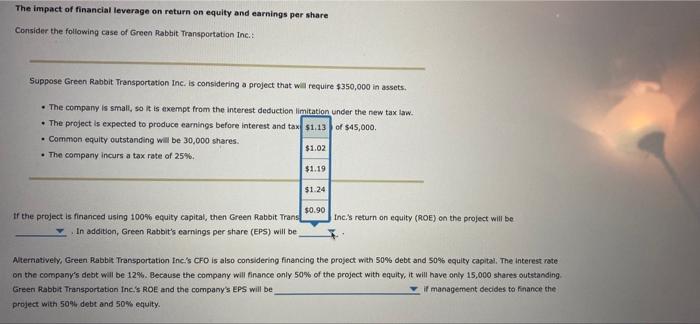

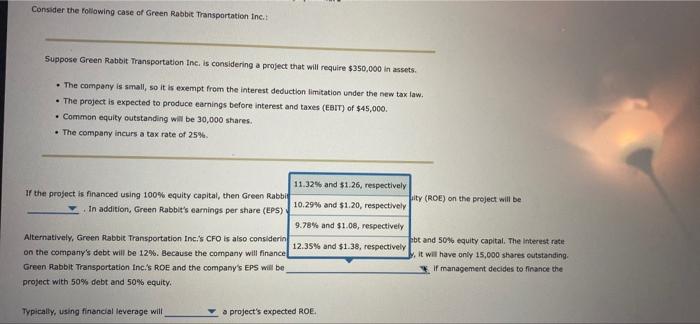

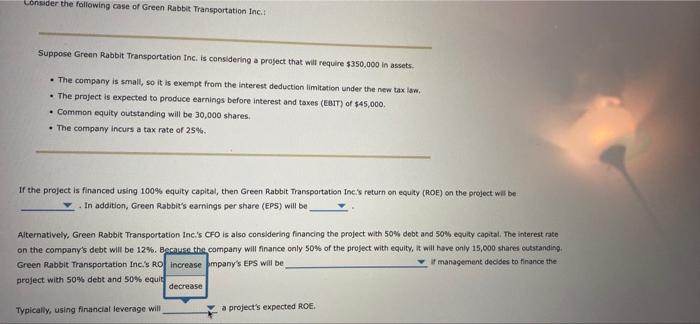

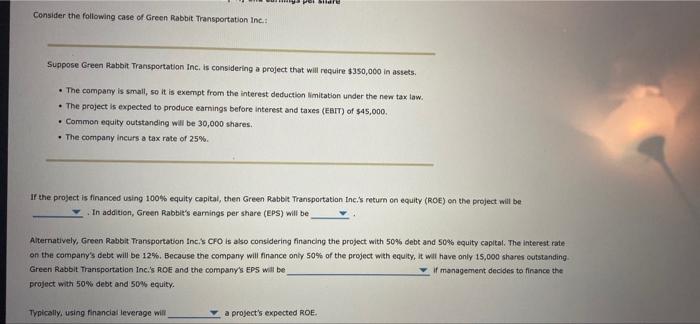

2. Business and financial risk The impact of financial leverage on return on equity and earnings per share Consider the following case of Green Rabbit Transportation Inc. Suppose Green Rabbit Transportation Inc. is considering a project that will require $350,000 in assets The company is mall, so is exempt from the interest deduction limitation under the new taxi . The project is expected to produce earnings before interest and taxes (EBIT) of $45,000 . Common equity outstanding will be 30,000 shares The company incur a tax rate of 25% in the project is financed using 100% equity capital, then Green Rabbit Transportation Inc.'s return on equity (ROC) on the project will be I. In addition, Green Rabbit's earnings per share (EPS) will be 10.1255 Green Rabbit Transportation Inc. CFOs we considering financing the project with 50% debt and 50% equity capital. The interest rate 9.65 pany's debt will be 12%. Because the company will finance only 50% of the project with evity, it will have only 15,000 shares outstanding Transportation Inc. ROE and the company's EPS will be If management decides to hinance the 8.68% 50% debt and 50% equity 11.09 typamsing financial leverage will project's expected ROE The impact of financial leverage on return on equity and earnings per share Consider the following case of Green Rabbit Transportation Inc.: Suppose Green Rabbit Transportation Inc. is considering a project that will require $350,000 in assets. The company is small, so it is exempt from the interest deduction limitation under the new tax law. . The project is expected to produce earnings before interest and tax 51.13 of 545,000 . Common equity outstanding will be 30,000 shares. $1.02 The company incurs a tax rate of 25%. $1.19 $1.24 Inc.'s return on equity (ROE) on the project will be $0.90 If the project is financed using 100% equity capital, then Green Rabbit Trans! In addition, Green Rabbit's earnings per share (EPS) will be Alternatively, Green Rabbit Transportation Inc.'s CFO is also considering financing the project with 50% debt and 50% equity capital. The Interest rate on the company's debt will be 12%. Because the company will finance only 50% of the project with equity, it will have only 15,000 shares outstanding Green Rabbit Transportation Inc.'s ROE and the company's EPS will be if management decides to finance the project with 50% debt and 50% equity. Consider the following case of Green Rabbit Transportation Inc.: Suppose Green Rabbit Transportation Inc. is considering a project that will require $350,000 in assets. The company is small, so it is exempt from the interest deduction limitation under the new tax law. The project is expected to produce earnings before interest and taxes (EBIT) of $45,000 Common equity outstanding will be 30,000 shares The company incurs a tax rate of 25% 11.32% and $1.26, respectively 17 the project is financed using 100% equity capital, then Green Rabbit pulty (ROE) on the project will be 10.29% and $1.20, respectively . In addition, Green Rabbit's earnings per share (EPS) 9.78% and $1.08, respectively Alternatively, Green Rabbit Transportation Inc.'s CFO is also considerin mbt and 50% equity capital. The Interest rate 12.35% and $1.38, respectively on the company's debt will be 12%. Because the company will finance it will have only 15,000 shares outstanding Green Rabbit Transportation Inc.'s ROE and the company's EPS will be If management decides to finance the project with 50% debt and 50% equity. Typically, using financial leverage will a project's expected ROE. Consider the following case of Green Rabbit Transportation Inc. Suppose Green Rabbit Transportation Inc. is considering a project that will require $350,000 in assets. The company is small, so it is exempt from the Interest deduction limitation under the new tax law, The project is expected to produce earnings before interest and taxes (EBIT) of $45,000 Common equity outstanding will be 30,000 shares The company incurs a tax rate of 25% If the project is financed using 100% equity capital, then Green Rabbit Transportation Inc.'s return on equity (ROE) on the project will be In addition, Green Rabbit's earnings per share (EPS) will be Alternatively, Green Rabbit Transportation Inc.'s CFO is also considering financing the project with 50% debt and 50% equity capital. The interest rate on the company's debt will be 12%. Because the company will finance only 50% of the project with equity, it will have only 15,000 shares outstanding Green Rabbit Transportation Inc.'s RO Increase pmpany's EPS will be if management decides to finance the project with 50% debt and 50% equid decrease Typically, using financial leverage will a project's expected ROE. Por Side Consider the following case of Green Rabbit Transportation Inc. Suppose Green Rabbit Transportation Inc. is considering a project that will require $350,000 in assets. The company is small, so it is exempt from the interest deduction limitation under the new tax law. . The project is expected to produce earnings before interest and taxes (EBIT) of $45,000 Common equity outstanding will be 30,000 shares The company incurs a tax rate of 25% If the project is financed using 100% equity capital, then Green Rabbit Transportation Inc.'s return on equity (ROE) on the project will be In addition, Green Rabbit's earnings per share (EPS) will be Alternatively, Green Rabbit Transportation Inc.'s CFO is also considering financing the project with 50% debt and 50% equity capital. The interest rate on the company's debt will be 12%. Because the company will finance only 50% of the project with equity. It will have only 15,000 shares outstanding Green Rabbit Transportation Inc.'s ROE and the company's EPS will be if management decides to finance the project with 50% debt and 50% equity. Typically, using financial leverage will a project's expected ROE