Answered step by step

Verified Expert Solution

Question

1 Approved Answer

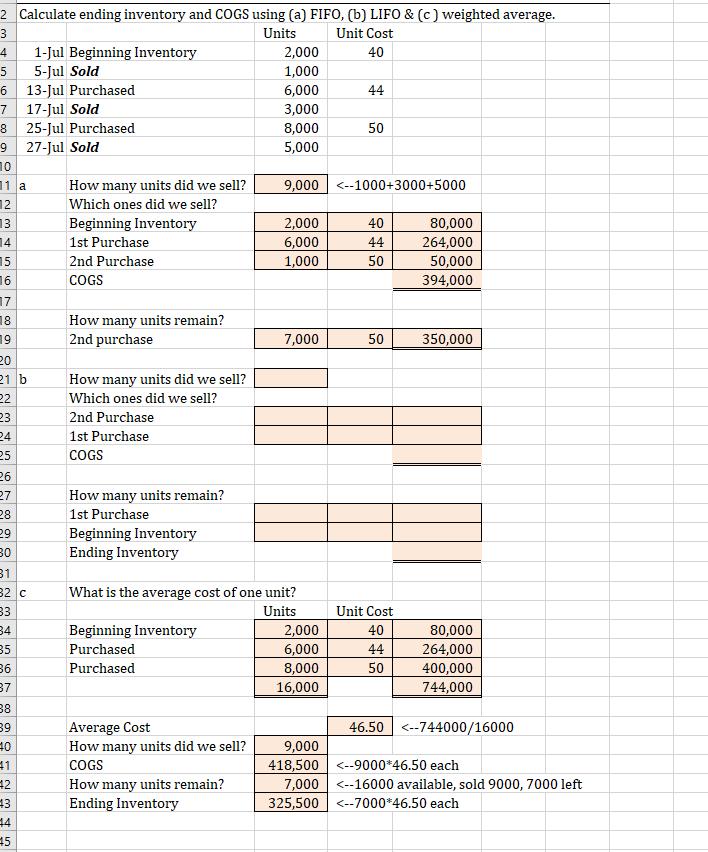

2 Calculate ending inventory and COGS using (a) FIFO, (b) LIFO & (c) weighted average. 3 Units Unit Cost 40 4 1-Jul Beginning Inventory

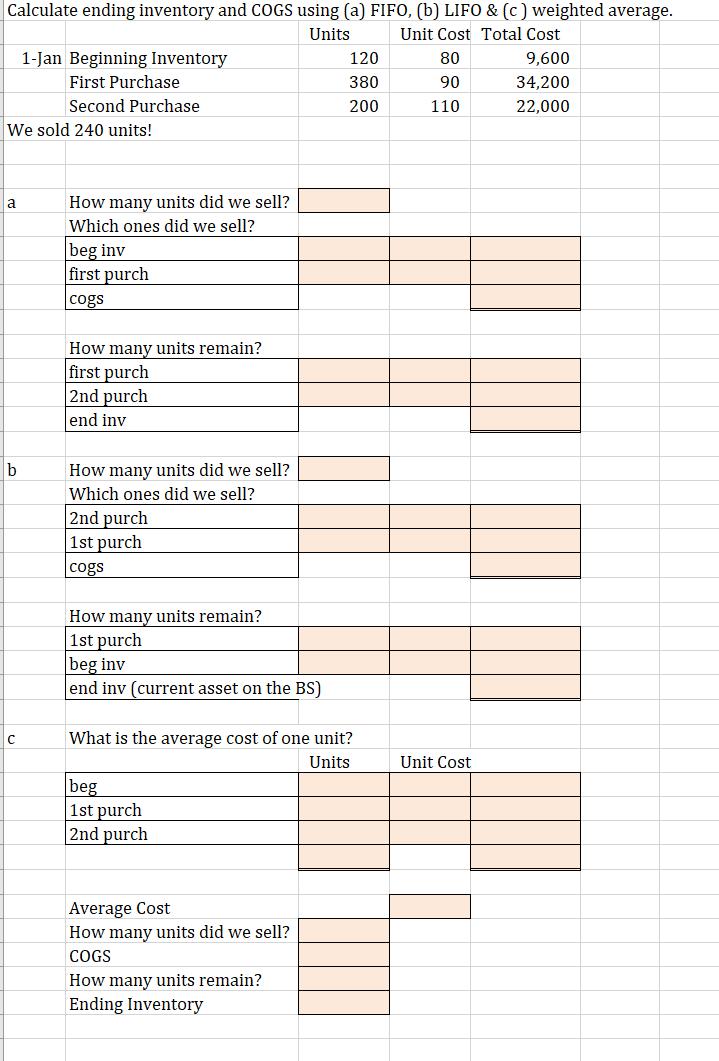

2 Calculate ending inventory and COGS using (a) FIFO, (b) LIFO & (c) weighted average. 3 Units Unit Cost 40 4 1-Jul Beginning Inventory 5 5-Jul Sold 6 13-Jul Purchased 7 17-Jul Sold 8 25-Jul Purchased 9 27-Jul Sold 10 N8600 AWNO 11 a 12 13 14 15 16 17 18 19 20 21 b 22 23 24 25 26 27 28 29 ON MY ON 30 31 33 34 35 36 37 38 39 40 41 How many units did we sell? Which ones did we sell? Beginning Inventory 2345 1st Purchase 2nd Purchase COGS How many units remain? 2nd purchase How many units did we sell? Which ones did we sell? 32 c What is the average cost of one unit? Units 2nd Purchase 1st Purchase COGS How many units remain? 1st Purchase Beginning Inventory Ending Inventory Beginning Inventory Purchased Purchased 2,000 1,000 6,000 3,000 8,000 5,000 Average Cost How many units did we sell? COGS How many units remain? Ending Inventory 2,000 6,000 1,000 9,000 Calculate ending inventory and COGS using (a) FIFO, (b) LIFO & (c) weighted average. Units Unit Cost Total Cost 80 90 110 We sold 240 units! a b 1-Jan Beginning Inventory First Purchase Second Purchase C How many units did we sell? Which ones did we sell? beg inv first purch cogs How many units remain? first purch 2nd purch end inv How many units did we sell? Which ones did we sell? 2nd purch 1st purch cogs How many units remain? 1st purch beg inv end inv (current asset on the BS) What is the average cost of one unit? Units beg 1st purch 2nd purch Average Cost How many units did we sell? COGS 120 380 200 How many units remain? Ending Inventory Unit Cost 9,600 34,200 22,000

Step by Step Solution

★★★★★

3.45 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started