2. Calculate the accounts receivable turnover and the average collection period for both

companies for 2020 and 2021. Write a paragraph comparing 2021 with 2020 and Coke

with Pepsi using these two ratios to indicate the effectiveness of their accounts

receivable collections. Which of the two companies seem to be doing a better job with

receivables? How does this collection process affect the overall success of the

company?

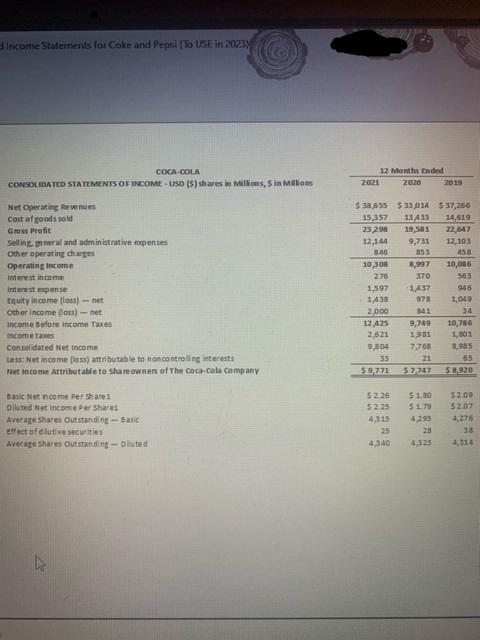

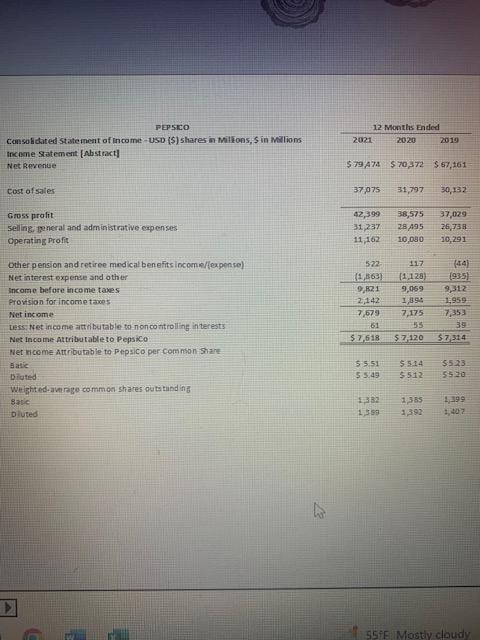

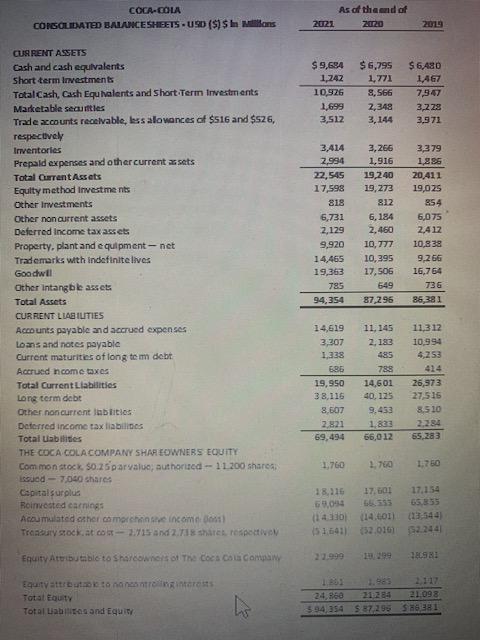

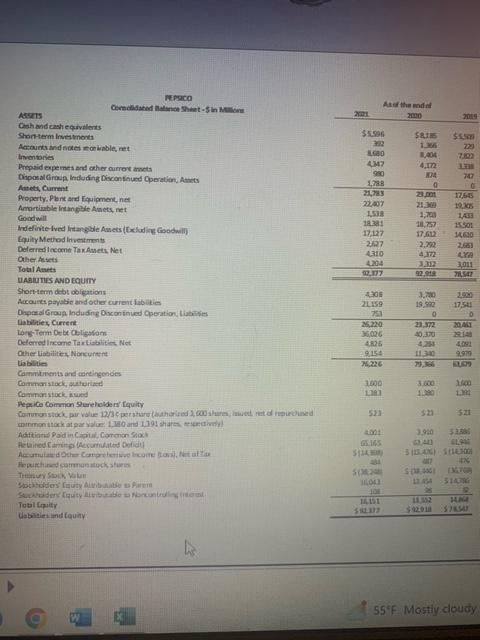

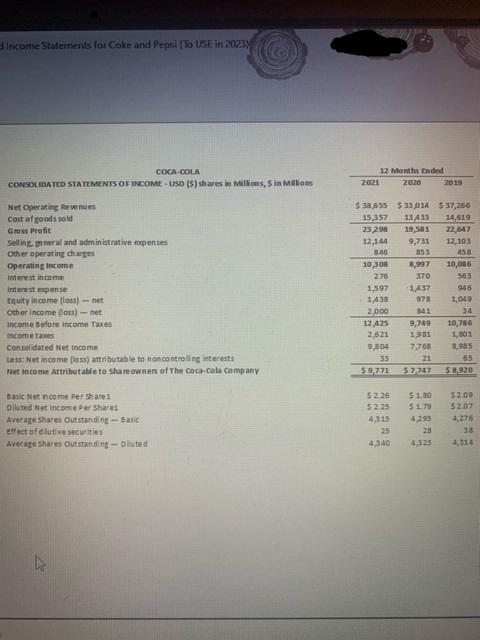

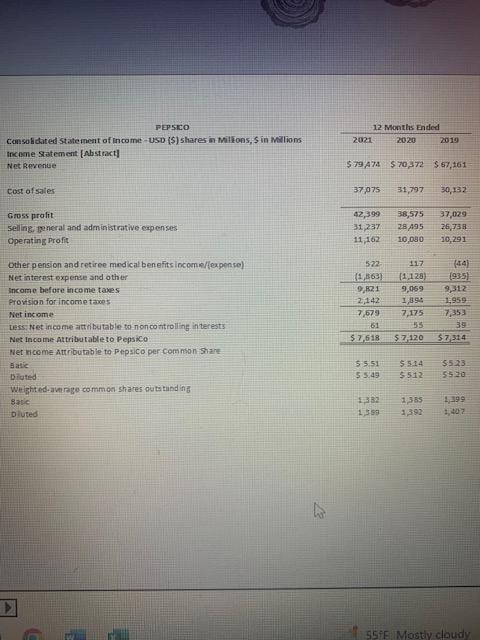

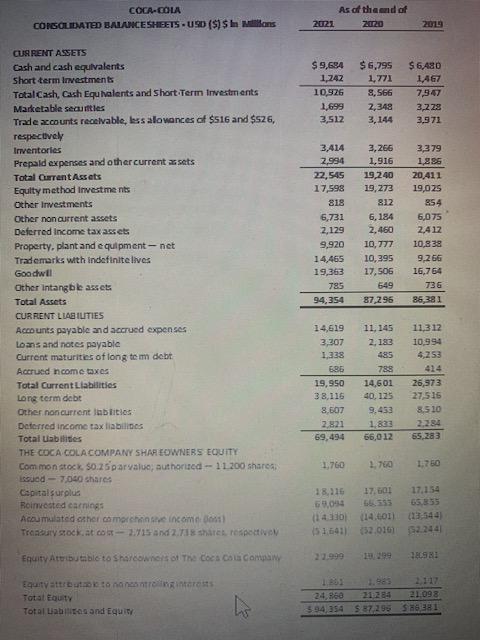

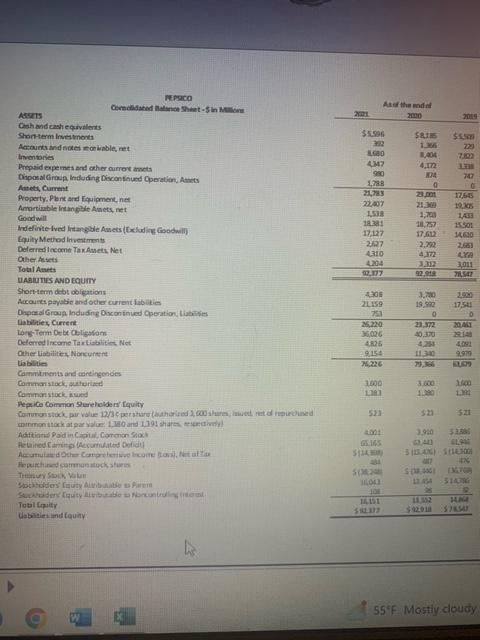

I've added the balance sheets and statement of incomes below.

tincome Statements for Coke and Pepoi t To USE in 2CO3y, Consolidated State rieat of Income - USD (S) shares in Millons, S in Milions 20212020201912monthsEnded Income Sratement [Abst nact] Net Revenue $79,A74$70,372$57,261 cost ofsater Gross prafit selingi general and administrative eapenses. Opernting Profit other pension and retiree mndical benefits incomieffexpensel Net interest expense and other Income before income taxes Provision for incorme taops Net income- Less: Nfet income attnbutable to noncotitrolling interests Net Incame Attribatable to Pepsico: Niet riceme Attributable to pepsico per comnson-share Satic Dilutisd: Weight ed-aunrige common shares outitand in Batic Dluted cochcos As of thend of CuGpient Assers Gash and cash equivalents short term luvestments Totalcash, Cach Equhalents and short.Term Investments Marketable secunties \begin{tabular}{rrr} $9,684 & $6,795 & $6,480 \\ 1,242 & 1,771 & 1,467 \\ \hline 10,526 & 8,566 & 7,947 \\ 1,699 & 2,348 & 3,228 \\ 3,512 & 3,144 & 3,971 \end{tabular} Trade accounts recelvable, bss alovances of $516 and $526,3,5123,1443,971 respectively Irventories Frepald expenses and other current issets Total CurrentAssets Equlty method investme nis othor Irwestments Ocher non aurrent assets Deferred income taxassets Property, plant and equlpment - net Trademarks whth indafinitelives Goodwill Other intangbk assets Total Assets \begin{tabular}{rrr} 3,414 & 3,266 & 3,379 \\ 2,994 & 1,916 & 1,985 \\ \hline 22,515 & 19,240 & 20,411 \\ 17,598 & 19,273 & 19,025 \\ 818 & 812 & 854 \\ 6,731 & 6,184 & 6,075 \\ 2,129 & 2,460 & 2,412 \\ 9,920 & 10,777 & 10,838 \\ 14,465 & 10,395 & 9,266 \\ 19,363 & 17,506 & 16,764 \\ 795 & 649 & 736 \\ \hline 94,354 & 87,296 & 86,381 \\ \hline & & \\ \hline \end{tabular} CURRENT LlaGIUTES Acwounts payable and accrued expenser Loans and notes payable Current maturities of long tem debt. Accrused ncome twees Total CurrentLlabilitios Long rerm dabe Orher noncurrent lablities. Deterred income tax liabilines Total Uablitites THE COCA COLACOMPANY SHAFYOWNERS ECUITY isejed -7040 shares copitaisurplus Boimested carnings Acoumulated eaher comorehsin she incemin (osi) Totat Equaty Tot al Lablitos and Equin: reprace Awts Guh and cash equivalests Shonterm linestnont Actount and note noriable, net Inventories Prepoid expemes and ceher aurrov amets Diposaldiraia indeding Dicconthued Opertion, Anets Autets Curnet Property. Plart ard fauipment, net Amretiable intangble Amets, net Goodwill Iredefinte lved lrtangble Ausets (ficlading Goodwili) Equity Method liventmonts Delerredincome Tax Aumets Net Cher Altets Total Atnett HAaIUTIS AND EQUTY Shorterm debt wolikations Axaurts poyatic and other curent iablitie Ohpesal Graup lnduding Oxcon inued Operation, Liablistes Liakithies, Current larstem Deke nelisuiam Oelerred Ireme Taxtiablities Net Quer liabilites, Norcunter tiabliten Cornitinents and areingenoes Commanstock, zaturiact Conmanstack, isues Pepice Common Surelolde ravity Adftiaris PadtinC pit, Cormon Sial Ae ained Caring (Aecumdatted Deidil Fioperthinet carmenateckstien Thethur Sock Vivi Socitudes' Crutvalwibuabe a Pind Total fracty Uabieiet and fauiny