Answered step by step

Verified Expert Solution

Question

1 Approved Answer

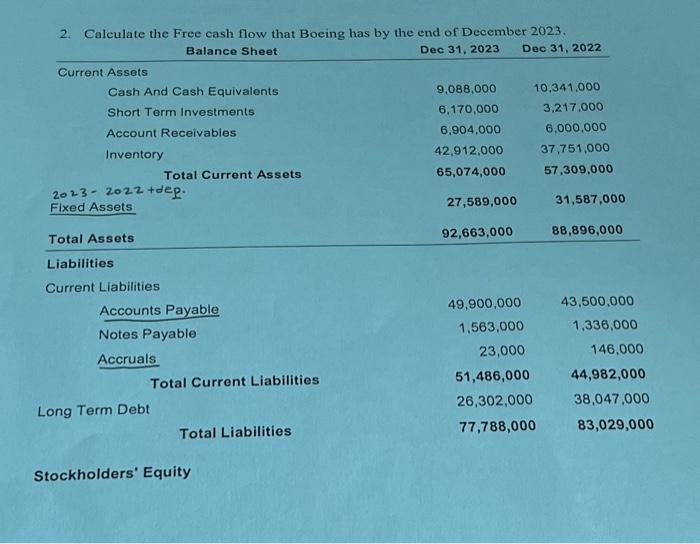

2. Calculate the Free cash flow that Boeing has by the end of December 2023. Balance Sheet Dec 31, 2023 Dec 31, 2022 Current Assets

2. Calculate the Free cash flow that Boeing has by the end of December 2023. Balance Sheet Dec 31, 2023 Dec 31, 2022 Current Assets Cash And Cash Equivalents Short Term Investments Account Receivables Inventory 2023 2022 +dep. Fixed Assets Total Assets Liabilities Current Liabilities Total Current Assets Accounts Payable Notes Payable Accruals Long Term Debt Total Current Liabilities Total Liabilities Stockholders' Equity 9,088,000 6,170,000 6,904,000 42,912,000 65,074,000 27,589,000 92,663,000 49,900,000 1,563,000 23,000 51,486,000 26,302,000 77,788,000 10,341,000 3,217,000 6,000,000 37,751,000 57,309,000 31,587,000 88,896,000 43,500,000 1,336,000 146,000 44,982,000 38,047,000 83,029,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started