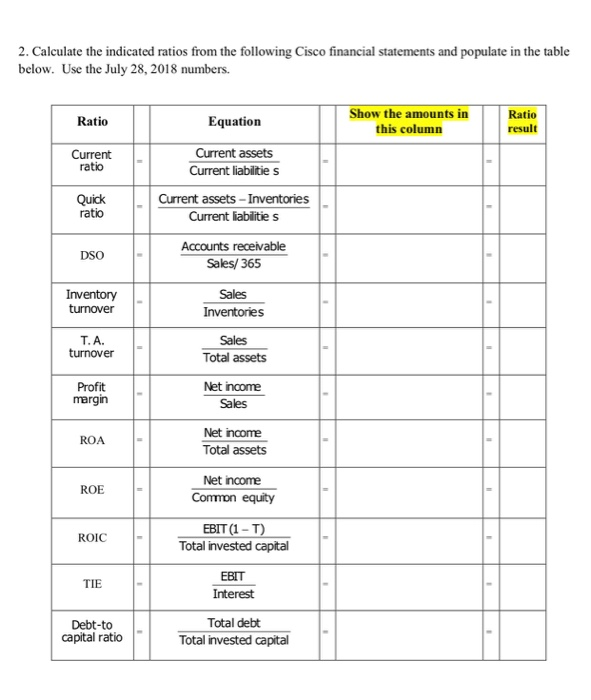

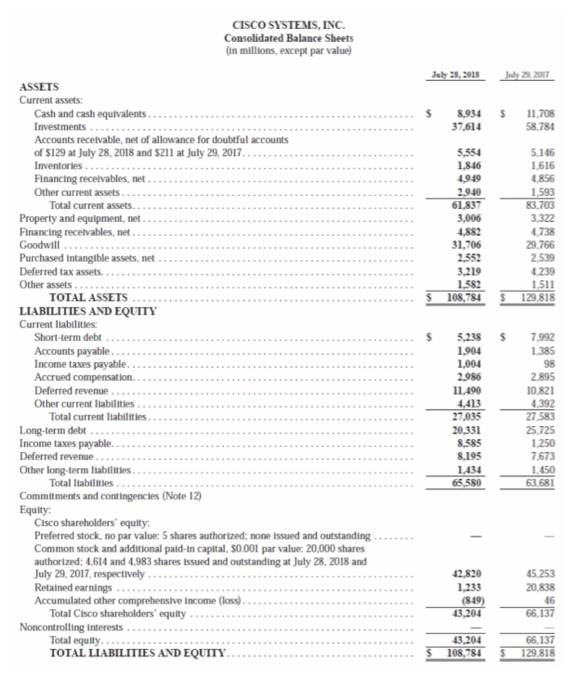

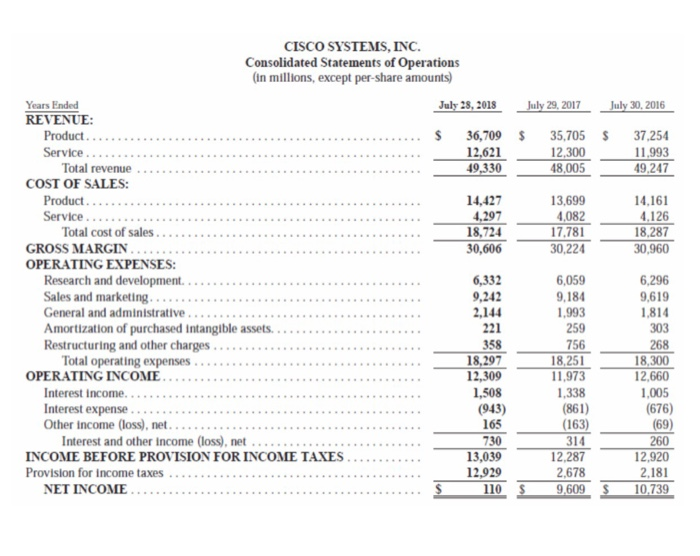

2. Calculate the indicated ratios from the following Cisco financial statements and populate in the table below. Use the July 28, 2018 numbers. Show the amounts in this column Ratio result Ratio Equation Current assets Current liabiltie s Current assets- Inventories Current iablitie s Accounts receivable Sales/ 365 Sales Inventories Sales Total assets Net income Current ratio Quick ratio DSO turnover turnover Profit margin Sales Net income Total assets ROA Net income Commron equity ROE EBIT (1 ROICTotal invested capital EBIT Interest Total debt Total invested capital TIE Debt-to capital ratio CISCO SYSTEMS,INC Consolidated Balance Sheets in millions, except par value Jly28,201Su9.207 ASSETS Current assets: Cash and cash equivalents 37,614 8.784 Accounts receivable, net of allowance for doubtful accounts of $129 at July 28, 2018 and $211 at July 29, 2017 5,146 1616 856 1,593 83.703 3.322 .738 29.766 2.539 239 1511 108,784 S 129,818 5,554 1846 Flnancing recelvables, net Other current assets 2.940 61.837 3,006 4882 31,706 Total current assets. Property and equipment, net Financing recelvables, net Purchased Intangible assets, net Deferred tax assets Other assets 3,219 1,582 TOTAL ASSETS LIABILITIES AND EQUITY --.*... Current liabilitles Short-term debt 5238 799 98 2986 11,490 4413 27,035 20331 8,585 8,195 1434 65,580 0,821 4.392 27 583 25,725 1250 7.673 1.450 63.681 Deferred revenue Other current Iiablities Total current lablilitles Long-term debt Income taxes payable. Deferred revenue Other long-term liabilities Total liabilities Commitments and contingencies (Note 12) Cisco shareholders' equity Preferred stock, no par value: 5 shares authorized: none issued and outstanding...... Common stock and additional paid-in capital, $0.001 par value: 20,000 shares authorized: 4,614 and 4,983 shares Issued and outstanding at July 28, 2018 and July 29, 2017, respectively Retalned earnings Accumulated other comprehensive income (loss 45.253 46 Total Cisco shareholders' equity Total equity TOTAL LIABILITIES AND EQUITY... 4320466.137 S 108,784 129,818 CISCO SYSTEMS, INC. Consolidated Statements of Operations (In millions, except per-share amounts) Years Ended REVENUE July 28, 201 Jul 29,2017July 30. 2016 2.621G 12,300 11,993 49.247 49.330 48,005 COST OF SALES 14,427 4,297 18,724 30,606 13,699 4,082 17,781 30,224 14,161 ,126 18,287 30,960 GROSS MARGIN OPERATING EXPENSES 6,332 9,242 2,144 221 358 18,297 12,309 6,059 9,184 1,993 259 756 18,251 11,973 1,338 (861) (163) 314 12,287 2,678 9,619 ,814 303 268 18,300 12,660 1,005 (676) (69) Sales and marketing Amortization of purchased Intangible assets. Restructuring and other charges Total operating expenses OPERATING INCOME 943) 165 730 13,039 12,929 Interest expense Interest and other income (loss), net INCOME BEFORE PROVISION FOR INCOME TAXES.._......... Provision for income taxes 12,920 2,181