Answered step by step

Verified Expert Solution

Question

1 Approved Answer

3. If the estimated amount of depreciation on equipment for a period is Rs. 2,000, the adjusting entry to record depreciation would be? (a) Debit

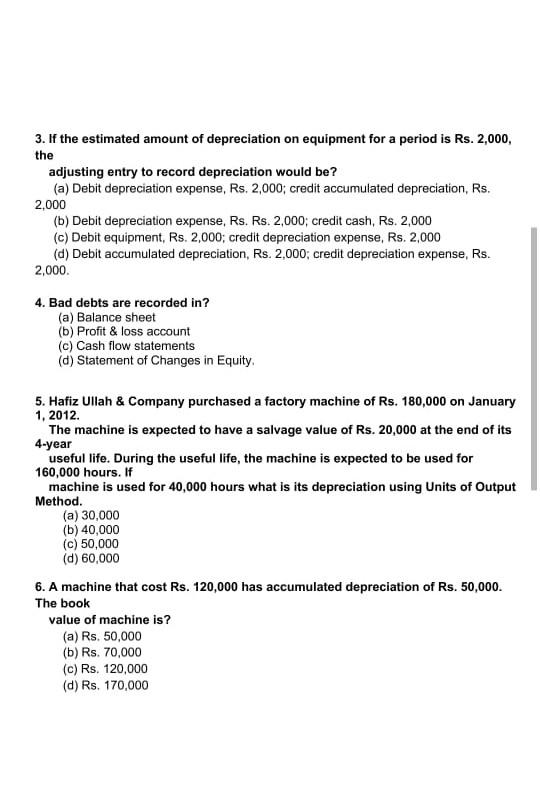

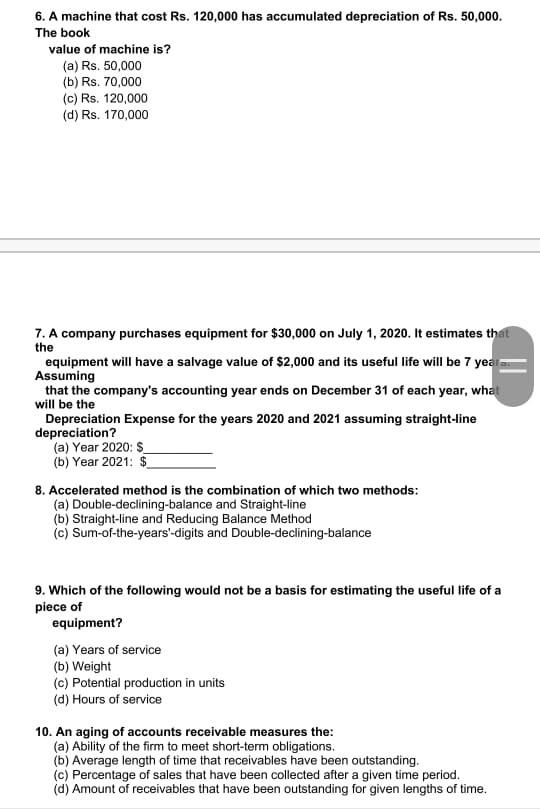

3. If the estimated amount of depreciation on equipment for a period is Rs. 2,000, the adjusting entry to record depreciation would be? (a) Debit depreciation expense, Rs. 2,000; credit accumulated depreciation, Rs. 2,000 (b) Debit depreciation expense, Rs. Rs. 2,000; credit cash, Rs. 2,000 (c) Debit equipment, Rs. 2,000; credit depreciation expense, Rs. 2,000 (d) Debit accumulated depreciation, Rs. 2,000; credit depreciation expense, Rs. 2,000 4. Bad debts are recorded in? (a) Balance sheet (b) Profit & loss account (c) Cash flow statements (d) Statement of Changes in Equity 5. Hafiz Ullah & Company purchased a factory machine of Rs. 180,000 on January 1, 2012. The machine is expected to have a salvage value of Rs. 20,000 at the end of its 4-year useful life. During the useful life, the machine is expected to be used for 160,000 hours. If machine is used for 40,000 hours what is its depreciation using Units of Output Method. (a) 30,000 (b) 40,000 (c) 50,000 (d) 60,000 6. A machine that cost Rs. 120,000 has accumulated depreciation of Rs. 50,000. The book value of machine is ? (a) Rs. 50,000 (b) Rs. 70,000 (c) Rs. 120,000 (d) Rs. 170,000 6. A machine that cost Rs. 120,000 has accumulated depreciation of Rs. 50,000. The book value of machine is? (a) Rs. 50,000 (b) Rs. 70,000 (c) Rs. 120,000 (d) Rs. 170,000 7. A company purchases equipment for $30,000 on July 1, 2020. It estimates that the equipment will have a salvage value of $2,000 and its useful life will be 7 year Assuming that the company's accounting year ends on December 31 of each year, what will be the Depreciation Expense for the years 2020 and 2021 assuming straight-line depreciation? (a) Year 2020: $ (b) Year 2021: $ 8. Accelerated method is the combination of which two methods: (a) Double-declining-balance and Straight-line (b) Straight-line and Reducing Balance Method (c) Sum-of-the-years'-digits and Double-declining-balance 9. Which of the following would not be a basis for estimating the useful life of a piece of equipment? (a) Years of service (b) Weight (c) Potential production in units (d) Hours of service 10. An aging of accounts receivable measures the: (a) Ability of the firm to meet short-term obligations. (b) Average length of time that receivables have been outstanding. (c) Percentage of sales that have been collected after a given time period. (d) Amount of receivables that have been outstanding for given lengths of time

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started