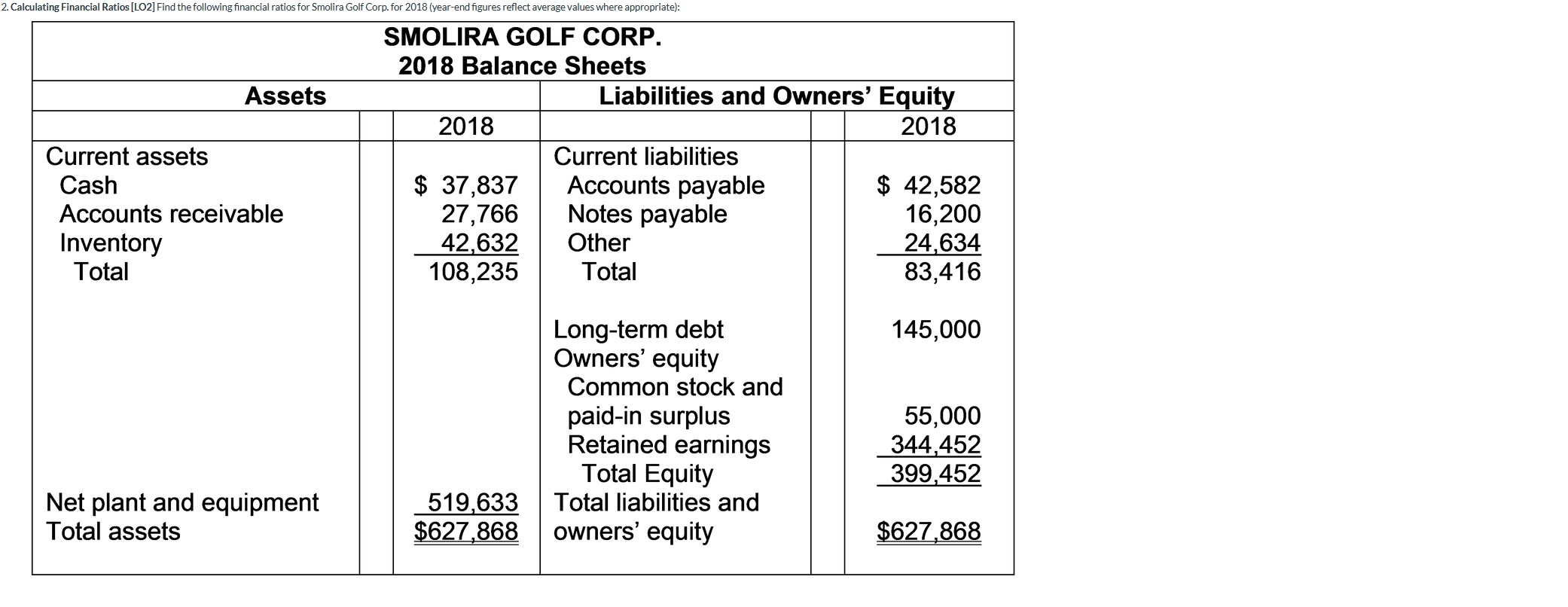

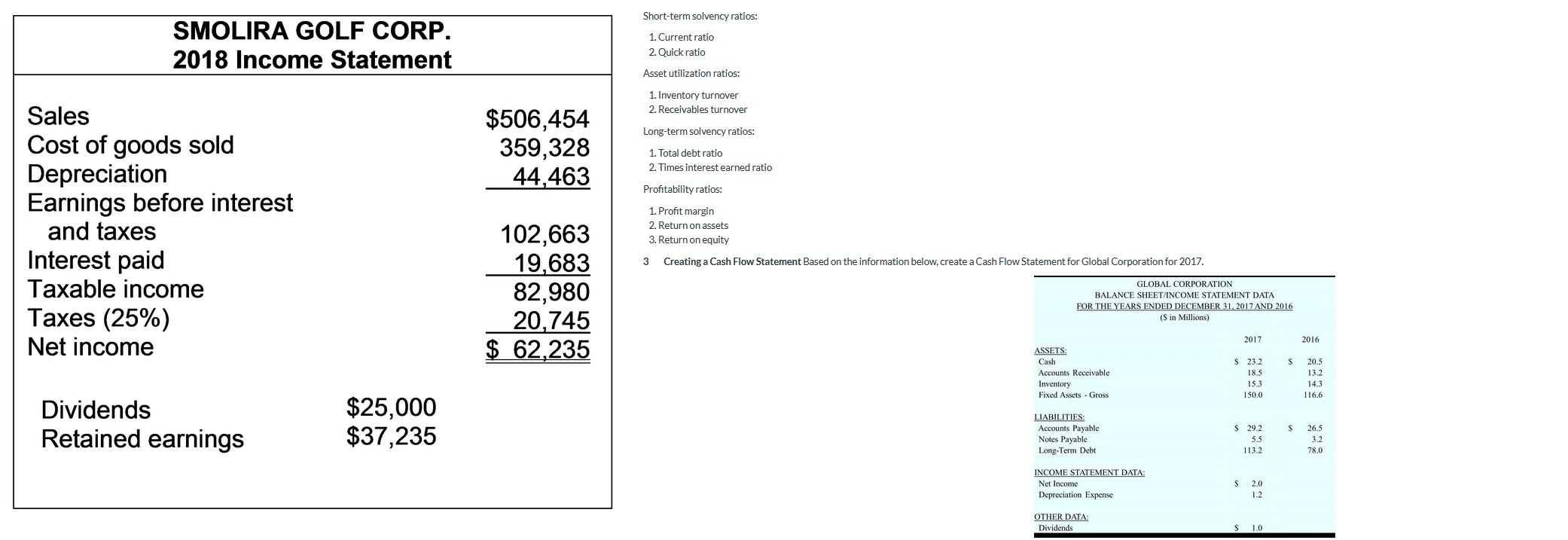

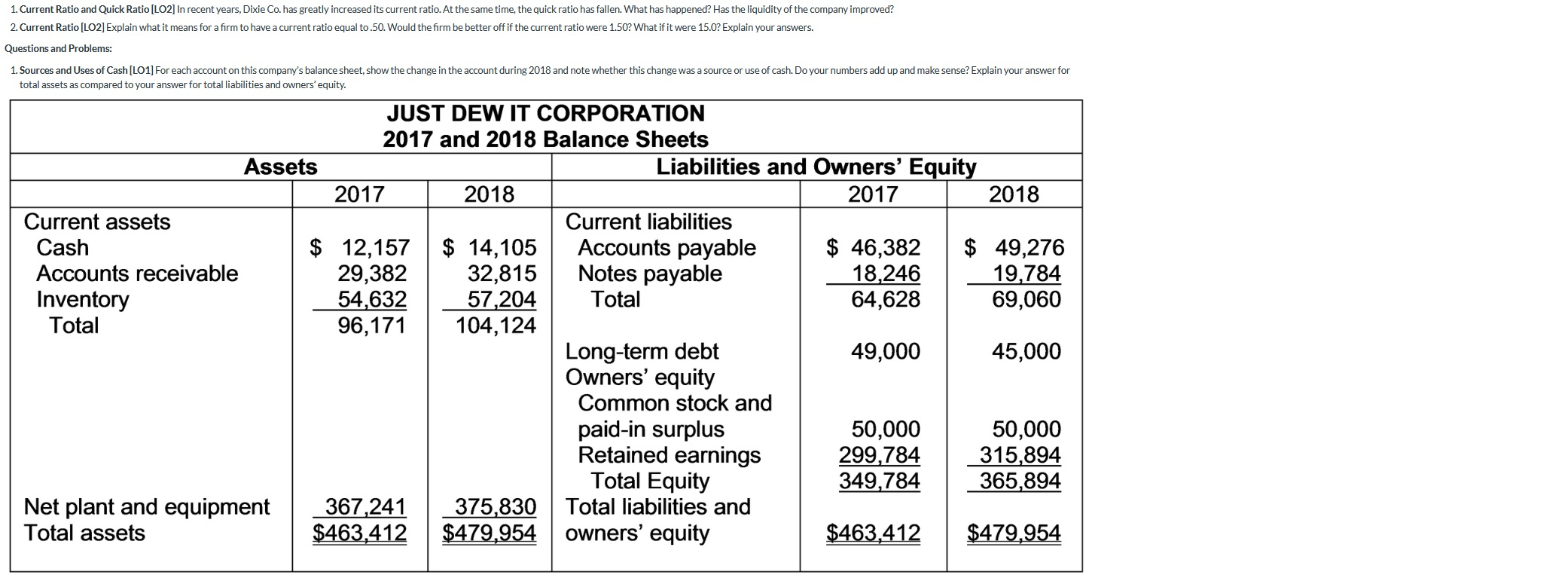

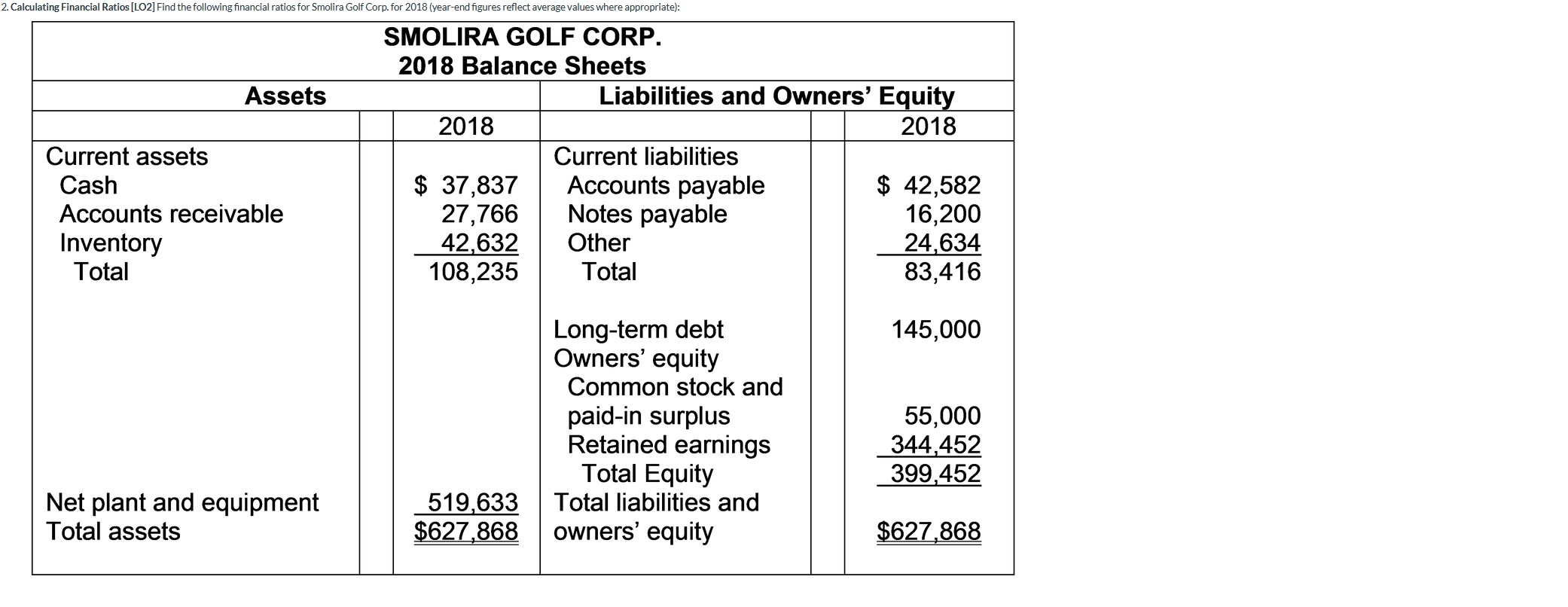

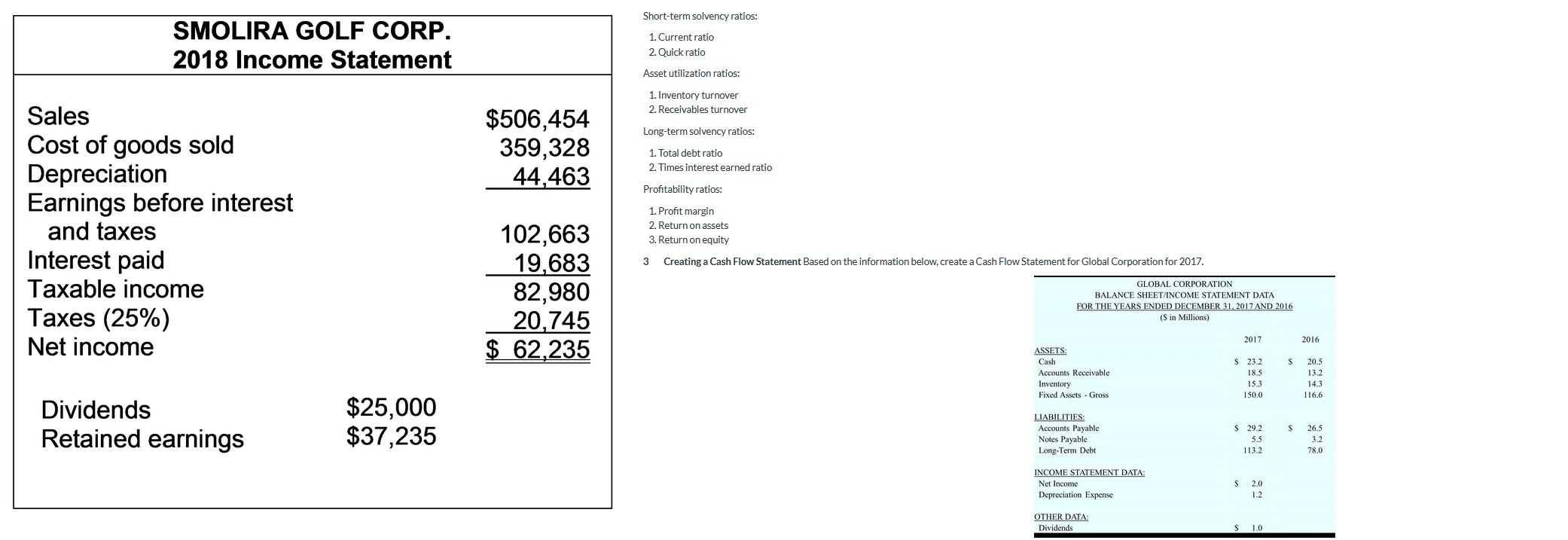

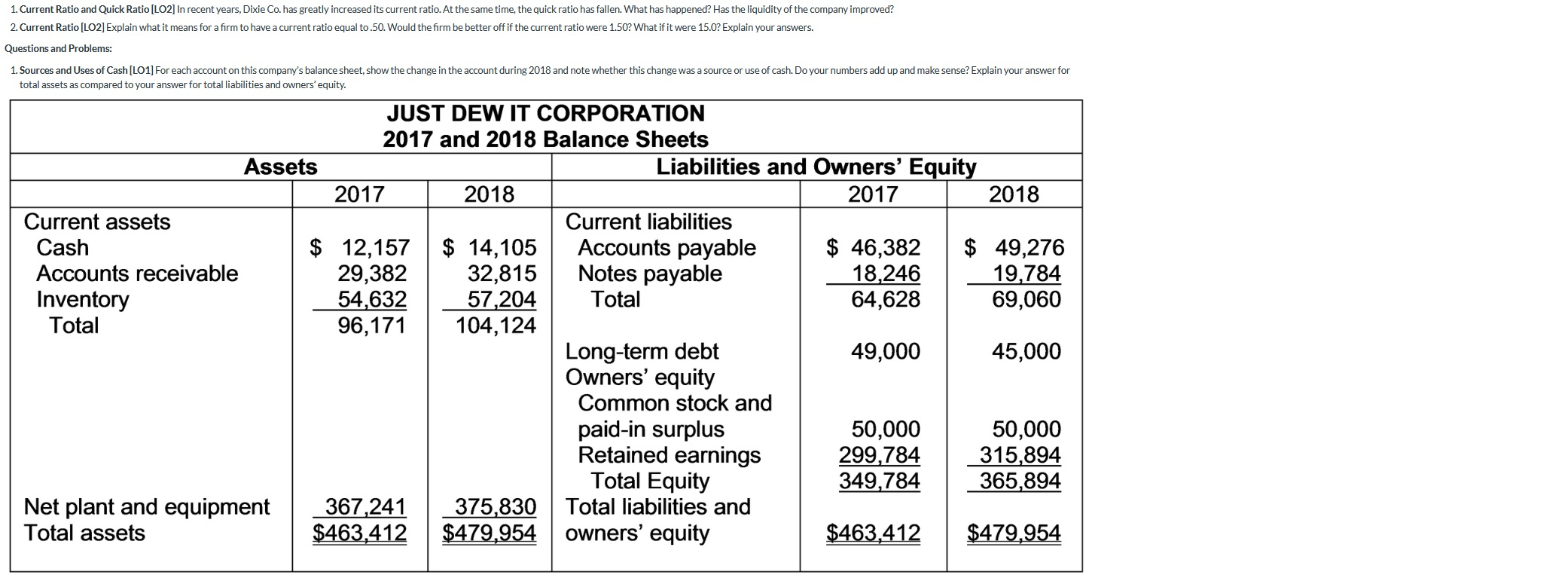

2. Calculating Financial Ratios [LO2] Find the following financial ratios for Smolira Golf Corp. for 2018 (year-end figures reflect average values where appropriate): Assets Current assets Cash Accounts receivable Inventory Total SMOLIRA GOLF CORP. 2018 Balance Sheets Liabilities and Owners' Equity 2018 2018 Current liabilities $ 37,837 Accounts payable $ 42,582 27,766 Notes payable 16,200 42,632 Other 24,634 108,235 Total 83,416 145,000 Long-term debt Owners' equity Common stock and paid-in surplus Retained earnings Total Equity | Total liabilities and owners' equity 55,000 344,452 399,452 Net plant and equipment Total assets 519,633 $627,868 $627,868 Short-term solvency ratios: SMOLIRA GOLF CORP. 2018 Income Statement 1. Current ratio 2. Quick ratio Asset utilization ratios: 1. Inventory turnover 2. Receivables turnover Long-term solvency ratios: $506,454 359,328 44,463 1. Total debt ratio 2. Times interest earned ratio Profitability ratios: Sales Cost of goods sold Depreciation Earnings before interest and taxes Interest paid Taxable income Taxes (25%) Net income 1. Profit margin 2. Return on assets 3. Return on equity 3 Creating a Cash Flow Statement Based on the information below.create a Cash Flow Statement for Global Corporation for 2017. 102,663 19,683 82,980 20,745 $ 62,235 GLOBAL CORPORATION BALANCE SHEET/INCOME STATEMENT DATA FOR THE YEARS ENDED DECEMBER 31, 2017 AND 2016 (S in Millions) 2017 2016 $ $ ASSETS: Cash Accounts Receivable Inventory Fixed Assets - Gross 23.2 18.5 15.3 150.0 20.5 13.2 14.3 116.6 Dividends Retained earnings $25,000 $37,235 LIABILITIES: Accounts Payable Notes Payable Long-Term Debt $ 29.2 5.5 113.2 26.5 3.2 78.0 INCOME STATEMENT DATA: Net Income Depreciation Expense 1.2 OTHER DATA: Dividends $ 1.0 1. Current Ratio and Quick Ratio [LO2] In recent years, Dixie Co. has greatly increased its current ratio. At the same time, the quick ratio has fallen. What has happened? Has the liquidity of the company improved? 2. Current Ratio [LO2] Explain what it means for a firm to have a current ratio equal to.50. Would the firm be better off if the current ratio were 1.50? What if it were 15.0? Explain your answers. Questions and Problems: 1. Sources and Uses of Cash [LO1] For each account on this company's balance sheet, show the change in the account during 2018 and note whether this change was a source or use of cash. Do your numbers add up and make sense? Explain your answer for total assets as compared to your answer for total liabilities and owners' equity. JUST DEW IT CORPORATION 2017 and 2018 Balance Sheets Assets Liabilities and Owners' Equity 2017 / 2018 2017 2018 Current assets Current liabilities Cash $ 12,157 $ 14,105 Accounts payable $ 46,382 $ 49,276 Accounts receivable 29,382 32,815 Notes payable 18,246 19,784 Inventory 54,632 57,204 Total 64,628 69,060 Total 96,171 104,124 Long-term debt 49,000 45,000 Owners' equity Common stock and paid-in surplus 50,000 50,000 Retained earnings 299,784 315,894 Total Equity 349,784 365,894 Net plant and equipment 367,241 375,830 | Total liabilities and Total assets $463,412 $479,954 owners' equity $463,412 $479,954