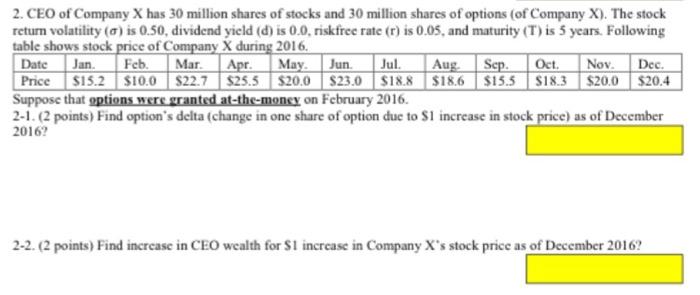

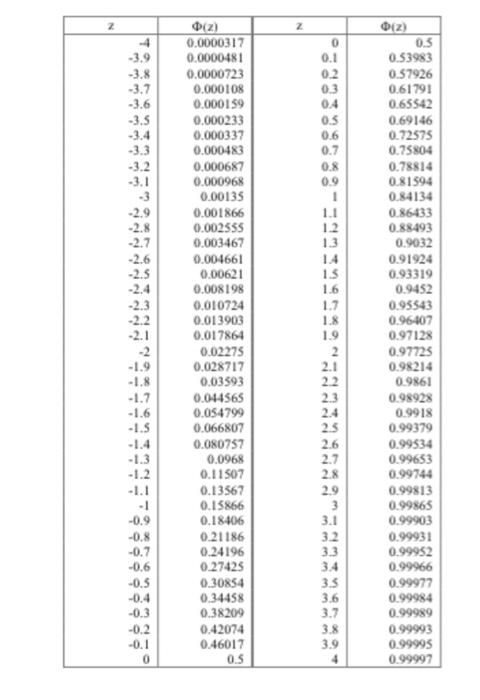

2. CEO of Company X has 30 million shares of stocks and 30 million shares of options (of Company X). The stock Tetum volatility (C) is 0.50, dividend yield (d) is 0.0, riskfree rate (r) is 0.05, and maturity (T) is 5 years. Following table shows stock price of Company X during 2016, Date Jan Feb Mar Apr. May. Jun. Aug Sep. Oct. Nov. Dec. Price $15.2 $10.0 $22.7 $25.5 $20.0 $23.0 $18.8 $18.6 $15.5 518.3 $20.0 $20.4 Suppose that options were granted at-the-money on February 2016. 2-1. (2 points) Find option's delta (change in one share of option due to $1 increase in stock price) as of December Jul. 2016? 2-2. (2 points) Find incrcase in CEO wealth for $1 increase in Company X's stock price as of December 2016? -3.8 -3.5 0 0.1 0.2 0.3 0.4 0.5 0.6 0.7 0.8 0.9 -3.2 -3.1 -3 -2.9 -2.8 -2.7 -2.6 -2.5 1.2 -2.3 -2.1 0(2) 0.0000317 0.0000481 0.0000723 0.000108 0.000159 0.000233 0.000337 0.000483 0.000687 0.000968 0.00135 0.001866 0.002555 0.003467 0.004661 0.00621 0.008198 0.010724 0.013903 0.017864 0.02275 0.028717 0.03593 0.044565 0.054799 0.066807 0.080757 0.0968 0.11507 0.13567 0.13866 0.18406 0.21186 0.24196 0.27425 0.30854 0.34458 0.38209 0.42074 0.46017 0.5 1.5 1.6 1.7 1.8 1.9 2 2.1 2.2 2.3 (2) 0.5 0.53983 0.57926 0.61791 0.63542 0.69146 0.72575 0.75804 0.78814 0.81594 0.84134 0.86433 0.88493 0.9032 0.91924 0.93319 0.9452 0.95543 0.96407 0.97128 0.97725 0.98214 0.9861 0.98928 0.9918 0.99379 0.99534 0.99653 0.99744 0.99813 0.99865 0.99903 0.99931 0.99952 0.99966 0.99977 0.99984 0.99989 0.99993 0.99995 0.99997 -1.9 -1.8 -1.7 -1.6 -1.5 -1.4 -1.3 2.5 2.6 2.7 2.8 2.9 3 3.1 3.2 3.3 -1 -0.9 -0.8 -0.7 -0.6 -0.5 -0.4 -0.3 -0.2 -0.1 0 34 3.5 3.6 3.7 3.8 3.9 4 2. CEO of Company X has 30 million shares of stocks and 30 million shares of options (of Company X). The stock Tetum volatility (C) is 0.50, dividend yield (d) is 0.0, riskfree rate (r) is 0.05, and maturity (T) is 5 years. Following table shows stock price of Company X during 2016, Date Jan Feb Mar Apr. May. Jun. Aug Sep. Oct. Nov. Dec. Price $15.2 $10.0 $22.7 $25.5 $20.0 $23.0 $18.8 $18.6 $15.5 518.3 $20.0 $20.4 Suppose that options were granted at-the-money on February 2016. 2-1. (2 points) Find option's delta (change in one share of option due to $1 increase in stock price) as of December Jul. 2016? 2-2. (2 points) Find incrcase in CEO wealth for $1 increase in Company X's stock price as of December 2016? -3.8 -3.5 0 0.1 0.2 0.3 0.4 0.5 0.6 0.7 0.8 0.9 -3.2 -3.1 -3 -2.9 -2.8 -2.7 -2.6 -2.5 1.2 -2.3 -2.1 0(2) 0.0000317 0.0000481 0.0000723 0.000108 0.000159 0.000233 0.000337 0.000483 0.000687 0.000968 0.00135 0.001866 0.002555 0.003467 0.004661 0.00621 0.008198 0.010724 0.013903 0.017864 0.02275 0.028717 0.03593 0.044565 0.054799 0.066807 0.080757 0.0968 0.11507 0.13567 0.13866 0.18406 0.21186 0.24196 0.27425 0.30854 0.34458 0.38209 0.42074 0.46017 0.5 1.5 1.6 1.7 1.8 1.9 2 2.1 2.2 2.3 (2) 0.5 0.53983 0.57926 0.61791 0.63542 0.69146 0.72575 0.75804 0.78814 0.81594 0.84134 0.86433 0.88493 0.9032 0.91924 0.93319 0.9452 0.95543 0.96407 0.97128 0.97725 0.98214 0.9861 0.98928 0.9918 0.99379 0.99534 0.99653 0.99744 0.99813 0.99865 0.99903 0.99931 0.99952 0.99966 0.99977 0.99984 0.99989 0.99993 0.99995 0.99997 -1.9 -1.8 -1.7 -1.6 -1.5 -1.4 -1.3 2.5 2.6 2.7 2.8 2.9 3 3.1 3.2 3.3 -1 -0.9 -0.8 -0.7 -0.6 -0.5 -0.4 -0.3 -0.2 -0.1 0 34 3.5 3.6 3.7 3.8 3.9 4