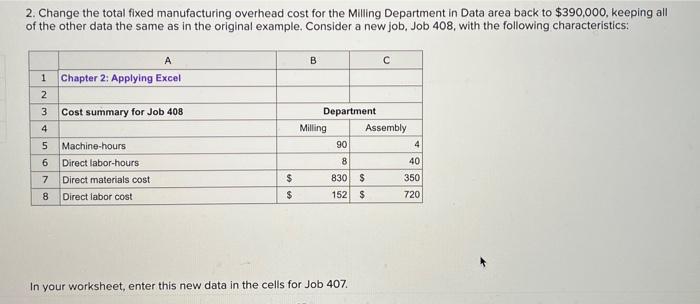

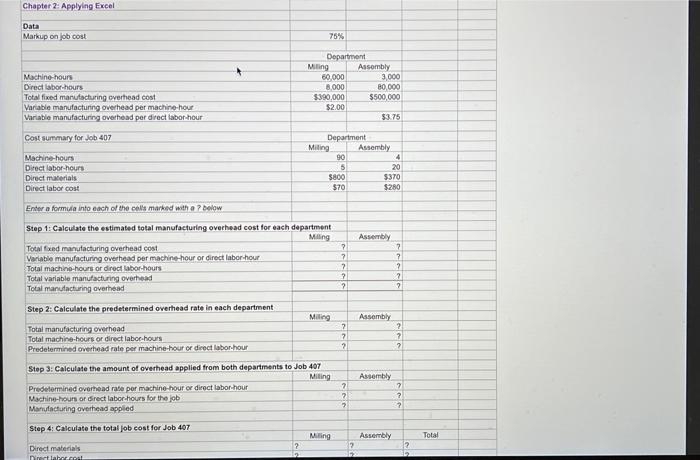

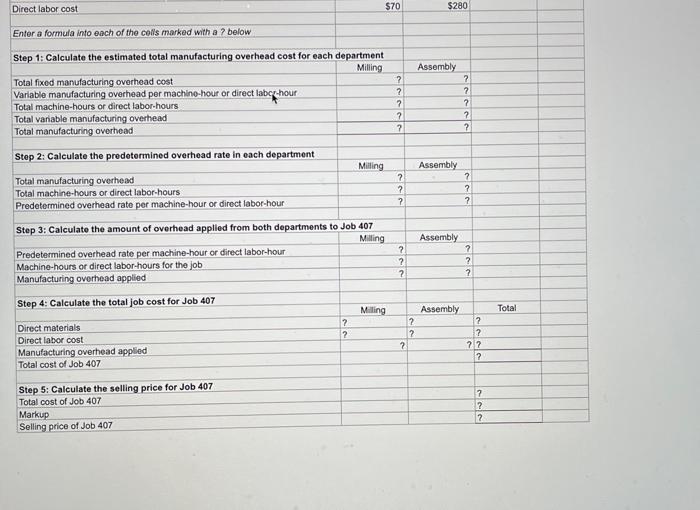

2. Change the total fixed manufacturing overhead cost for the Milling Department in Data area back to $390,000, keeping all of the other data the same as in the original example. Consider a new job, Job 408 , with the following characteristics: In your worksheet, enter this new data in the cells for Job 407. Chapter 2: Applyling Excel Data Markup on lob cost 75% Department Machine-tours Direct laborthours Total fixed marulacturing overthead cost Variable manufacturing overhead per machiro-hour. Variable manufacturing overhead per diect labor hour \begin{tabular}{r|r} \multicolumn{1}{c|}{ Mling } & \multicolumn{1}{c}{ Assembly } \\ \hline 60,000 & 3,000 \\ \hline 8,000 & 80,000 \\ \hline$390,000 & $500,000 \\ \hline 22.00 & \\ \hline & $3.75 \\ \hline \end{tabular} Cost summary for Job 407 Department Machirs-hours Ditect labor-heurs Direct macerials: Direct labor cost \begin{tabular}{|r|r|} \hline \multicolumn{1}{|l|}{ Miling } & \multicolumn{1}{c|}{ Assembly } \\ \hline 90 & 4 \\ \hline 5 & 20 \\ \hline 5800 & $370 \\ \hline 570 & $260 \\ \hline \end{tabular} Enter a formula into each of the cells markad with a ? beiew Step 1: Calculate the estimated total manufacturing ovechead cost for each department Total fxed manulacturing overhead cost Variable manufacturing overhesd per machine hour or direct labor hour: Total machho-hours or dinect labor-hours Total variable manufacturing overhedi Total manutacturing overhead \begin{tabular}{|c|c|c|} \hline Miling & Assembly \\ \hline \end{tabular} Step 2: Calculate the predetermined overhead rate in each department Total manufacturing owerhead Total maching-hours or direct labochours Predetermined oveihead rale per machine tour or dicect labor-hour Step 3: Calculate the amount of overhead applied from both departments to Job 497 Predelermined overthead rase por machine-hour or diroct labor-hour Machine-hours or is rect labor-hours for the job Marudacturing overhead applied. Step 4: Calculate the total job cost for Job 407 Direct materials Direct labor cost $70$280 Enter a formula into each of the colls marked with a ? below Step 1: Calculate the estimated total manufacturing overhead cost for each department Total fixed manulacturing overhead cost Varlable manufacturing overhead per machino-hour or direct labcy thour Total machine-hours or direct labor-hours Total variable manufacturing overhead Total manufacturing overhead Milling Assembly Step 2: Calculate the predetermined overhead rate in each department Total manufacturing overhesd Total machine-hours or direct labor-hours Predetermined overhead rate per machine-hour or direct labor-hour \begin{tabular}{r|r|} \hline Miling & Assembly \\ \hline? & ? \\ \hline? & ? \\ \hline? & ? \end{tabular} Step 3: Calculate the amount of overhead applled from both departments to Job 407 Predetermined overhead rate per machine-hour or direct labor-hour Machine-hours or difect labor-hours for the job Manufacturing overhead applied Milling Assembly Step 4: Calculate the total job cost for Job 407 Direct materials Direct labor cost Manufacturing overhead applied Total cost of Job 407 Step 5: Calculate the selling price for Job 407 Total cost of Job 407 Markup Selling price of Job 407