2. Chapter 11 Minicase Conch Republic Electronics, Part 2

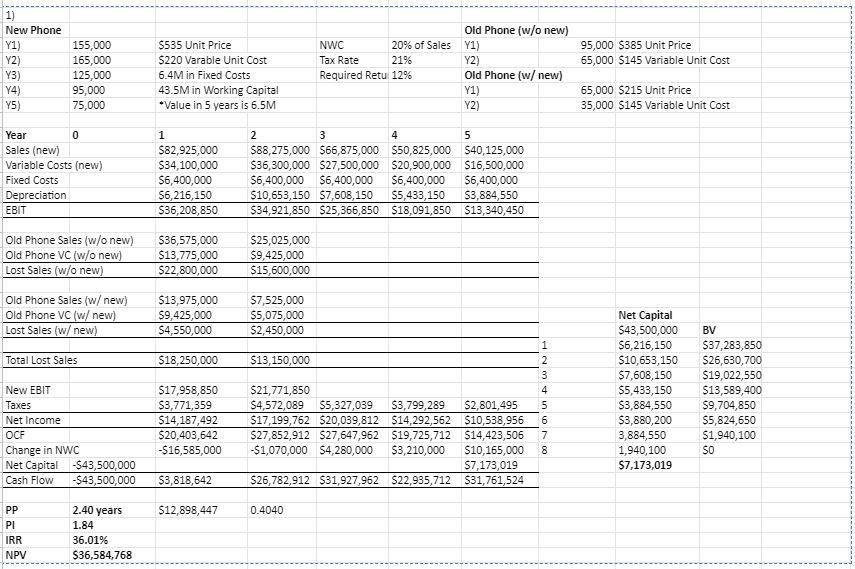

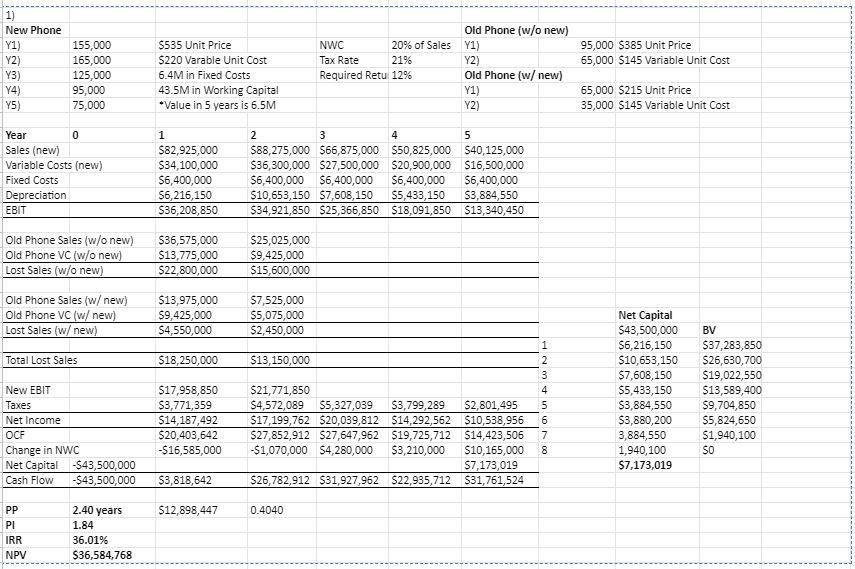

a. A good spreadsheet model to automatically recalculate cash flows will make it easy to respond to #1 and #2 in Part 2 of this case. Review your spreadsheet model to make sure it is ready to go.

b. In order to respond to #1, assume that one downside standard deviation of price is $75 and that you want to evaluate the impact of one standard deviation and two standard deviation price reductions.

c. To respond to #2, assume that one downside standard deviation of sales volume (quantity sold) is 20% in relation to the base case of forecasted sales volume applied in Part 1. Evaluate the impact on one and two standard deviation reductions in sales volume. (See excel graph below for Part 1)

d. This is an added #3. Assess the impact of changes in discount rates on NPV under the rationale that the risks associated with the economy are greater than anticipated. Present an NPV profile graph using the base case from Part 1. (See excel graph below for Part 1)

e. Based on all of your analysis above, assess and support your analysis of risk associated with this project and whether it impacts your recommendation in the Part 1 minicase. (See excel graph below for Part 1)

MINICASE Conch Republic Electronics, Part 2 Shelley Couts, the owner of Conch Republic Electronics, has has asked Jay to analyze how changes in the price of the new received the capital budgeting analysis from Jay McCanless smartphone and changes in the quantity sold will affect the for the new smartphone the company is considering. Shelley NPV of the project. is pleased with the results, but she still has concerns about the Shelley has asked Jay to prepare a memo answering the fol- new smartphone. Conch Republic has used a small market re- lowing questions. search firm for the past 20 years, but recently the founder of that firm has retired. Because of this, Shelley is not convinced QUESTIONS the sales projections presented by the market research firm 1. How sensitive is the NPV to changes in the price of the are entirely accurate. Additionally, because of rapid changes ir new smartphone? in technology, she is concerned that a competitor may enter 2. How sensitive is the NPV to changes in the quantity sold the market. This would likely force Conch Republic to lower the sales price of its new smartphone. For these reasons, she of the new smartphone? 1) New Phone Y1) Y2) Y3) Y4) Y5) 155,000 165,000 125,000 95,000 75,000 95,000 $385 Unit Price 65,000 $145 Variable Unit Cost $535 Unit Price 5220 Varable Unit Cost 6.4M in Fixed Costs 43.5M in Working Capital *Value in 5 years is 6.5M Old Phone (w/o new) NWC 20% of Sales Y1) Tax Rate 21% Y2) Required Retu 12% Old Phone (w/ new) Y1) Y2) 65,000 $215 Unit Price 35,000 $145 Variable Unit Cost 1 Year 0 Sales (new) Variable Costs (new) Fixed Costs Depreciation EBIT 1 $82,925,000 $34,100,000 $6,400,000 S6,216,150 $36,208,850 2 3 4 5 $88,275,000 $66,875,000 $50,825,000 $40,125,000 $36,300,000 $27,500,000 $20,900,000 $16,500,000 $6,400,000 $6,400,000 $6,400,000 $6,400,000 $10,653,150 $7,608,150 $5,433,150 $3,884,550 $34,921,850 $25,366,850 $18,091,850 $13,340,450 Old Phone Sales (w/o new) Old Phone VC (w/o new) Lost Sales (w/o new) $36,575,000 $13,775,000 $22,800,000 $25,025,000 $9,425,000 $15,600,000 Old Phone Sales (w/ new) Old Phone VC (w/ new) Lost Sales (w/ new) $13,975,000 $9,425,000 $4,550,000 $7,525,000 $5,075,000 $2,450,000 HN Total Lost Sales $18,250,000 $13,150,000 New EBIT Taxes Net Income OCF Change in NWC Net Capital -$43,500,000 Cash Flow -$43,500,000 $17,958,850 $3,771,359 $14,187,492 $20,403,642 -$16,585,000 $21,771,850 $4,572,089 $5,327,039 $3,799,289 $2,801,495 $17,199,762 $20,039,812 $14,292,562 $10,538,956 S27,852,912 $27,647,962 $19,725,712 514,423,506 -$1,070,000 $4,280,000 $3,210,000 $10,165,000 $7,173,019 $26,782,912 $31,927,962 $22,935,712 $31,761,524 3 4 5 6 7 8 Net Capital S43,500,000 $6,216,150 $10,653,150 $7,608,150 $5,433,150 $3,884,550 $3,880,200 3,884,550 1,940,100 $7,173,019 BV $37,283,850 $26,630,700 $19,022,550 $13,589,400 $9,704,850 $5,824,650 $1,940,100 SO $3,818,642 2.40 years $12,898,447 0.4040 PP PI IRR NPV 1.84 36.01% $36,584,768 MINICASE Conch Republic Electronics, Part 2 Shelley Couts, the owner of Conch Republic Electronics, has has asked Jay to analyze how changes in the price of the new received the capital budgeting analysis from Jay McCanless smartphone and changes in the quantity sold will affect the for the new smartphone the company is considering. Shelley NPV of the project. is pleased with the results, but she still has concerns about the Shelley has asked Jay to prepare a memo answering the fol- new smartphone. Conch Republic has used a small market re- lowing questions. search firm for the past 20 years, but recently the founder of that firm has retired. Because of this, Shelley is not convinced QUESTIONS the sales projections presented by the market research firm 1. How sensitive is the NPV to changes in the price of the are entirely accurate. Additionally, because of rapid changes ir new smartphone? in technology, she is concerned that a competitor may enter 2. How sensitive is the NPV to changes in the quantity sold the market. This would likely force Conch Republic to lower the sales price of its new smartphone. For these reasons, she of the new smartphone? 1) New Phone Y1) Y2) Y3) Y4) Y5) 155,000 165,000 125,000 95,000 75,000 95,000 $385 Unit Price 65,000 $145 Variable Unit Cost $535 Unit Price 5220 Varable Unit Cost 6.4M in Fixed Costs 43.5M in Working Capital *Value in 5 years is 6.5M Old Phone (w/o new) NWC 20% of Sales Y1) Tax Rate 21% Y2) Required Retu 12% Old Phone (w/ new) Y1) Y2) 65,000 $215 Unit Price 35,000 $145 Variable Unit Cost 1 Year 0 Sales (new) Variable Costs (new) Fixed Costs Depreciation EBIT 1 $82,925,000 $34,100,000 $6,400,000 S6,216,150 $36,208,850 2 3 4 5 $88,275,000 $66,875,000 $50,825,000 $40,125,000 $36,300,000 $27,500,000 $20,900,000 $16,500,000 $6,400,000 $6,400,000 $6,400,000 $6,400,000 $10,653,150 $7,608,150 $5,433,150 $3,884,550 $34,921,850 $25,366,850 $18,091,850 $13,340,450 Old Phone Sales (w/o new) Old Phone VC (w/o new) Lost Sales (w/o new) $36,575,000 $13,775,000 $22,800,000 $25,025,000 $9,425,000 $15,600,000 Old Phone Sales (w/ new) Old Phone VC (w/ new) Lost Sales (w/ new) $13,975,000 $9,425,000 $4,550,000 $7,525,000 $5,075,000 $2,450,000 HN Total Lost Sales $18,250,000 $13,150,000 New EBIT Taxes Net Income OCF Change in NWC Net Capital -$43,500,000 Cash Flow -$43,500,000 $17,958,850 $3,771,359 $14,187,492 $20,403,642 -$16,585,000 $21,771,850 $4,572,089 $5,327,039 $3,799,289 $2,801,495 $17,199,762 $20,039,812 $14,292,562 $10,538,956 S27,852,912 $27,647,962 $19,725,712 514,423,506 -$1,070,000 $4,280,000 $3,210,000 $10,165,000 $7,173,019 $26,782,912 $31,927,962 $22,935,712 $31,761,524 3 4 5 6 7 8 Net Capital S43,500,000 $6,216,150 $10,653,150 $7,608,150 $5,433,150 $3,884,550 $3,880,200 3,884,550 1,940,100 $7,173,019 BV $37,283,850 $26,630,700 $19,022,550 $13,589,400 $9,704,850 $5,824,650 $1,940,100 SO $3,818,642 2.40 years $12,898,447 0.4040 PP PI IRR NPV 1.84 36.01% $36,584,768