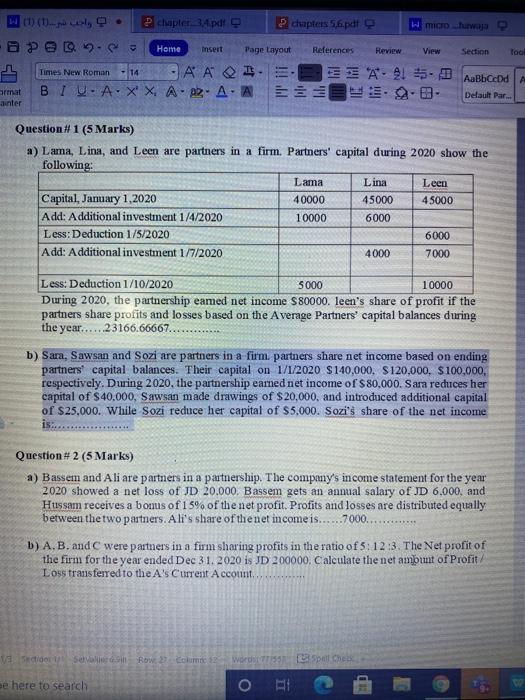

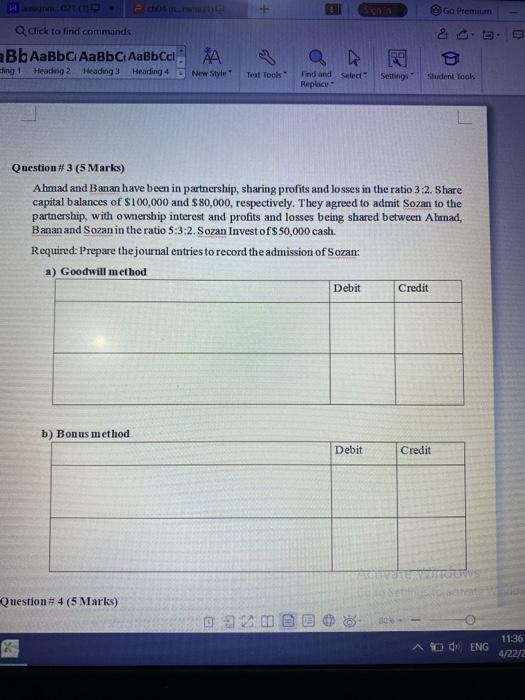

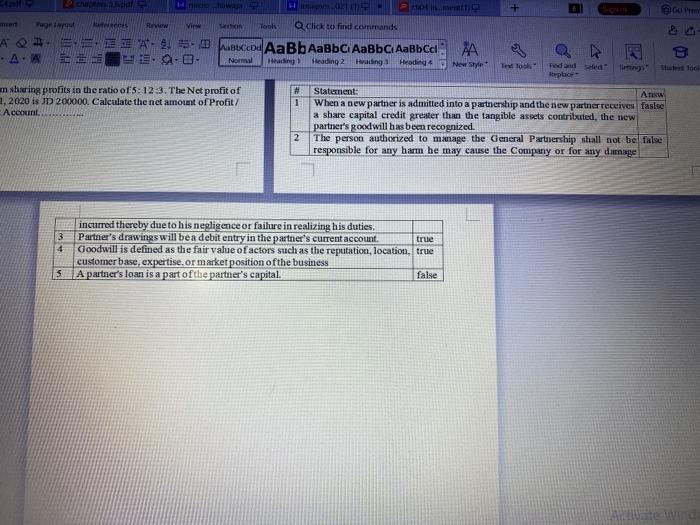

2 chapter 34 pdf 2 chapters 5,6.pdf W micro huwapo (1) @P2 Home Insert Page Layout References Review View Section fool Times New Roman -14 SAA OI BIU.A.XX, A. A. A A 21 - AaBbceDd armat anter - Default Par. Question #1 (5 Marks) a) Lama, Lina, and Leen are partners in a firm. Partners' capital during 2020 show the following: Lama Lina Leen Capital, January 1,2020 40000 45000 45000 Add: Additional investment 1/4/2020 10000 6000 Less:Deduction 1/5/2020 6000 Add: Additional investment 1/7/2020 4000 7000 Less: Deduction 1/10/2020 5000 10000 During 2020, the partnership eamed net income $80000. leen's share of profit if the partners share profits and losses based on the Average Partners' capital balances during the year.....23166.66667... b) Sara, Sawsan and Sozi are partners in a firm partners share net in come based on ending partners' capital balances. Their capital on 1/1/2020 $140,000 $120,000, $100,000, respectively. During 2020. the partnership eamed net income of $80,000. Sara reduces her capital of $40.000, Sawsan made drawings of $20,000, and introduced additional capital of $25.000. While Sozi reduce her capital of $5.000. Sozi's share of the net income is... Question# 2 (5 Marks) a) Bassem and Ali are partners in a partnership. The company's income statement for the year 2020 showed a net loss of JD 20.000. Bassem gets an annual salary of JD 6.000, and Hussam receives a boms of 15% of the net profit. Profits and losses are distributed equally between the two partners. Ali's share of the net income is.....7000......... b) A.B. and were partners in a firm sharing profits in the ratio of 5:12:3. The Net profit of the firm for the year ended Dec 31, 2020 is JD 200000. Calculate the net amount of Profit / Loss transferred to the A's Current Account Sections Row >> Column 1 Word 55 spalle be here to search O Go Premium Click to find commands sling Heading 2 Heading Heading 4 New Style Test Tools Find and select Replace Settings Student tools Question# 3 (5 Marks) Ahmad and Banan have been in partnership, sharing profits and losses in the ratio 3:2. Share capital balances of $100,000 and $80,000, respectively. They agreed to admit Sozan to the partnership, with ownership interest and profits and losses being shared between Ahmad, Banan and Sozan in the ratio S:3:2. Sozan InvestofS50,000 cash. Required: Prepare the journal entries to record the admission of Sozam a) Goodwill method Debit Credit b) Bonus method Debit Credit Question# 4 (5 Marks) 23 AO ENG 1136 4/22/2 H. P. POFI DS w View Tanks Q Click to find commands AQEEI A-1 Da AaBb AaBbc AaBbci AaBbcc A .A 29.90 Normal Facing Heading 2 Hacing Heading 4 New Style Test to Tento Repor un sharing profits in the ratio of 5:12 3. The Net profit of # Statement: Atuw 2. 2020 is JD 20XX00. Calculate the net amount of Profit/ 1 When a new partner is admitted into a partnership and the new partner receives fasise Account a sbare capital credit greater than the tangible assets contributed, the new partner's goodwill has been recognized 2 The person authorized to manage the General Partnership shall not be false responsible for any harm he may cause the Company or for any damage 3 4 incurred thereby due to his negligence or failure in realizing his duties. Partner's drawings will be a debit entry in the partner's current account true Goodwill is defined as the fair value of actors such as the reputation, location, true customer base, expertise, or market position ofthe business A partner's loan is a part of the partner's capital. false 5