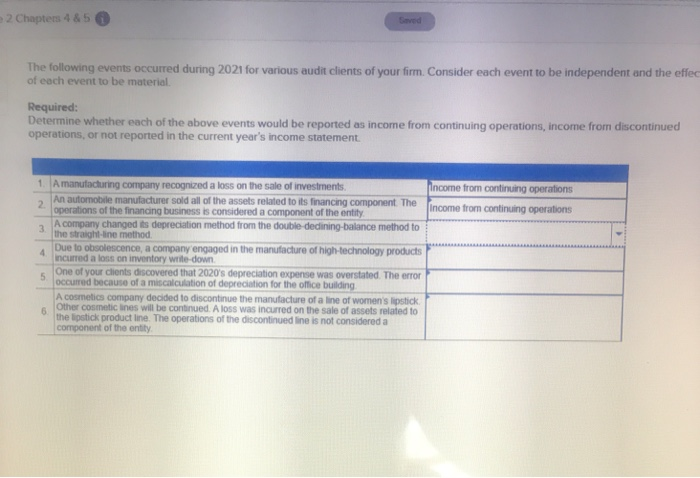

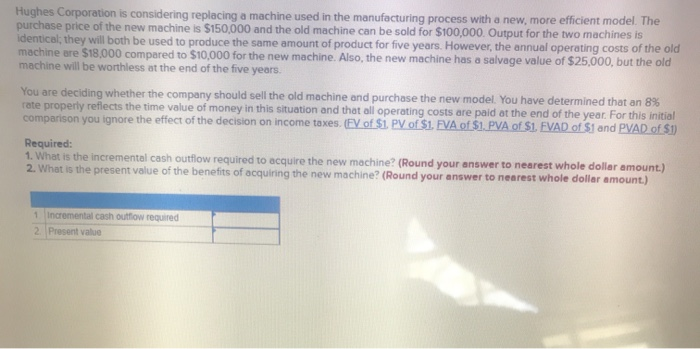

2 Chapter 4&5 The following events occurred during 2021 for various audit clients of your firm. Consider each event to be independent and the effee of each event to be material Required: Determine whether each of the above events would be reported as income from continuing operations, income from discontinued operations, or not reported in the current year's income statement. Income from continuing operations income from continuing operations 1 Amanufacturing company recognized a loss on the sale of investments nucurer sold all of the assets related to its financng component the operations of the financing business is considered a component of the entity A company changed its depreciation method from the double dedining-balance method to the straight line method Due to obsolescence, a company engaged in the manufacture of high-technology products incurred also inventory write down One of your clients discovered that 2020's depreciation expense was overstated. The error Occurred because of a miscalculation of depreciation for the office buding A cosmetics company decided to discontinue the manufacture of a line of women's lipstick Other cosmetic lines will be continued A loss was incurred on the sale of assets related to the lipstick product line. The operations of the discontinued line is not considered a component of the entity Hughes Corporation is considering replacing a machine used in the manufacturing process with a new, more efficient model. The purchase price of the new machine is $150,000 and the old machine can be sold for $100,000. Output for the two machines is identical, they will both be used to produce the same amount of product for five years. However, the annual operating costs of the old machine are $18,000 compared to $10,000 for the new machine. Also, the new machine has a salvage value of $25.000, but the old machine will be worthless at the end of the five years. You are deciding whether the company should sell the old machine and purchase the new model. You have determined that an 8% rate properly reflects the time value of money in this situation and that all operating costs are paid at the end of the year. For this initial comparison you ignore the effect of the decision on income taxes. (FV of $1. PV of $1. FVA of $1. PVA of $1. FVAD of $1 and PVAD of $1 Required: 1. What is the incremental cash outflow required to acquire the new machine? (Round your answer to nearest whole dollar amount.) 2. What is the present value of the benefits of acquiring the new machine? (Round your answer to nearest whole dollar amount.) 1 Incremental cash outflow required 2 procent value