Answered step by step

Verified Expert Solution

Question

1 Approved Answer

#2 Chapter 6 Homework 2 Exact Photo Service purchased a new color printer at the beginning of Year 1 Tor $40,60u. I ne printer is

#2

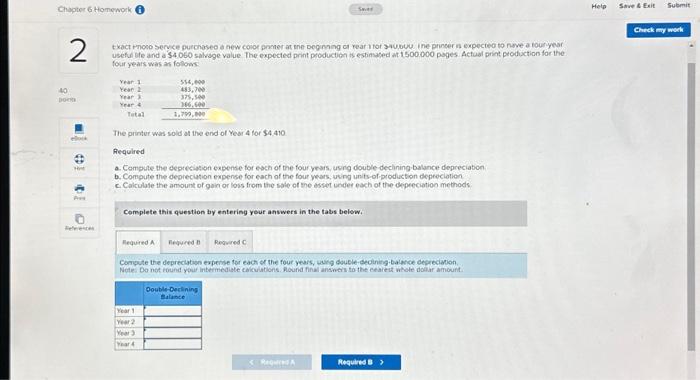

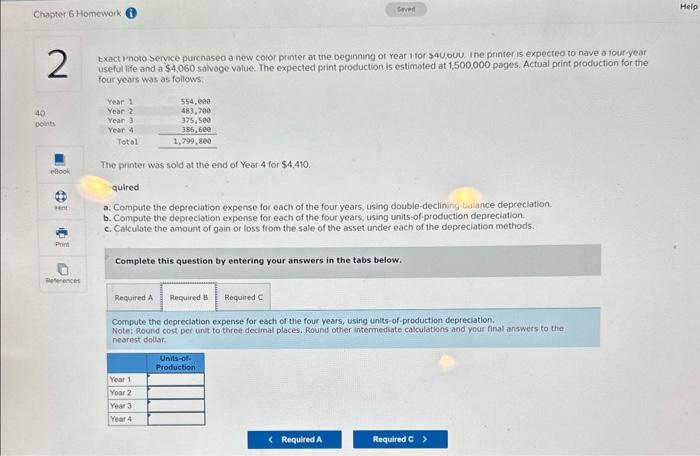

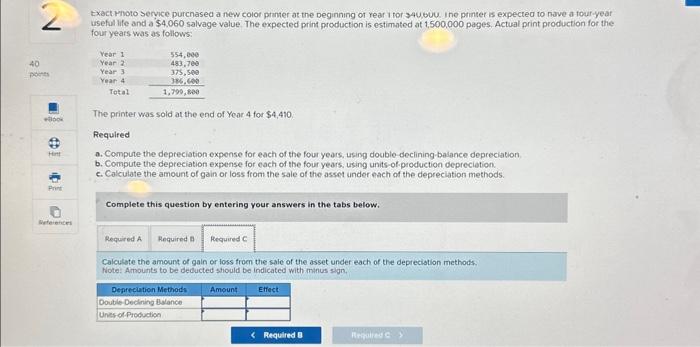

Chapter 6 Homework 2 Exact Photo Service purchased a new color printer at the beginning of Year 1 Tor $40,60u. I ne printer is expected to nave a four-year useful life and a $4,060 salvage value. The expected print production is estimated at 1,500,000 pages. Actual print production for the four years was as follows: 40 points eBook Hint Print References Year 1 Year 2 Year 3 Year 4 Total The printer was sold at the end of Year 4 for $4,410. 554,000 483,700 375,500 386,600 1,799,800 Required a. Compute the depreciation expense for each of the four years, using double-declining-balance depreciation. b. Compute the depreciation expense for each of the four years, using units-of-production depreciation. c. Calculate the amount of gain or loss from the sale of the asset under each of the depreciation methods. Required A Complete this question by entering your answers in the tabs below. Year 1 Year 2 Year 3 Year 4 Required B Saved Required C Compute the depreciation expense for each of the four years, using double-declining-balance depreciation. Note: Do not round your intermediate calculations. Round final answers to the nearest whole dollar amount. Double-Declining Balance Help Save & Exit Submit Check my work 4

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started