Answered step by step

Verified Expert Solution

Question

1 Approved Answer

2 Check my work mode: This shows what is correct or incorrect for the work you have completed so far. It does not indicate completion.

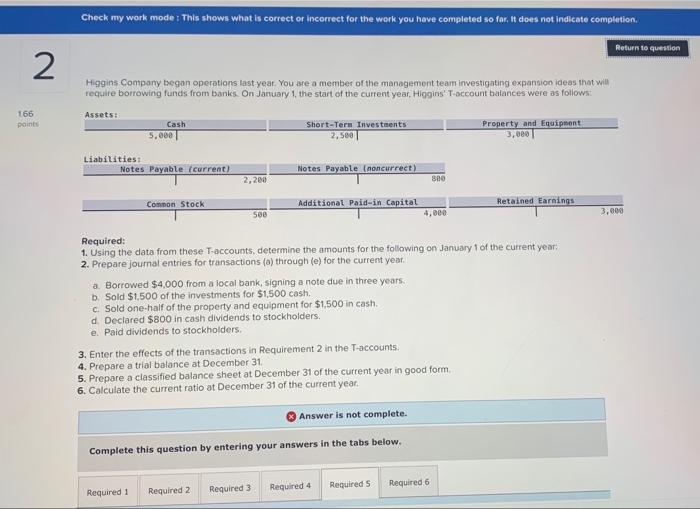

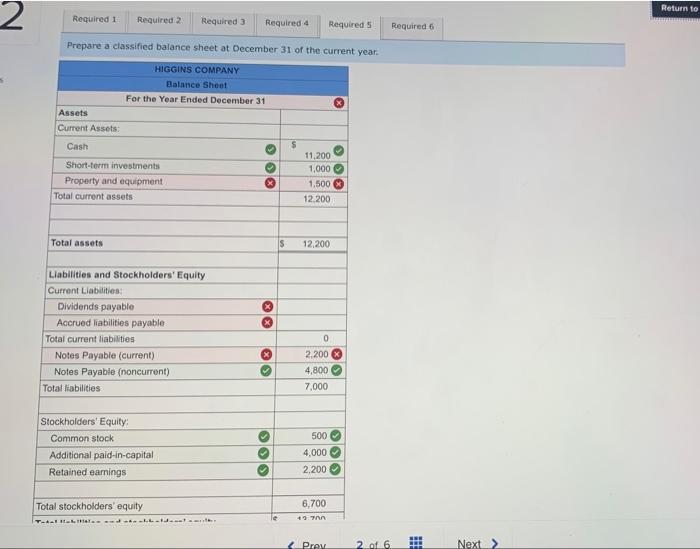

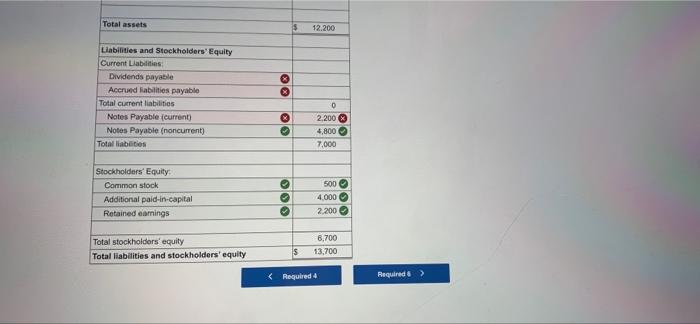

2 Check my work mode: This shows what is correct or incorrect for the work you have completed so far. It does not indicate completion. 166 Higgins Company began operations last year. You are a member of the management team investigating expansion ideas that will require borrowing funds from banks. On January 1, the start of the current year, Higgins' T-account balances were as follows: Assets: points Cash 5,000 Short-Term Investments 2,500 Property and Equipment 3,000 Return to question Liabilities: Notes Payable (current) Notes Payable (noncurrect) 2,200. 800 Common Stock Additional Paid-in Capital Retained Earnings 500 4,000 3,000 Required: 1. Using the data from these T-accounts, determine the amounts for the following on January 1 of the current year: 2. Prepare journal entries for transactions (a) through (e) for the current year. a. Borrowed $4,000 from a local bank, signing a note due in three years. b. Sold $1,500 of the investments for $1,500 cash. c. Sold one-half of the property and equipment for $1,500 in cash. d. Declared $800 in cash dividends to stockholders. e. Paid dividends to stockholders. 3. Enter the effects of the transactions in Requirement 2 in the T-accounts. 4. Prepare a trial balance at December 31.. 5. Prepare a classified balance sheet at December 31 of the current year in good form. 6. Calculate the current ratio at December 31 of the current year. Answer is not complete. Complete this question by entering your answers in the tabs below. Required 1 Required 21 Required 3 Required 4 Required S Required 6 2 Required 11 Required 2 Required 3 Required 4 Required 5 Required 6 Prepare a classified balance sheet at December 31 of the current year. HIGGINS COMPANY Balance Sheet For the Year Ended December 31 Assets Current Assets: Cash Short-term investments Property and equipment Total current assets Total assets Liabilities and Stockholders' Equity Current Liabilities: Dividends payable 100 S 11,200 1,000 1,500 12.200 300 S 12,200 Accrued liabilities payable Total current liabilities 0 Notes Payable (current) 2,200 Notes Payable (noncurrent) 4,800 Total liabilities 7,000 Stockholders' Equity: Common stock 500 Additional paid-in-capital 4,000 Retained earnings 2,200 Total stockholders' equity 6,700 45700 Prev 2 of 6 # Next> Return to Total assets Liabilities and Stockholders' Equity Current Liabilities: Dividends payable Accrued liabilities payable Total current liabilities Notes Payable (current) Notes Payable (noncurrent) Total liabilities Stockholders' Equity Common stock Additional paid-in-capital Retained eamings Total stockholders' equity Total liabilities and stockholders' equity 00 00 000 15 12.200 2,200 4,800 7,000 500 4,000 2,200

2 Check my work mode: This shows what is correct or incorrect for the work you have completed so far. It does not indicate completion. 166 Higgins Company began operations last year. You are a member of the management team investigating expansion ideas that will require borrowing funds from banks. On January 1, the start of the current year, Higgins' T-account balances were as follows: Assets: points Cash 5,000 Short-Term Investments 2,500 Property and Equipment 3,000 Return to question Liabilities: Notes Payable (current) Notes Payable (noncurrect) 2,200. 800 Common Stock Additional Paid-in Capital Retained Earnings 500 4,000 3,000 Required: 1. Using the data from these T-accounts, determine the amounts for the following on January 1 of the current year: 2. Prepare journal entries for transactions (a) through (e) for the current year. a. Borrowed $4,000 from a local bank, signing a note due in three years. b. Sold $1,500 of the investments for $1,500 cash. c. Sold one-half of the property and equipment for $1,500 in cash. d. Declared $800 in cash dividends to stockholders. e. Paid dividends to stockholders. 3. Enter the effects of the transactions in Requirement 2 in the T-accounts. 4. Prepare a trial balance at December 31.. 5. Prepare a classified balance sheet at December 31 of the current year in good form. 6. Calculate the current ratio at December 31 of the current year. Answer is not complete. Complete this question by entering your answers in the tabs below. Required 1 Required 21 Required 3 Required 4 Required S Required 6 2 Required 11 Required 2 Required 3 Required 4 Required 5 Required 6 Prepare a classified balance sheet at December 31 of the current year. HIGGINS COMPANY Balance Sheet For the Year Ended December 31 Assets Current Assets: Cash Short-term investments Property and equipment Total current assets Total assets Liabilities and Stockholders' Equity Current Liabilities: Dividends payable 100 S 11,200 1,000 1,500 12.200 300 S 12,200 Accrued liabilities payable Total current liabilities 0 Notes Payable (current) 2,200 Notes Payable (noncurrent) 4,800 Total liabilities 7,000 Stockholders' Equity: Common stock 500 Additional paid-in-capital 4,000 Retained earnings 2,200 Total stockholders' equity 6,700 45700 Prev 2 of 6 # Next> Return to Total assets Liabilities and Stockholders' Equity Current Liabilities: Dividends payable Accrued liabilities payable Total current liabilities Notes Payable (current) Notes Payable (noncurrent) Total liabilities Stockholders' Equity Common stock Additional paid-in-capital Retained eamings Total stockholders' equity Total liabilities and stockholders' equity 00 00 000 15 12.200 2,200 4,800 7,000 500 4,000 2,200 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started