2 chosen stocks are Boulder and Erskine.

your calculation would be greatly helpful to recheck whether Ive got the right answers here.

thank you

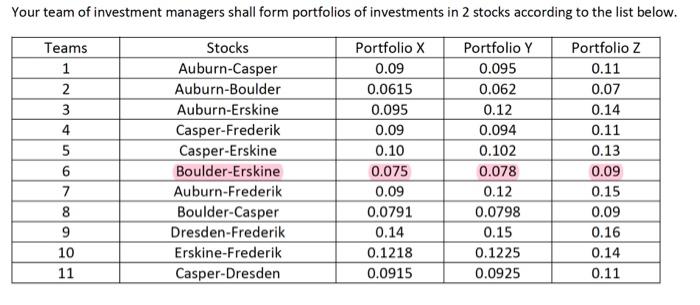

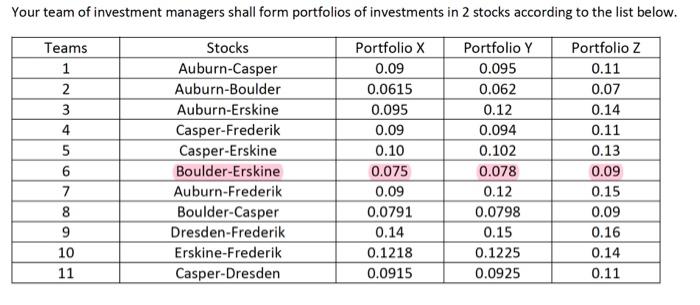

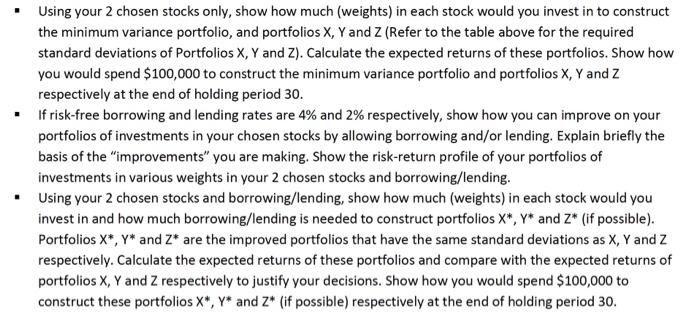

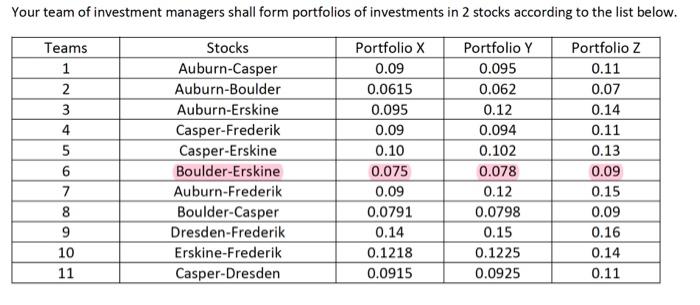

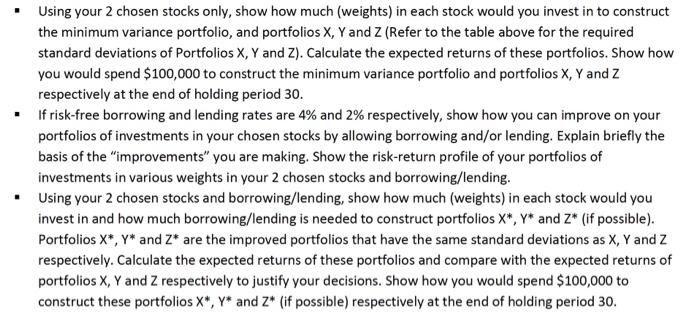

Your team of investment managers shall form portfolios of investments in 2 stocks according to the list below. Teams 1 2 3 4 5 6 7 8 9 10 11 Stocks Auburn-Casper Auburn-Boulder Auburn-Erskine Casper-Frederik Casper-Erskine Boulder-Erskine Auburn-Frederik Boulder-Casper Dresden-Frederik Erskine-Frederik Casper-Dresden Portfolio X 0.09 0.0615 0.095 0.09 0.10 0.075 0.09 0.0791 0.14 0.1218 0.0915 Portfolio Y 0.095 0.062 0.12 0.094 0.102 0.078 0.12 0.0798 0.15 0.1225 0.0925 Portfolio 2 0.11 0.07 0.14 0.11 0.13 0.09 0.15 0.09 0.16 0.14 0.11 . Using your 2 chosen stocks only, show how much (weights) in each stock would you invest in to construct the minimum variance portfolio, and portfolios X, Y and Z (Refer to the table above for the required standard deviations of Portfolios X, Y and 2). Calculate the expected returns of these portfolios. Show how you would spend $100,000 to construct the minimum variance portfolio and portfolios X, Y and Z respectively at the end of holding period 30. . If risk-free borrowing and lending rates are 4% and 2% respectively, show how you can improve on your portfolios of investments in your chosen stocks by allowing borrowing and/or lending. Explain briefly the basis of the "improvements" you are making. Show the risk-return profile of your portfolios of investments in various weights in your 2 chosen stocks and borrowing/lending. Using your 2 chosen stocks and borrowing/lending, show how much (weights) in each stock would you invest in and how much borrowing/lending is needed to construct portfolios X*, Y* and Z* (if possible). Portfolios X*, Y* and Z* are the improved portfolios that have the same standard deviations as X, Y and Z respectively. Calculate the expected returns of these portfolios and compare with the expected returns of portfolios X, Y and Z respectively to justify your decisions. Show how you would spend $100,000 to construct these portfolios X*, Y* and Z* (if possible) respectively at the end of holding period 30. Your team of investment managers shall form portfolios of investments in 2 stocks according to the list below. Teams 1 2 3 4 5 6 7 8 9 10 11 Stocks Auburn-Casper Auburn-Boulder Auburn-Erskine Casper-Frederik Casper-Erskine Boulder-Erskine Auburn-Frederik Boulder-Casper Dresden-Frederik Erskine-Frederik Casper-Dresden Portfolio X 0.09 0.0615 0.095 0.09 0.10 0.075 0.09 0.0791 0.14 0.1218 0.0915 Portfolio Y 0.095 0.062 0.12 0.094 0.102 0.078 0.12 0.0798 0.15 0.1225 0.0925 Portfolio 2 0.11 0.07 0.14 0.11 0.13 0.09 0.15 0.09 0.16 0.14 0.11 . Using your 2 chosen stocks only, show how much (weights) in each stock would you invest in to construct the minimum variance portfolio, and portfolios X, Y and Z (Refer to the table above for the required standard deviations of Portfolios X, Y and 2). Calculate the expected returns of these portfolios. Show how you would spend $100,000 to construct the minimum variance portfolio and portfolios X, Y and Z respectively at the end of holding period 30. . If risk-free borrowing and lending rates are 4% and 2% respectively, show how you can improve on your portfolios of investments in your chosen stocks by allowing borrowing and/or lending. Explain briefly the basis of the "improvements" you are making. Show the risk-return profile of your portfolios of investments in various weights in your 2 chosen stocks and borrowing/lending. Using your 2 chosen stocks and borrowing/lending, show how much (weights) in each stock would you invest in and how much borrowing/lending is needed to construct portfolios X*, Y* and Z* (if possible). Portfolios X*, Y* and Z* are the improved portfolios that have the same standard deviations as X, Y and Z respectively. Calculate the expected returns of these portfolios and compare with the expected returns of portfolios X, Y and Z respectively to justify your decisions. Show how you would spend $100,000 to construct these portfolios X*, Y* and Z* (if possible) respectively at the end of holding period 30