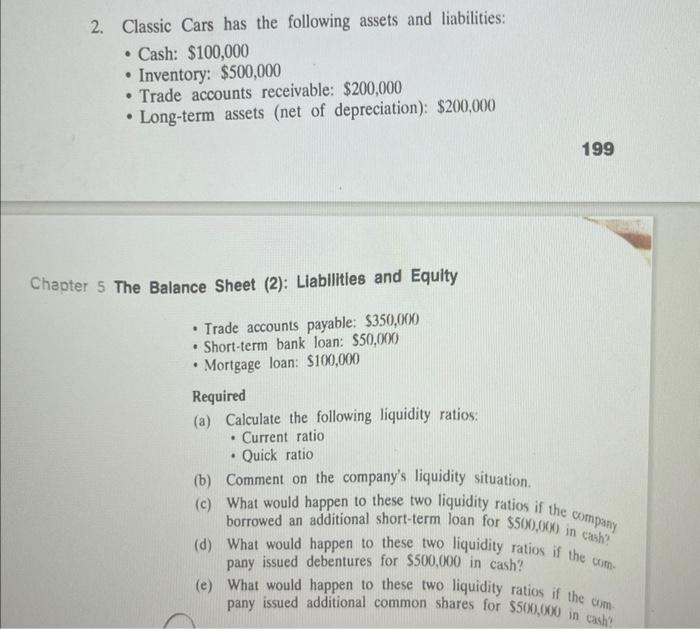

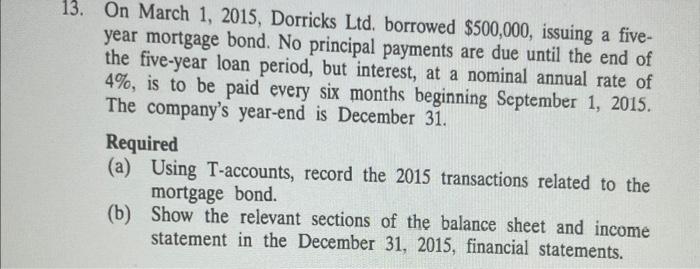

2. Classic Cars has the following assets and liabilities: - Cash: $100,000 - Inventory: $500,000 - Trade accounts receivable: $200,000 - Long-term assets (net of depreciation): $200,000 199 5 The Balance Sheet (2): Liabilities and Equity - Trade accounts payable: $350,000 - Short-term bank loan: $50,000) - Mortgage loan: $100,000 Required (a) Calculate the following liquidity ratios: - Current ratio - Quick ratio (b) Comment on the company's liquidity situation, (c) What would happen to these two liquidity ratios if the company borrowed an additional short-term loan for $5000,000 in cash? (d) What would happen to these two liquidity ratios if the coom. pany issued debentures for $500,000 in cash? (e) What would happen to these two liquidity ratios if the cim. pany issued additional common shares for $5000,000 in cash? 15. Un March 1, 2015, Dorricks Ltd. borrowed $500,000, issuing a fiveyear mortgage bond. No principal payments are due until the end of the five-year loan period, but interest, at a nominal annual rate of 4%, is to be paid every six months beginning September 1, 2015. The company's year-end is December 31 . Required (a) Using T-accounts, record the 2015 transactions related to the mortgage bond. (b) Show the relevant sections of the balance sheet and income statement in the December 31,2015 , financial statements. 2. Classic Cars has the following assets and liabilities: - Cash: $100,000 - Inventory: $500,000 - Trade accounts receivable: $200,000 - Long-term assets (net of depreciation): $200,000 199 5 The Balance Sheet (2): Liabilities and Equity - Trade accounts payable: $350,000 - Short-term bank loan: $50,000) - Mortgage loan: $100,000 Required (a) Calculate the following liquidity ratios: - Current ratio - Quick ratio (b) Comment on the company's liquidity situation, (c) What would happen to these two liquidity ratios if the company borrowed an additional short-term loan for $5000,000 in cash? (d) What would happen to these two liquidity ratios if the coom. pany issued debentures for $500,000 in cash? (e) What would happen to these two liquidity ratios if the cim. pany issued additional common shares for $5000,000 in cash? 15. Un March 1, 2015, Dorricks Ltd. borrowed $500,000, issuing a fiveyear mortgage bond. No principal payments are due until the end of the five-year loan period, but interest, at a nominal annual rate of 4%, is to be paid every six months beginning September 1, 2015. The company's year-end is December 31 . Required (a) Using T-accounts, record the 2015 transactions related to the mortgage bond. (b) Show the relevant sections of the balance sheet and income statement in the December 31,2015 , financial statements