Answered step by step

Verified Expert Solution

Question

1 Approved Answer

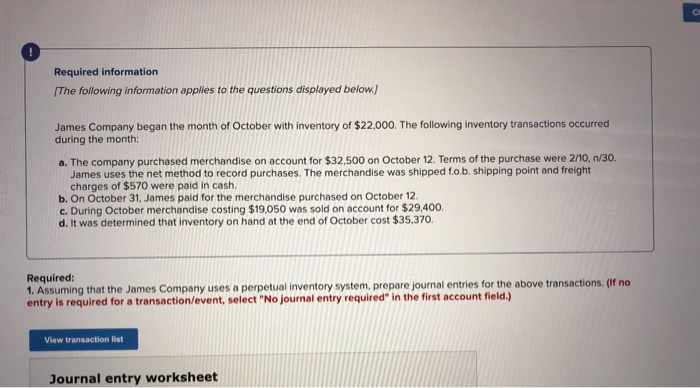

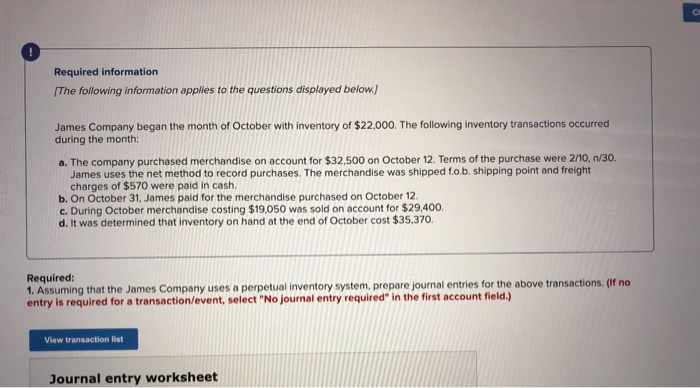

2 co Required information [The following information applies to the questions displayed below) James Company began the month of October with inventory of $22,000. The

2

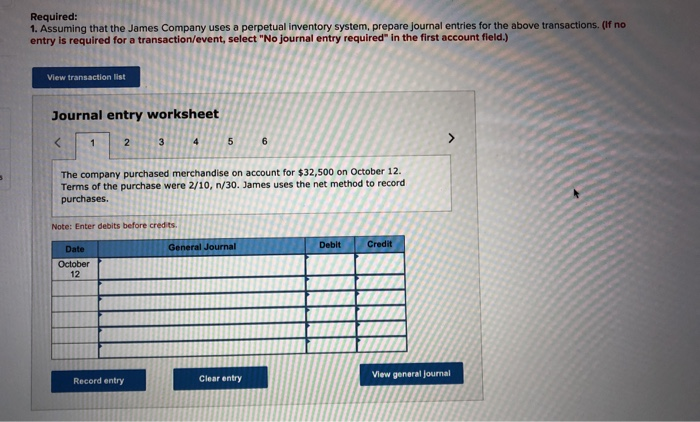

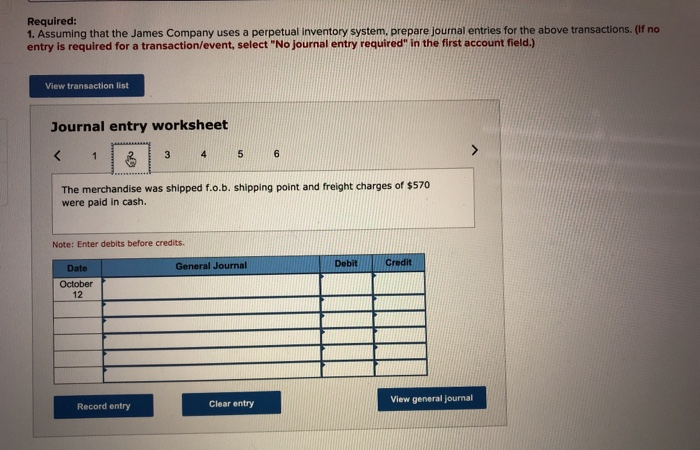

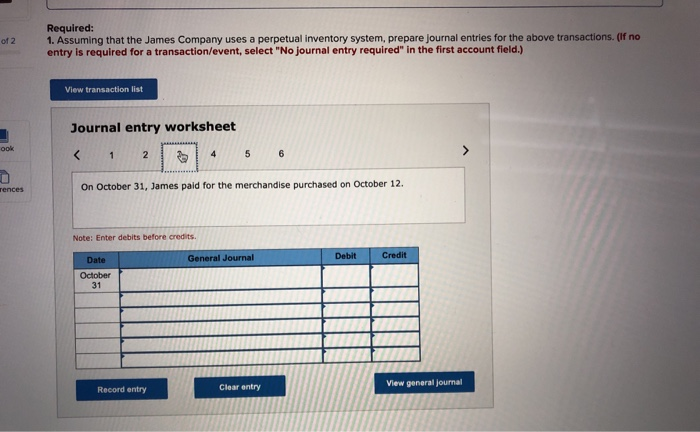

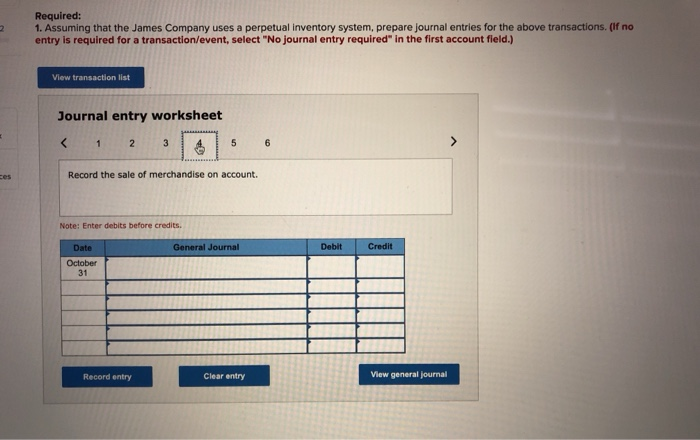

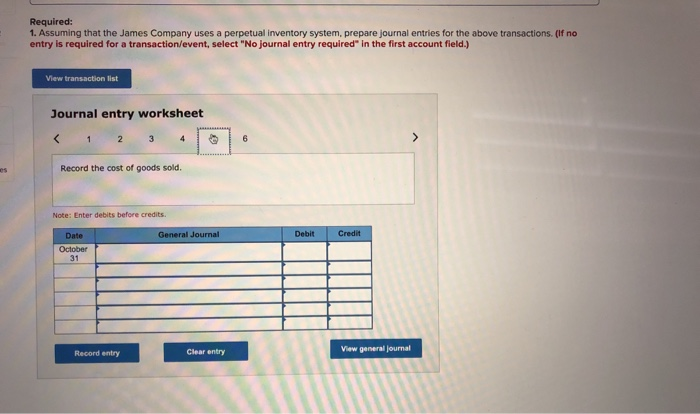

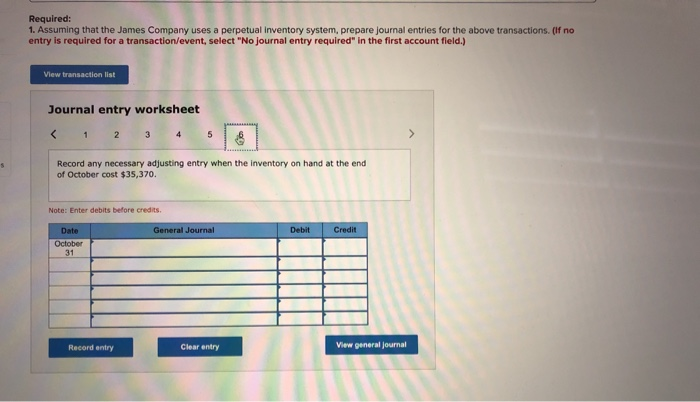

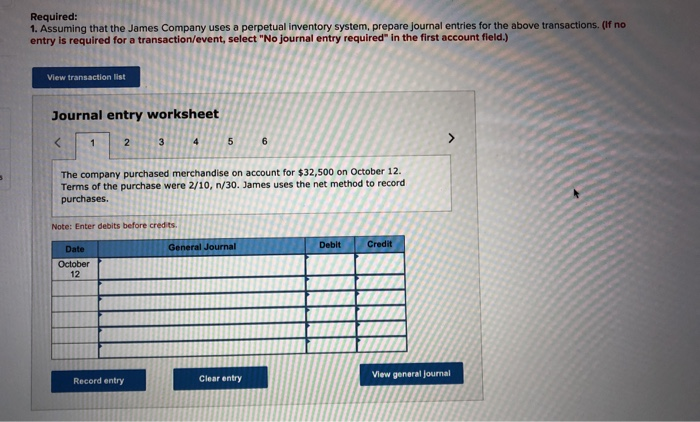

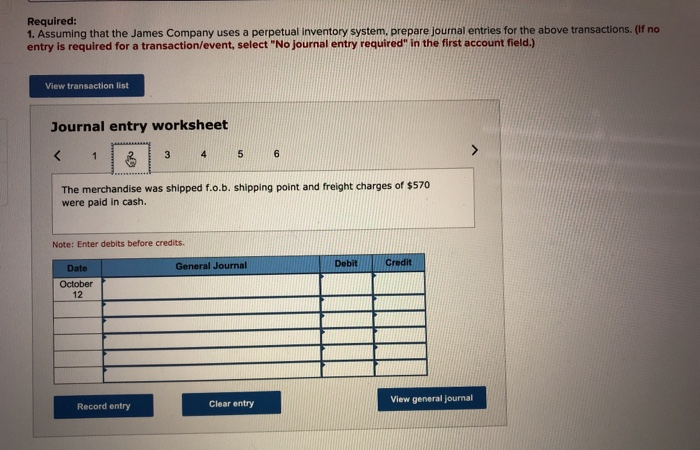

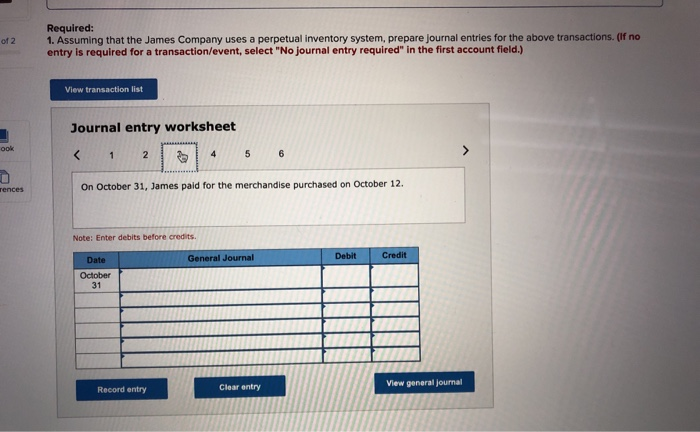

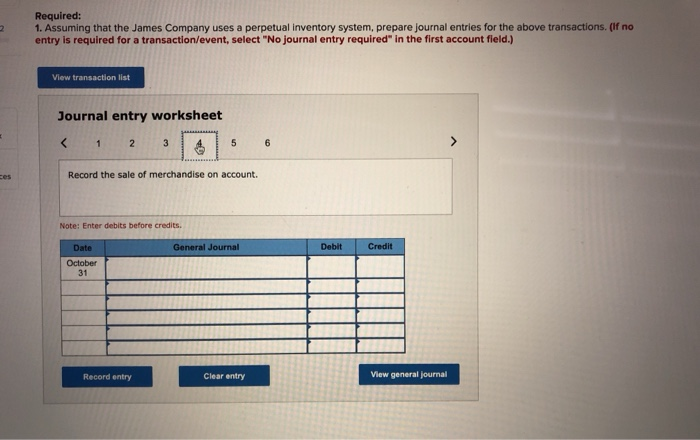

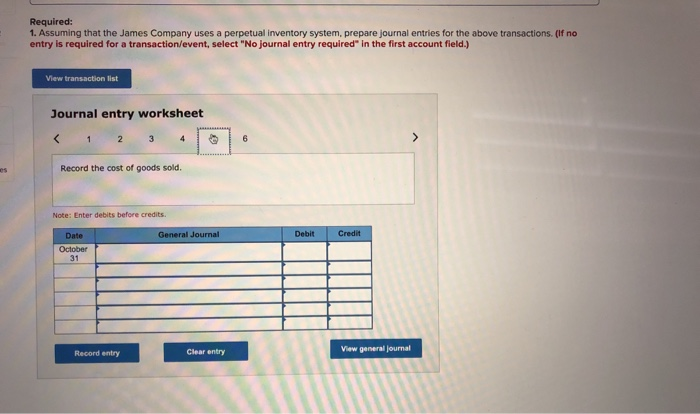

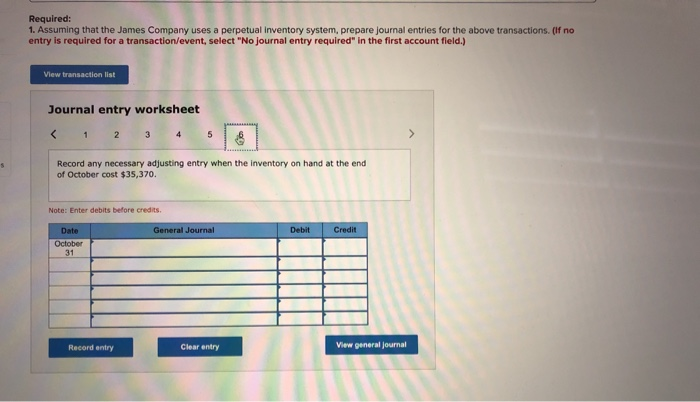

co Required information [The following information applies to the questions displayed below) James Company began the month of October with inventory of $22,000. The following inventory transactions occurred during the month a. The company purchased merchandise on account for $32,500 on October 12. Terms of the purchase were 2/10,n/30. James uses the net method to record purchases. The merchandise was shipped fo.b. shipping point and freight charges of $570 were paid in cash, b. On October 31, James paid for the merchandise purchased on October 12. c. During October merchandise costing $19,050 was sold on account for $29,400, d. It was determined that inventory on hand at the end of October cost $35,370. Required: 1. Assuming that the James Company uses a perpetual inventory system, prepare journal entries for the above transactions. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet Required: 1. Assuming that the James Company uses a perpetual inventory system, prepare journal entries for the above transactions. (If no entry is required for a transaction/event, select "No journal entry required in the first account field.) View transaction list Journal entry worksheet 1 2 3 4 5 6 > The company purchased merchandise on account for $32,500 on October 12. Terms of the purchase were 2/10, 1/30. James uses the net method to record purchases. Note: Enter debits before credits Debit General Journal Date Credit October 12 Record entry Clear entry View general Journal Required: 1. Assuming that the James Company uses a perpetual Inventory system, prepare journal entries for the above transactions. (if no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet 1 3 4 5 6 The merchandise was shipped f.o.b. shipping point and freight charges of $570 were paid in cash. Note: Enter debits before credits General Journal Debit Credit Date October 12 Record entry Clear entry View general Journal of 2 Required: 1. Assuming that the James Company uses a perpetual inventory system, prepare journal entries for the above transactions. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet ook 2 4 5 6 rences On October 31, James paid for the merchandise purchased on October 12. Note: Enter debits before credits Debit General Journal Date Credit October 31 Record entry Clear entry View general Journal 2 Required: 1. Assuming that the James Company uses a perpetual inventory system, prepare journal entries for the above transactions. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet 1 2 3 5 6 > Record the sale of merchandise on account. Note: Enter debits before credits. Date General Journal Debit Credit October 31 Record entry Clear entry View general Journal Required: 1. Assuming that the James Company uses a perpetual inventory system, prepare journal entries for the above transactions. (If no entry is required for a transaction/event, select "No journal entry required in the first account field.) View transaction list Journal entry worksheet 1 2 3 4 6 Record the cost of goods sold. Note: Enter debits before credits. General Journal Debit Credit Date October 31 Record entry Clear entry View general Journal Required: 1. Assuming that the James Company uses a perpetual Inventory system, prepare journal entries for the above transactions. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list > Journal entry worksheet

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started