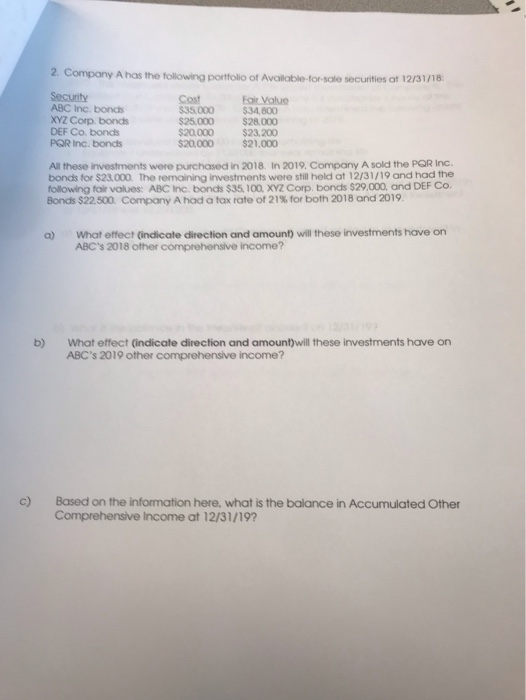

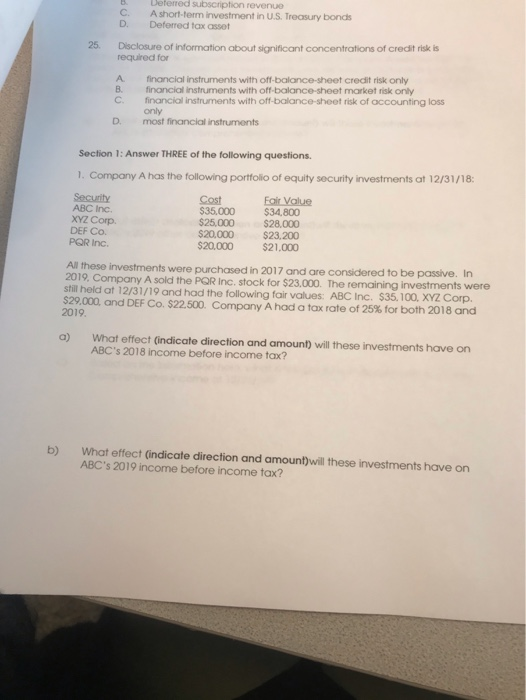

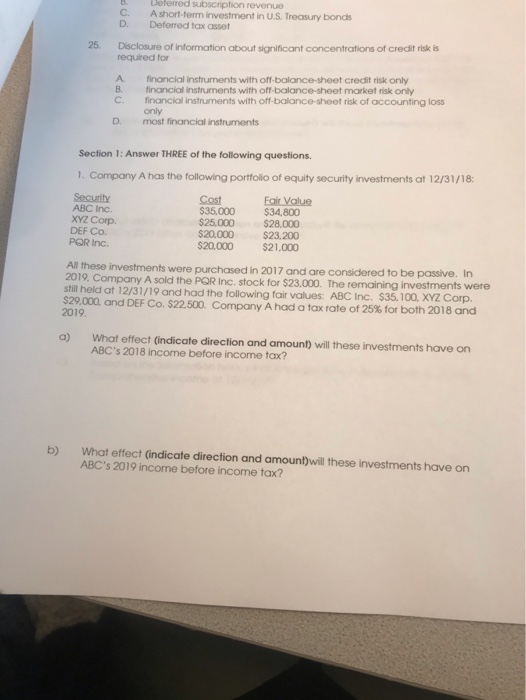

2. Company A has the following portfolio of Available-for-sale securities at 12/31/18 Security ABC Inc. bonds XYZ Corp. bonds DEF Co. bonds Eair Value $34,800 $28.000 $23,200 $21,000 Cost $35,000 $25.000 $20.000 $20000 POR Inc. bonds All these investments were purchased in 2018. In 2019, Company A sold the POR Inc. bonds for $23.000. The remaining investments were still held at 12/31/19 and had the following fair values: ABC Inc. bonds $35, 100, XYZ Corp. bonds $29,000, and DEF Co. Bonds $22.500. Company A had a tax rate of 219% for both 2018 and 2019 What effect (indicate direction and amount) will these investments ABC's 2018 ofther comprehensive income? have on 2//192 What effect (indicate direction and amount)will these investments have on b) ABC's 2019 other comprehensive income? c) Based on the information here, what is the balance in Accumulated Other Comprehensive Income at 12/31/19? Deferred subscription revenue A short-term investment in U.S. Treasury bonds Deferred tax asset C. Disclosure of inforrmation about significant concentrations of credit risk is required for 25. financial instruments with off-balance-sheet credit risk only financial Instruments with off-balance-sheet market risk only financial instruments with off-balance-sheet risk of accounting loss only most financial instruments A B C D Section 1: Answer THREE of the following questions. 1. Company A has the following portfolio of equity security investments at 12/31/18: Eair Value $34,800 $28,000 $23,200 $21,000 Security ABC Inc. XYZ Corp DEF Co PQR Inc. Cost $35.000 $25,000 $20,000 $20.000 All these investments were purchased in 2017 and are considered to be passive. In 2019, Company A sold the PQR Inc. stock for $23,000. The remaining investments were still held at 12/31/19 and had the following fair values: ABC Inc. $35.100. XYZ Corp. $29,000, and DEF Co. $22.500. Company A had a tax rate of 25 % for both 2018 and 2019 a) What effect (indicate direction and amount) will these investments have on ABC's 2018 income before income tax? What effect (indicate direction and amount)will these investments have on ABC's 2019 income before income tax? b) Deferred subscription revenue A short-term investment in U.S. Treasury bonds Deferred tax asset C. Disclosure of inforrmation about significant concentrations of credit risk is required for 25. financial instruments with off-balance-sheet credit risk only financial instruments with off-balance-sheet market risk only financial instruments with off-balance-sheet risk of accounting loss only most financial instruments A. B D Section 1: Answer THREE of the following questions. 1. Company A has the following portfolio of equity security investments at 12/31/18: Eair Value $34,800 $28,000 $23,200 $21,000 Security ABC Inc. XYZ Corp DEF Co PQR Inc. Cost $35,000 $25,000 $20,000 $20.000 All these investments were purchased in 2017 and are considered to be passive. In 2019, Company A sold the PQR Inc. stock for $23,000. The remaining investments were still held at 12/31/19 and had the following fair values: ABC Inc. $35.100. XYZ Corp. $29,000, and DEF Co. $22.500. Company A had a tax rate of 25 % for both 2018 and 2019. a) What effect (indicate direction and amount) will these investments have on ABC's 2018 income before income tax? What effect (indicate direction and amount)will these investments have on ABC's 2019 income before income tax? b) 2. Company A has the following portfolio of Available-for-sale securities at 12/31/18 Security ABC Inc. bonds XYZ Corp. bonds DEF Co. bonds Eair Value $34,800 $28.000 $23,200 $21,000 Cost $35,000 $25.000 $20.000 $20000 POR Inc. bonds All these investments were purchased in 2018. In 2019, Company A sold the POR Inc. bonds for $23.000. The remaining investments were still held at 12/31/19 and had the following fair values: ABC Inc. bonds $35, 100, XYZ Corp. bonds $29,000, and DEF Co. Bonds $22.500. Company A had a tax rate of 219% for both 2018 and 2019 What effect (indicate direction and amount) will these investments ABC's 2018 ofther comprehensive income? have on 2//192 What effect (indicate direction and amount)will these investments have on b) ABC's 2019 other comprehensive income? c) Based on the information here, what is the balance in Accumulated Other Comprehensive Income at 12/31/19? Deferred subscription revenue A short-term investment in U.S. Treasury bonds Deferred tax asset C. Disclosure of inforrmation about significant concentrations of credit risk is required for 25. financial instruments with off-balance-sheet credit risk only financial Instruments with off-balance-sheet market risk only financial instruments with off-balance-sheet risk of accounting loss only most financial instruments A B C D Section 1: Answer THREE of the following questions. 1. Company A has the following portfolio of equity security investments at 12/31/18: Eair Value $34,800 $28,000 $23,200 $21,000 Security ABC Inc. XYZ Corp DEF Co PQR Inc. Cost $35.000 $25,000 $20,000 $20.000 All these investments were purchased in 2017 and are considered to be passive. In 2019, Company A sold the PQR Inc. stock for $23,000. The remaining investments were still held at 12/31/19 and had the following fair values: ABC Inc. $35.100. XYZ Corp. $29,000, and DEF Co. $22.500. Company A had a tax rate of 25 % for both 2018 and 2019 a) What effect (indicate direction and amount) will these investments have on ABC's 2018 income before income tax? What effect (indicate direction and amount)will these investments have on ABC's 2019 income before income tax? b) Deferred subscription revenue A short-term investment in U.S. Treasury bonds Deferred tax asset C. Disclosure of inforrmation about significant concentrations of credit risk is required for 25. financial instruments with off-balance-sheet credit risk only financial instruments with off-balance-sheet market risk only financial instruments with off-balance-sheet risk of accounting loss only most financial instruments A. B D Section 1: Answer THREE of the following questions. 1. Company A has the following portfolio of equity security investments at 12/31/18: Eair Value $34,800 $28,000 $23,200 $21,000 Security ABC Inc. XYZ Corp DEF Co PQR Inc. Cost $35,000 $25,000 $20,000 $20.000 All these investments were purchased in 2017 and are considered to be passive. In 2019, Company A sold the PQR Inc. stock for $23,000. The remaining investments were still held at 12/31/19 and had the following fair values: ABC Inc. $35.100. XYZ Corp. $29,000, and DEF Co. $22.500. Company A had a tax rate of 25 % for both 2018 and 2019. a) What effect (indicate direction and amount) will these investments have on ABC's 2018 income before income tax? What effect (indicate direction and amount)will these investments have on ABC's 2019 income before income tax? b)