Answered step by step

Verified Expert Solution

Question

1 Approved Answer

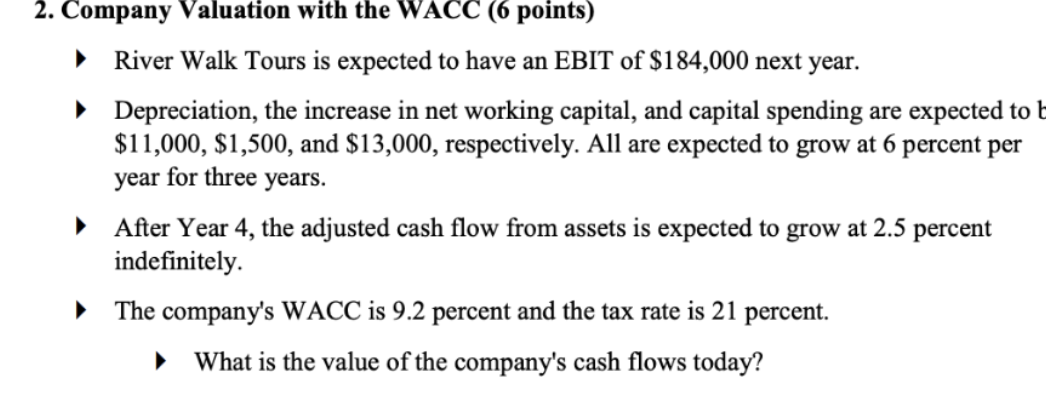

2. Company Valuation with the WACC (6 points) River Walk Tours is expected to have an EBIT of $184,000 next year. Depreciation, the increase

2. Company Valuation with the WACC (6 points) River Walk Tours is expected to have an EBIT of $184,000 next year. Depreciation, the increase in net working capital, and capital spending are expected to b $11,000, $1,500, and $13,000, respectively. All are expected to grow at 6 percent per year for three years. After Year 4, the adjusted cash flow from assets is expected to grow at 2.5 percent indefinitely. The company's WACC is 9.2 percent and the tax rate is 21 percent. What is the value of the company's cash flows today?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To determine the value of the companys cash flows today we can follow these steps Step 1 Calculate the Free Cash Flow FCF for Years 13 1 EBIT Earnings ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started