2.

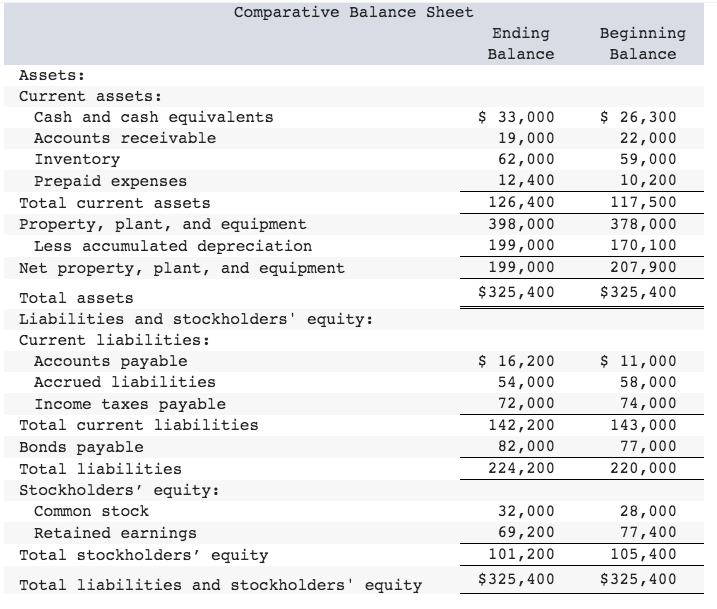

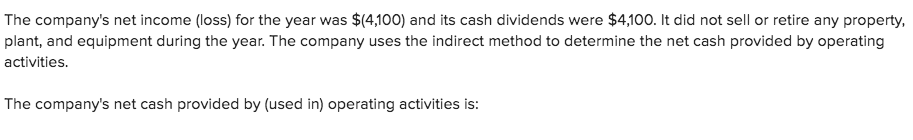

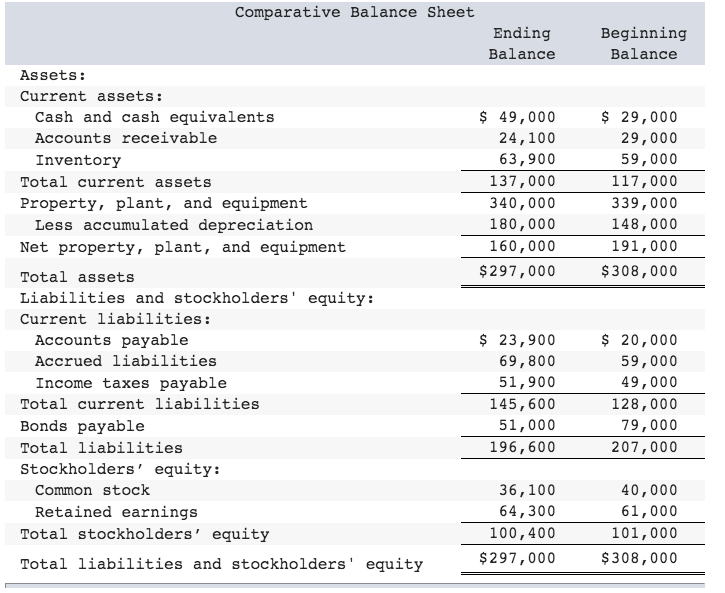

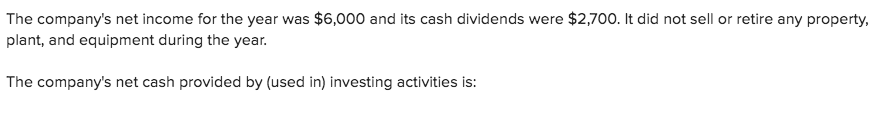

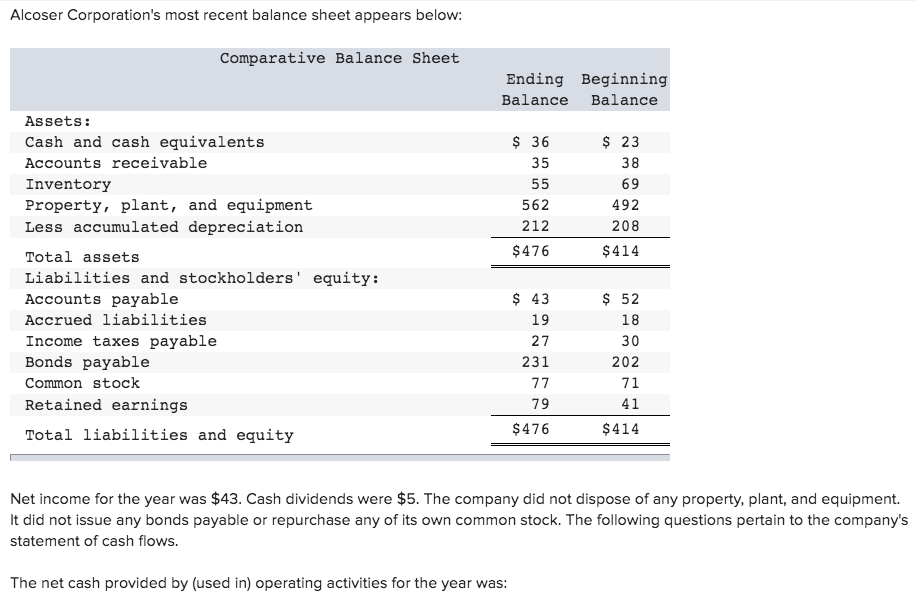

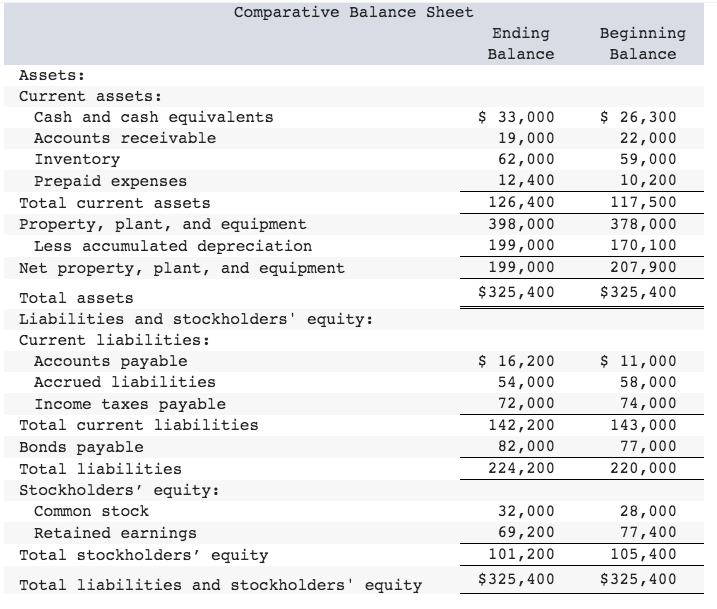

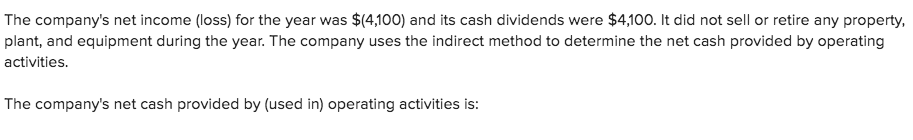

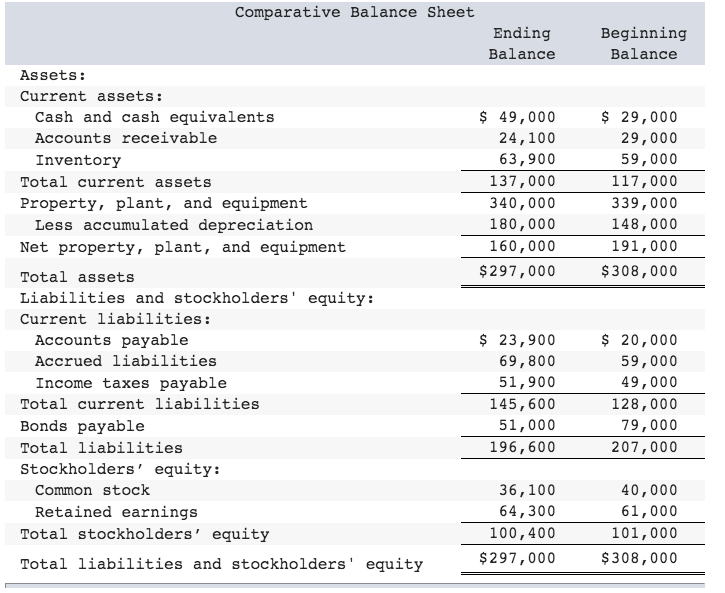

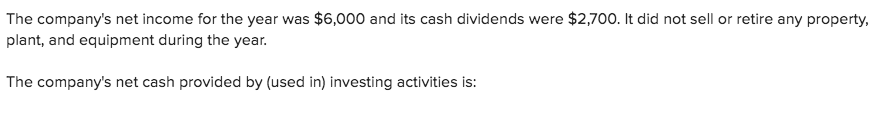

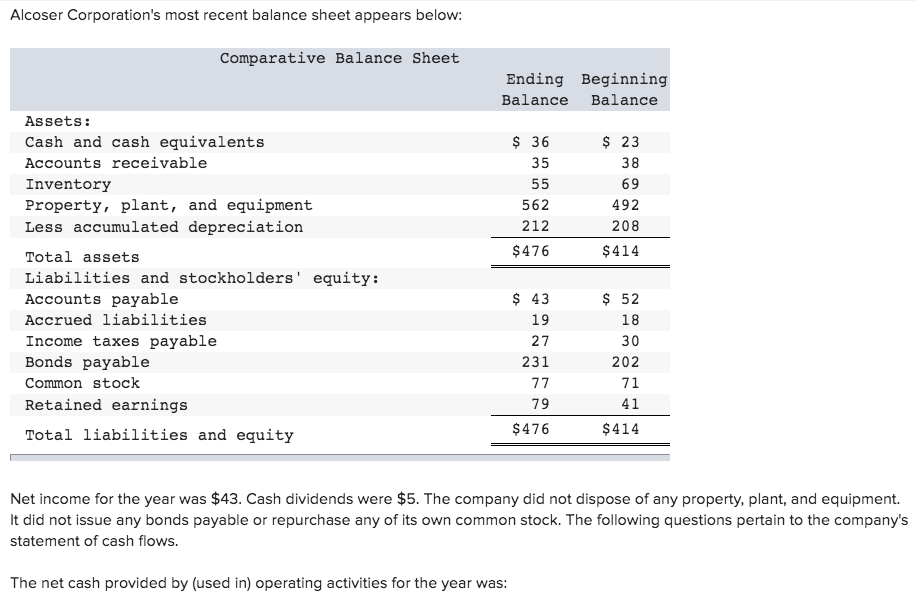

Comparative Balance Sheet Ending Beginning Balance Balance Assets: Current assets: Cash and cash equivalents 33,000 $26,300 Accounts receivable 19,000 22,000 62,000 59,000 Inventory Prepaid expenses 12,400 10,200 126,400 117,500 Total current assets Property, plant, and equipment 398,000 378,000 199,000 170,100 207,900 Less accumulated depreciation 199,000 Net property, plant, and equipment $325,400 $325,400 Total assets Liabilities and stockholders' equity: Current liabilities: $ 16,200 Accounts payable $11,000 Accrued liabilities 54,000 58,000 Income taxes payable 72,000 74,000 Total current liabilities 142,200 143,000 Bonds payable 82,000 77,000 224,200 220,000 Total liabilities Stockholders' equity Common stock 32,000 28,000 Retained earnings 69,200 77,400 Total stockholders' equity 101,200 105,400 $325,400 $325,400 Total liabilities and stockholders' equity The company's net income (loss) for the year was $(4,100) and its cash dividends were $4,100. It did not sell or retire any property, plant, and equipment during the year. The company uses the indirect method to determine the net cash provided by operating activities The company's net cash provided by (used in) operating activities is: Comparative Balance Sheet Ending Beginning Balance Balance Assets: Current assets $ 49,000 $ 29,000 Cash and cash equivalents 24,100 29,000 Accounts receivable 63,900 59,000 Inventory 137,000 117,000 Total current assets Property, plant, and equipment 340,000 339,000 180,000 148,000 Less accumulated depreciation 160,000 191,000 Net property, plant, and equipment $297,000 $308,000 Total assets Liabilities and stockholders' equity Current liabilities: $ 23,900 Accounts payable $20,000 Accrued liabilities 69,800 59,000 Income taxes payable 51,900 49,000 145,600 51,000 Total current liabilities 128,000 Bonds payable 79,000 196,600 207,000 Total liabilities Stockholders' equity Common stock 36,100 40,000 Retained earnings Total stockholders' equity 64,300 61,000 100,400 101,000 $297,000 $308,000 Total liabilities and stockholders' equity 1 The company's net income for the year was $6,000 and its cash dividends were $2,700. It did not sell or retire any property, plant, and equipment during the year. The company's net cash provided by (used in) investing activities is Alcoser Corporation's most recent balance sheet appears below: Comparative Balance Sheet Ending Beginning Balance Balance Assets $ 36 $ 23 Cash and cash equivalents Accounts receivable 35 38 55 69 Inventory Property, plant, and equipment Less accumulated depreciation 562 492 208 212 $476 $414 Total assets Liabilities and stockholders' equity: Accounts payable $ 43 $ 52 Accrued liabilities 19 18 Income taxes payable 27 30 Bonds payable 231 202 71 Common stock 77 Retained earnings 79 41 $476 $414 Total liabilities and equity Net income for the year was $43. Cash dividends were $5. The company did not dispose of any property, plant, and equipment. It did not issue any bonds payable or repurchase any of its own common stock. The following questions pertain to the company's statement of cash flows. The net cash provided by (used in) operating activities for the year was