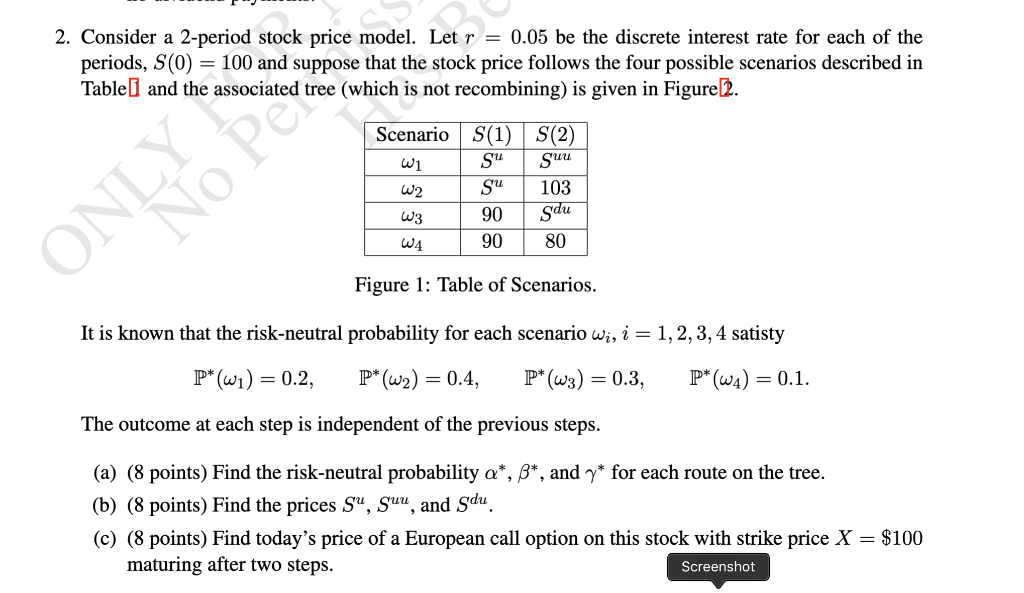

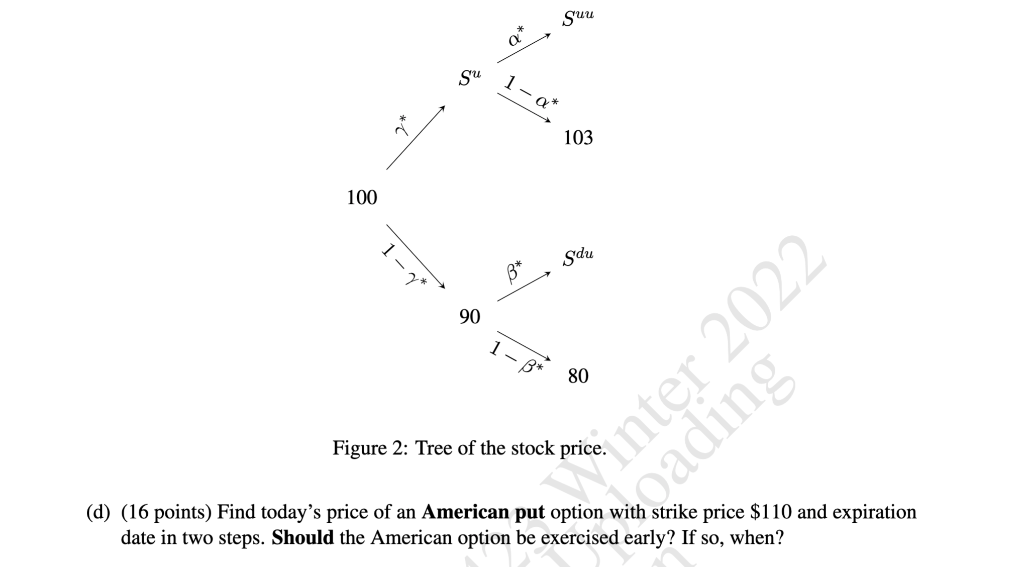

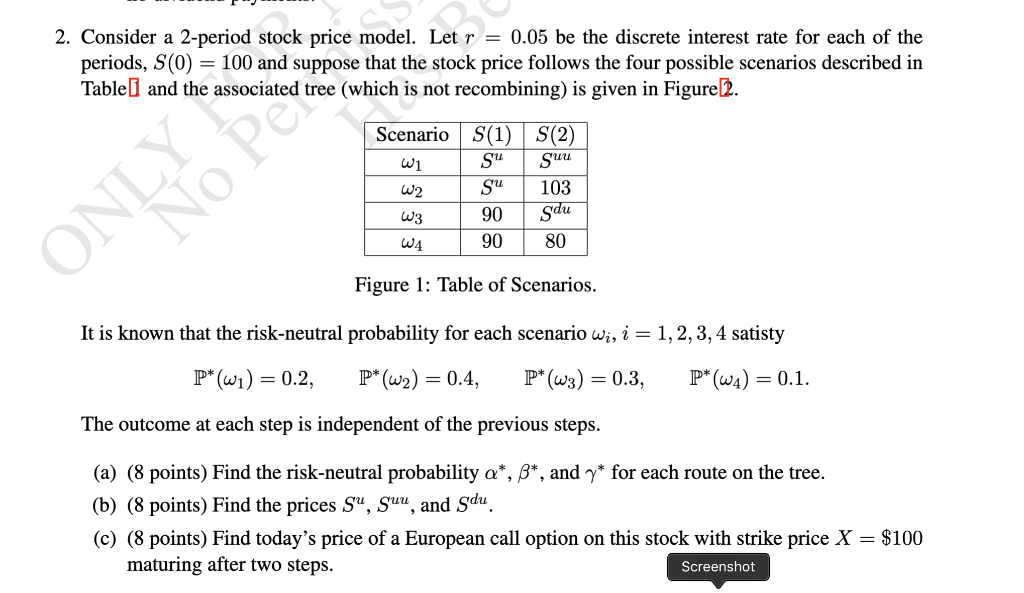

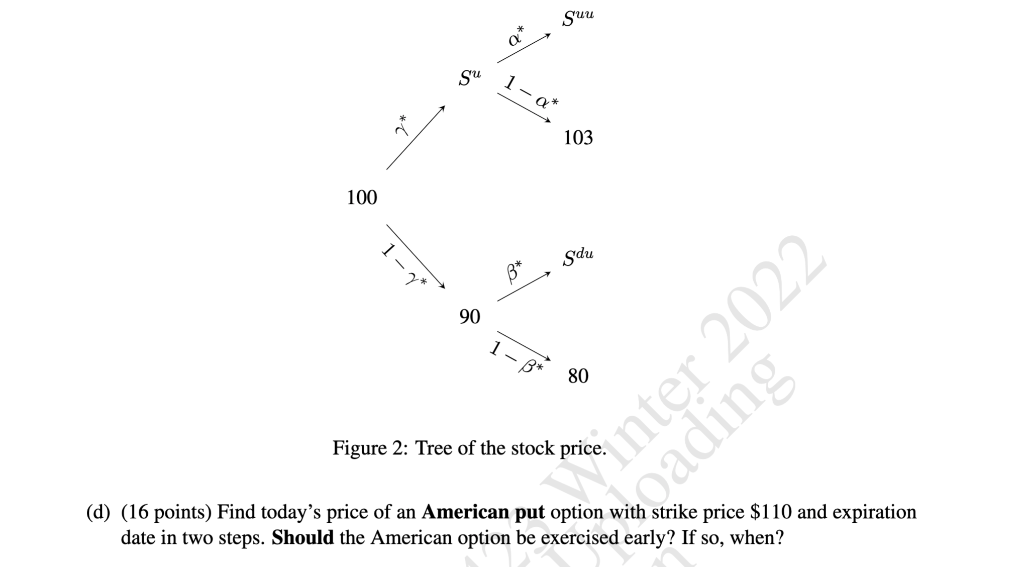

2. Consider a 2-period stock price model. Let r = 0.05 be the discrete interest rate for each of the periods, S(0) = 100 and suppose that the stock price follows the four possible scenarios described in Tablel and the associated tree (which is not recombining) is given in Figure 2. Suu Scenario S(1) S(2) Su W2 su 103 W3 90 gdu 90 80 ONLINE Figure 1: Table of Scenarios. It is known that the risk-neutral probability for each scenario wi, i = 1, 2, 3, 4 satisty P* (wi) = 0.2, P* (w2) = 0.4, P* (W3) = 0.3, P* (W4) = 0.1. The outcome at each step is independent of the previous steps. (a) (8 points) Find the risk-neutral probability a*,*, and y* for each route on the tree. (b) (8 points) Find the prices Su, suu, and Sdu. (c) (8 points) Find today's price of a European call option on this stock with strike price X = $100 maturing after two steps. Screenshot suu su 1- a* 103 100 Soy 1-7 90 1 80 Figure 2: Tree of the stock price. (d) (16 points) Find today's price of an American put option with strike price $110 and expiration date in two steps. Should the American option be exercised early? If so, when? 2. Consider a 2-period stock price model. Let r = 0.05 be the discrete interest rate for each of the periods, S(0) = 100 and suppose that the stock price follows the four possible scenarios described in Tablel and the associated tree (which is not recombining) is given in Figure 2. Suu Scenario S(1) S(2) Su W2 su 103 W3 90 gdu 90 80 ONLINE Figure 1: Table of Scenarios. It is known that the risk-neutral probability for each scenario wi, i = 1, 2, 3, 4 satisty P* (wi) = 0.2, P* (w2) = 0.4, P* (W3) = 0.3, P* (W4) = 0.1. The outcome at each step is independent of the previous steps. (a) (8 points) Find the risk-neutral probability a*,*, and y* for each route on the tree. (b) (8 points) Find the prices Su, suu, and Sdu. (c) (8 points) Find today's price of a European call option on this stock with strike price X = $100 maturing after two steps. Screenshot suu su 1- a* 103 100 Soy 1-7 90 1 80 Figure 2: Tree of the stock price. (d) (16 points) Find today's price of an American put option with strike price $110 and expiration date in two steps. Should the American option be exercised early? If so, when