Answered step by step

Verified Expert Solution

Question

1 Approved Answer

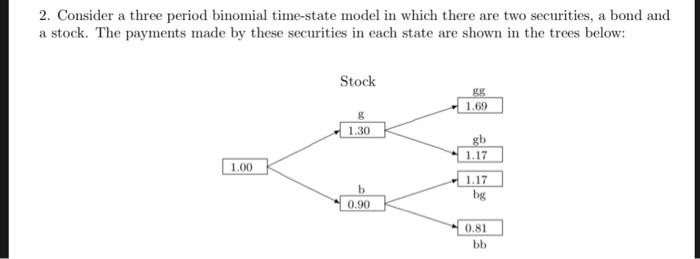

2. Consider a three period binomial time-state model in which there are two securities, a bond and a stock. The payments made by these

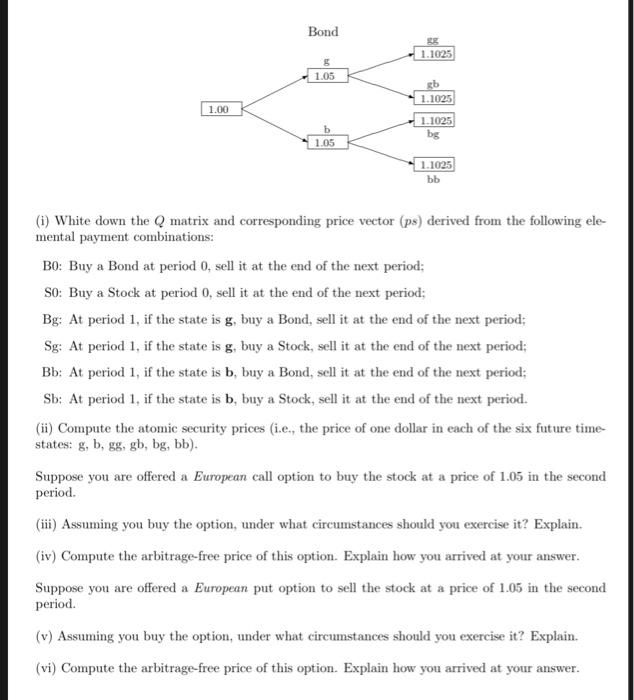

2. Consider a three period binomial time-state model in which there are two securities, a bond and a stock. The payments made by these securities in each state are shown in the trees below: 1.00 Stock g 1.30 b 0.90 1.69 gb 1.17 1.17 bg 0.81 bb 1.00 Bond g 1.05 b 1.05 1.1025 1.1025 1.1025 bg 1.1025 bb (i) White down the Q matrix and corresponding price vector (ps) derived from the following ele- mental payment combinations: BO: Buy a Bond at period 0, sell it at the end of the next period; S0: Buy a Stock at period 0, sell it at the end of the next period; Bg: At period 1, if the state is g, buy a Bond, sell it at the end of the next period; Sg: At period 1, if the state is g, buy a Stock, sell it at the end of the next period; Bb: At period 1, if the state is b, buy a Bond, sell it at the end of the next period; Sb: At period 1, if the state is b, buy a Stock, sell it at the end of the next period. (ii) Compute the atomic security prices (i.e., the price of one dollar in each of the six future time- states: g, b, gg, gb, bg, bb). Suppose you are offered a European call option to buy the stock at a price of 1.05 in the second period. (iii) Assuming you buy the option, under what circumstances should you exercise it? Explain. (iv) Compute the arbitrage-free price of this option. Explain how you arrived at your answer. Suppose you are offered a European put option to sell the stock at a price of 1.05 in the second period. (v) Assuming you buy the option, under what circumstances should you exercise it? Explain. (vi) Compute the arbitrage-free price of this option. Explain how you arrived at your answer.

Step by Step Solution

★★★★★

3.44 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below i Q Matrix and Price Vector Q Matrix BO ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started