Question

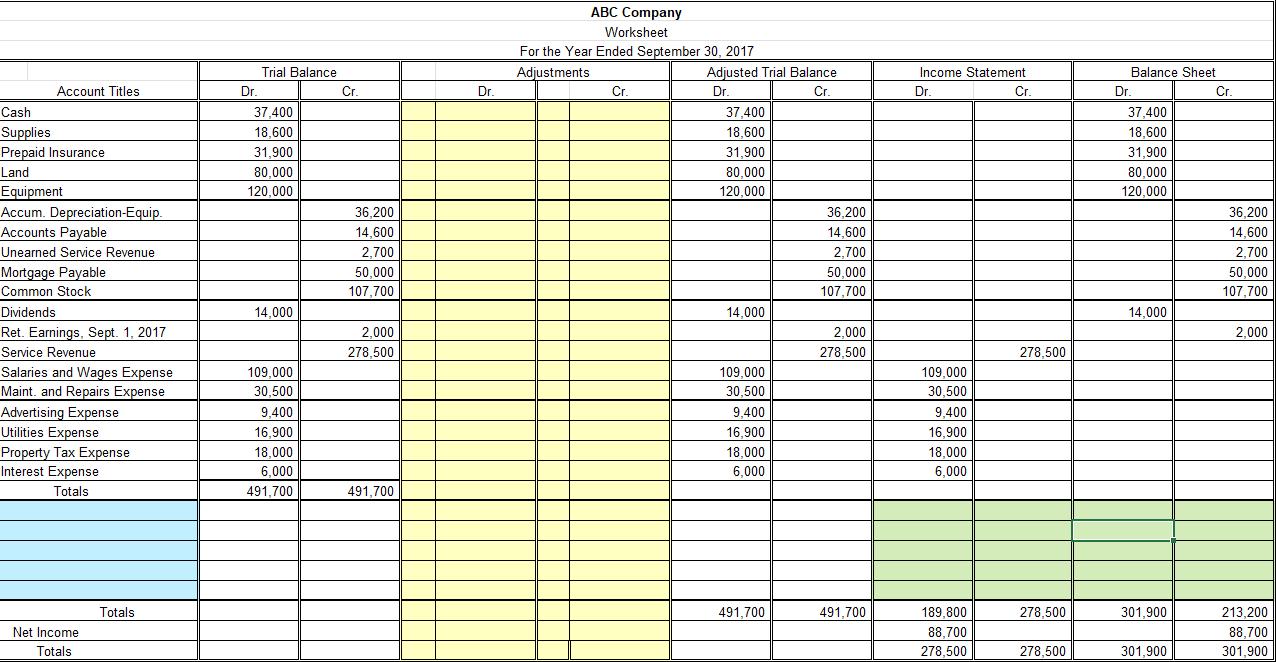

Prepare the adjusting journal entries in the worksheet labelled ABC. The adjusted trial balance columns will update automatically. You need to enter the journal entry

Prepare the adjusting journal entries in the worksheet labelled ABC.

The adjusted trial balance columns will update automatically.

You need to enter the journal entry reference letters (a, b, c, etc.)

In the blue-shaded boxes at the bottem, you can add accounts if they don't appear in the trial balance (Don't repeat accounts already reported in the trial balance.) Make Journal Entries Adjustments needed at year-end a At year-end, 3,900 of prepaid insurance relates to next year's insurance coverage.

b At year-end, supplies of $4,200 were left in inventory.

c Services of $2,000 were earned that were prepaid earlier in the year.

d Received the invoice for $3,000 for the 4th quarter property taxes.

e Interest on the mortgage for the year is 12%. This will be paid in January.

f Depreciation expense for the year was $5,800.

Account Titles Cash Supplies Prepaid Insurance Land Equipment Accum. Depreciation-Equip. Accounts Payable Unearned Service Revenue Mortgage Payable Common Stock Dividends Ret. Earnings, Sept. 1, 2017 Service Revenue Salaries and Wages Expense Maint. and Repairs Expense Advertising Expense Utilities Expense Property Tax Expense Interest Expense Totals Net Income Totals Totals Dr. Trial Balance 37,400 18.600 31.900 80,000 120,000 14,000 109,000 30,500 9,400 16,900 18,000 6,000 491,700 Cr 36,200 14.600 2,700 50,000 107,700 2,000 278,500 491,700 Dr. ABC Company Worksheet For the Year Ended September 30, 2017 Adjustments Cr. Adjusted Trial Balance Dr. Cr. 37,400 18,600 31,900 80,000 120,000 14,000 109,000 30,500 9,400 16,900 18,000 6,000 491,700 36,200 14,600 2,700 50,000 107,700 2,000 278,500 491,700 Income Statement Dr. 109,000 30,500 9,400 16,900 18,000 6,000 189,800 88,700 278,500 Cr. 278,500 278,500 278,500 Balance Sheet Dr. 37,400 18,600 31,900 80,000 120,000 14.000 301,900 301,900 Cr. 36,200 14,600 2,700 50,000 107,700 2,000 213,200 88,700 301,900 Account Titles Cash Supplies Prepaid Insurance Land Equipment Accum. Depreciation-Equip. Accounts Payable Unearned Service Revenue Mortgage Payable Common Stock Dividends Ret. Earnings, Sept. 1, 2017 Service Revenue Salaries and Wages Expense Maint. and Repairs Expense Advertising Expense Utilities Expense Property Tax Expense Interest Expense Totals Net Income Totals Totals Dr. Trial Balance 37,400 18.600 31.900 80,000 120,000 14,000 109,000 30,500 9,400 16,900 18,000 6,000 491,700 Cr 36,200 14.600 2,700 50,000 107,700 2,000 278,500 491,700 Dr. ABC Company Worksheet For the Year Ended September 30, 2017 Adjustments Cr. Adjusted Trial Balance Dr. Cr. 37,400 18,600 31,900 80,000 120,000 14,000 109,000 30,500 9,400 16,900 18,000 6,000 491,700 36,200 14,600 2,700 50,000 107,700 2,000 278,500 491,700 Income Statement Dr. 109,000 30,500 9,400 16,900 18,000 6,000 189,800 88,700 278,500 Cr. 278,500 278,500 278,500 Balance Sheet Dr. 37,400 18,600 31,900 80,000 120,000 14.000 301,900 301,900 Cr. 36,200 14,600 2,700 50,000 107,700 2,000 213,200 88,700 301,900

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Adjusting Journal Entries for ABC Company Here are the adjusting journal entries for ABC Company at yearend September 30 2017 a Prepaid Insurance Adju...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started