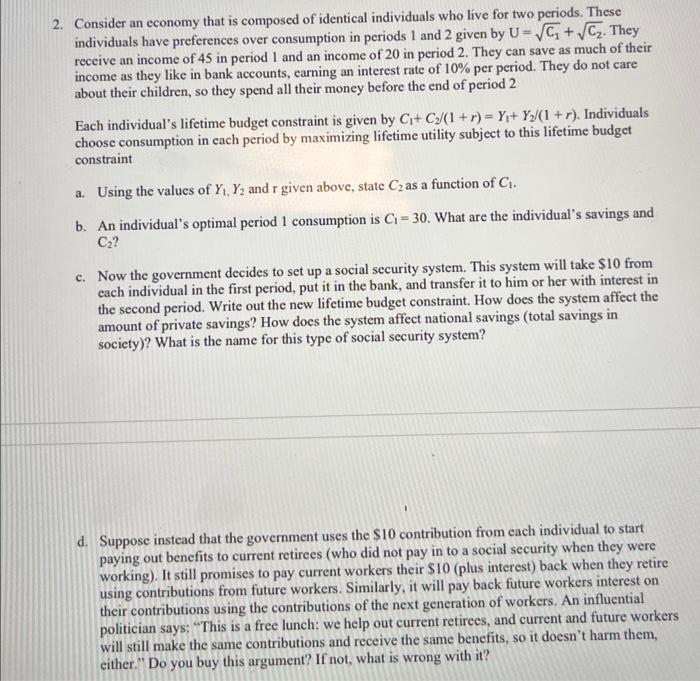

2. Consider an economy that is composed of identical individuals who live for two periods. These individuals have preferences over consumption in periods 1 and 2 given by U=C1+C2. They receive an income of 45 in period 1 and an income of 20 in period 2. They can save as much of their income as they like in bank accounts, earning an interest rate of 10% per period. They do not care about their children, so they spend all their money before the end of period 2 Each individual's lifetime budget constraint is given by C1+C2/(1+r)=Y1+Y2/(1+r). Individuals choose consumption in each period by maximizing lifetime utility subject to this lifetime budget constraint a. Using the values of Y1,Y2 and r given above, state C2 as a function of C1. b. An individual's optimal period 1 consumption is C1=30. What are the individual's savings and C2 ? c. Now the government decides to set up a social security system. This system will take $10 from each individual in the first period, put it in the bank, and transfer it to him or her with interest in the second period. Write out the new lifetime budget constraint. How does the system affect the amount of private savings? How does the system affect national savings (total savings in society)? What is the name for this type of social security system? d. Suppose instead that the government uses the $10 contribution from each individual to start paying out benefits to current retirees (who did not pay in to a social security when they were working). It still promises to pay current workers their $10 (plus interest) back when they retire using contributions from future workers. Similarly, it will pay back future workers interest on their contributions using the contributions of the next generation of workers. An influential politician says: "This is a free lunch: we help out current retirees, and current and future workers will still make the same contributions and receive the same benefits, so it doesn't harm them, either." Do you buy this argument? If not, what is wrong with it? 2. Consider an economy that is composed of identical individuals who live for two periods. These individuals have preferences over consumption in periods 1 and 2 given by U=C1+C2. They receive an income of 45 in period 1 and an income of 20 in period 2. They can save as much of their income as they like in bank accounts, earning an interest rate of 10% per period. They do not care about their children, so they spend all their money before the end of period 2 Each individual's lifetime budget constraint is given by C1+C2/(1+r)=Y1+Y2/(1+r). Individuals choose consumption in each period by maximizing lifetime utility subject to this lifetime budget constraint a. Using the values of Y1,Y2 and r given above, state C2 as a function of C1. b. An individual's optimal period 1 consumption is C1=30. What are the individual's savings and C2 ? c. Now the government decides to set up a social security system. This system will take $10 from each individual in the first period, put it in the bank, and transfer it to him or her with interest in the second period. Write out the new lifetime budget constraint. How does the system affect the amount of private savings? How does the system affect national savings (total savings in society)? What is the name for this type of social security system? d. Suppose instead that the government uses the $10 contribution from each individual to start paying out benefits to current retirees (who did not pay in to a social security when they were working). It still promises to pay current workers their $10 (plus interest) back when they retire using contributions from future workers. Similarly, it will pay back future workers interest on their contributions using the contributions of the next generation of workers. An influential politician says: "This is a free lunch: we help out current retirees, and current and future workers will still make the same contributions and receive the same benefits, so it doesn't harm them, either." Do you buy this argument? If not, what is wrong with it