Answered step by step

Verified Expert Solution

Question

1 Approved Answer

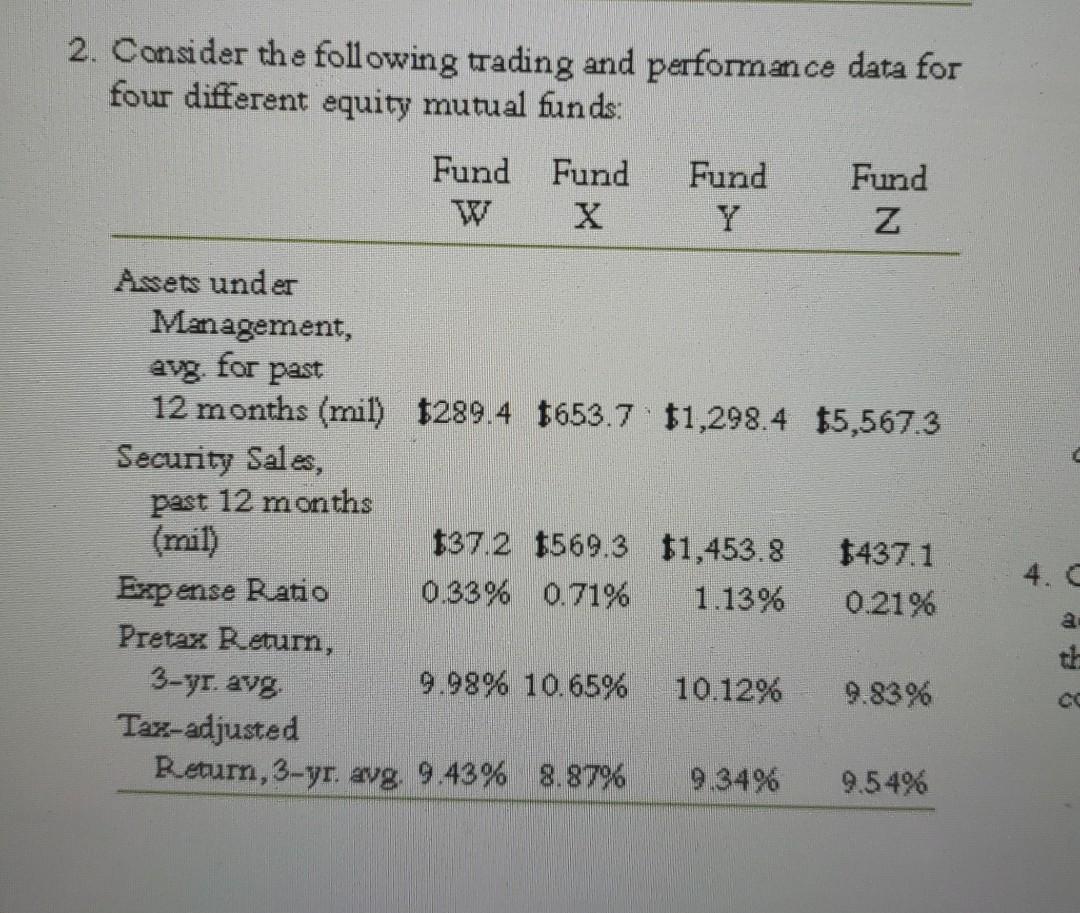

2. Consider the following trading and performance data for four different equity mutual funds: Fund Fund Fund Fund X Y Z Assets under Management, avo

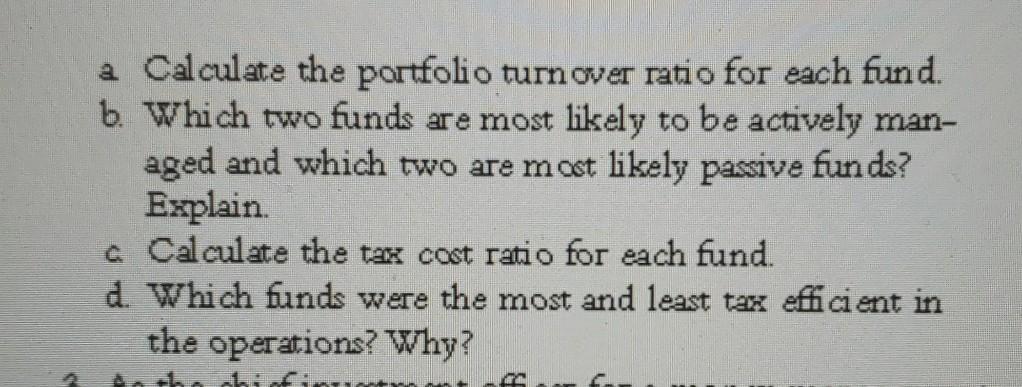

2. Consider the following trading and performance data for four different equity mutual funds: Fund Fund Fund Fund X Y Z Assets under Management, avo for past 12 months (mil) $289.4 $653.7 $1,298.4 $5,567.3 Security Sales, past 12 months 137.2 $569.3 11,453.8 $437.1 Expense Ratio 0.33% 0.71% 1.13% 0.21% Pretax Return, 3-yr. avg 9.98% 10.65% 10.12% 9.8396 Taz-adjusted Return, 3-yr. avg. 9.43% 8.87% 9.34% 9.54% a a Calculate the portfolio turnover ratio for each fund. 6. Which two funds are most likely to be actively man- aged and which two are most likely passive funds? Explain a Calculate the tax cost ratio for each fund. d. Which funds were the most and least tax efficient in the operations? Why? es

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started