Answered step by step

Verified Expert Solution

Question

1 Approved Answer

2 Consolidated Pasta Is currently expected to pay annual dividends of $10 a share in perpetuity on the 1.3 million shares that are outstanding. Shareholders

2

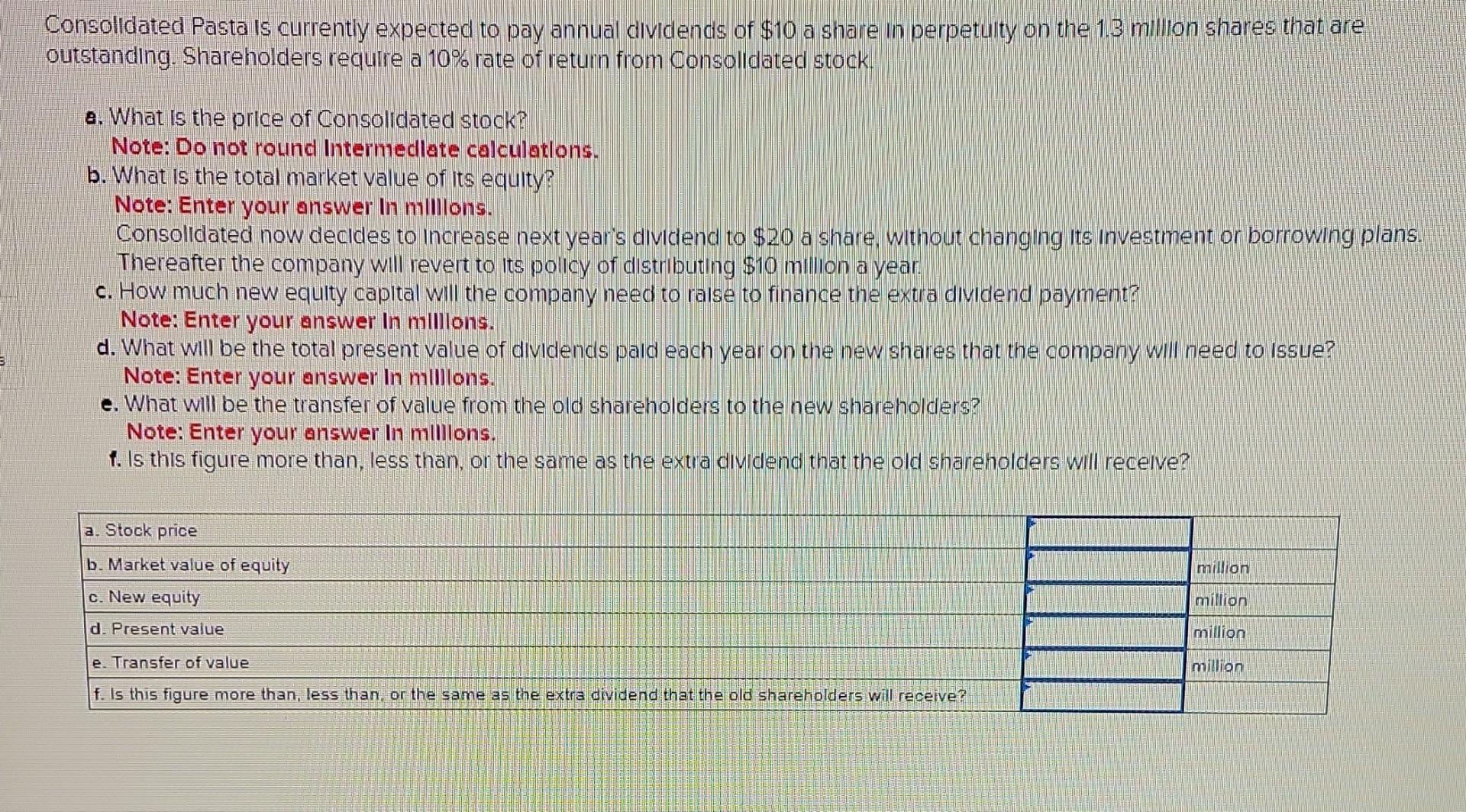

Consolidated Pasta Is currently expected to pay annual dividends of $10 a share in perpetuity on the 1.3 million shares that are outstanding. Shareholders require a 10% rate of return from Consolldated stock Q. What is the price of Consolidated stock? Note: Do not round Intermedlate calculatlons. b. What is the total market value of its equity? Note: Enter your answer In millilons. Consolidated now decides to increase next year's dividend to $20 a share, without changing its investment or borrowing plans. Thereafter the company will revert to its policy of dlstributing $10 million a year. c. How much new equity capltal will the company need to ralse to finance the extra dividend payment? Note: Enter your answer In milllons. d. What will be the total present value of dividends pald each year on the new shares that the company will need to Issue? Note: Enter your answer In milllons. e. What will be the transfer of value from the old shareholders to the new shareholders? Note: Enter your answer ln millilons. f. Is this figure more than, less than, or the same as the extia dividend that the old shareholders will receiveStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started