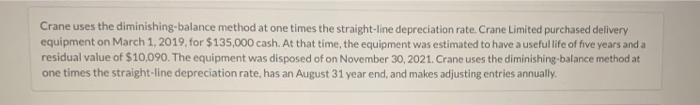

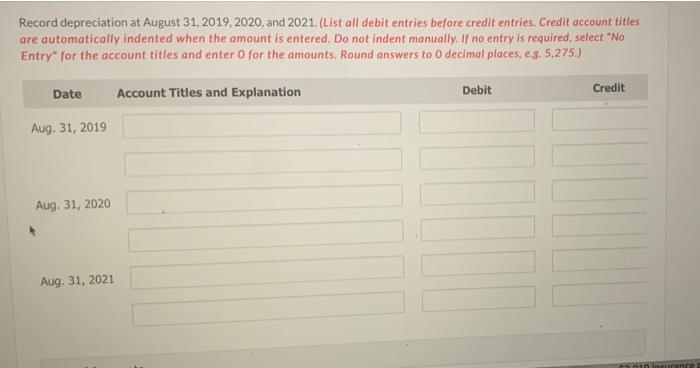

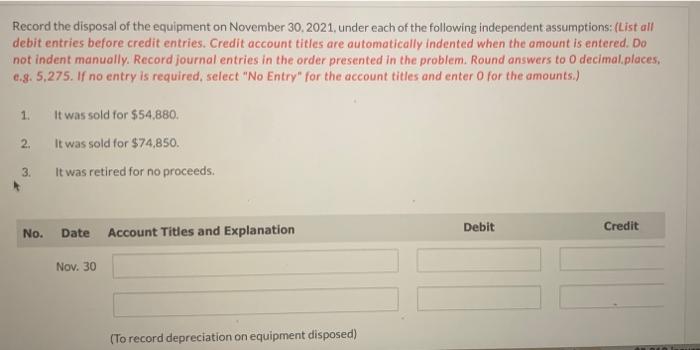

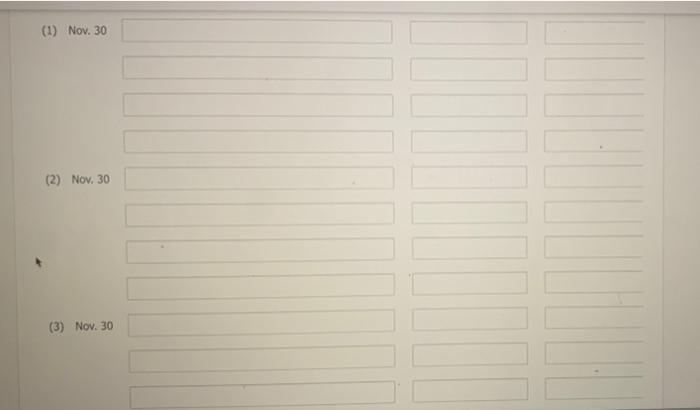

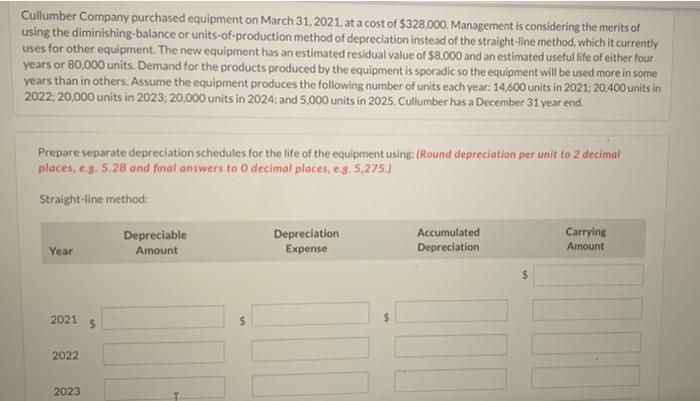

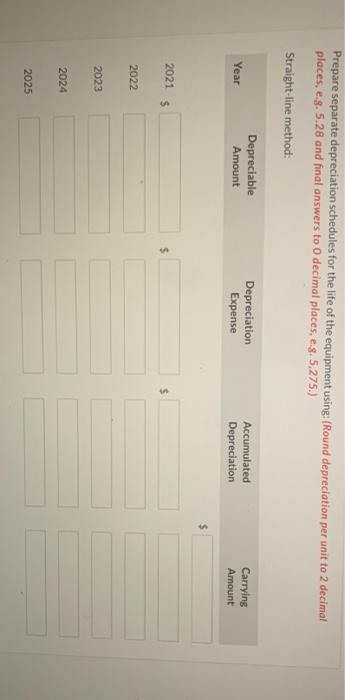

Crane uses the diminishing-balance method at one times the straight-line depreciation rate. Crane Limited purchased delivery equipment on March 1, 2019, for $135,000 cash. At that time, the equipment was estimated to have a useful life of five years and a residual value of $10,090. The equipment was disposed of on November 30, 2021. Crane uses the diminishing-balance method at one times the straight-line depreciation rate, has an August 31 year end, and males adjusting entries annually. Record depreciation at August 31,2019,2020, and 2021. (List all debit entries before credit entries. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts. Round answers to o decimal places, c.8.5,275.) Date Account Titles and Explanation Debit Credit Aug. 31, 2019 Aug. 31, 2020 Aug. 31, 2021 rance Record the disposal of the equipment on November 30, 2021, under each of the following independent assumptions: (List all debit entries before credit entries. Credit account titles are automatically indented when the amount is entered. Do not indent manually. Record journal entries in the order presented in the problem. Round answers to decimal.places, 0.8.5,275. If no entry is required, select "No Entry" for the account titles and enter o for the amounts.) 1 2. It was sold for $54,880. It was sold for $74,850 It was retired for no proceeds. 3. Debit No. Credit Account Titles and Explanation Date Nov. 30 (To record depreciation on equipment disposed) (1) Nov. 30 (2) Nov. 30 (3) Nov. 30 Cullumber Company purchased equipment on March 31, 2021. at a cost of $328,000. Management is considering the merits of using the diminishing-balance or units-of-production method of depreciation instead of the straight-line method, which it currently uses for other equipment. The new equipment has an estimated residual value of $8,000 and an estimated useful life of either four years or 80,000 units. Demand for the products produced by the equipment is sporadic so the equipment will be used more in some years than in others. Assume the equipment produces the following number of units each year: 14,600 units in 2021: 20.400 units in 2022: 20,000 units in 2023; 20,000 units in 2024; and 5,000 units in 2025. Cullumber has a December 31 year end. Prepare separate depreciation schedules for the life of the equipment using: (Round depreciation per unit to 2 decimal places, c.8. 5.28 and final answers to 0 decimal places.c.3.5,275.) Straight-line method: Depreciable Amount Depreciation Expense Accumulated Depreciation Carrying Amount Year 2021 $ $ 2022 2023 Prepare separate depreciation schedules for the life of the equipment using: (Round depreciation per unit to 2 decimal places, e.3. 5.28 and final answers to 0 decimal places, e g. 5,275.) Straight-line method: Year Depreciable Amount Depreciation Expense Accumulated Depreciation Carrying Amount $ 2021 $ $ $ 2022 2023 2024 2025