Answered step by step

Verified Expert Solution

Question

1 Approved Answer

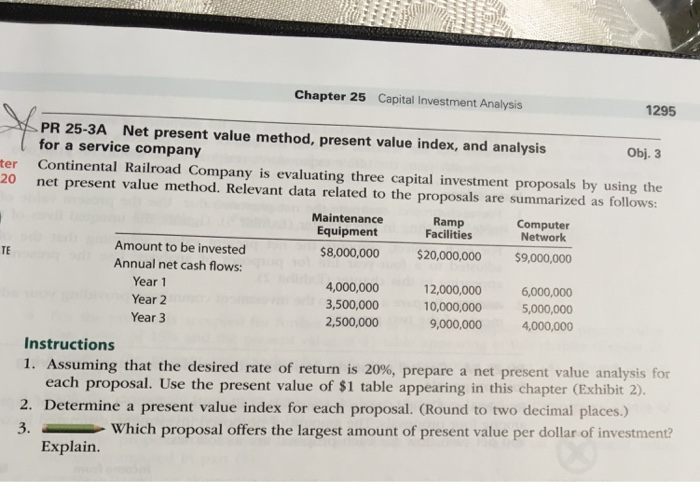

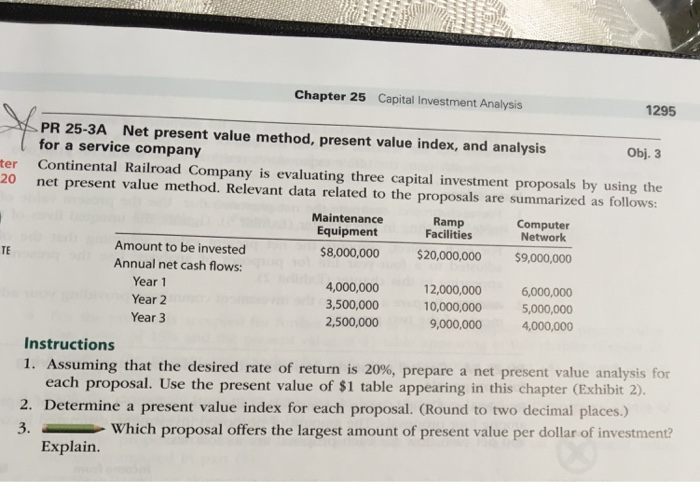

2. Determine a present value index for each proposal. Chapter 25 Capital Investment Analysis 1295 PR 25-3A Net present value method, present value index, and

2. Determine a present value index for each proposal.

Chapter 25 Capital Investment Analysis 1295 PR 25-3A Net present value method, present value index, and analysis for a service company Continental Railroad Company is evaluating three capital investment proposals by using the net present value method. Relevant data related to the proposals are summarized as follows: Obj. 3 ter 20 Maintenance Equipment $8,000,000 Ramp Facilities Computer Network Amount to be invested Annual net cash flows $20,000,000 $9,000,000 TE Year 1 Year 2 Year 3 4,000,000 3,500,000 2,500,000 12,000,000 10,000,000 9,000,000 6,000,000 5,000,000 4,000,000 Instructions I. Assuming that the desired rate of return is 20%, prepare a net present value analysis for each proposal. Use the present value of $1 table appearing in this chapter (Exhibit 2). 2. Determine a present value index for each proposal. (Round to two decimal places.) 3.Which proposal offers the largest amount of present value per dollar of investment? Explain

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started