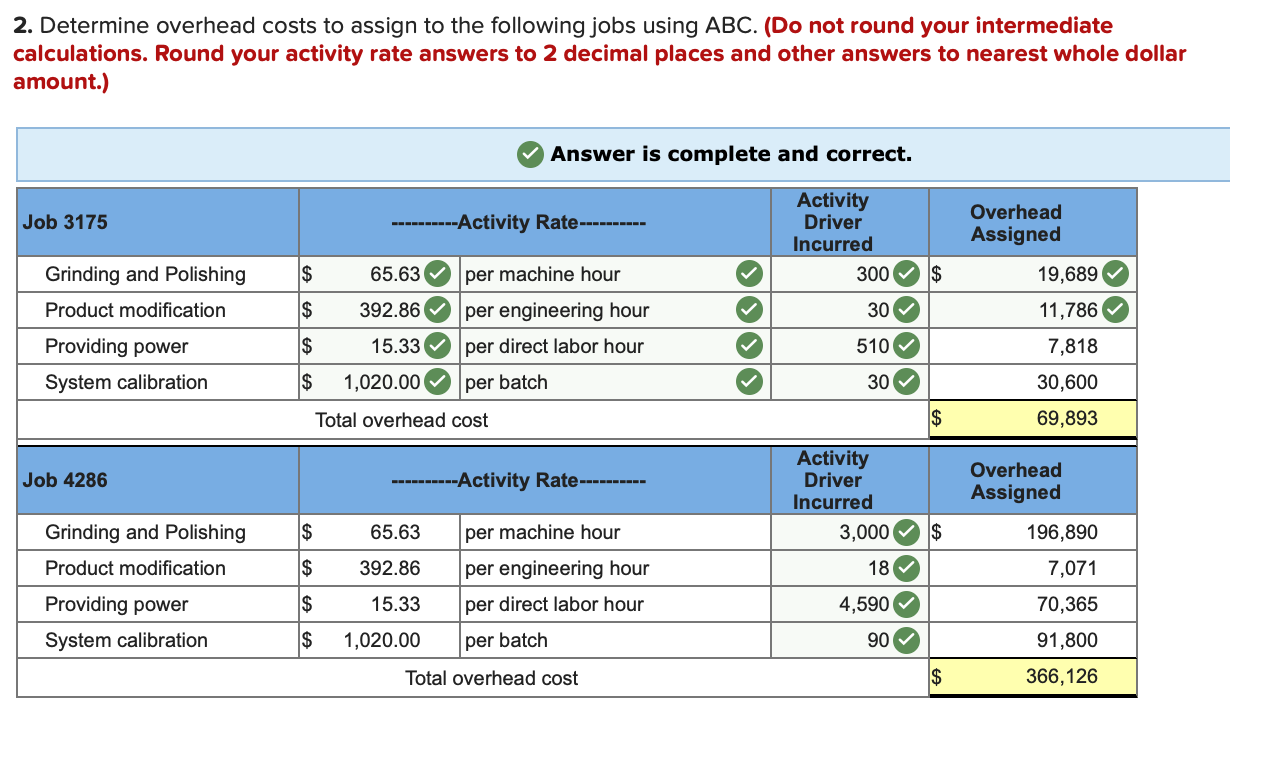

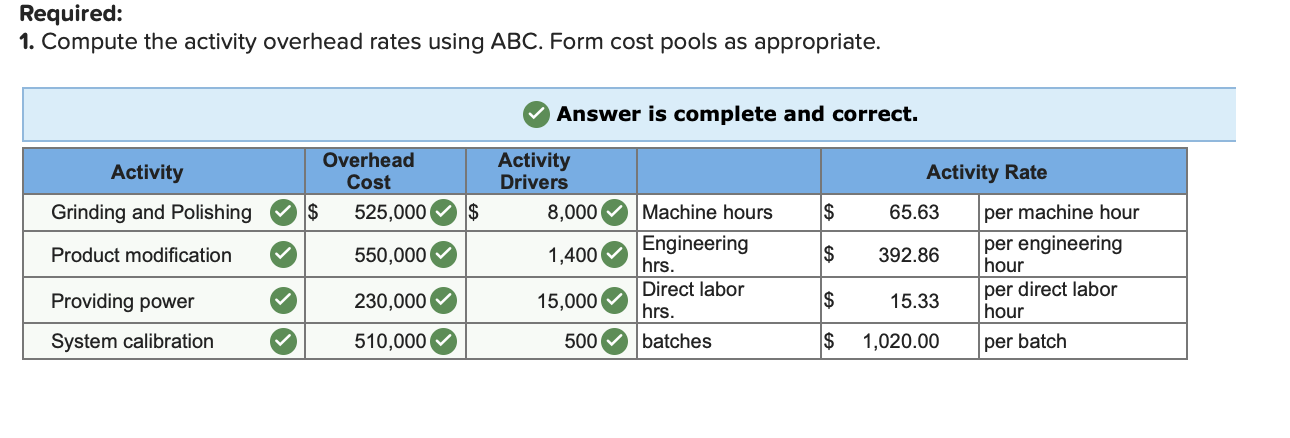

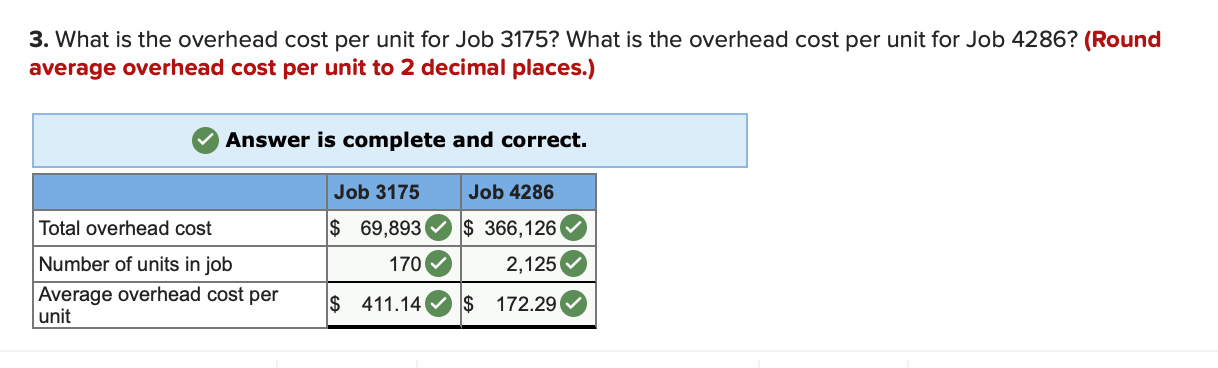

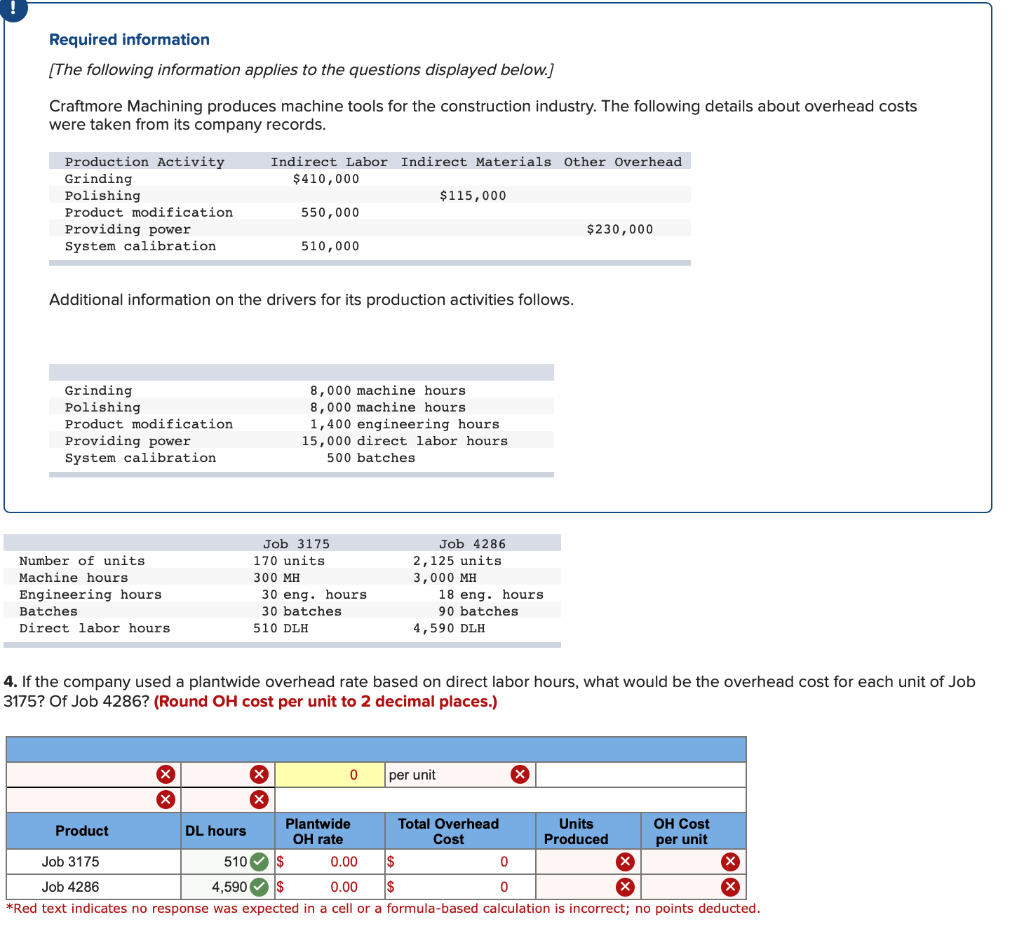

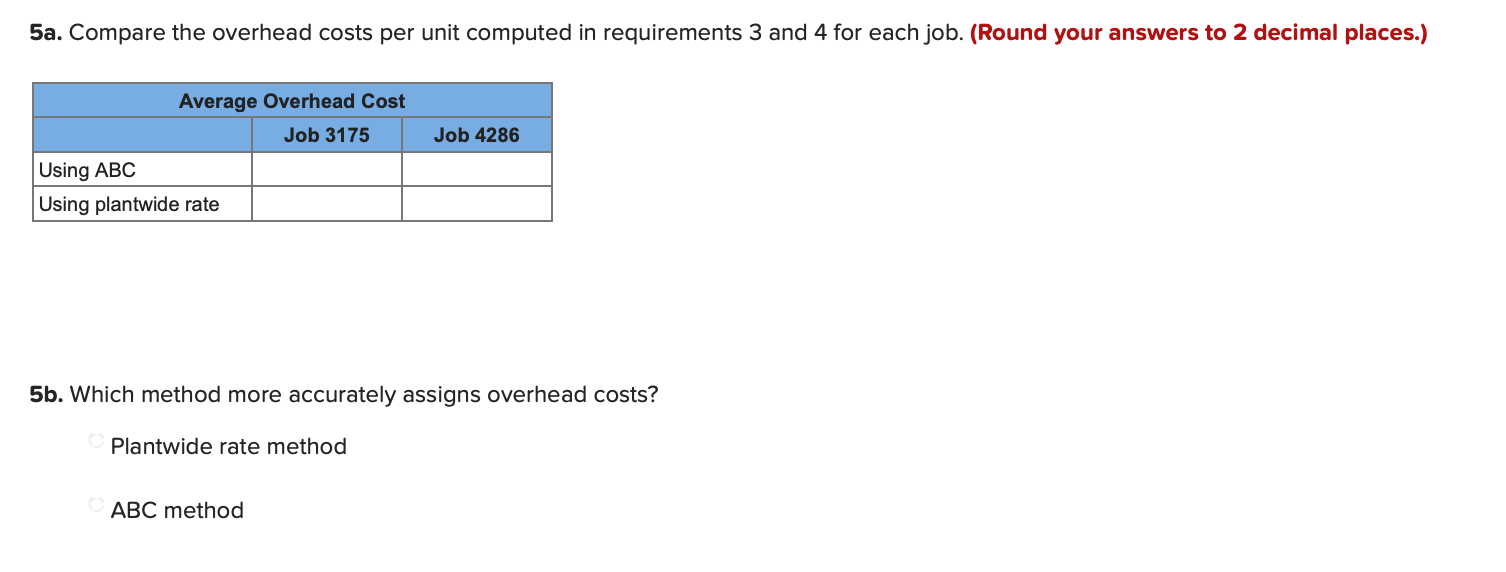

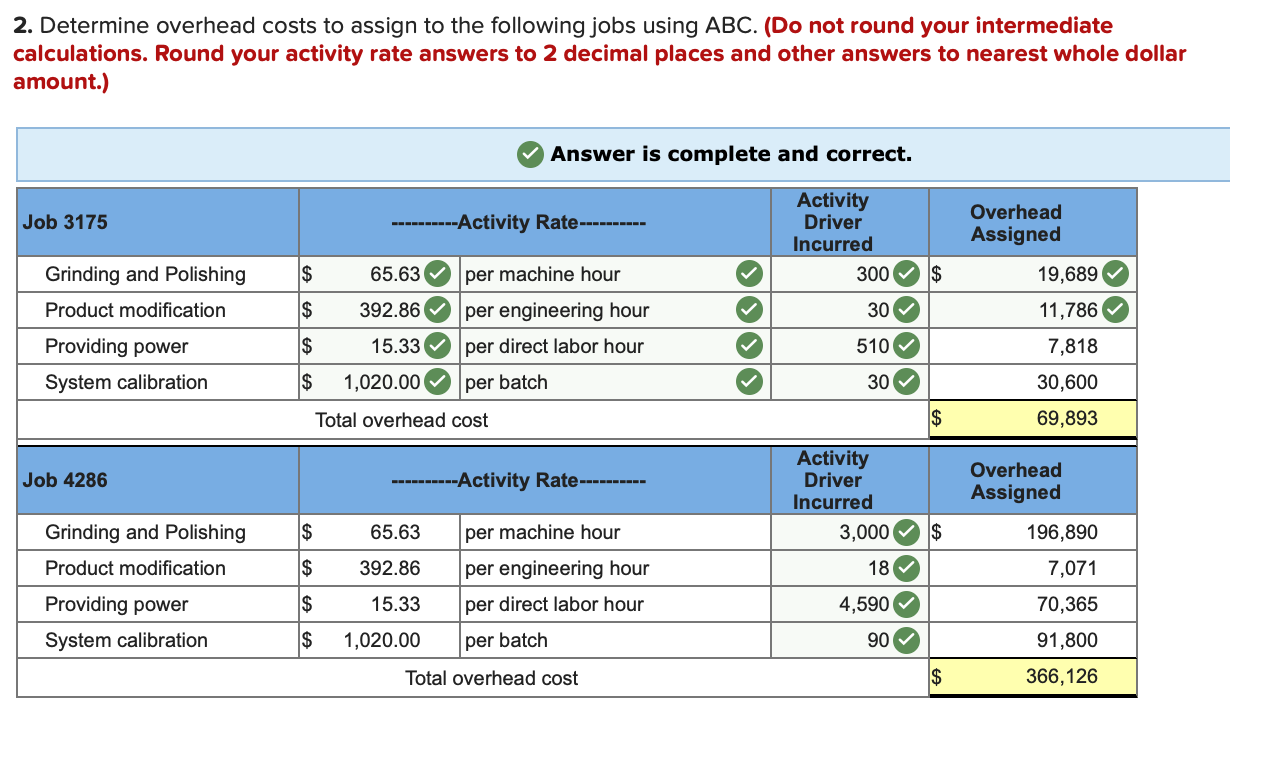

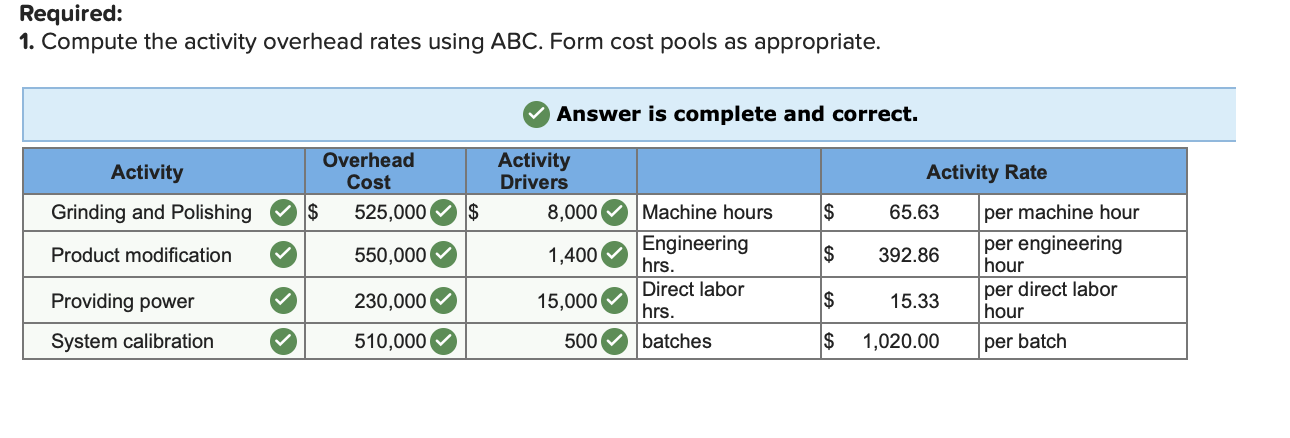

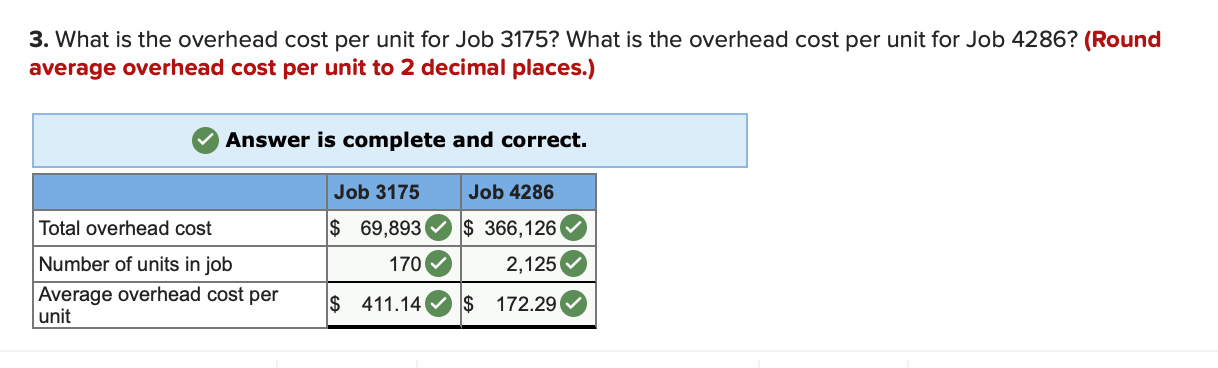

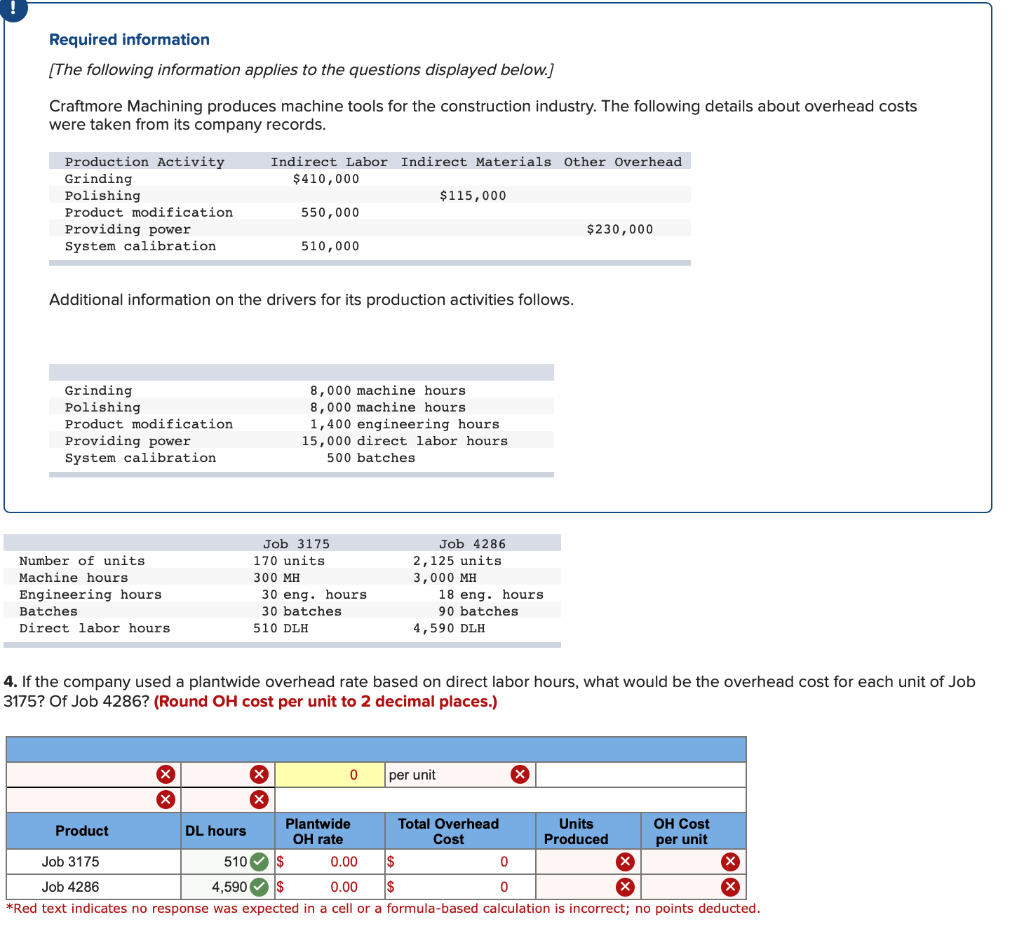

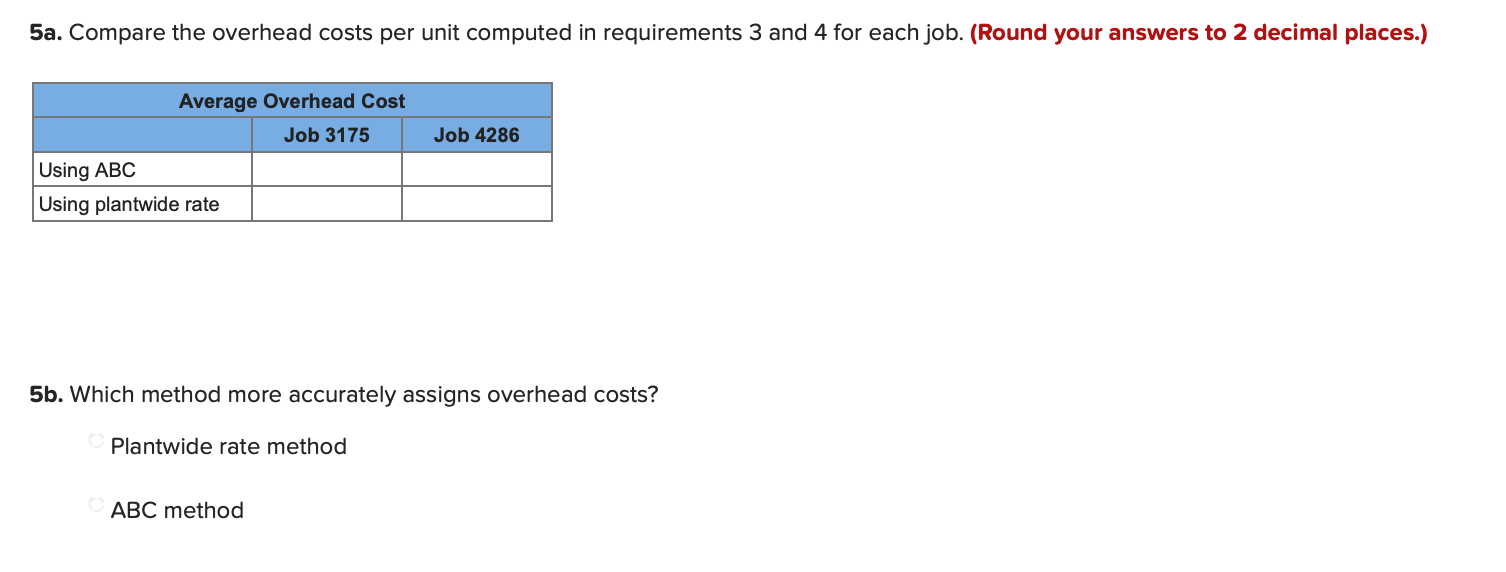

2. Determine overhead costs to assign to the following jobs using ABC. (Do not round your intermediate answers to 2 decimal places and other answers to nearest whole dollar amount.) Answer is complete and correct. Job 3175 ----------Activity Rate-------- $ $ Grinding and Polishing Product modification Providing power System calibration 65.63 392.86 15.33 1,020.00 $ Activity Driver Incurred 300 30 510 30 per machine hour per engineering hour per direct labor hour per batch Overhead Assigned 19,689 11,786 7,818 30,600 $ Total overhead cost 69,893 Job 4286 ---------Activity Rate-------- Overhead Assigned $ Grinding and Polishing Product modification Providing power System calibration 196,890 7,071 Activity Driver Incurred 3,000 18 4,590 90 65.63 392.86 15.33 1,020.00 $ $ $ per machine hour per engineering hour per direct labor hour per batch 70,365 91,800 366,126 Total overhead cost Required: 1. Compute the activity overhead rates using ABC. Form cost pools as appropriate. Answer is complete and correct. Activity Activity Rate Overhead Cost $ 525,000 Activity Drivers 8,000 Grinding and Polishing $ $ 65.63 Product modification 1,400 Machine hours Engineering hrs. Direct labor $ 392.86 550,000 230,000 510,000 per machine hour per engineering hour per direct labor hour per batch Providing power 15,000 hrs. $ $ 15.33 1,020.00 System calibration 500 batches 3. What is the overhead cost per unit for Job 3175? What is the overhead cost per unit for Job 4286? (Round average overhead cost per unit to 2 decimal places.) Answer is complete and correct. Total overhead cost Number of units in job Average overhead cost per unit Job 3175 $ 69,893 170 $ 411.14 Job 4286 $ 366,126 2,125 $ 172.29 Required information [The following information applies to the questions displayed below.) Craftmore Machining produces machine tools for the construction industry. The following details about overhead costs were taken from its company records. Production Activity Grinding Polishing Product modification Providing power System calibration Indirect Labor Indirect Materials Other Overhead $410,000 $115,000 550,000 $230,000 510,000 Additional information on the drivers for its production activities follows. Grinding Polishing Product modification Providing power System calibration 8,000 machine hours 8,000 machine hours 1,400 engineering hours 15,000 direct labor hours 500 batches Number of units Machine hours Engineering hours Batches Direct labor hours Job 3175 170 units 300 MH 30 eng. hours 30 batches 510 DLH Job 4286 2,125 units 3,000 MH 18 eng. hours 90 batches 4,590 DLH 4. If the company used a plantwide overhead rate based on direct labor hours, what would be the overhead cost for each unit of Job 3175? Of Job 4286? (Round OH cost per unit to 2 decimal places.) X X 0 per unit Product DL hours Plantwide Total Overhead Units OH Cost OH rate Cost Produced per unit Job 3175 510 $ 0.00 0 Job 4286 4,590 $ 0.00 *Red text indicates no response was expected in a cell or a formula-based calculation is incorrect; no points deducted. 5a. Compare the overhead costs per unit computed in requirements 3 and 4 for each job. (Round your answers to 2 decimal places.) Job 4286 Average Overhead Cost Job 3175 Using ABC Using plantwide rate 5b. Which method more accurately assigns overhead costs? Plantwide rate method ABC method