Answered step by step

Verified Expert Solution

Question

1 Approved Answer

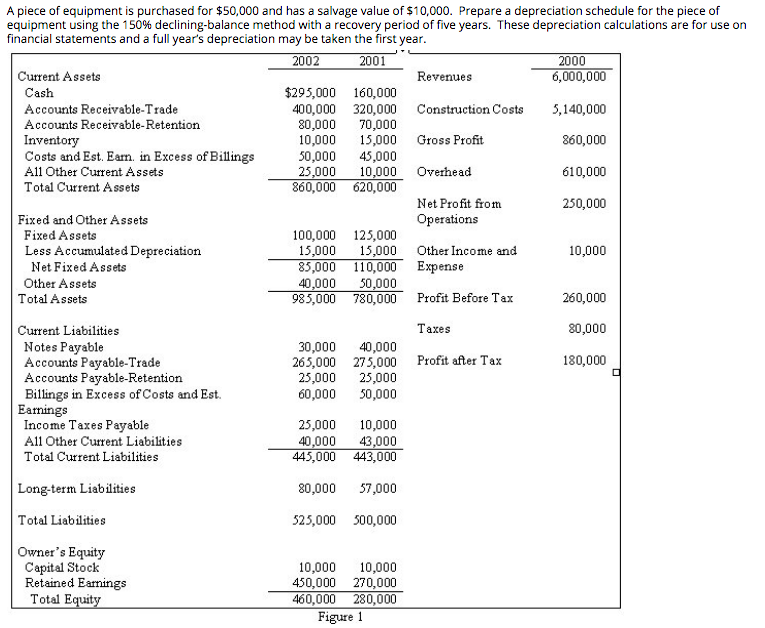

2. Determine the debt to equity ratio for the company in Figure 1. How does their debt to equity ratio compare to the industry average

2. Determine the debt to equity ratio for the company in Figure 1. How does their debt to equity ratio compare to the industry average for a commercial contractor and what does this mean?

3. Determine the accounts payable to revenue ratio for the company in Figure 1. How do their accounts payable to revenue ratio compare to the industry average for a commercial contractor and what does this mean?

4.Determine the general overhead ratio for the company in Figure 1. What insight does this give you into the companys finances?

A piece of equipment is purchased for $50,000 and has a salvage value of $10,000. Prepare a depreciation schedule for the piece of equipment using the 150% declining-balance method with a recovery period of five years. These depreciation calculations are for use on financial statements and a full year's depreciation may be taken the first year. 2002 2001 2000 Current Assets Revenues 6,000,000 Cash $295,000 160,000 Accounts Receivable-Trade 400,000 320,000 Construction Costs 5,140,000 Accounts Receivable-Retention 80,000 70,000 Inventory 10,000 15,000 Gross Profit 860,000 Costs and Est. Eam in Excess of Billings 50,000 45,000 All Other Current Assets 25,000 10,000 Overhead 610,000 Total Current Assets 860,000 620,000 Net Profit from 250,000 Fixed and Other Assets Operations Fixed Assets 100,000 125,000 Less Accumulated Depreciation 15,000 15,000 Other Income and 10,000 Net Fixed Assets 85,000 110,000 Expense Other Assets 40,000 50,000 Total Assets 985,000 780,000 Profit Before Tax 260,000 Taxes 80,000 Profit after Tax 180,000 Current Liabilities Notes Payable Accounts Payable-Trade Accounts Payable-Retention Billings in Excess of Costs and Est. Earnings Income Taxes Payable All Other Current Liabilities Total Current Liabilities 30,000 265,000 25,000 60,000 40,000 275,000 25,000 50,000 25,000 40,000 445,000 10,000 43,000 443,000 Long-term Liabilities 80,000 57,000 Total Liabilities 525,000 500,000 Owner's Equity Capital Stock Retained Earnings Total Equity 10,000 10,000 450,000 270,000 460,000 280,000 Figure 1Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started