Overview:

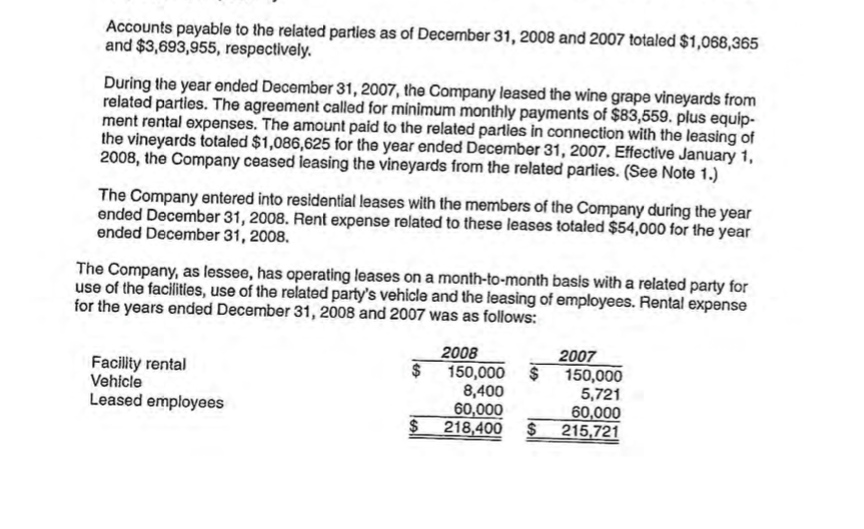

The purpose of this exercise is to use analytical procedures in order to identify potential business risks and risks of the financial statements containing material misstatements. The winery financial statements are available on the Oaks site as are the full set of the companys financial statements, which also include the notes to the financial statements. Ive also posted an examples of analytical procedures that we also reviewed in class. You may work in groups of up to three people.

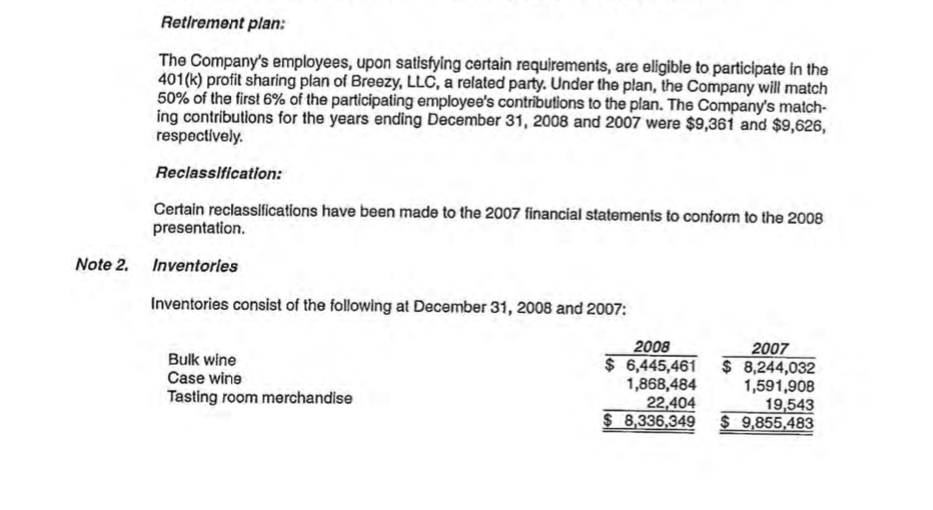

You are to identify one area of the financial statements (i.e., potentially misstated accounts) and do three rounds of the procedures listed below.

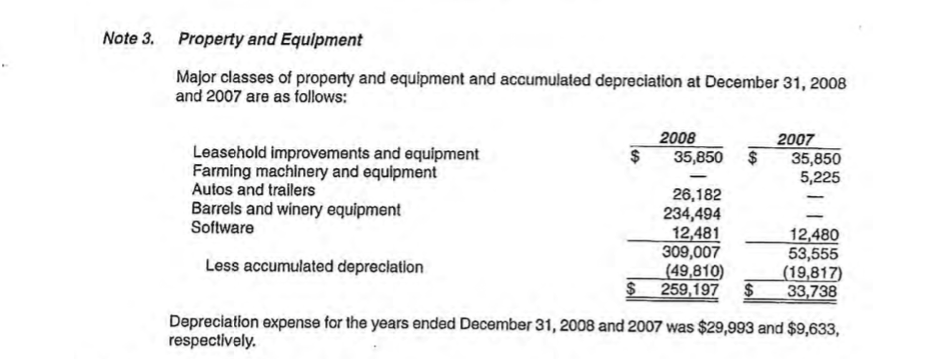

Procedures:

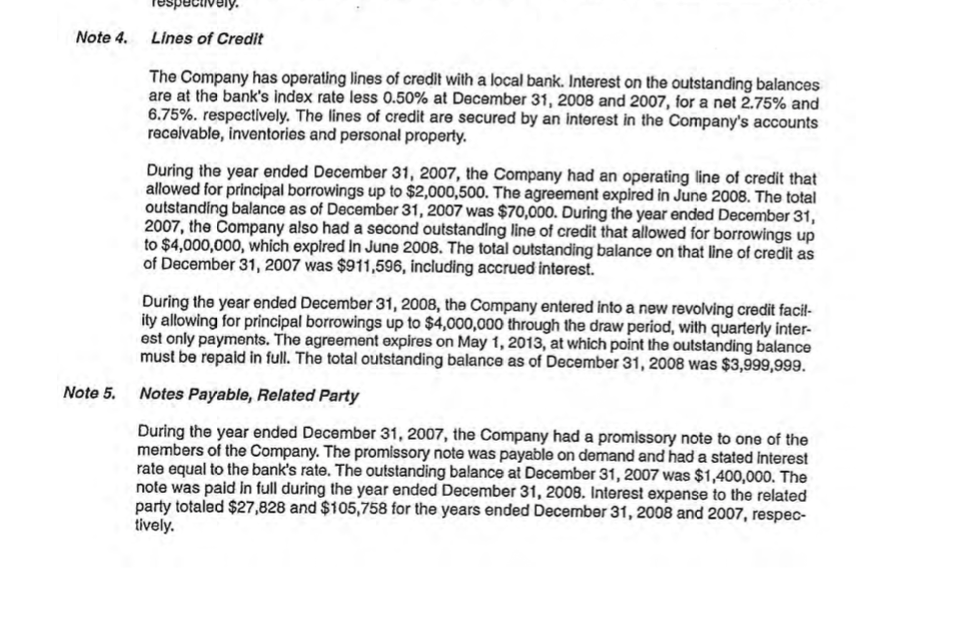

- Identify account balances and line items that contain significant % and $ changes over the prior period on the balance sheet and income statement (theyve already been calculated, you just need to identify the significant ones).

- For each significant change, address the following issues in your group discussion:

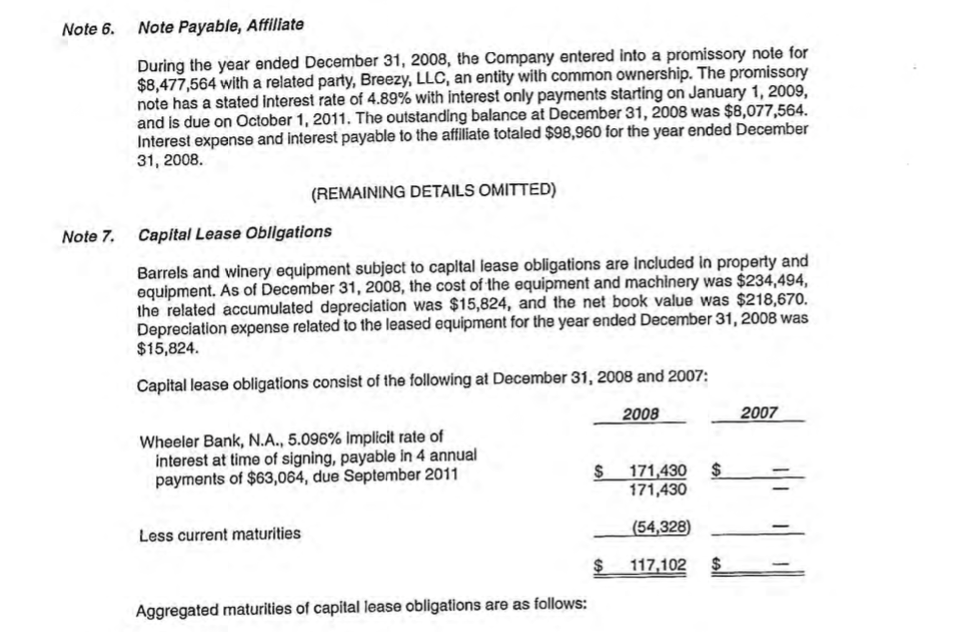

- Does the change in a given account balance make sense given the behavior of related accounts?

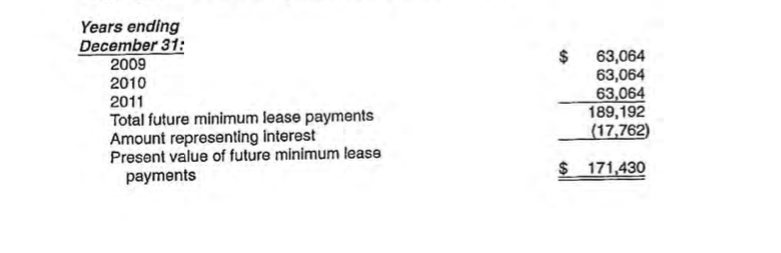

- Does the behavior of these accounts suggest that a misstatement may occur in the financial statements?

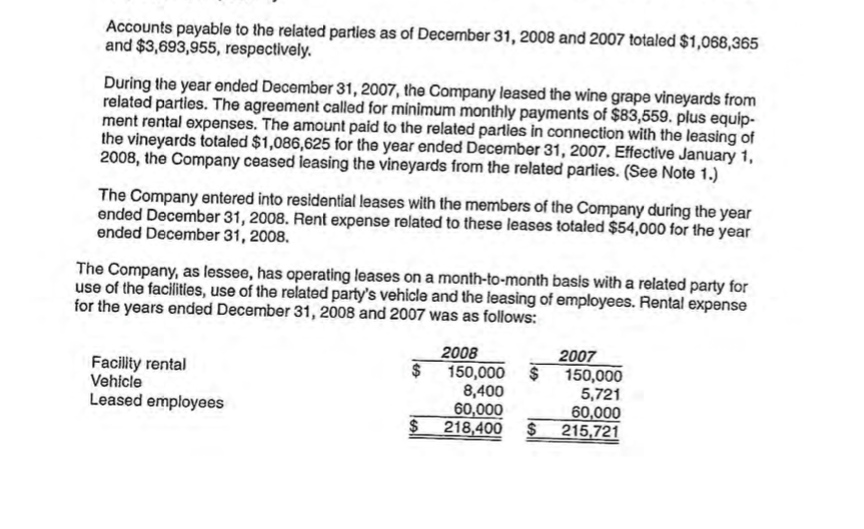

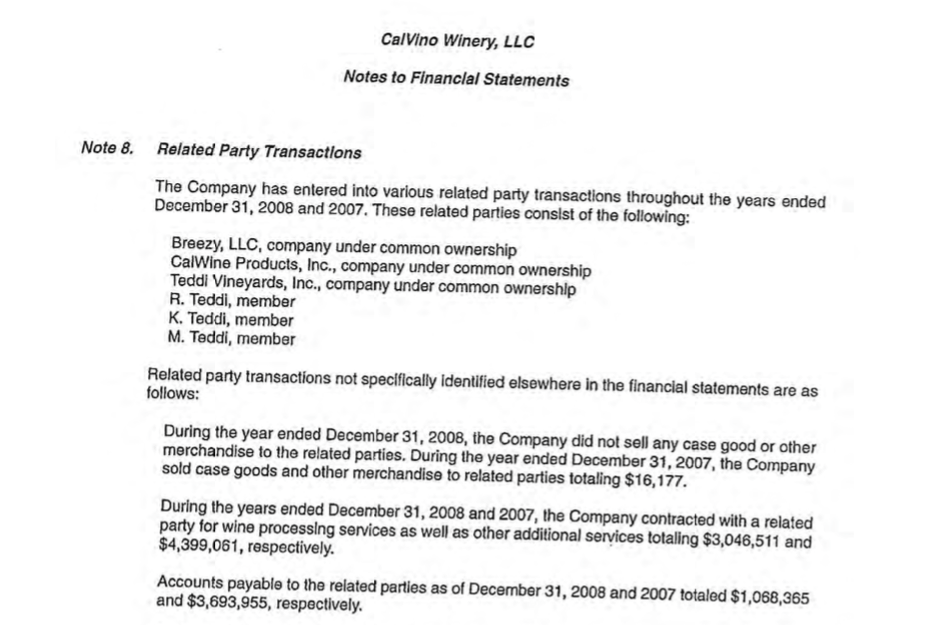

- Are there a legitimate business reasons why such trends in the account(s) exist?

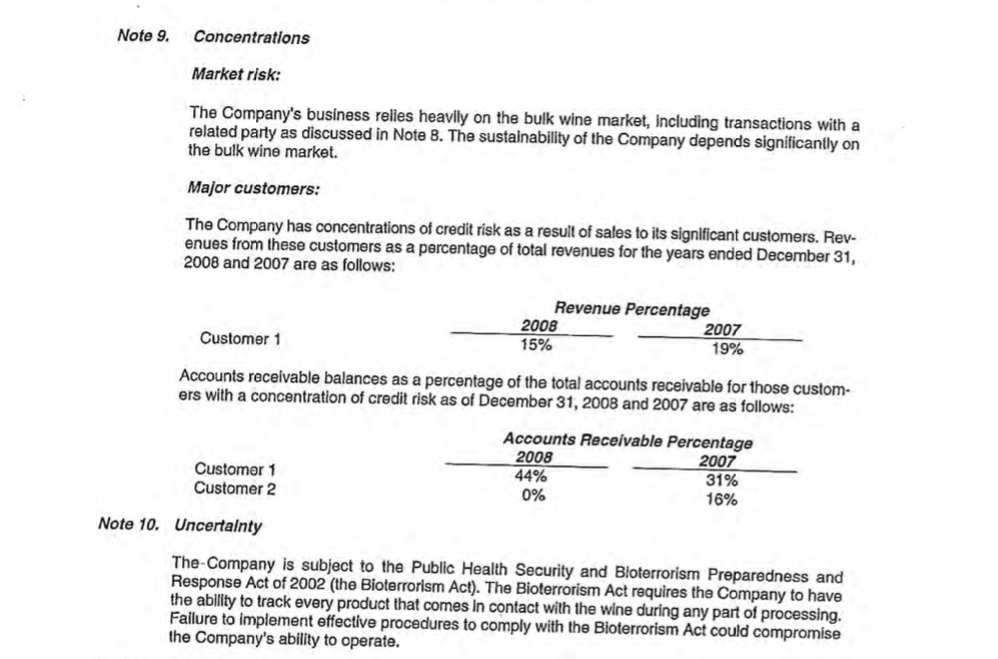

- Using the ratios that your group has computed suggest either of the following exist:

- A materially misstated account is included in the audit financial statements.

- The winery is facing a potential going concern issue.

- How would your response to parts 2 & 3 affect the nature of your year-end, substantive audit procedures?

Deliverables:

- Include a fresh copy of the winery financial statement xls, which includes a letter beside each balance or line item that you have identified as significant. For each letter, provide an explanation of that variation in an attached word document (as part of the document described in part c below) that addresses the potential issues described in part 2 above.

- Include a worksheet (xls) that shows the ratios that you have computed and follow the lettered note idea described above to address the issues in part 3 above on an accompanying word document.

- In a third (word) document, please address part 4 above following a memo format that includes the following sections:

- Significant findings (highlights from the lettered note explanations from parts 2 & 3)

- Conclusions regarding the potential impact of your findings on year-end audit procedures and whether your group has concluded that there is a going concern issue.

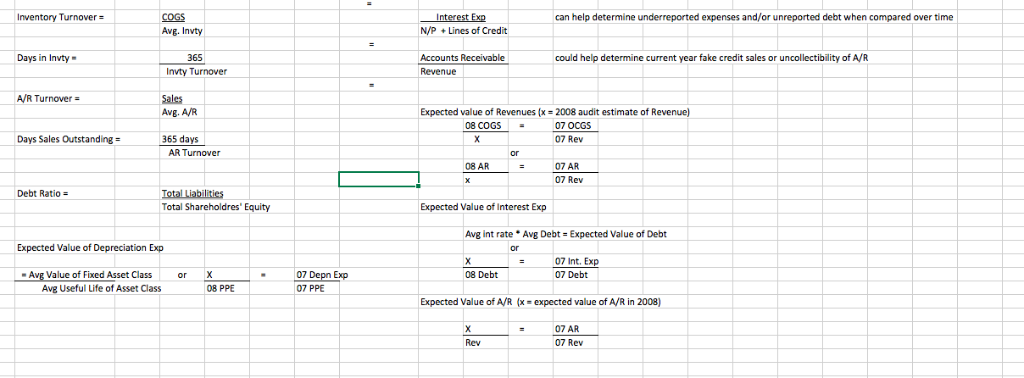

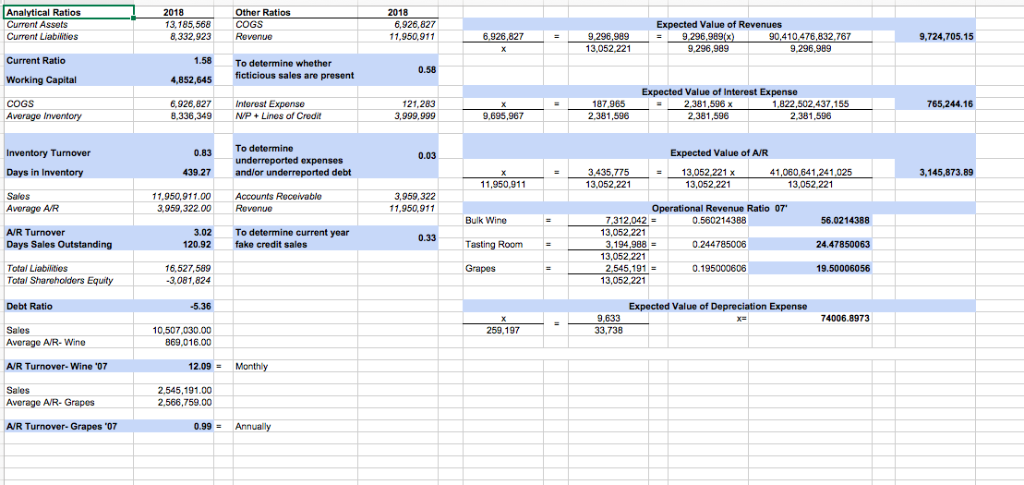

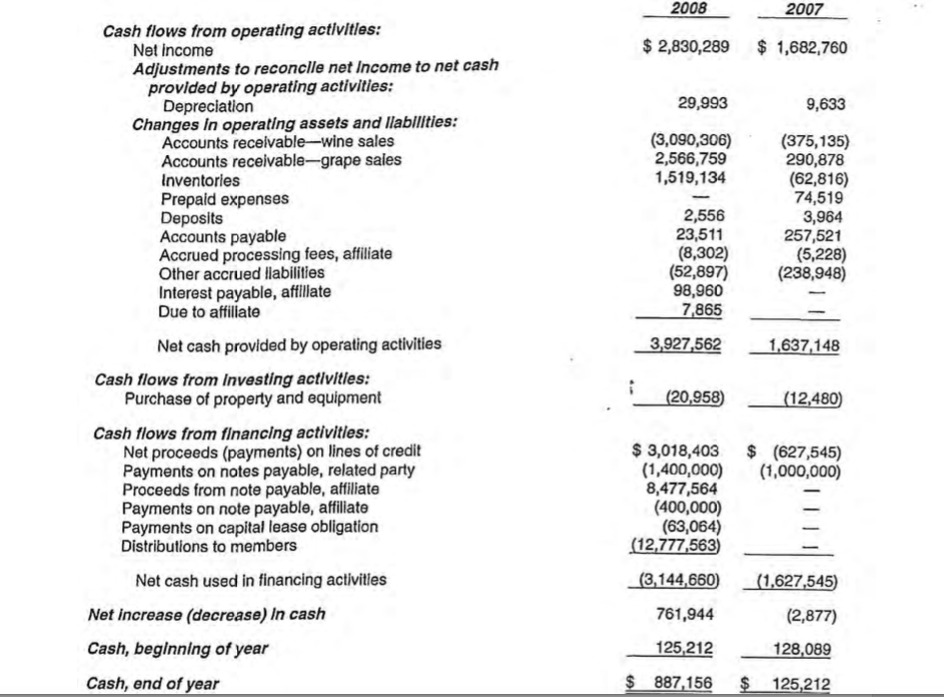

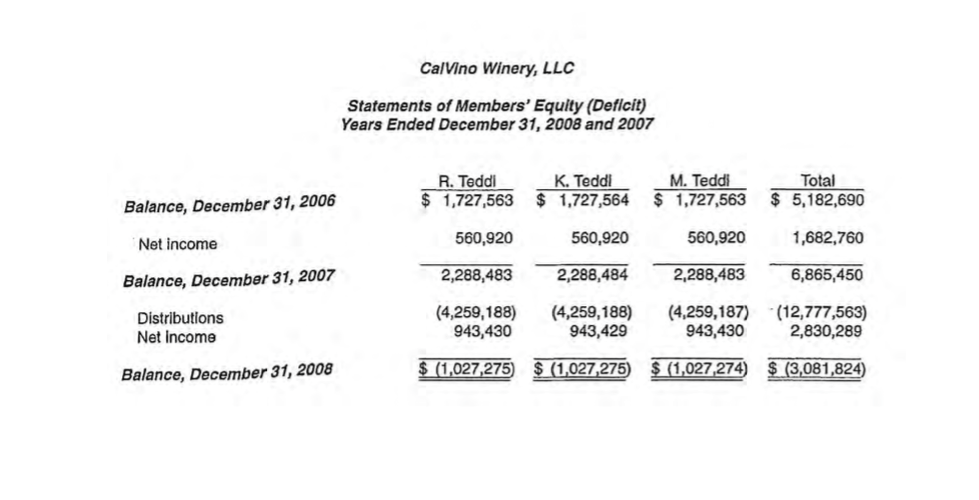

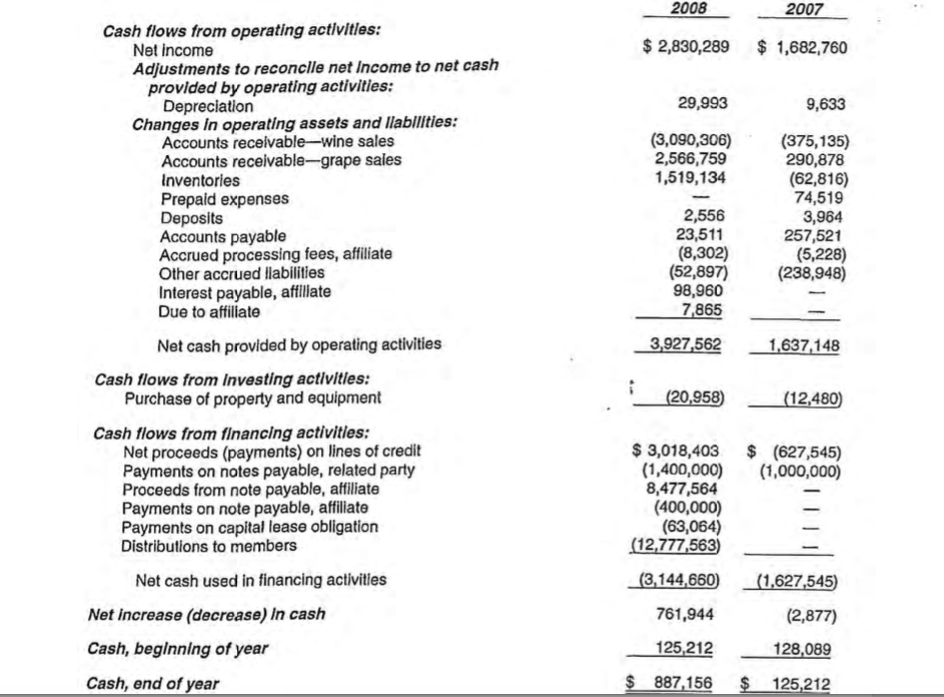

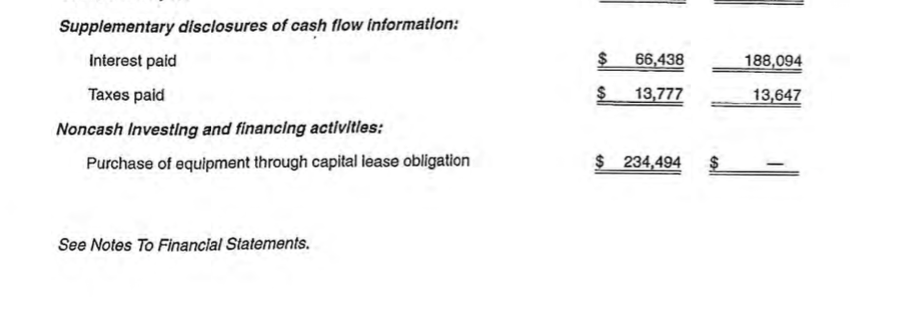

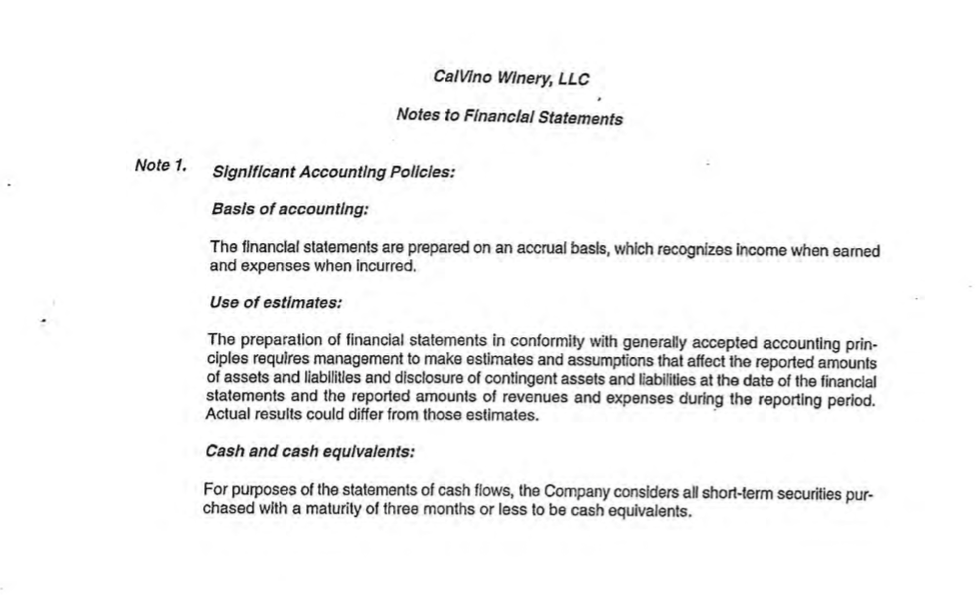

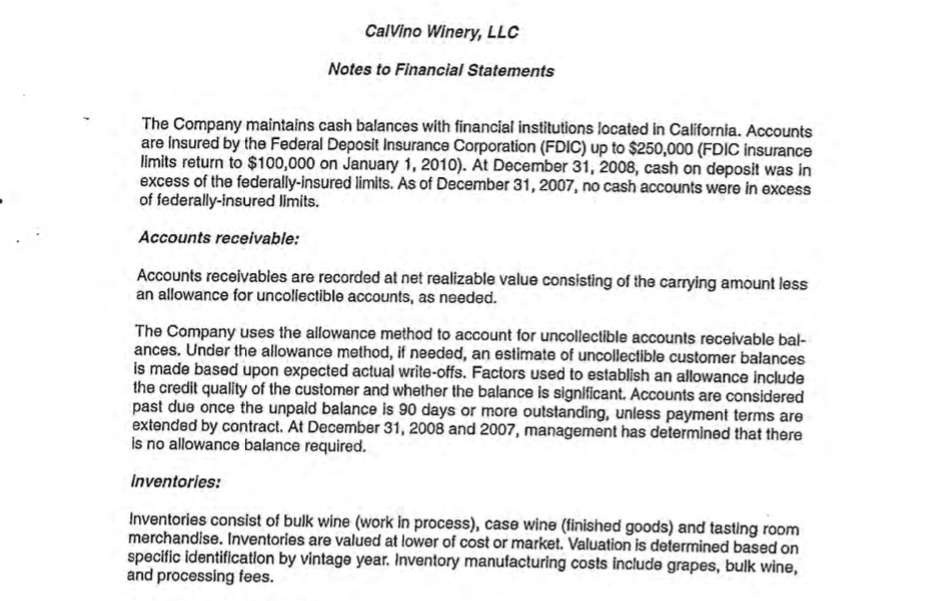

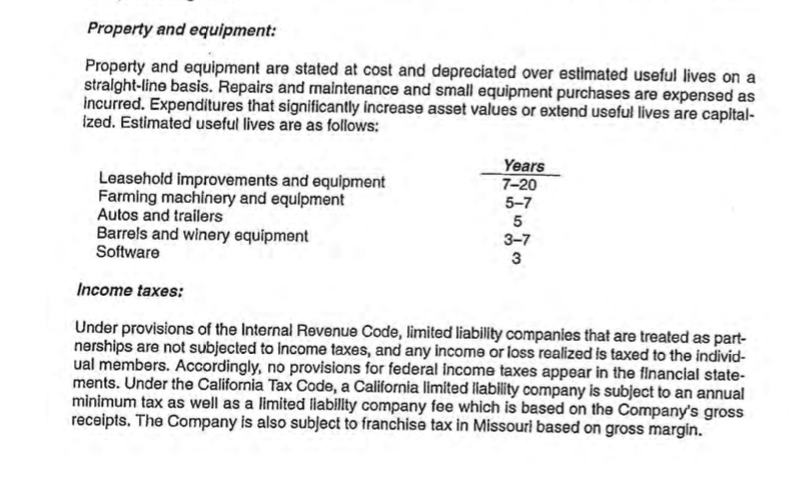

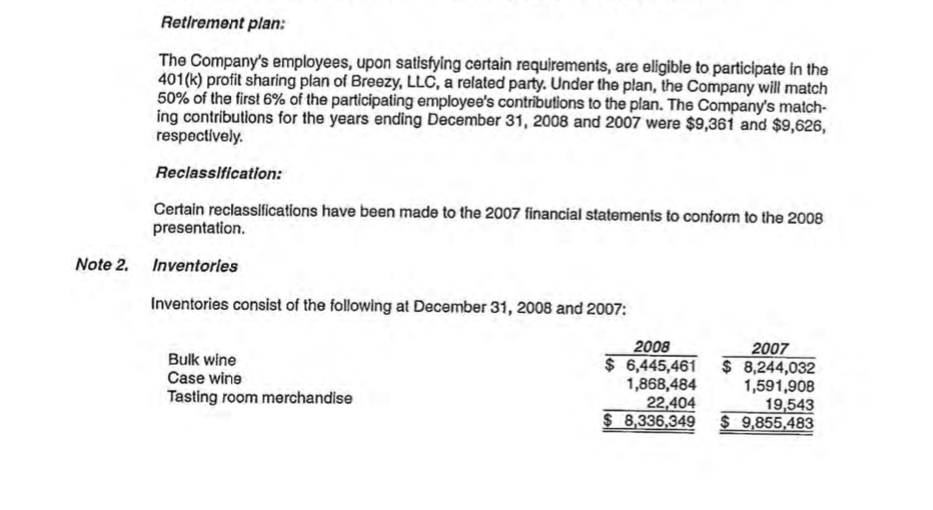

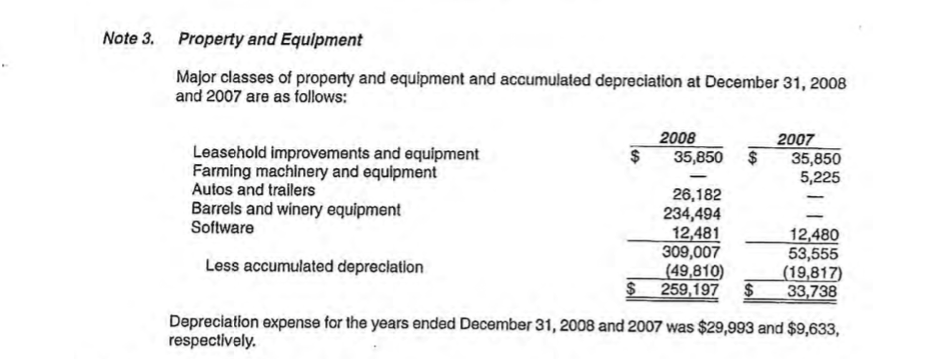

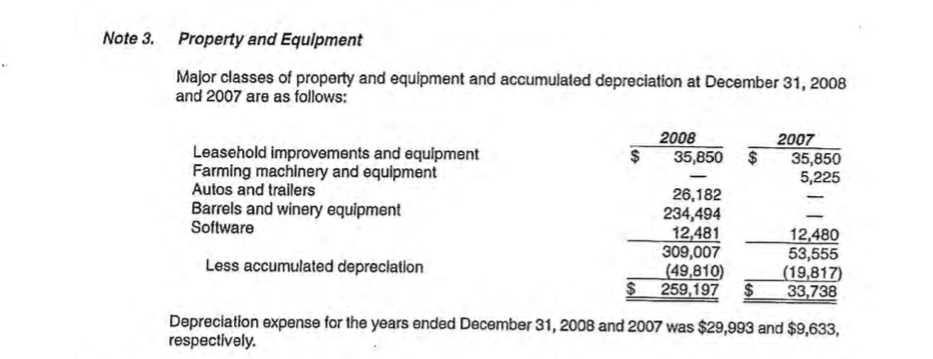

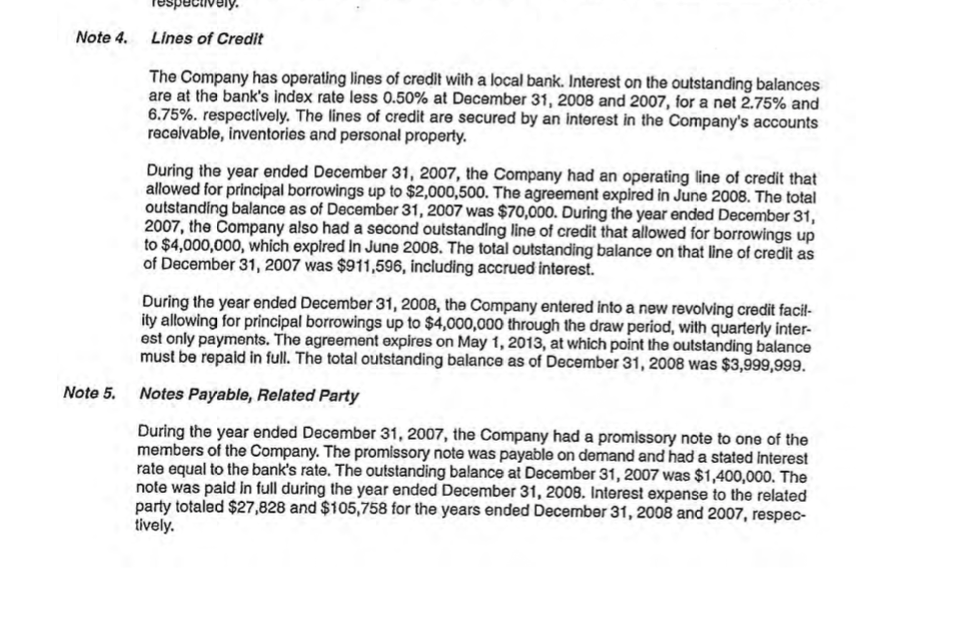

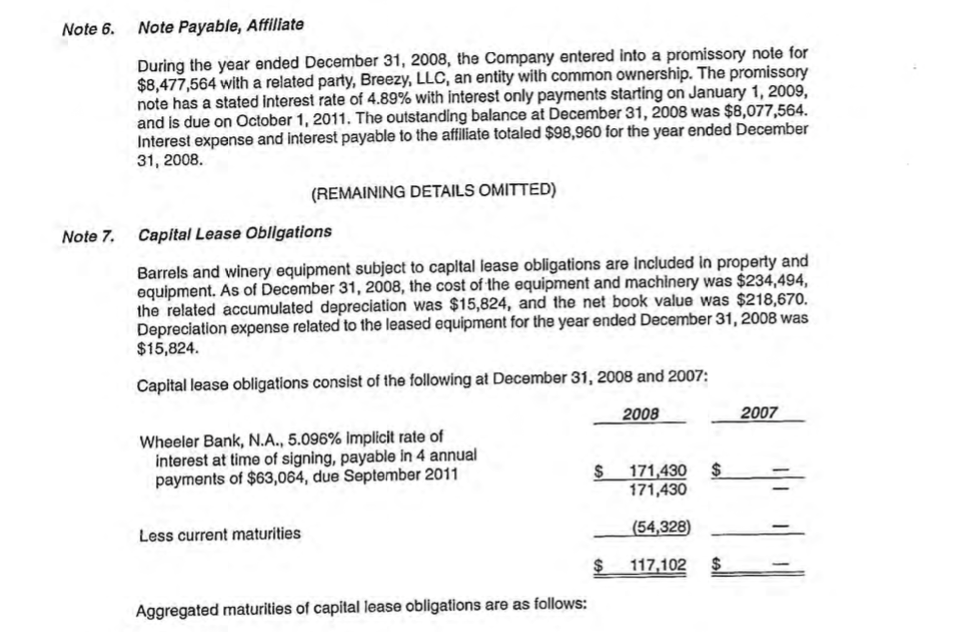

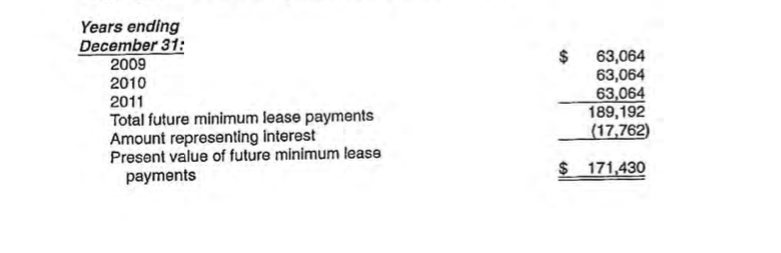

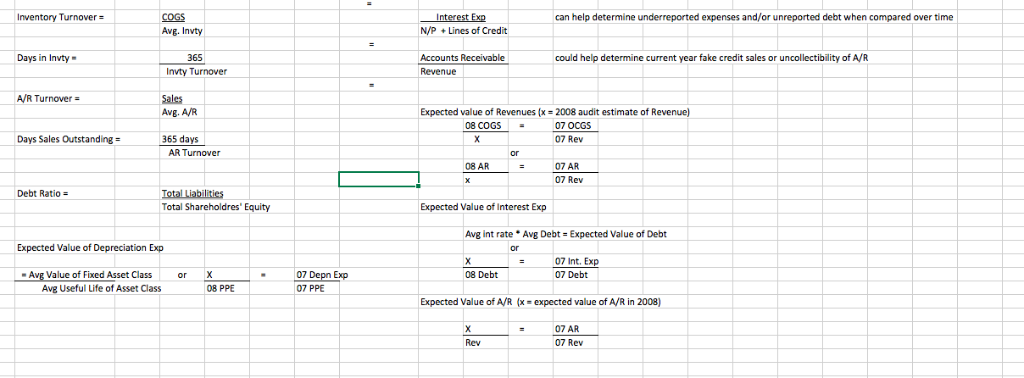

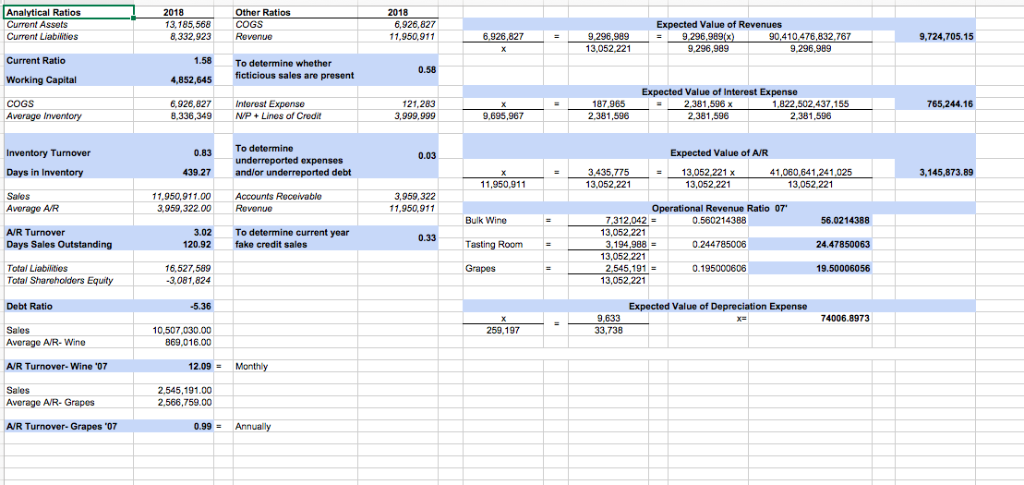

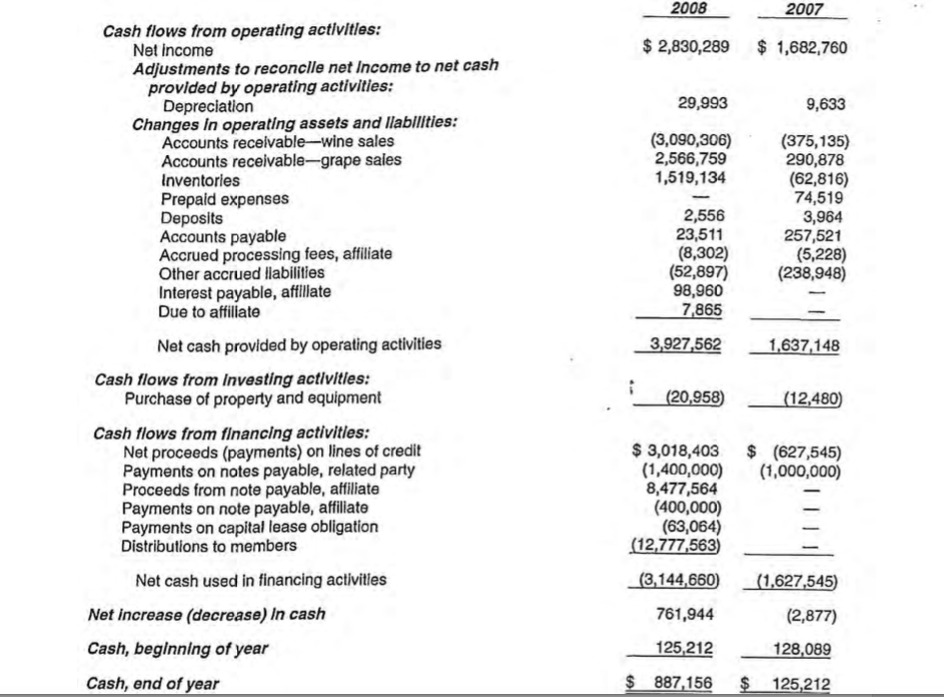

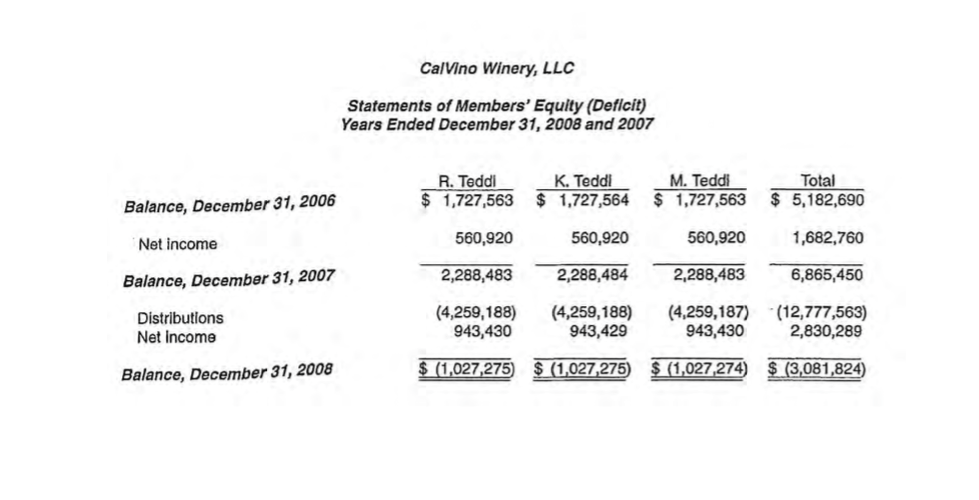

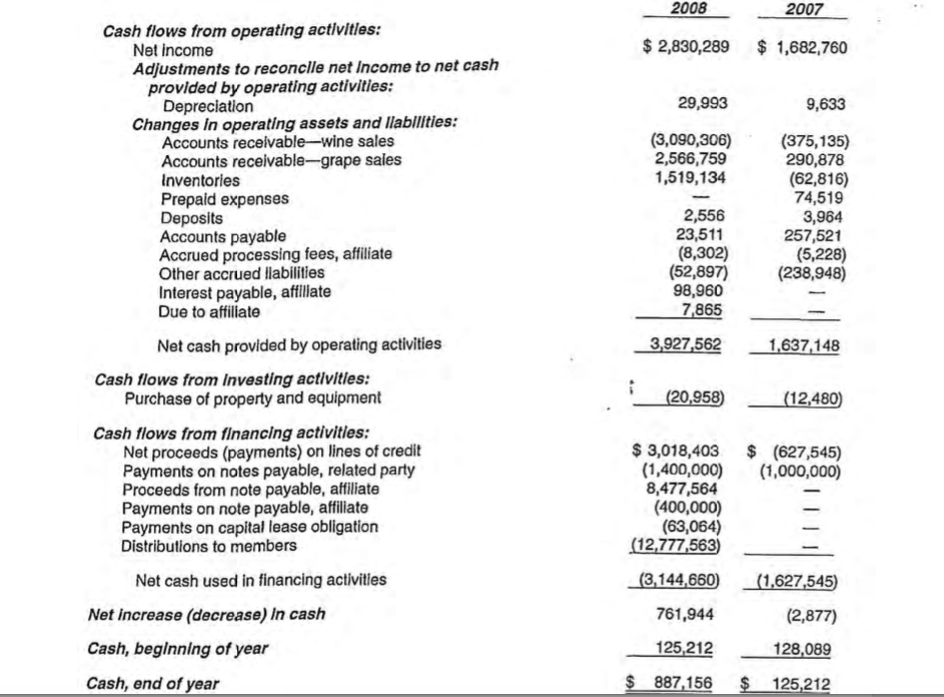

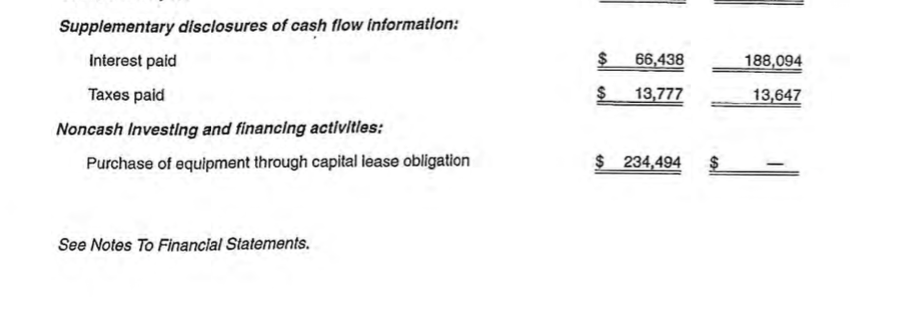

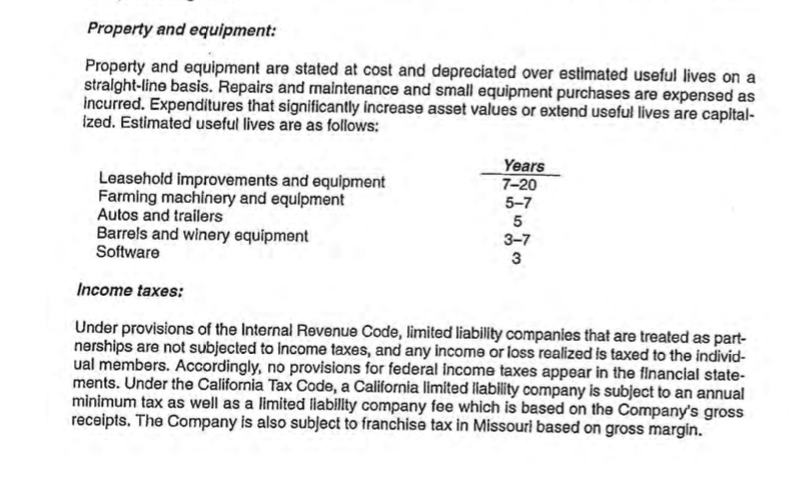

Inventory Turnover = COGS can help determine underreported expenses and/or unreported debt when compared over time Avg. Invty N/PLines of Credit Days in Invty 365 Accounts Receivable could help determine current year fake credit sales or uncollectibility of A/R Invty Turnover A/R Turnover Sales Avg. AR Expected value of Revenues (x 08 COGS 2008 audit estimate of Revenue) 07 OCGS 07 Rev Days Sales Outstanding- 365 days AR Turnover 08 AR 07 AR 07 Rev Debt Ratio Total Shareholdres Equity Expected Value of Interest Exp Avg int rate Avg Debt Expected Value of Debt Expected Value of Depreciation Exp 07 Int. Ex 07 Debt Avg Value of Fixed Asset Class 08 Debt 07 07 PPE Exp Avg Useful Life of Asset Class 08 PPE Expected Value of A/R (x-expected value of A/R in 2008) 07 AR 07 Rev Rev I Ratios 2018 Other Ratios 2018 3185,568 COGS 8,332,923 Revenue Current Assets 6,926,827 1,950,91 Expected Value of Revenues : 9.296,989(x 9,724,705.15 Current Liabilities Current Ratio Working Capital 6.926,827 9.296,989 13,052,221 90,410,476,832.767 9,296,989 9.296,989 1.58 To determine whether 852,645 ficticious sales are present 0.58 Expected Value of Interest Expense 6.926,827 8,336,349 Interest Expense NP+Lines of Credit 121,283 3,999,99 187,965 2.381,596 2.381.596x 2,381,596 1822,502437,155 2,381,596 765,244.16 Average Inventory 9,695,967 Inventory Turnover 0.83 To determine Expected Value of A/R 0.03 Days in Inventory 3927 and/or underreported debt 3,435,775 3,052,221 13.052,221 x 13,052 221 41,060,641,241,025 3,052,221 3,145,873.89 . 1,950,911 1,950,911.00Accounts Receivable 3.959,32200Revnue 3,959,322 11,950,911 Average A/R A/R Turnover Days Sales Outstanding Total Liabilities Total Shareholders Equity Debt Ratio Operational Revenue Ratio 07 7.312.042 13,052,221 3194.988 13,052,221 2,545,191 13,052,221 Bulk Wine 0.560214388 0.244785006 0.195000606 56.0214388 24.47850063 19.50006056 3.02 To determine current year fake credit sales 120.92 Tasting Room 16,527,589 Grapes -3,081,824 5.36 10.507,030.00 Expected Value of Depreciation Expense 74006.8973 259,197 33,738 Average AR- Wine 69,016.00 A/R Turnover-Wine '07 12.09Monthly 2,545,191.00 2,566,759.00 Average A/R- Grapes A/R Turnover- Grapes '07 0.99Annually 2008 2007 Cash flows from operating activitles: $ 2,830,289 $1,682,760 Net income Adjustments to reconclle net Income to net cash provided by operating activities: Depreciation 29,993 9,633 Changes In operating assets and llablities: (3,090,306 (375,135) Accounts receivable-wine sales Accounts receivable-grape sales Inventories Prepaid expenses Deposits Accounts payable Accrued processing fees, affiliate Other accrued llabilities 2,566,759 1,519,134 290,878 (62,816) 2,556 23,511 (8,302) 74,519 3,964 257,521 (5,228) (52,897) (238,948) Interest payable, afilate Due to affiliate 98,960 7,865 1,637, 148 (20,958) (12480) 3,018,403 (627,545) Net cash provided by operating activities 3,927,562 Cash flows from Investing activitles: Purchase of property and equipment Cash flows from financing activities: Net proceeds (payments) on lines of credit Payments on notes payable, related party (1,400,000) 1,000,000) Proceeds from note payable, affilliate Payments on note payable, affiliate Payments on capital lease obligation 8,477,564 (400,000) (63,064) Distributions to members (12,777,563 (3,144 660) 1.627.545) (2,877) 128,089 125,212 Net cash used in financing activities Net increase (decrease) In cash Cash, beginning of year Cash, end of year 761,944 125,212 $ 887.156 CalVino Winery, LLC Statements of Members' Equity (Deficit) Years Ended December 31, 2008 and 2007 R. Teddi K. Teddi M. Teddi Total $ 1,727,563 $1,727,564 $ 1,727,563 $5,182,690 1,682,760 6,865,450 (4,259,188 4,259,188) (4,259,187) (12,777,563) Balance, December 31, 2006 Net income 560,920 560,920 560,920 2,288,483 2,288,484 2,288,483 Balance, December 31, 2007 Distributions Net income 943,430 943,429 943,430 2,830,289 Balance, December 31, 2008 (027275 (1027275 $(1,027 274 $(3,081,824 2008 2007 Cash flows from operating activitles: $ 2,830,289 $1,682,760 Net income Adjustments to reconclle net Income to net cash provided by operating activities: Depreciation 29,993 9,633 Changes In operating assets and llablities: (3,090,306 (375,135) Accounts receivable-wine sales Accounts receivable-grape sales Inventories Prepaid expenses Deposits Accounts payable Accrued processing fees, affiliate Other accrued llabilities 2,566,759 1,519,134 290,878 (62,816) 2,556 23,511 (8,302) 74,519 3,964 257,521 (5,228) (52,897) (238,948) Interest payable, afilate Due to affiliate 98,960 7,865 1,637, 148 (20,958) (12480) 3,018,403 (627,545) Net cash provided by operating activities 3,927,562 Cash flows from Investing activitles: Purchase of property and equipment Cash flows from financing activities: Net proceeds (payments) on lines of credit Payments on notes payable, related party (1,400,000) 1,000,000) Proceeds from note payable, affilliate Payments on note payable, affiliate Payments on capital lease obligation 8,477,564 (400,000) (63,064) Distributions to members (12,777,563 (3,144 660) 1.627.545) (2,877) 128,089 125,212 Net cash used in financing activities Net increase (decrease) In cash Cash, beginning of year Cash, end of year 761,944 125,212 $ 887.156 Supplementary disclosures of cash flow information: 66438188,094 188,094 Interest paid Taxes paid s13,777 13,647 Noncash Investing and financing activitles: Purchase of equipment through capital lease obligation $ 234,494 See Notes To Financial Statements. CalVino Winery, LLC Notes to Financlal Statements Note 1. Significant Accounting Policles: Basis of accounting: The financlal statements are prepared on an accrual basls, which recognizes income when eaned and expenses when incurred. Use of estimates: The preparation of financial statements in conformity with generally accepted accounting prin- ciples requires management to make estimates and assumptions that affect the reported amounts of assets and liablitles and disclosure of contingent assets and liabilities at the date of the financlal statements and the reported amounts of revenues and expenses during the reporting period Actual results could differ from those estimates Cash and cash equlvalents: For purposes of the statements of cash flows, the Company considers all short-term securities pur- chased with a maturity of three months or less to be cash equivalents. CalVino Winery, LLC Notes to Financial Statements The Company maintains cash balances with financial institutions located in California. Accounts are insured by the Federal Deposit Insurance Corporation (FDIC) up to $250,000 (FDIC insurance limits return to $100,000 on January 1, 2010). At December 31, 2008, cash on deposit was in excess of the federally-insured limits. As of December 31,2007, no cash accounts were in excess of federally-insured limits. Accounts receivable: Accounts receivables are recorded at net realizable value consisting of the carrying amount less an allowance for uncoliectible accounts, as needed. The Company uses the allowance method to account for uncollectible accounts receivable bal- ances. Under the allowance method, if needed, an estimate of uncollectible customer balances is made based upon expected actual write-offs. Factors used to establish an allowance include the credit quality of the customer and whether the balance is signlficant. Accounts are considered past due once the unpaid balance is 90 days or more outstanding, unless payment terms are extended by contract. At December 31, 2008 and 2007, management has determined that there is no allowance balance required. Inventories: Inventories consist of bulk wine (work in process), case wine (finished goods) and tasting room merchandise. Inventories are valued at lower of cost or market. Valuation is determined based on specific identification by vintage year. Inventory manufacturing costs include grapes, bulk wine and processing fees. Advertising: It is the Company's policy to expense advertising costs in the period in which they were incurred Advertising costs for the periods ending December 31, 2008 and 2007 were $32,614 and $42,051, respectively Shlpping and handling charges: The Company reports shipping and handling fees charged to customers as part of net sales and the associated expense as part of cost of sales. Presentation of sales tax: Various states and counties impose a sales tax on the Company's sales. The Company collects that sales tax from customers and remits the entire amount to the respective taxing authority. The Company's accounting policy is to exclude the tax collected and remitted from revenue and cost of sales. Sales incentives: The Company has a sales incentive program offered to wine club members, in which the wine club members receive CalVino bucks to use as a discount against future purchases. Sales incentives provided to customers are accounted for in accordance with EITF Issue No. 01-9, "Accounting for Conslderation Given by a Vendor to a Customer or Reseller of the Vendor's Products." Under these guidelines, the Company records sales incentlives as a reduction to revenues at the later of whern the related revenue is recognized or when the program is offered to the customer. Retirement plan: The Company's employees, upon satisfying certain requirements, are eligible to participate in the 401(k) profit sharing plan of Breezy, LLC, a related party. Under the plan, the Company will match 50% of the first 6% of the participating employee's contributions to the plan. The Company's match. ing contributions for the years ending December 31, 2008 and 2007 were $9,361 and $9,626, respectively Reclasslfication: Certain reclasilfications have been made to the 2007 financial statements to conform to the 2008 presentation Note 2. Inventorles Inventories consist of the following at December 31, 2008 and 2007 2008 2007 Bulk wine Case wine Tasting room merchandise $6,445,461 $8,244,032 1,591,908 22.40419,54S 8,336,349 $ 9,855,483 1,868,484 Note 3. Property and Equipment Major classes of property and equipment and accumulated depreciation at December 31, 2008 and 2007 are as follows: 2008 2007 Leasehold improvements and equipment Farming machinery and equipment Autos and trailers Barrels and winery equipment Software $ 35,85035,850 5,225 26,182 234,494 12,481 309,007 49,81 12,480 53,555 19817 $ 259,19733,738 Depreclation expense for the years ended December 31, 2008 and 2007 was $29,993 and $9,633 Less accumulated depreclation respectively Note 3. Property and Equipment Major classes of property and equipment and accumulated depreciation at December 31, 2008 and 2007 are as follows: 2008 2007 Leasehold improvements and equipment Farming machinery and equipment Autos and trailers Barrels and winery equipment Software $ 35,85035,850 5,225 26,182 234,494 12,481 309,007 49,81 12,480 53,555 19817 $ 259,19733,738 Depreclation expense for the years ended December 31, 2008 and 2007 was $29,993 and $9,633 Less accumulated depreclation respectively Note 4. Lines of Credit The Company has operating lines of credit with a local bank. Interest on the outstanding balances are at the bank's index rate less 0.50% at December 31, 2008 and 2007, for a net 2.75% and 6.75%, respectively. The lines of credit are secured by an interest in the Company's accounts receivable, inventories and personal property. During the year ended December 31, 2007, the Company had an operating line of credit that allowed for principal borrowings up to $2,000,500. The agreement expired in June 2008. The total outstanding balance as of December 31, 2007 was $70,000. During the year ended December 31 2007, the Company also had a second outstanding line of credit that allowed for borrowings up to $4,000,000, which explred In June 2008. The total outstanding balance on that line of credit as of December 31, 2007 was $911,596, including accrued interest. During the year ended December 31, 2008, the Company entered into a new revolving credit faci- ity allowing for principal borrowings up to $4,000,000 through the draw period, with quarterly inter- est only payments. The agreement expires on May 1,2013, at which point the outstanding balance must be repald in full. The total outstanding balance as of December 31, 2008 was $3,999,999 Note 5. Notes Payable, Related Party During the year ended December 31, 2007, the Company had a promissory note to one of the members of the Company. The promissory note was payable on demand and had a stated interest rate equal to the bank's rate. The outstanding balance at December 31, 2007 was $1,400,000. The note was pald in full during the year ended December 31, 2008. Interest expense to the related party totaled $27,828 and $105,758 for the years ended December 31, 2008 and 2007, respec- Note 6. Note Payable, Affiliate uring the year ended December 31, 2008, the Company entered into a promissory note for $8,477,564 with a related party, Breezy, LLC, an entity with common ownership. The p note has a stated interest rate of 4.89% with interest only payments starting on January 1, 2009 and is due on Interest expense and interest payable to the affiliate totaled $98,960 for the year ended December 31, 2008. romissory October 1, 2011. The outstanding balance at December 31, 2008 was $8,077,564. (REMAINING DETAILS OMITTED) Note 7 Capital Lease Obligations Barrels and winery equipment subject to capital lease obligations are included in property and equipment. As of December 31, 2008, the cost of the equipment and machinery was $ the related accumulated depreciation was $ Depreciation expense related to the leased equipment for the year ended December 31,2008 was $15,824 234,494, 15,824, and the net book value was $218,670. Capital lease obligations consist of the following at December 31, 2008 and 2007: 2008 2007 Wheeler Bank, N.A., 5.096% implicit rate of interest at time of signing, payable in 4 annual payments of $63,064, due September 2011 $ 171430 171,430 Less current maturities (54,328)T 117,102 S Aggregated maturities of capital lease obligations are as follows: Years ending December 31 2009 2010 2011 Total future minimum lease payments Amount representing interest Present value of future minimum lease $ 63,064 63,064 63,064 189,192 (17,762) $171,430 payments CalVino Winery, LLC Notes to Financial Statements Note 8. Related Party Transactions The Company has entered into various related party transactions throughout the December 31, 2008 and 2007. These related parties consist of the following: years ended Breezy, LLC, company under common ownership CalWine Products, Inc., company under common ownership Teddi Vineyards, Inc., company under common ownership R. Teddi, member K. Teddi, member M. Teddi, member the financial statements are as Related party transactions not specifically identified elsewhere in follows During the year ended December 31, 2008, the Company did not sell any case good or other merchandise to the related parties. During the year ended December 31,2007, the Company sold case goods and other merchandise to related parties totaling $16,177. During the years ended December 31, 2008 and 2007, the Company contracted with a related party for wine processing services as well as other additional services totaling $3,046,511 and $4,399,061, respectively. Accounts payable to the related parties as of December 31, 2008 and 2007 totaled $1,068,365 and $3,693,955, respectively CalVino Winery, LLC Notes to Financial Statements Note 8. Related Party Transactions The Company has entered into various related party transactions throughout the December 31, 2008 and 2007. These related parties consist of the following: years ended Breezy, LLC, company under common ownership CalWine Products, Inc., company under common ownership Teddi Vineyards, Inc., company under common ownership R. Teddi, member K. Teddi, member M. Teddi, member the financial statements are as Related party transactions not specifically identified elsewhere in follows During the year ended December 31, 2008, the Company did not sell any case good or other merchandise to the related parties. During the year ended December 31,2007, the Company sold case goods and other merchandise to related parties totaling $16,177. During the years ended December 31, 2008 and 2007, the Company contracted with a related party for wine processing services as well as other additional services totaling $3,046,511 and $4,399,061, respectively. Accounts payable to the related parties as of December 31, 2008 and 2007 totaled $1,068,365 and $3,693,955, respectively Accounts payable to the related parties as of December 31, 2008 and 2007 totaled $1,068,365 and $3,693,955, respectively During the year ended December 31, 2007, the Company leased the wine grape vineyards from related parties. The agreement called for minimum monthly payments of $83,559. plus equip- ment rental expenses. The amount paid to the related parties in connection with the leasing of the vineyards totaled $1,086,625 for the year ended December 31, 2007. Effective January 1, 2008, the Company ceased leasing the vineyards from the related parties. (See Note 1.) The Company entered into residential leases with the members of the Company during the year ended December 31, 2008. Rent expense related to these leases totaled $54,000 for the year ended December 31, 2008. The Company, as lessee, has operating leases on a month-to-month basis with a related party for use of the facilities, use of the related party's vehicle and the leasing of employees. Rental expense for the years ended December 31, 2008 and 2007 was as follows: 2008 2007 Facility rental Vehicle Leased employees $ 150,000 150,000 5,721 60,000 S218,400 215.721 8,400 60,000 Note 9. Concentrations Market risk: The Company's business relies heavily on the bulk wine market, j related party as discussed in Note 8. The sustainability of the Company depends significantly on the bulk wine market. ncluding transactions with a Major customers: The Company has concentrations of credit risk as a result of sales to its significant customers. Rev enues from these customers as a percentage of total revenues for the 2008 and 2007 are as follows years ended December 31 Revenue Percentage 2008 15% 2007 19% Customer 1 Accounts receivable balances as a percentage of the total accounts ers with a concentration of credit risk as of December 31, 2008 and 2007 are as follows: receivable for those custom- Accounts Receivable Percentage Customer 1 Customer 2 2008 44% 0% 2007 31% 16% Note 10. Uncertainty The-Company is subject to the Public Health Security and Bioterrorism Preparedness and Response Act of 2002 (the Bioterrorism Act). The Bioterrorism Act requires the Company to have the ability to track every product that comes in contact with the wine during any part of processing Falilure to implement effective procedures to comply with the Bioterrorism Act could the Company's ability to operate. Note 10. Uncertainty The-Company is subject to the Public Health Security and Bloterrorism Preparedness and Response Act of 2002 (the Bioterrorism Act). The Bioterrorism Act requires the Company to have the ability to track every product that comes in contact with the wine during any part of processing. Failure to implement effective procedures to comply with the Bioterrorism Act could compromise the Company's ability to operate Note 11. Commitments and Contingencles The Company has guaranteed a stand-by letter of credit for Breezy, LLC, a related party by com- mon ownership. There are no amounts drawn on this letter of credit as of December 31, 2008. Possible Understatement of Interest Expense: A-Interest Expense Declines (-23.6%) while Debt Levels Increase (400%) (see Wine-BS and Wine-US) Interest expense is likely understated given the dramatic increase of over 400% on interest-bearing debt that occurred during 2008. The 2008 debt level should warrant an increase in the interest expense, ratheir than a decline as currently reported on the 2008 comparative income statement. B- Projected Audit Value of 2008 Interest Expense (see Wine/Ratio) Based on the calculations, projected audit values of 2008 interest expense exceed the client's book value of 2008 Interest Expense by approximately $621,701, or 22% of 2008 net income. C- Recalculation of 2008 Interest Expense (see Wine/Ratio) After reviewing the footnote disclosures relating to the various debt, interest rates were applied to the related debt balances to recompute a projected audit value of 2008 interest expense, which exceeded the client's book value for 2008 interest expense by $407,220 (14% of 2008 net income). Conclusion: The preceding analysis suggests that 2008 interest expense is understated by a potentially material amount and should be further investigated with substantive testing during the year-end audit procedures. The audit program should be modified to include examination of debt agreements for the purpose of making a more refined recalculation of 2008 interest expense, which would also consider the duration of the loan balances during the 2008 period. Inventory Turnover = COGS can help determine underreported expenses and/or unreported debt when compared over time Avg. Invty N/PLines of Credit Days in Invty 365 Accounts Receivable could help determine current year fake credit sales or uncollectibility of A/R Invty Turnover A/R Turnover Sales Avg. AR Expected value of Revenues (x 08 COGS 2008 audit estimate of Revenue) 07 OCGS 07 Rev Days Sales Outstanding- 365 days AR Turnover 08 AR 07 AR 07 Rev Debt Ratio Total Shareholdres Equity Expected Value of Interest Exp Avg int rate Avg Debt Expected Value of Debt Expected Value of Depreciation Exp 07 Int. Ex 07 Debt Avg Value of Fixed Asset Class 08 Debt 07 07 PPE Exp Avg Useful Life of Asset Class 08 PPE Expected Value of A/R (x-expected value of A/R in 2008) 07 AR 07 Rev Rev I Ratios 2018 Other Ratios 2018 3185,568 COGS 8,332,923 Revenue Current Assets 6,926,827 1,950,91 Expected Value of Revenues : 9.296,989(x 9,724,705.15 Current Liabilities Current Ratio Working Capital 6.926,827 9.296,989 13,052,221 90,410,476,832.767 9,296,989 9.296,989 1.58 To determine whether 852,645 ficticious sales are present 0.58 Expected Value of Interest Expense 6.926,827 8,336,349 Interest Expense NP+Lines of Credit 121,283 3,999,99 187,965 2.381,596 2.381.596x 2,381,596 1822,502437,155 2,381,596 765,244.16 Average Inventory 9,695,967 Inventory Turnover 0.83 To determine Expected Value of A/R 0.03 Days in Inventory 3927 and/or underreported debt 3,435,775 3,052,221 13.052,221 x 13,052 221 41,060,641,241,025 3,052,221 3,145,873.89 . 1,950,911 1,950,911.00Accounts Receivable 3.959,32200Revnue 3,959,322 11,950,911 Average A/R A/R Turnover Days Sales Outstanding Total Liabilities Total Shareholders Equity Debt Ratio Operational Revenue Ratio 07 7.312.042 13,052,221 3194.988 13,052,221 2,545,191 13,052,221 Bulk Wine 0.560214388 0.244785006 0.195000606 56.0214388 24.47850063 19.50006056 3.02 To determine current year fake credit sales 120.92 Tasting Room 16,527,589 Grapes -3,081,824 5.36 10.507,030.00 Expected Value of Depreciation Expense 74006.8973 259,197 33,738 Average AR- Wine 69,016.00 A/R Turnover-Wine '07 12.09Monthly 2,545,191.00 2,566,759.00 Average A/R- Grapes A/R Turnover- Grapes '07 0.99Annually 2008 2007 Cash flows from operating activitles: $ 2,830,289 $1,682,760 Net income Adjustments to reconclle net Income to net cash provided by operating activities: Depreciation 29,993 9,633 Changes In operating assets and llablities: (3,090,306 (375,135) Accounts receivable-wine sales Accounts receivable-grape sales Inventories Prepaid expenses Deposits Accounts payable Accrued processing fees, affiliate Other accrued llabilities 2,566,759 1,519,134 290,878 (62,816) 2,556 23,511 (8,302) 74,519 3,964 257,521 (5,228) (52,897) (238,948) Interest payable, afilate Due to affiliate 98,960 7,865 1,637, 148 (20,958) (12480) 3,018,403 (627,545) Net cash provided by operating activities 3,927,562 Cash flows from Investing activitles: Purchase of property and equipment Cash flows from financing activities: Net proceeds (payments) on lines of credit Payments on notes payable, related party (1,400,000) 1,000,000) Proceeds from note payable, affilliate Payments on note payable, affiliate Payments on capital lease obligation 8,477,564 (400,000) (63,064) Distributions to members (12,777,563 (3,144 660) 1.627.545) (2,877) 128,089 125,212 Net cash used in financing activities Net increase (decrease) In cash Cash, beginning of year Cash, end of year 761,944 125,212 $ 887.156 CalVino Winery, LLC Statements of Members' Equity (Deficit) Years Ended December 31, 2008 and 2007 R. Teddi K. Teddi M. Teddi Total $ 1,727,563 $1,727,564 $ 1,727,563 $5,182,690 1,682,760 6,865,450 (4,259,188 4,259,188) (4,259,187) (12,777,563) Balance, December 31, 2006 Net income 560,920 560,920 560,920 2,288,483 2,288,484 2,288,483 Balance, December 31, 2007 Distributions Net income 943,430 943,429 943,430 2,830,289 Balance, December 31, 2008 (027275 (1027275 $(1,027 274 $(3,081,824 2008 2007 Cash flows from operating activitles: $ 2,830,289 $1,682,760 Net income Adjustments to reconclle net Income to net cash provided by operating activities: Depreciation 29,993 9,633 Changes In operating assets and llablities: (3,090,306 (375,135) Accounts receivable-wine sales Accounts receivable-grape sales Inventories Prepaid expenses Deposits Accounts payable Accrued processing fees, affiliate Other accrued llabilities 2,566,759 1,519,134 290,878 (62,816) 2,556 23,511 (8,302) 74,519 3,964 257,521 (5,228) (52,897) (238,948) Interest payable, afilate Due to affiliate 98,960 7,865 1,637, 148 (20,958) (12480) 3,018,403 (627,545) Net cash provided by operating activities 3,927,562 Cash flows from Investing activitles: Purchase of property and equipment Cash flows from financing activities: Net proceeds (payments) on lines of credit Payments on notes payable, related party (1,400,000) 1,000,000) Proceeds from note payable, affilliate Payments on note payable, affiliate Payments on capital lease obligation 8,477,564 (400,000) (63,064) Distributions to members (12,777,563 (3,144 660) 1.627.545) (2,877) 128,089 125,212 Net cash used in financing activities Net increase (decrease) In cash Cash, beginning of year Cash, end of year 761,944 125,212 $ 887.156 Supplementary disclosures of cash flow information: 66438188,094 188,094 Interest paid Taxes paid s13,777 13,647 Noncash Investing and financing activitles: Purchase of equipment through capital lease obligation $ 234,494 See Notes To Financial Statements. CalVino Winery, LLC Notes to Financlal Statements Note 1. Significant Accounting Policles: Basis of accounting: The financlal statements are prepared on an accrual basls, which recognizes income when eaned and expenses when incurred. Use of estimates: The preparation of financial statements in conformity with generally accepted accounting prin- ciples requires management to make estimates and assumptions that affect the reported amounts of assets and liablitles and disclosure of contingent assets and liabilities at the date of the financlal statements and the reported amounts of revenues and expenses during the reporting period Actual results could differ from those estimates Cash and cash equlvalents: For purposes of the statements of cash flows, the Company considers all short-term securities pur- chased with a maturity of three months or less to be cash equivalents. CalVino Winery, LLC Notes to Financial Statements The Company maintains cash balances with financial institutions located in California. Accounts are insured by the Federal Deposit Insurance Corporation (FDIC) up to $250,000 (FDIC insurance limits return to $100,000 on January 1, 2010). At December 31, 2008, cash on deposit was in excess of the federally-insured limits. As of December 31,2007, no cash accounts were in excess of federally-insured limits. Accounts receivable: Accounts receivables are recorded at net realizable value consisting of the carrying amount less an allowance for uncoliectible accounts, as needed. The Company uses the allowance method to account for uncollectible accounts receivable bal- ances. Under the allowance method, if needed, an estimate of uncollectible customer balances is made based upon expected actual write-offs. Factors used to establish an allowance include the credit quality of the customer and whether the balance is signlficant. Accounts are considered past due once the unpaid balance is 90 days or more outstanding, unless payment terms are extended by contract. At December 31, 2008 and 2007, management has determined that there is no allowance balance required. Inventories: Inventories consist of bulk wine (work in process), case wine (finished goods) and tasting room merchandise. Inventories are valued at lower of cost or market. Valuation is determined based on specific identification by vintage year. Inventory manufacturing costs include grapes, bulk wine and processing fees. Advertising: It is the Company's policy to expense advertising costs in the period in which they were incurred Advertising costs for the periods ending December 31, 2008 and 2007 were $32,614 and $42,051, respectively Shlpping and handling charges: The Company reports shipping and handling fees charged to customers as part of net sales and the associated expense as part of cost of sales. Presentation of sales tax: Various states and counties impose a sales tax on the Company's sales. The Company collects that sales tax from customers and remits the entire amount to the respective taxing authority. The Company's accounting policy is to exclude the tax collected and remitted from revenue and cost of sales. Sales incentives: The Company has a sales incentive program offered to wine club members, in which the wine club members receive CalVino bucks to use as a discount against future purchases. Sales incentives provided to customers are accounted for in accordance with EITF Issue No. 01-9, "Accounting for Conslderation Given by a Vendor to a Customer or Reseller of the Vendor's Products." Under these guidelines, the Company records sales incentlives as a reduction to revenues at the later of whern the related revenue is recognized or when the program is offered to the customer. Retirement plan: The Company's employees, upon satisfying certain requirements, are eligible to participate in the 401(k) profit sharing plan of Breezy, LLC, a related party. Under the plan, the Company will match 50% of the first 6% of the participating employee's contributions to the plan. The Company's match. ing contributions for the years ending December 31, 2008 and 2007 were $9,361 and $9,626, respectively Reclasslfication: Certain reclasilfications have been made to the 2007 financial statements to conform to the 2008 presentation Note 2. Inventorles Inventories consist of the following at December 31, 2008 and 2007 2008 2007 Bulk wine Case wine Tasting room merchandise $6,445,461 $8,244,032 1,591,908 22.40419,54S 8,336,349 $ 9,855,483 1,868,484 Note 3. Property and Equipment Major classes of property and equipment and accumulated depreciation at December 31, 2008 and 2007 are as follows: 2008 2007 Leasehold improvements and equipment Farming machinery and equipment Autos and trailers Barrels and winery equipment Software $ 35,85035,850 5,225 26,182 234,494 12,481 309,007 49,81 12,480 53,555 19817 $ 259,19733,738 Depreclation expense for the years ended December 31, 2008 and 2007 was $29,993 and $9,633 Less accumulated depreclation respectively Note 3. Property and Equipment Major classes of property and equipment and accumulated depreciation at December 31, 2008 and 2007 are as follows: 2008 2007 Leasehold improvements and equipment Farming machinery and equipment Autos and trailers Barrels and winery equipment Software $ 35,85035,850 5,225 26,182 234,494 12,481 309,007 49,81 12,480 53,555 19817 $ 259,19733,738 Depreclation expense for the years ended December 31, 2008 and 2007 was $29,993 and $9,633 Less accumulated depreclation respectively Note 4. Lines of Credit The Company has operating lines of credit with a local bank. Interest on the outstanding balances are at the bank's index rate less 0.50% at December 31, 2008 and 2007, for a net 2.75% and 6.75%, respectively. The lines of credit are secured by an interest in the Company's accounts receivable, inventories and personal property. During the year ended December 31, 2007, the Company had an operating line of credit that allowed for principal borrowings up to $2,000,500. The agreement expired in June 2008. The total outstanding balance as of December 31, 2007 was $70,000. During the year ended December 31 2007, the Company also had a second outstanding line of credit that allowed for borrowings up to $4,000,000, which explred In June 2008. The total outstanding balance on that line of credit as of December 31, 2007 was $911,596, including accrued interest. During the year ended December 31, 2008, the Company entered into a new revolving credit faci- ity allowing for principal borrowings up to $4,000,000 through the draw period, with quarterly inter- est only payments. The agreement expires on May 1,2013, at which point the outstanding balance must be repald in full. The total outstanding balance as of December 31, 2008 was $3,999,999 Note 5. Notes Payable, Related Party During the year ended December 31, 2007, the Company had a promissory note to one of the members of the Company. The promissory note was payable on demand and had a stated interest rate equal to the bank's rate. The outstanding balance at December 31, 2007 was $1,400,000. The note was pald in full during the year ended December 31, 2008. Interest expense to the related party totaled $27,828 and $105,758 for the years ended December 31, 2008 and 2007, respec- Note 6. Note Payable, Affiliate uring the year ended December 31, 2008, the Company entered into a promissory note for $8,477,564 with a related party, Breezy, LLC, an entity with common ownership. The p note has a stated interest rate of 4.89% with interest only payments starting on January 1, 2009 and is due on Interest expense and interest payable to the affiliate totaled $98,960 for the year ended December 31, 2008. romissory October 1, 2011. The outstanding balance at December 31, 2008 was $8,077,564. (REMAINING DETAILS OMITTED) Note 7 Capital Lease Obligations Barrels and winery equipment subject to capital lease obligations are included in property and equipment. As of December 31, 2008, the cost of the equipment and machinery was $ the related accumulated depreciation was $ Depreciation expense related to the leased equipment for the year ended December 31,2008 was $15,824 234,494, 15,824, and the net book value was $218,670. Capital lease obligations consist of the following at December 31, 2008 and 2007: 2008 2007 Wheeler Bank, N.A., 5.096% implicit rate of interest at time of signing, payable in 4 annual payments of $63,064, due September 2011 $ 171430 171,430 Less current maturities (54,328)T 117,102 S Aggregated maturities of capital lease obligations are as follows: Years ending December 31 2009 2010 2011 Total future minimum lease payments Amount representing interest Present value of future minimum lease $ 63,064 63,064 63,064 189,192 (17,762) $171,430 payments CalVino Winery, LLC Notes to Financial Statements Note 8. Related Party Transactions The Company has entered into various related party transactions throughout the December 31, 2008 and 2007. These related parties consist of the following: years ended Breezy, LLC, company under common ownership CalWine Products, Inc., company under common ownership Teddi Vineyards, Inc., company under common ownership R. Teddi, member K. Teddi, member M. Teddi, member the financial statements are as Related party transactions not specifically identified elsewhere in follows During the year ended December 31, 2008, the Company did not sell any case good or other merchandise to the related parties. During the year ended December 31,2007, the Company sold case goods and other merchandise to related parties totaling $16,177. During the years ended December 31, 2008 and 2007, the Company contracted with a related party for wine processing services as well as other additional services totaling $3,046,511 and $4,399,061, respectively. Accounts payable to the related parties as of December 31, 2008 and 2007 totaled $1,068,365 and $3,693,955, respectively CalVino Winery, LLC Notes to Financial Statements Note 8. Related Party Transactions The Company has entered into various related party transactions throughout the December 31, 2008 and 2007. These related parties consist of the following: years ended Breezy, LLC, company under common ownership CalWine Products, Inc., company under common ownership Teddi Vineyards, Inc., company under common ownership R. Teddi, member K. Teddi, member M. Teddi, member the financial statements are as Related party transactions not specifically identified elsewhere in follows During the year ended December 31, 2008, the Company did not sell any case good or other merchandise to the related parties. During the year ended December 31,2007, the Company sold case goods and other merchandise to related parties totaling $16,177. During the years ended December 31, 2008 and 2007, the Company contracted with a related party for wine processing services as well as other additional services totaling $3,046,511 and $4,399,061, respectively. Accounts payable to the related parties as of December 31, 2008 and 2007 totaled $1,068,365 and $3,693,955, respectively Accounts payable to the related parties as of December 31, 2008 and 2007 totaled $1,068,365 and $3,693,955, respectively During the year ended December 31, 2007, the Company leased the wine grape vineyards from related parties. The agreement called for minimum monthly payments of $83,559. plus equip- ment rental expenses. The amount paid to the related parties in connection with the leasing of the vineyards totaled $1,086,625 for the year ended December 31, 2007. Effective January 1, 2008, the Company ceased leasing the vineyards from the related parties. (See Note 1.) The Company entered into residential leases with the members of the Company during the year ended December 31, 2008. Rent expense related to these leases totaled $54,000 for the year ended December 31, 2008. The Company, as lessee, has operating leases on a month-to-month basis with a related party for use of the facilities, use of the related party's vehicle and the leasing of employees. Rental expense for the years ended December 31, 2008 and 2007 was as follows: 2008 2007 Facility rental Vehicle Leased employees $ 150,000 150,000 5,721 60,000 S218,400 215.721 8,400 60,000 Note 9. Concentrations Market risk: The Company's business relies heavily on the bulk wine market, j related party as discussed in Note 8. The sustainability of the Company depends significantly on the bulk wine market. ncluding transactions with a Major customers: The Company has concentrations of credit risk as a result of sales to its significant customers. Rev enues from these customers as a percentage of total revenues for the 2008 and 2007 are as follows years ended December 31 Revenue Percentage 2008 15% 2007 19% Customer 1 Accounts receivable balances as a percentage of the total accounts ers with a concentration of credit risk as of December 31, 2008 and 2007 are as follows: receivable for those custom- Accounts Receivable Percentage Customer 1 Customer 2 2008 44% 0% 2007 31% 16% Note 10. Uncertainty The-Company is subject to the Public Health Security and Bioterrorism Preparedness and Response Act of 2002 (the Bioterrorism Act). The Bioterrorism Act requires the Company to have the ability to track every product that comes in contact with the wine during any part of processing Falilure to implement effective procedures to comply with the Bioterrorism Act could the Company's ability to operate. Note 10. Uncertainty The-Company is subject to the Public Health Security and Bloterrorism Preparedness and Response Act of 2002 (the Bioterrorism Act). The Bioterrorism Act requires the Company to have the ability to track every product that comes in contact with the wine during any part of processing. Failure to implement effective procedures to comply with the Bioterrorism Act could compromise the Company's ability to operate Note 11. Commitments and Contingencles The Company has guaranteed a stand-by letter of credit for Breezy, LLC, a related party by com- mon ownership. There are no amounts drawn on this letter of credit as of December 31, 2008. Possible Understatement of Interest Expense: A-Interest Expense Declines (-23.6%) while Debt Levels Increase (400%) (see Wine-BS and Wine-US) Interest expense is likely understated given the dramatic increase of over 400% on interest-bearing debt that occurred during 2008. The 2008 debt level should warrant an increase in the interest expense, ratheir than a decline as currently reported on the 2008 comparative income statement. B- Projected Audit Value of 2008 Interest Expense (see Wine/Ratio) Based on the calculations, projected audit values of 2008 interest expense exceed the client's book value of 2008 Interest Expense by approximately $621,701, or 22% of 2008 net income. C- Recalculation of 2008 Interest Expense (see Wine/Ratio) After reviewing the footnote disclosures relating to the various debt, interest rates were applied to the related debt balances to recompute a projected audit value of 2008 interest expense, which exceeded the client's book value for 2008 interest expense by $407,220 (14% of 2008 net income). Conclusion: The preceding analysis suggests that 2008 interest expense is understated by a potentially material amount and should be further investigated with substantive testing during the year-end audit procedures. The audit program should be modified to include examination of debt agreements for the purpose of making a more refined recalculation of 2008 interest expense, which would also consider the duration of the loan balances during the 2008 period