Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(2] ) Distinguish between a future and an option. An investor wishes to purchase a one-year forward contract on a risk- free bond which

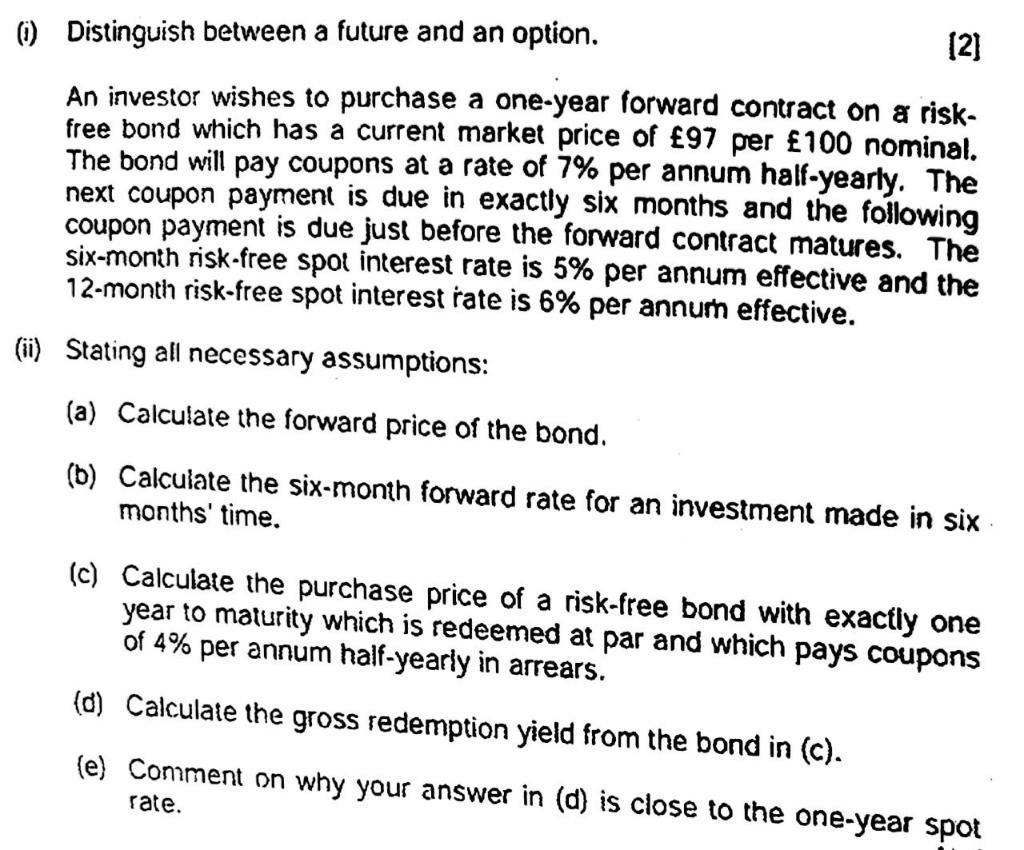

(2] ) Distinguish between a future and an option. An investor wishes to purchase a one-year forward contract on a risk- free bond which has a current market price of 97 per 100 nominal. The bond will pay coupons at a rate of 7% per annum half-yearly. The next coupon payment is due in exactly six months and the following coupon payment is due just before the forward contract matures. The six-month risk-free spot interest rate is 5% per annum effective and the 12-month risk-free spot interest rate is 6% per annum effective. (ii) Stating all necessary assumptions: (a) Calculate the forward price of the bond. (b) Calculate the six-month forward rate for an investment made in six months' time. (c) Calculate the purchase price of a risk-free bond with exactly one year to maturity which is redeemed at par and which pays coupons of 4% per annum half-yearly in arrears. (d) Calculate the gross redemption yield from the bond in (c). (e) Comment on why your answer in (d) is close to the one-year spot rate.

Step by Step Solution

★★★★★

3.45 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

i A future is a contract which obliges the parties to delivertake delivery of a particular quantity ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started