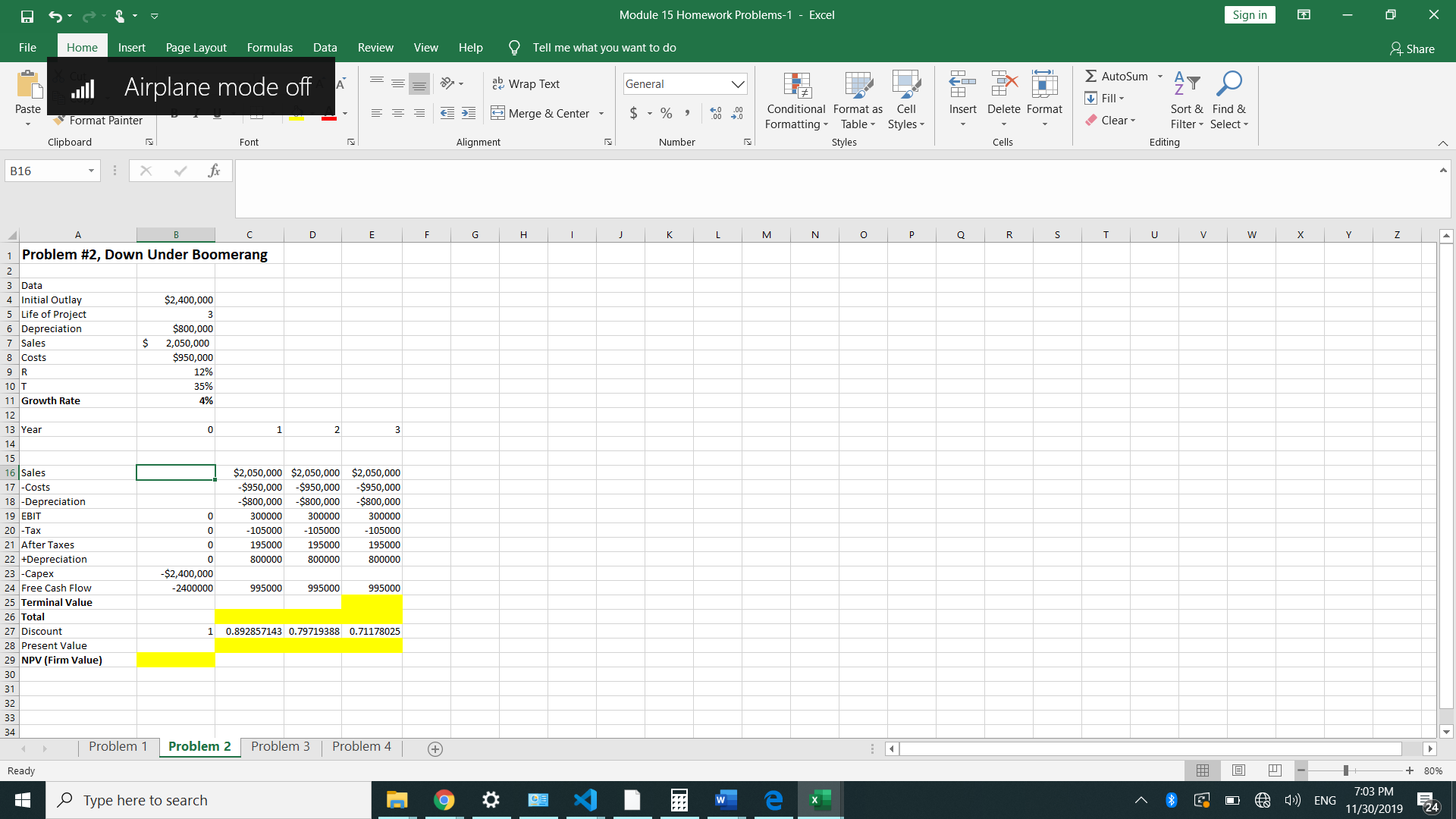

2- Down Under Boomerang, Inc. is considering a new three-year expansion project that requires an initial fixed asset investment of $2.4 million. The fixed asset will be depreciated straight-line to zero over its three-year tax life, after which it will be worthless. The project is estimated to generate $2,050,000 in annual sales, with costs of $950,000. The tax rate is 35% and the required return is 12 percent. Calculate the projects NPV and IRR. Suppose that Down Under Boomerang is projected to grow at a rate of 4% after year 3. What is the value of the firm?

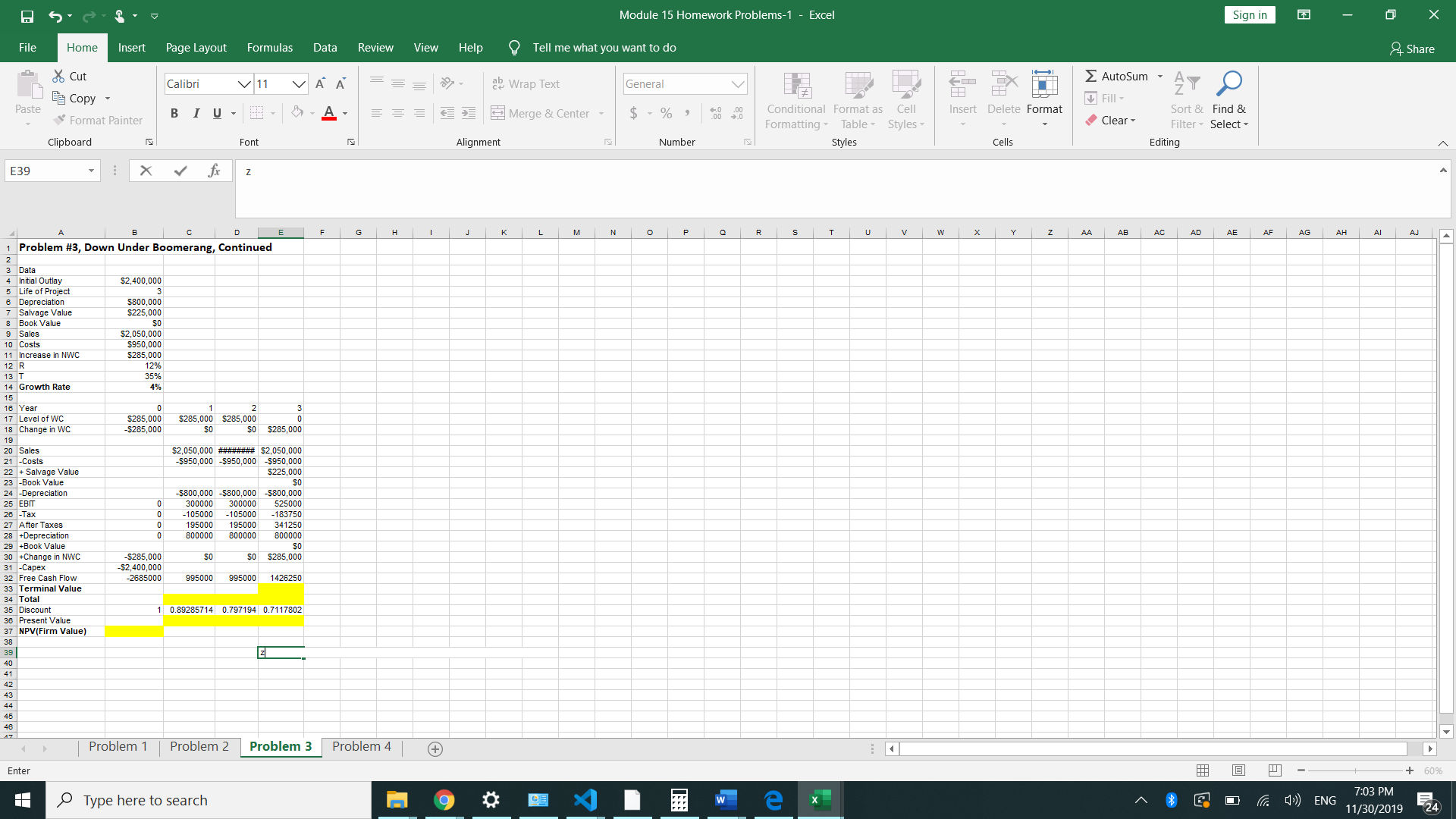

3- In problem 4, suppose the project requires an initial investment in net working capital of $285,000 and the fixed asset will have a market value of $225,000 at the end of the project. What are the new NPV and IRR?

Module 15 Homework Problems-1 - Excel Sign in X File Home Insert Page Layout Formulas Data Review View Help Tell me what you want to do Share Airplane mode off A al Wrap Text General AutoSum AY O Paste Conditional Format as Cell Insert Delete Format Fill - Sort & Find & Format Painter Merge & Center * % " 00 $.0 Formatting - Table . Styles - Clear - Filter - Select - Clipboard Font Alignment Number K Styles Cells Editing B16 X Y fix D E F G H J K L M N 0 P Q R S T U V W X Y Z Problem #2, Down Under Boomerang 3 Data 4 Initial Outlay $2,400,000 5 Life of Project 6 Depreciation $800,000 7 Sales $ 2,050,000 8 Costs $950,000 9 R 12% 10 T 35% 11 Growth Rate 4% 12 13 0 14 15 16 Sales $2,050,000 $2,050,000 $2,050,000 17 -Costs $950,000 -$950,000 -$950,000 18 -Depreciation $800,000 $800,000 -$800,000 19 EBIT 300000 300000 300000 20 -Tax 105000 -105000 -105000 21 After Taxes 195000 195000 195000 22 +Depreciation o 800000 800000 800000 23 -Capex $2,400,000 24 Free Cash Flow -2400000 995000 995000 995000 25 Terminal Value 26 Total 27 Discount 1 0.892857143 0.79719388 0.71178025 28 Present Value 29 NPV (Firm Value) 30 31 32 33 34 Problem 1 Problem 2 Problem 3 | Problem 4 | + Ready + 80% Type here to search W e X 1 8 GO ( ) ENG 7:03 PM 11/30/2019Module 15 Homework Problems-1 - Excel Sign in X File Home Insert Page Layout Formulas Data Review View Help Tell me what you want to do Share & Cut Calibri V 11 VA A al Wrap Text General AutoSum Fill - AYO Paste BE Copy - Format Painter BIU - - SA BE Merge & Center ~ % " Conditional Format as Cell Insert Delete Format Formatting ~ Table . Styles ~ Clear - Sort & Find & Filter - Select - Clipboard Font Alignment Number Styles Cells Editing E39 X fx B C D F G H K M N 0 P Q R S T U w Y Z AA AB AC AE AF AG AH AI AJ Problem #3, Down Under Boomerang, Continued 3 Data Initial Outlay $2,400,000 5 Life of Project Depreciation $800,000 7 Salvage Value $225,000 Book Value 9 Sales $2,050,000 10 Costs $950,000 11 Increase in NWC $285,000 12 R 13 T 35% 14 Growth Rate 15 16 Year 17 Level of WC $285,000 $285,000 $285,000 2 3 18 Change in WO -$285,000 50 $285,000 19 20 Sales $2,050,000 ######## $2,050,000 21 -Costs $950,000 -$950,000 -$950,000 22 + Salvage Value $225,000 23 -Book Value S 24 -Depreciation -$800,000 -$800,000 -$800,000 25 EBIT 300000 300000 525000 26 -Tax -105000 -105000 183750 27 After Taxes 195000 195000 341250 28 +Depreciation 800000 800000 800000 +Book Value SO 30 +Change in NWC $285,000 50 $285,000 31 - Capex $2,400,000 32 Free Cash Flow -2685000 995000 995000 1426250 33 Terminal Value 34 Total 35 Discount 1 0.89285714 0.797194 0.7117802 36 Present Value 37 NPV(Firm Value) 38 39 Problem 1 | Problem 2 Problem 3 Problem 4 | + Enter + 60% Type here to search W e X $ 6 0 ) ENG 7:03 PM 11/30/2019