Question

2. Download T-bill data from the Federal Reserve Bank of St. Louis (FRED) a. Use the 3-Month Treasury Bill: Secondary Market Rate as a

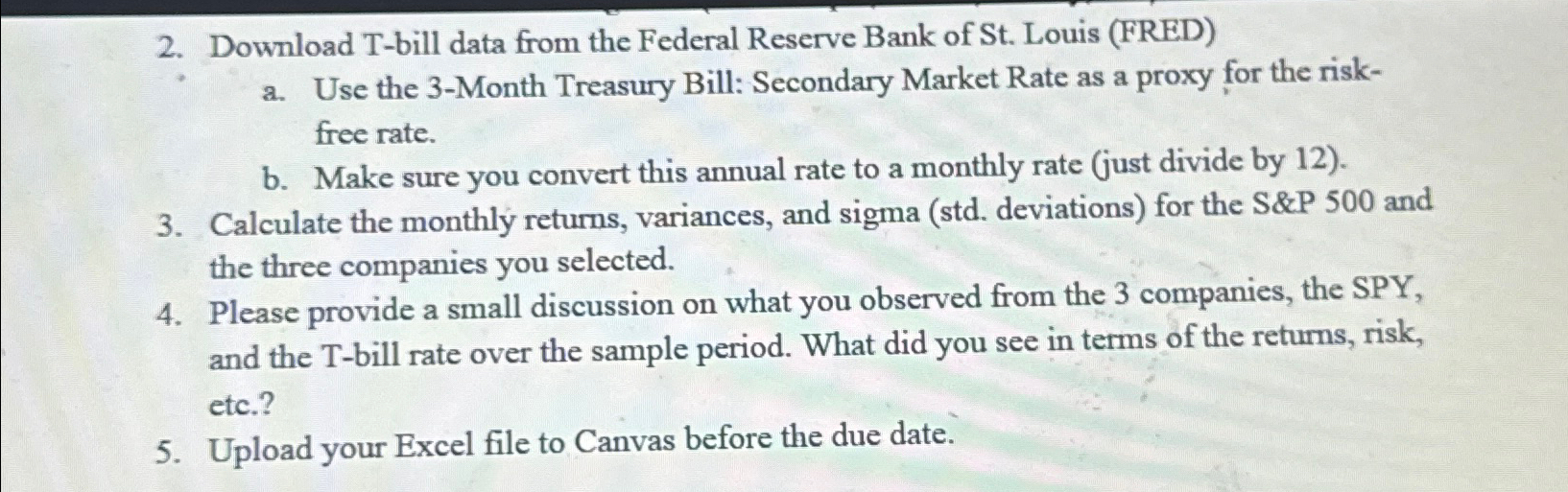

2. Download T-bill data from the Federal Reserve Bank of St. Louis (FRED) a. Use the 3-Month Treasury Bill: Secondary Market Rate as a proxy for the risk- free rate. b. Make sure you convert this annual rate to a monthly rate (just divide by 12). 3. Calculate the monthly returns, variances, and sigma (std. deviations) for the S&P 500 and the three companies you selected. 4. Please provide a small discussion on what you observed from the 3 companies, the SPY, and the T-bill rate over the sample period. What did you see in terms of the returns, risk, etc.? 5. Upload your Excel file to Canvas before the due date.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

International Finance Theory and Policy

Authors: Paul R. Krugman, Maurice Obstfeld, Marc J. Melitz

10th edition

978-0133425895, 133425894, 978-0133423631, 133423638, 978-0133423648

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App