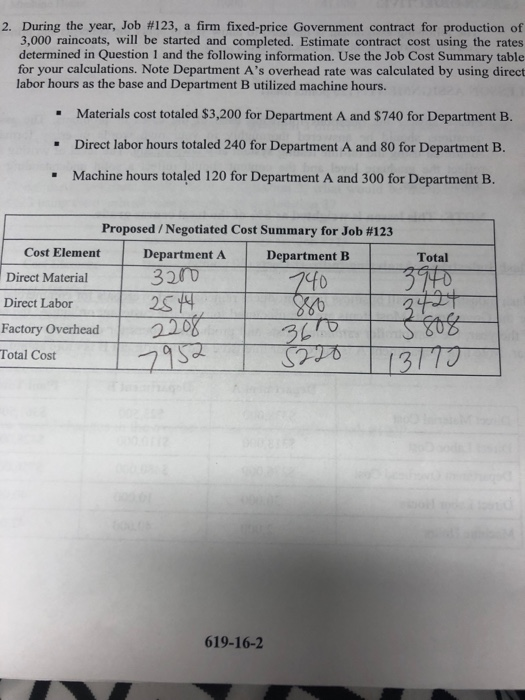

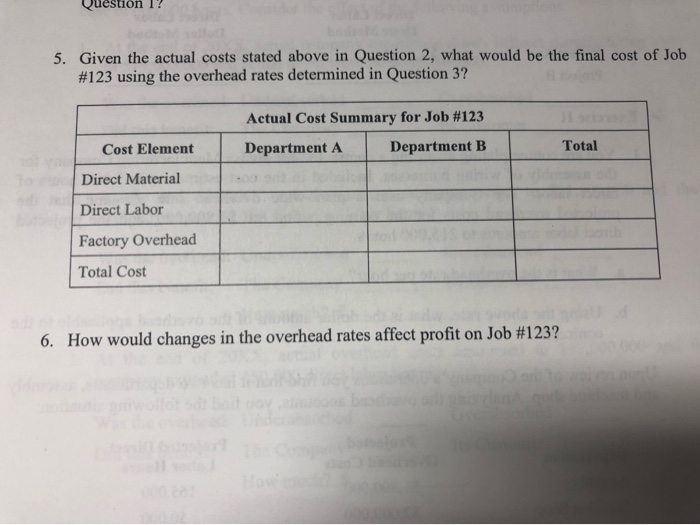

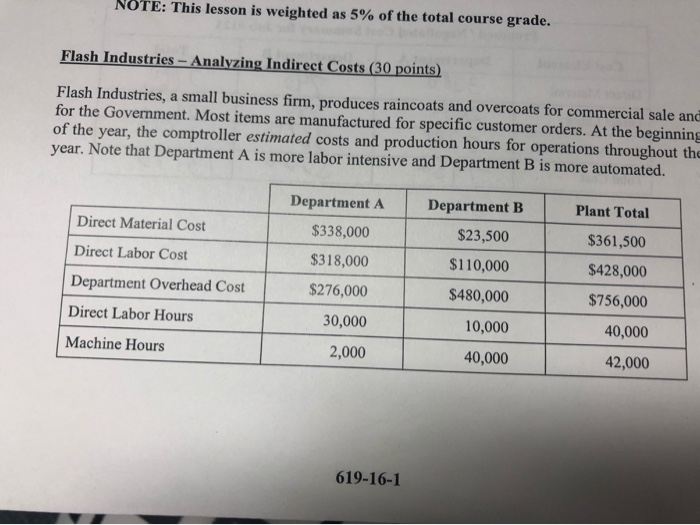

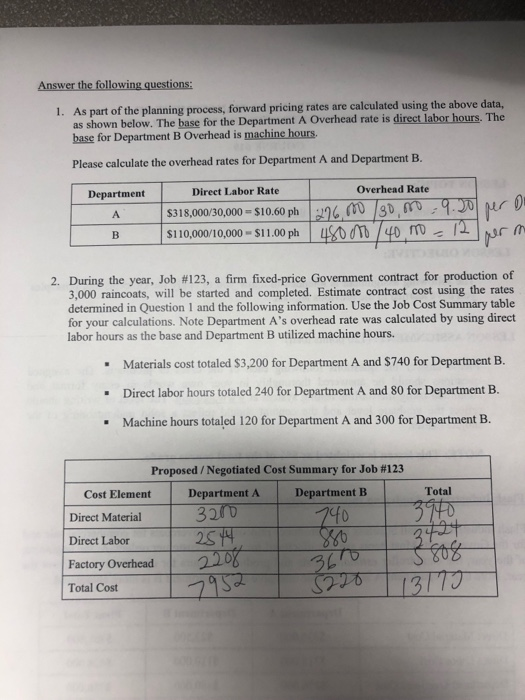

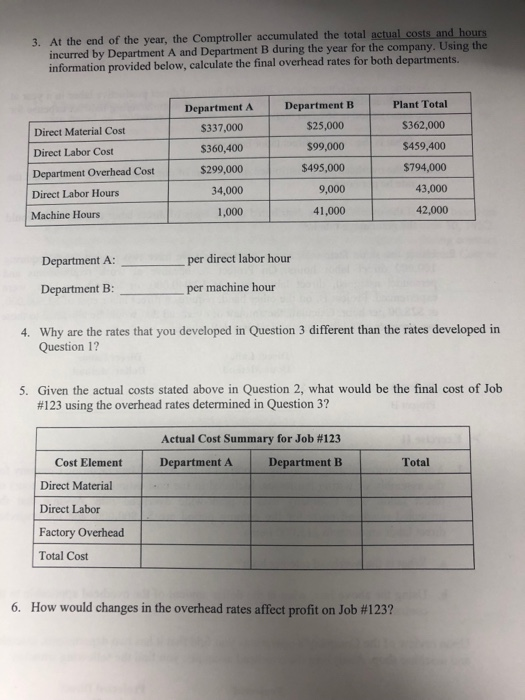

2. During the year, Job # 123, 3,000 raincoats, will be started and completed. Estimate contract cost using the rates determined in Question 1 and the following information. Use the Job Cost Summary table for your calculations. Note Department A's overhead rate was cal culated by using direct labor hours as the base and Department B utilized machine hours. a firm fixed-price Government contract for production of Materials cost totaled $3,200 for Department A and $740 for Department B. Direct labor hours totaled 240 for Department A and 80 for Department B. Machine hours totaled 120 for Department A and 300 for Department B. Proposed / Negotiated Cost Summary for Job 3 Cost Element Department A Department B Total 320 3T40 Direct Material 740 Direct Labor 220% Factory Overhead SPLO 13173 Total Cost 619-16-2 5. Given the actual costs stated above in Question 2, what would be the final cost of Job # 123 using the overhead rates determined in Question 3? Actual Cost Summary for Job #123 Department B Total Department A Cost Element Direct Material Direct Labor Factory Overhead Total Cost 6. How would changes in the overhead rates affect profit on Job #123? NOTE: This lesson is weighted as 5% of the total course grade. Flash Industries - Analyzing Indirect Costs (30 points) Flash Industries, a small business firm, produces raincoats and overcoats for commercial sale and for the Government. Most items are manufactured for specific customer orders. At the beginning of the year, the comptroller estimated costs and production hours for operations throughout the year. Note that Department A is more labor intensive and Department B is more automated. Department A Department B Plant Total Direct Material Cost $338,000 $23,500 $361,500 Direct Labor Cost $318,000 $1 10,000 $428,000 Department Overhead Cost $276,000 $480,000 $756,000 Direct Labor Hours 30,000 10,000 40,000 Machine Hours 2,000 40,000 42,000 619-16-1 Answer the following questions: 1. As part of the planning process, forward pricing rates are calculated using the above data, as shown below. The base for the Department A Overhead rate is direct labor hours. The base for Department B Overhead is machine hours. Please calculate the overhead rates for Department A and Department B. Department Direct Labor Rate Overhead Rate $318,000/30,000 $10.60 ph 3D, .30 $110,000/10,000-$11.00 ph 40/40 m12 A 2. During the year, Job # 123 , a firm fixed-price Government contract for production of 3,000 raincoats, will be started and completed. Estimate contract cost using the rates determined in Question 1 and the following information. Use the Job Cost Summary table for your calculations. Note Department A's overhead rate was calculated by using direct labor hours as the base and Department B utilized machine hours. Materials cost totaled $3,200 for Department A and $740 for Department B. Direct labor hours totaled 240 for Department A and 80 for Department B. Machine hours totaled 120 for Department A and 300 for Department B Proposed /Negotiated Cost Summary for Job # 123 Cost Element Department A Department B Total 3200 Direct Material 790 Direct Labor Factory Overhead SPIS 7152 Total Cost 13119 3. At the end of the year, the Comptroller accumulated the total actual costs and hours incurred by Department A and Department B during the year for the company. Using the information provided below, calculate the final overhead rates for both departments. Plant Total Department B Department A $25,000 $362,000 $337,000 Direct Material Cost $99,000 $459,400 $360,400 Direct Labor Cost $495,000 $794,000 $299,000 Department Overhead Cost 43,000 9,000 34,000 Direct Labor Hours 42,000 41,000 1,000 Machine Hours per direct labor hour Department A: Department B per machine hour 4. Why are the rates that you developed in Question 3 different than the rates developed in Question 1? 5. Given the actual costs stated above in Question 2, what would be the final cost of Job #123 using the overhead rates determined in Question 3? Actual Cost Summary for Job # 123 Department B Cost Element Department A Total Direct Material Direct Labor Factory Overhead Total Cost 6. How would changes in the overhead rates affect profit on Job # 123