Answered step by step

Verified Expert Solution

Question

1 Approved Answer

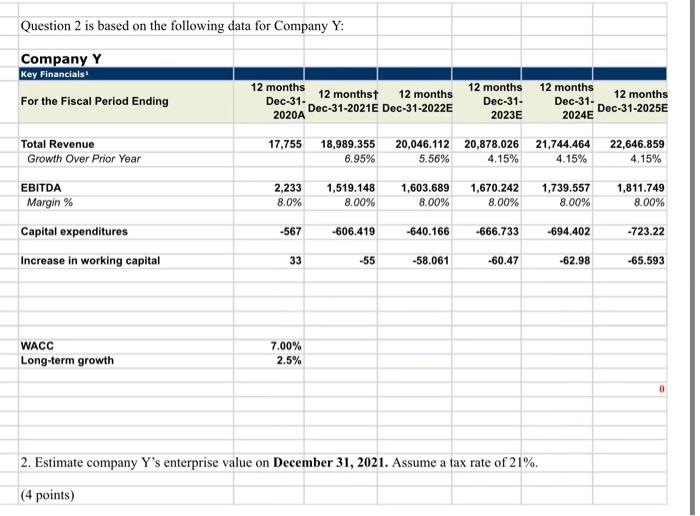

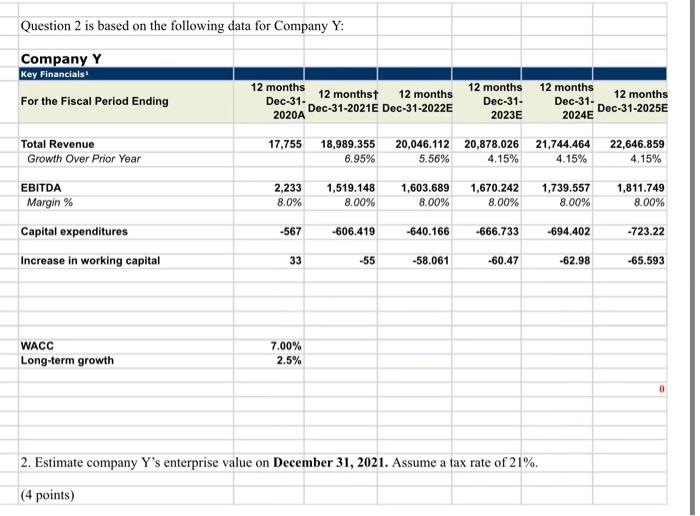

2.) Estimate company Ys enterprise value on December 31, 2021. Assume a tax rate of 21%. 6.) A.) Compute the equity value of the merged

2.) Estimate company Ys enterprise value on December 31, 2021. Assume a tax rate of 21%.

6.) A.) Compute the equity value of the merged firm and the stock price of the merged firm if the acquirer buys the target in a stock offer.

B.) What is the NPV of the deal for the target and the acquirer?

7.) A.) Assuming that the acquirer has zero cash, estimate the leverage ratio of the acquirer if it buys the target in an all cash deal. B.) Should the acquirer pay for this deal in cash? Discuss (2 paragraphs max)

8.) A.) If the acquirer decides to finance the deal only by issuing equity, what is the post-deal leverage of the acquirer? B.) What is the likely impact of this deal on the acquirer's credit rating? (discuss, 1 paragraph)

10.) A.) What is the NPV of this deal for the PE fund if the PE fund is planning to invest 5000 in cash in the deal in December 2020? (solution in red) B.) Estimate the IRR of the deal for the private equity fund for exit in December 2024 (assume debt stays constant from Dec 2020 until Dec 2024). (solution in red) C.) What are the reasons why the IRR is so much higher than the WACC of 10.3%?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started