Answered step by step

Verified Expert Solution

Question

1 Approved Answer

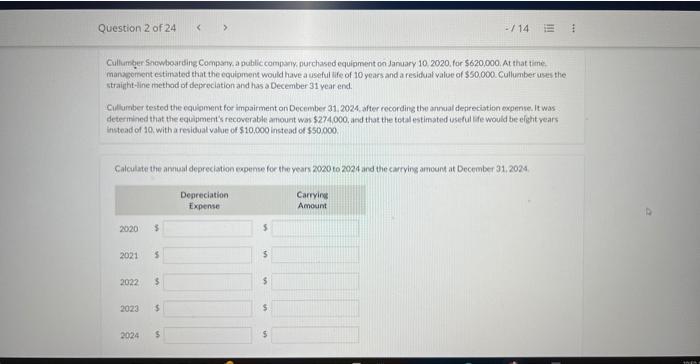

2 f Cullumber Snowhoarding Compsty, a public compayy, nurchased equipment on January 10,2020, for $620,000, At that time. manywerrentestimated that the equipment would have a

2 f

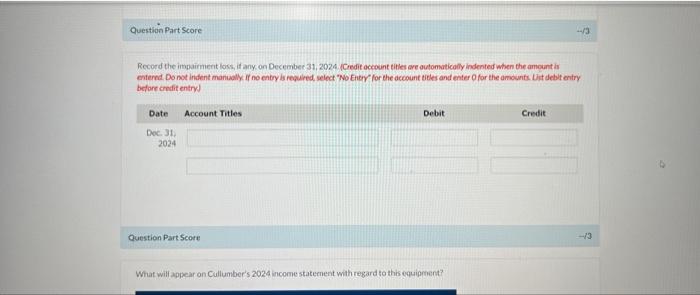

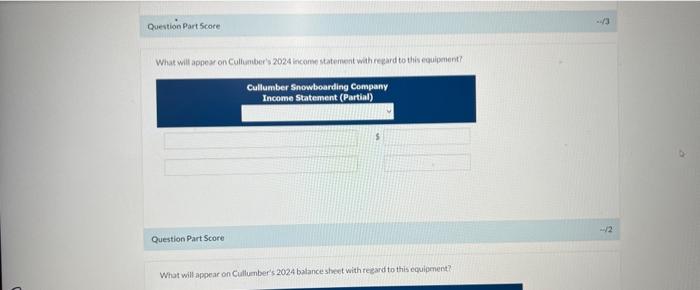

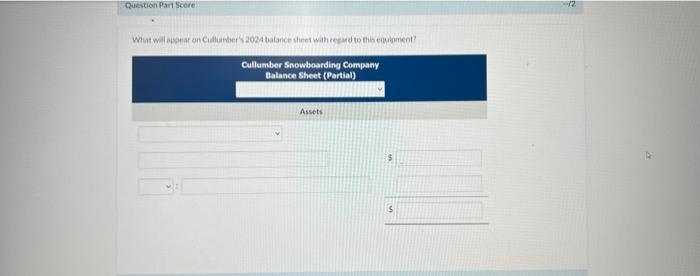

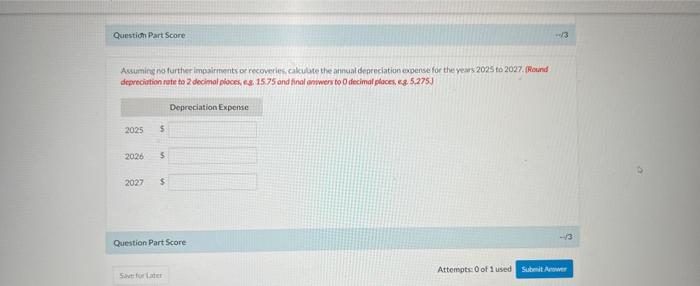

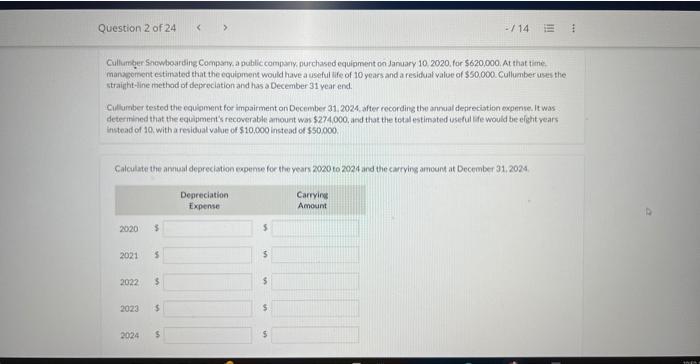

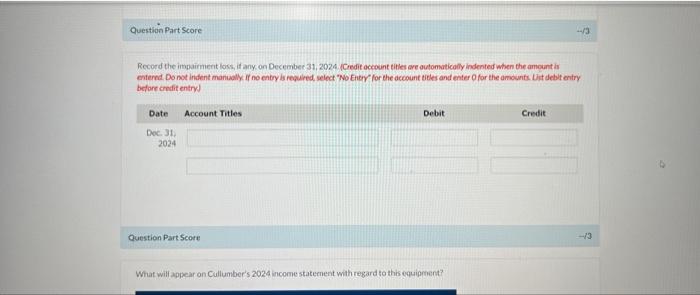

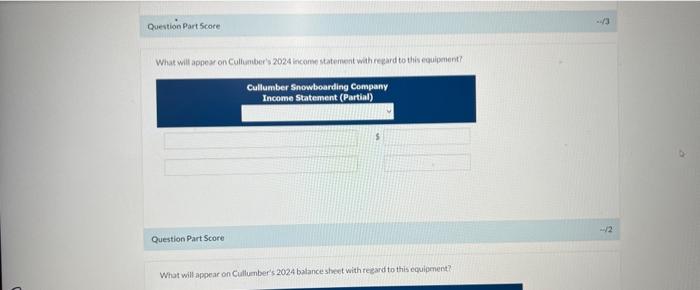

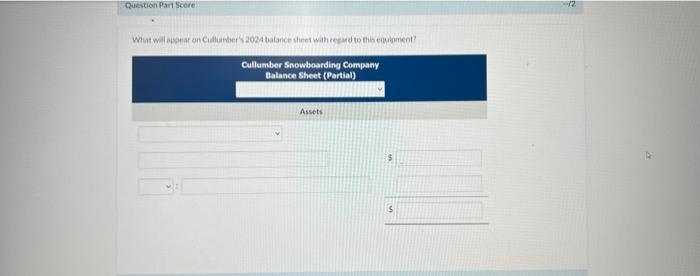

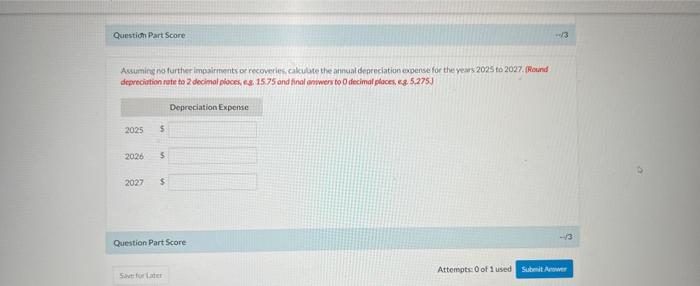

Cullumber Snowhoarding Compsty, a public compayy, nurchased equipment on January 10,2020, for $620,000, At that time. manywerrentestimated that the equipment would have a useful life of 10 years and a residual value of 550.000. Cullumber uses the straitht -line method of depreciation and has a December 31 year end. Cillumber teited the equiament for impairment on December 31. 2024 , after recording the annual depreciatibn woente. It was determined that the equipment's recoverable amourt was $274,000, and that the total estimated useful lefe would be eight years instead of 10 . with a reriduat value of $10,000 instead of $50.000. Calculate the armual depreciation expense for the years 2020 to 2024 and the carrying amount at December 31,2024 . Record the intagaimient loss, if any. on Decembec 31, 2024. Credit occount tites are outomatically indented when the amount in enternd. Do not inident manually. If no entry is required select "No Entey for the decount tides and enter O for the amounts. Dit deblt entry before crefit eniryd Question Part Scote What will appear on Cullumber's 2024 income staternent withregard to this equipetent? What will appey on Cullimber's 2024 income Matement with feieard to this equiperent? Question Part Score What will appear on Cullumber's 2024 balance slucet with te ard to this equipment? Cullumber Snowbearding Company Balance sheet (Partial) Assets 35 Assumine na furtiver impairments or recoveries, cakculate the annsual depreciation expensefor the years 2025 to 2027 . Pound depreciution rate to 2 decimal pioces, es, 15.75 and final antwers to 0 decimal ploces, es. 5,275 . Cullumber Snowhoarding Compsty, a public compayy, nurchased equipment on January 10,2020, for $620,000, At that time. manywerrentestimated that the equipment would have a useful life of 10 years and a residual value of 550.000. Cullumber uses the straitht -line method of depreciation and has a December 31 year end. Cillumber teited the equiament for impairment on December 31. 2024 , after recording the annual depreciatibn woente. It was determined that the equipment's recoverable amourt was $274,000, and that the total estimated useful lefe would be eight years instead of 10 . with a reriduat value of $10,000 instead of $50.000. Calculate the armual depreciation expense for the years 2020 to 2024 and the carrying amount at December 31,2024 . Record the intagaimient loss, if any. on Decembec 31, 2024. Credit occount tites are outomatically indented when the amount in enternd. Do not inident manually. If no entry is required select "No Entey for the decount tides and enter O for the amounts. Dit deblt entry before crefit eniryd Question Part Scote What will appear on Cullumber's 2024 income staternent withregard to this equipetent? What will appey on Cullimber's 2024 income Matement with feieard to this equiperent? Question Part Score What will appear on Cullumber's 2024 balance slucet with te ard to this equipment? Cullumber Snowbearding Company Balance sheet (Partial) Assets 35 Assumine na furtiver impairments or recoveries, cakculate the annsual depreciation expensefor the years 2025 to 2027 . Pound depreciution rate to 2 decimal pioces, es, 15.75 and final antwers to 0 decimal ploces, es. 5,275

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started