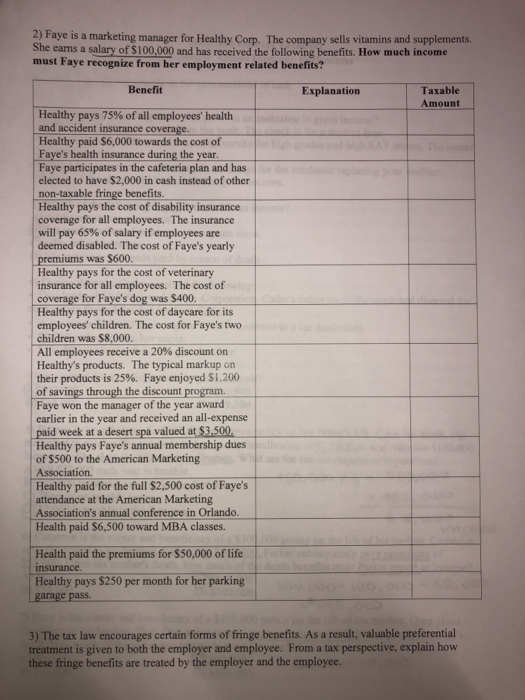

2) Faye is a marketing manager for Healthy Corp. The company sells vitamins and supplements. She earns a salary of $100,000 and has received the following benefits. How much income must Faye recognize from her employment related benefits? Benefit ble Explanation Amount Healthy pays 75 % of all employees' health and accident insurance coverage. Healthy paid $6,000 towards the cost of Faye's health insurance during the year. Faye participates in the cafeteria plan and has elected to have $2,000 in cash instead of other non-taxable fringe benefits. Healthy pays the cost of disability insurance coverage for all employees. The insurance will pay 65 % of salary if employees are deemed disabled. The cost of Faye's yearly premiums was $600. Healthy pays for the cost of veterinary insurance for all employees. The cost of coverage for Faye's dog was $400. Healthy pays for the cost of daycare for its employees' children. The cost for Faye's two children was $8,000. All employees receive a 20 % discount on Healthy's products. The typical markup on their products is 25 %. Faye enjoyed $i,200 of savings through the discount program. Faye won the manager of the year award earlier in the year and received an all-expense paid week at a desert spa valued at $3,500, Healthy pays Faye's annual membership dues of $500 to the American Marketing Association. Healthy paid for the full $2,500 cost of Faye's attendance at the American Marketing Association's annual conference in Orlando. Health paid $6,500 toward MBA classes. Health paid the premiums for $50,000 of life insurance. Healthy pays $250 per month for her parking garage pass. 3) The tax law encourages certain forms of fringe benefits. As a result, valuable preferential treatment is given to both the employer and employee. From a tax perspective, explain how these fringe benefits are treated by the employer and the employee. 2) Faye is a marketing manager for Healthy Corp. The company sells vitamins and supplements. She earns a salary of $100,000 and has received the following benefits. How much income must Faye recognize from her employment related benefits? Benefit ble Explanation Amount Healthy pays 75 % of all employees' health and accident insurance coverage. Healthy paid $6,000 towards the cost of Faye's health insurance during the year. Faye participates in the cafeteria plan and has elected to have $2,000 in cash instead of other non-taxable fringe benefits. Healthy pays the cost of disability insurance coverage for all employees. The insurance will pay 65 % of salary if employees are deemed disabled. The cost of Faye's yearly premiums was $600. Healthy pays for the cost of veterinary insurance for all employees. The cost of coverage for Faye's dog was $400. Healthy pays for the cost of daycare for its employees' children. The cost for Faye's two children was $8,000. All employees receive a 20 % discount on Healthy's products. The typical markup on their products is 25 %. Faye enjoyed $i,200 of savings through the discount program. Faye won the manager of the year award earlier in the year and received an all-expense paid week at a desert spa valued at $3,500, Healthy pays Faye's annual membership dues of $500 to the American Marketing Association. Healthy paid for the full $2,500 cost of Faye's attendance at the American Marketing Association's annual conference in Orlando. Health paid $6,500 toward MBA classes. Health paid the premiums for $50,000 of life insurance. Healthy pays $250 per month for her parking garage pass. 3) The tax law encourages certain forms of fringe benefits. As a result, valuable preferential treatment is given to both the employer and employee. From a tax perspective, explain how these fringe benefits are treated by the employer and the employee