Answered step by step

Verified Expert Solution

Question

1 Approved Answer

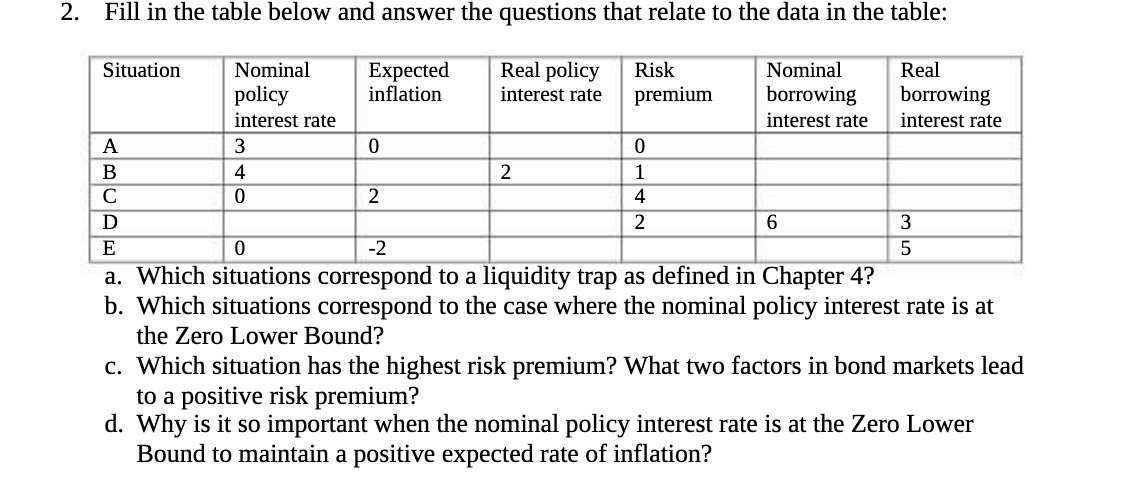

2. Fill in the table below and answer the questions that relate to the data in the table: Expected inflation Nominal borrowing Real borrowing

2. Fill in the table below and answer the questions that relate to the data in the table: Expected inflation Nominal borrowing Real borrowing interest rate interest rate Situation ABCDE Nominal policy interest rate 3 4 0 0 2 Real policy interest rate 2 Risk premium 0 1 4 2 6 3 5 0 -2 a. Which situations correspond to a liquidity trap as defined in Chapter 4? b. Which situations correspond to the case where the nominal policy interest rate is at the Zero Lower Bound? c. Which situation has the highest risk premium? What two factors in bond markets lead to a positive risk premium? d. Why is it so important when the nominal policy interest rate is at the Zero Lower Bound to maintain a positive expected rate of inflation?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a b Situation C and Situation E corresponds to the case where nominal policy interest rate is at zer...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started