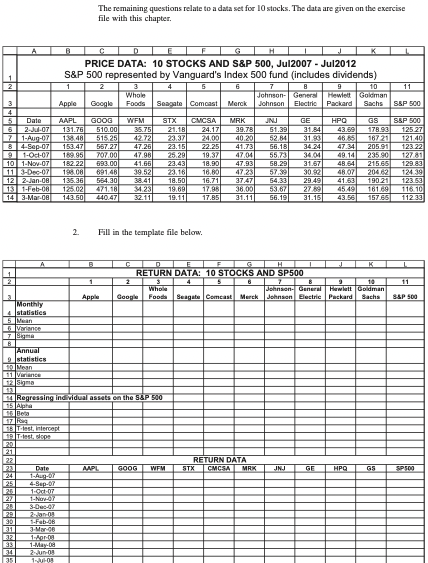

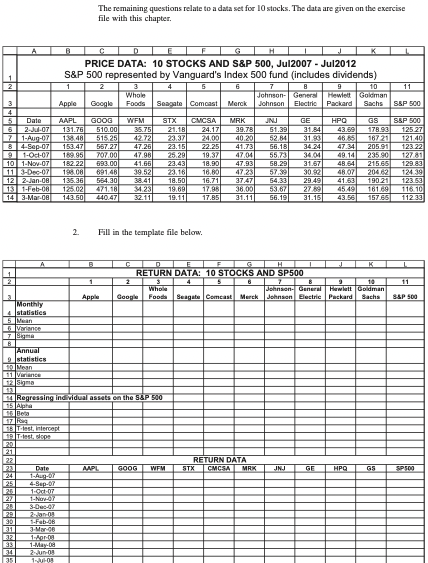

2. Fill in the template file below.

2. Fill in the template file below.

The remaining questions relate to a data set for 10 stocks. The data are given on the exercise file with this chapter. D PRICE DATA: 10 STOCKS AND S&P 500, Jul2007 - Jul2012 1 S&P 500 represented by Vanguard's Index 500 fund (includes dividends) 2 2 4 6 8 9 10 11 Whole Johnson General Hewlett Goldman 3 Apple Google Foods Seagate Comcast Merck Johnson Electric Packard Sachs SSP 500 4 5 Data AAPL GOOG WEM STX CMCSA MRK JNU GE GS SSP 500 6 2-JOY 131.76 510.00 35.751 21.18 24.17 39.781 51.39 31.84 43 178.93 125 27 21-Aug-07 138.48 515.25 42.721 23.37 24,00 40 201 52.84 3193 48 16721 121.40 8 Sep-07 153.47 567.27 47.26 23.15 22.25 41.73 56.18 34.24 47.34 20591 12322 91-OC-07 189.96 707.00 47.98 25,20 19.37 47.04 55.73 3441 49.14 23590 10 1-Nov.07 182.22 127 81 593.00 41.66 23.43 18.30 47.93 58.29 31.67 4. 215 129.83 11 3-Dec-07 19808 691.48 30.52 23.16 18.80 4723 57.39 30.82 48 07 2042 12 2-Jan-08 12439 135.36 56430 38.41 18.50 16.71 37.47 54.33 29.49 41.63 190.21 123.53 131-Feb-08 125.02 471.18 31231 19.69 17.95 36.001 53.67 27691 45491 16160 11610 143-Mar-08 143.50 440.47 32.111 19.11 17.85 31.11 56.19 31.151 157.65 112 33 2. Fill in the template file below. A B 1 0 H RETURN DATA: 10 STOCKS AND SP500 10 Whois Johnson General Hewlett Goldman Google Food Seagate Comcast Merck Johnson Electric Packard Sachs 11 Apple S&P 500 2 Monthly 4 statistics 5 Mean B Annual statistics Mean Trance Sigma 12 14 Regressing individual assets on the S&P 500 5A 16 Beta 17 15 Test, intercept 19Test, dlope 20 21 41 22 22 23 Date AUAPL GOOG WEM RETURN DATA STX CMCSA MRK JN. HPO SP500 4-Sep-OT 1.06.07 1-N- 3-Dec- 25 25 27 20 20 301 31 32 1-Feb-08 J.M. LADO 34 35 1-May-08 2. Jun 09 109 The remaining questions relate to a data set for 10 stocks. The data are given on the exercise file with this chapter. D PRICE DATA: 10 STOCKS AND S&P 500, Jul2007 - Jul2012 1 S&P 500 represented by Vanguard's Index 500 fund (includes dividends) 2 2 4 6 8 9 10 11 Whole Johnson General Hewlett Goldman 3 Apple Google Foods Seagate Comcast Merck Johnson Electric Packard Sachs SSP 500 4 5 Data AAPL GOOG WEM STX CMCSA MRK JNU GE GS SSP 500 6 2-JOY 131.76 510.00 35.751 21.18 24.17 39.781 51.39 31.84 43 178.93 125 27 21-Aug-07 138.48 515.25 42.721 23.37 24,00 40 201 52.84 3193 48 16721 121.40 8 Sep-07 153.47 567.27 47.26 23.15 22.25 41.73 56.18 34.24 47.34 20591 12322 91-OC-07 189.96 707.00 47.98 25,20 19.37 47.04 55.73 3441 49.14 23590 10 1-Nov.07 182.22 127 81 593.00 41.66 23.43 18.30 47.93 58.29 31.67 4. 215 129.83 11 3-Dec-07 19808 691.48 30.52 23.16 18.80 4723 57.39 30.82 48 07 2042 12 2-Jan-08 12439 135.36 56430 38.41 18.50 16.71 37.47 54.33 29.49 41.63 190.21 123.53 131-Feb-08 125.02 471.18 31231 19.69 17.95 36.001 53.67 27691 45491 16160 11610 143-Mar-08 143.50 440.47 32.111 19.11 17.85 31.11 56.19 31.151 157.65 112 33 2. Fill in the template file below. A B 1 0 H RETURN DATA: 10 STOCKS AND SP500 10 Whois Johnson General Hewlett Goldman Google Food Seagate Comcast Merck Johnson Electric Packard Sachs 11 Apple S&P 500 2 Monthly 4 statistics 5 Mean B Annual statistics Mean Trance Sigma 12 14 Regressing individual assets on the S&P 500 5A 16 Beta 17 15 Test, intercept 19Test, dlope 20 21 41 22 22 23 Date AUAPL GOOG WEM RETURN DATA STX CMCSA MRK JN. HPO SP500 4-Sep-OT 1.06.07 1-N- 3-Dec- 25 25 27 20 20 301 31 32 1-Feb-08 J.M. LADO 34 35 1-May-08 2. Jun 09 109

2. Fill in the template file below.

2. Fill in the template file below.