Answered step by step

Verified Expert Solution

Question

1 Approved Answer

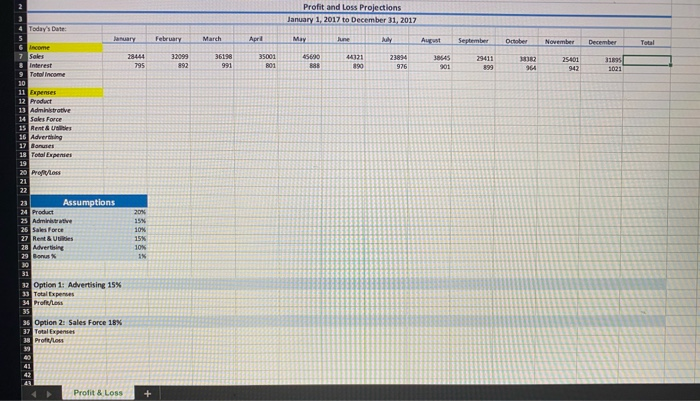

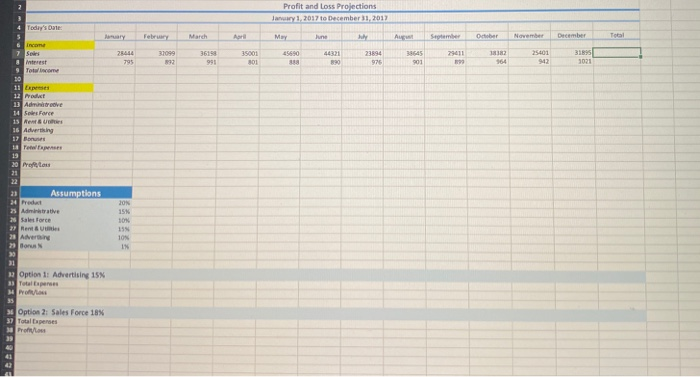

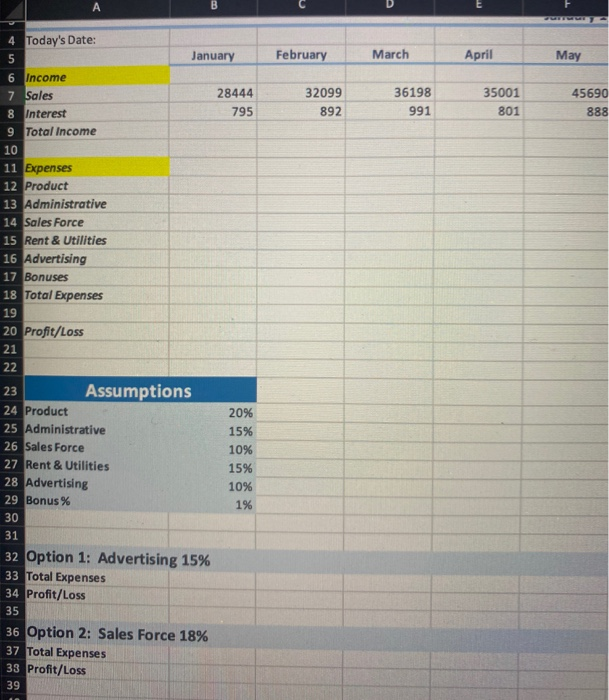

2. Fill the Total Income, Total Expenses, and Profit/Loss rows with Yellow (through column N). 3. Under Income, indent the two income categories two spaces

2. Fill the Total Income, Total Expenses, and Profit/Loss rows with Yellow (through column N).

3. Under Income, indent the two income categories two spaces (Sales and Interest). Under Expenses, indent the six expense categories two spaces.

4. Under Assumptions, insert a blank row above Bonus % and type in Target for Bonus, then next to it in B29 type in $35,000.

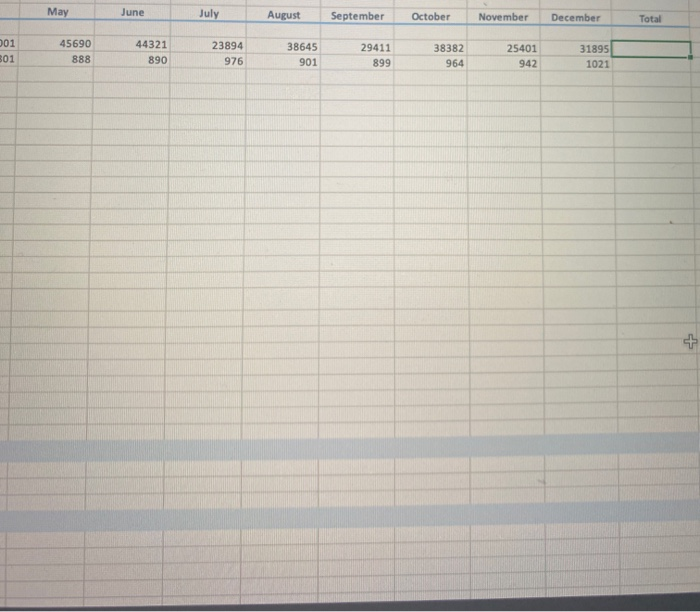

5. Using a function, calculate the Total Sales and Total Interest for the year.

6. Using a formula, calculate the Total Income for January (Sales plus Interest), and copy this across for the remaining months and year total.

7. Calculate the projected expenses (rows 12 through 16 excluding Bonuses) which are based upon the percentages under the assumptions as a portion of the Sales amount which appears under Income. Starting with the Product expenses for January, you will multiply the Sales for January by the Product % under assumptions. You will then copy this formula across for the additional months. Lesson 3, P a g e | 2 (In the original formula, you will need to use absolute and relative referencing. Note: If any of these values are $0, then you didnt use the absolute referencing correctly.)

8. Continue calculating the projected expenses for the remaining expense categories, excluding Bonuses (Administrative through Advertising). As above, you will calculate the amount for January, then copy across to the other months.

9. To calculate the Bonuses for January (row 17), you will use the IF function to compare the January Sales (B7) to the Target for Bonus amount (B29) under Assumptions. If the January Sales meets or exceeds the Target, then they will get a % of the sales as indicated under Assumptions (multiply the % for Bonuses (B30) by the Sales (B7)). If they dont meet the sales amount, then they get $0. Use Absolute and Relative Referencing. Note: It is possible for some of these results to be $0.

10. Copy the Bonuses formula across for the remaining months.

11. Use a function to calculate the total for each of the expense categories (column N) (sum up each row).

12. Use a function to calculate the Total Expenses for January, and copy this across for the additional months and the total for the year.

13. Calculate Profit/Loss row for the months and year by subtracting Total Expenses from Total Income.

14. Format numbers using Accounting Style for the top rows of each of the Income, Expenses, and the Total rows for each in addition to Profit/Loss rows (7, 9, 12, 18, & 20). Format remaining Income and Expense values to Comma Style.

15. Perform What-If Analysis by changing the Advertising % under Assumptions from 10% to 15%. Copy the new Total Expenses and Profit/Loss rows and paste them under the Option1 Heading (rows 34 and 35). Note: You need to Paste Special and use Values and Number formats.

16. Change the Advertising % under assumptions back to 10%. (Be sure the values under Option 1 do not change).

17. Perform What-If Analysis again, this time by changing the Sales Force % under Assumptions (B26) from 10% to 18%. Copy the Total Expenses and Profit/Loss rows and paste them under the Option 2 Heading (rows 38 & 39). See note in step 15

18. Change the Sales Force back to 10%

19. Use a function in cell B4 to display the current date. (you may need to format so that only the date appears)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started