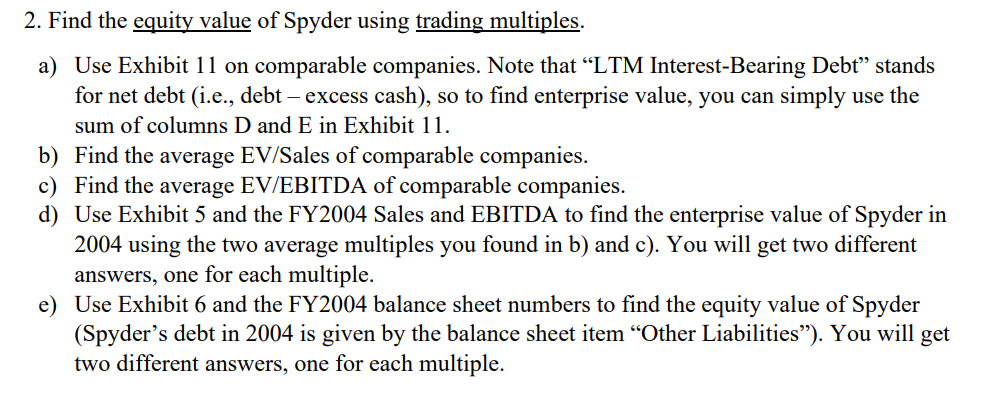

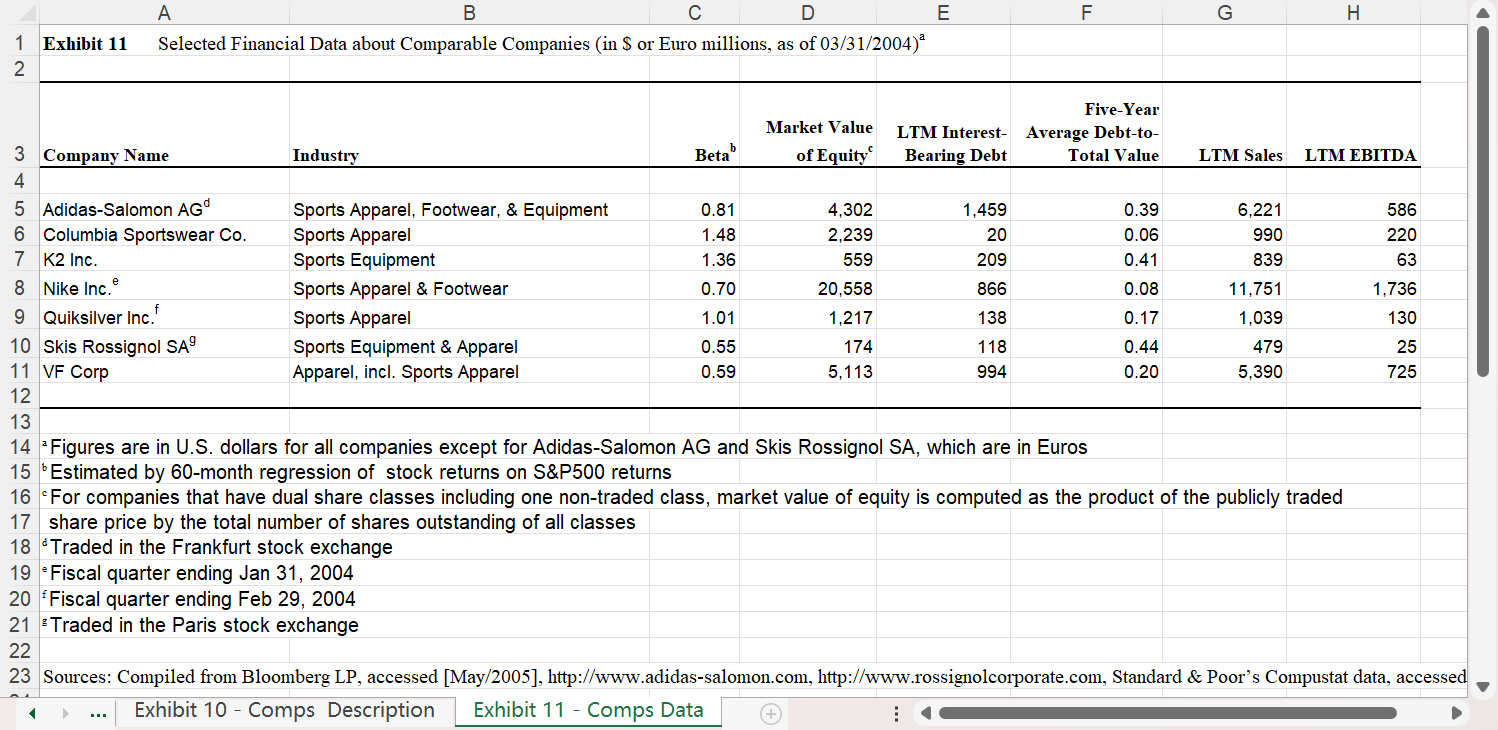

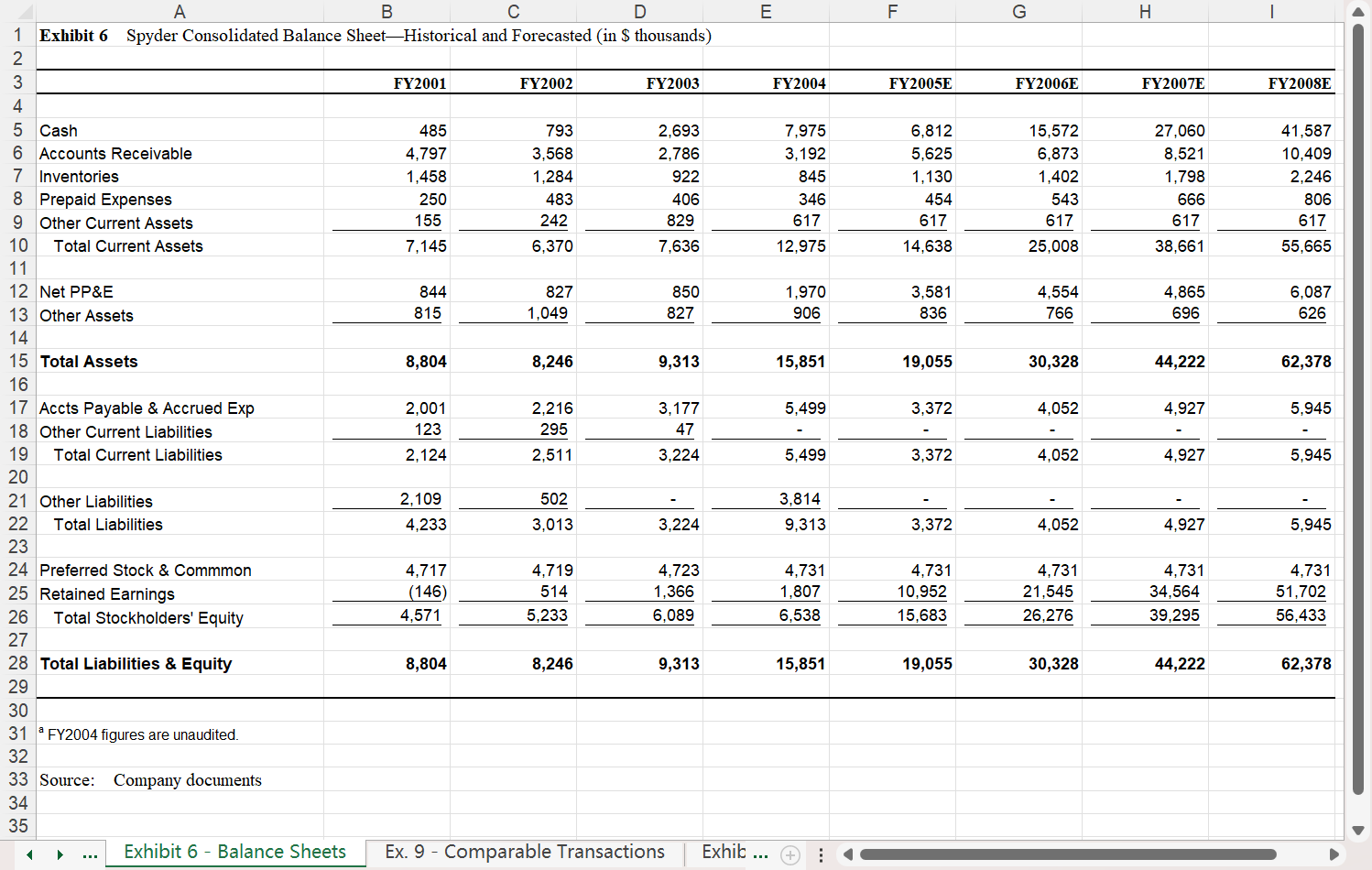

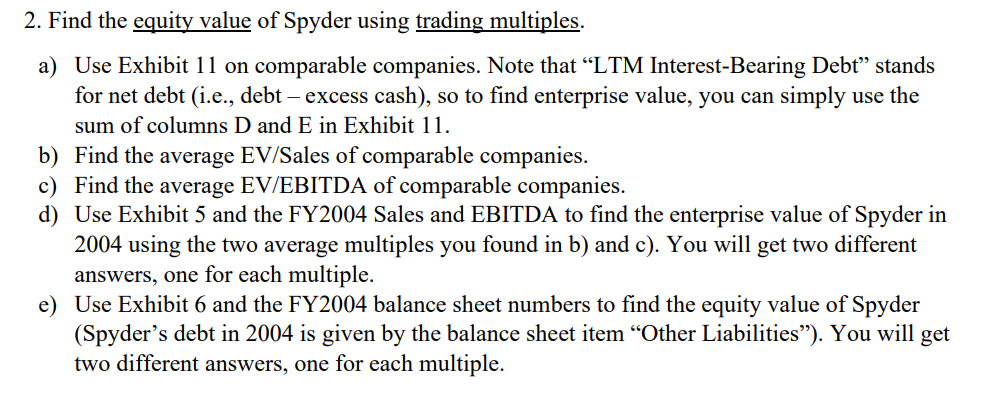

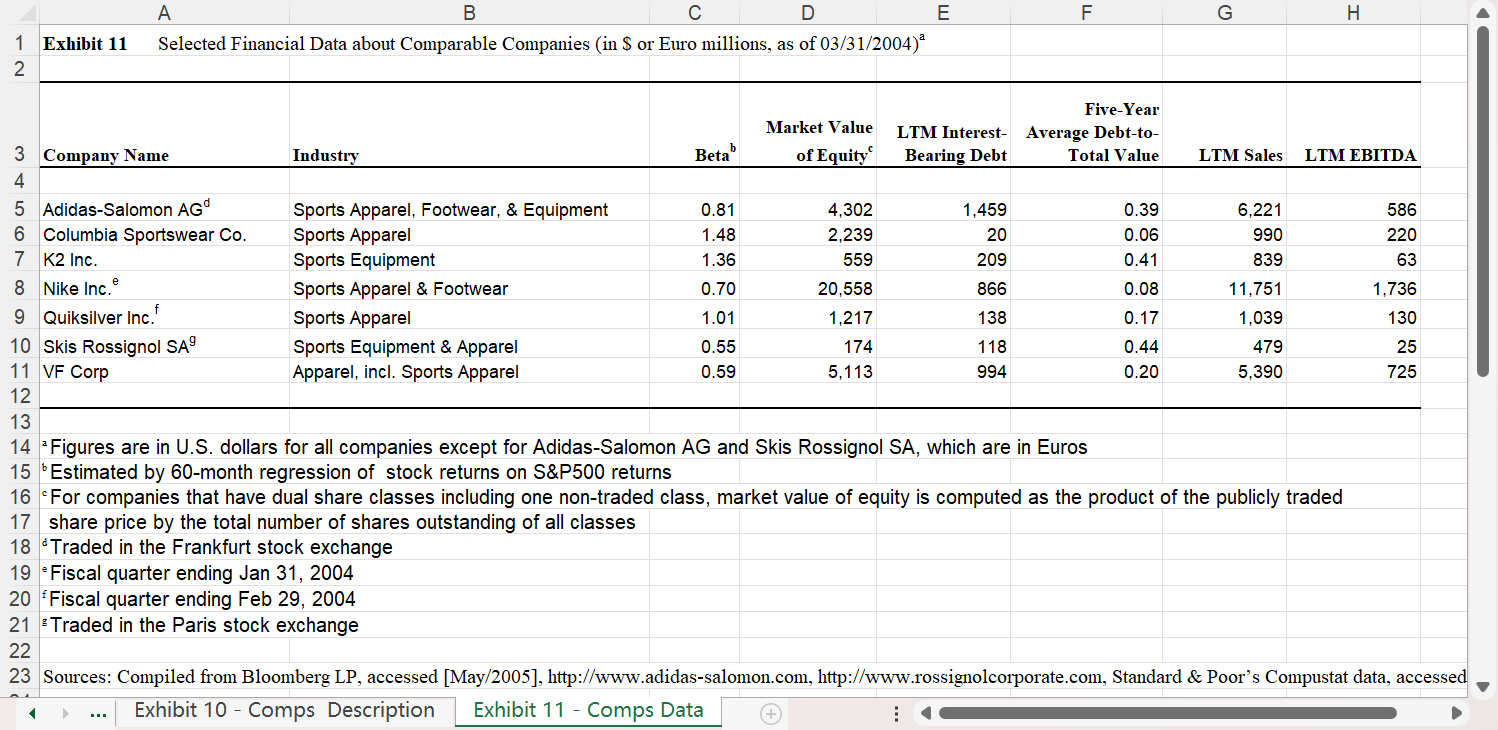

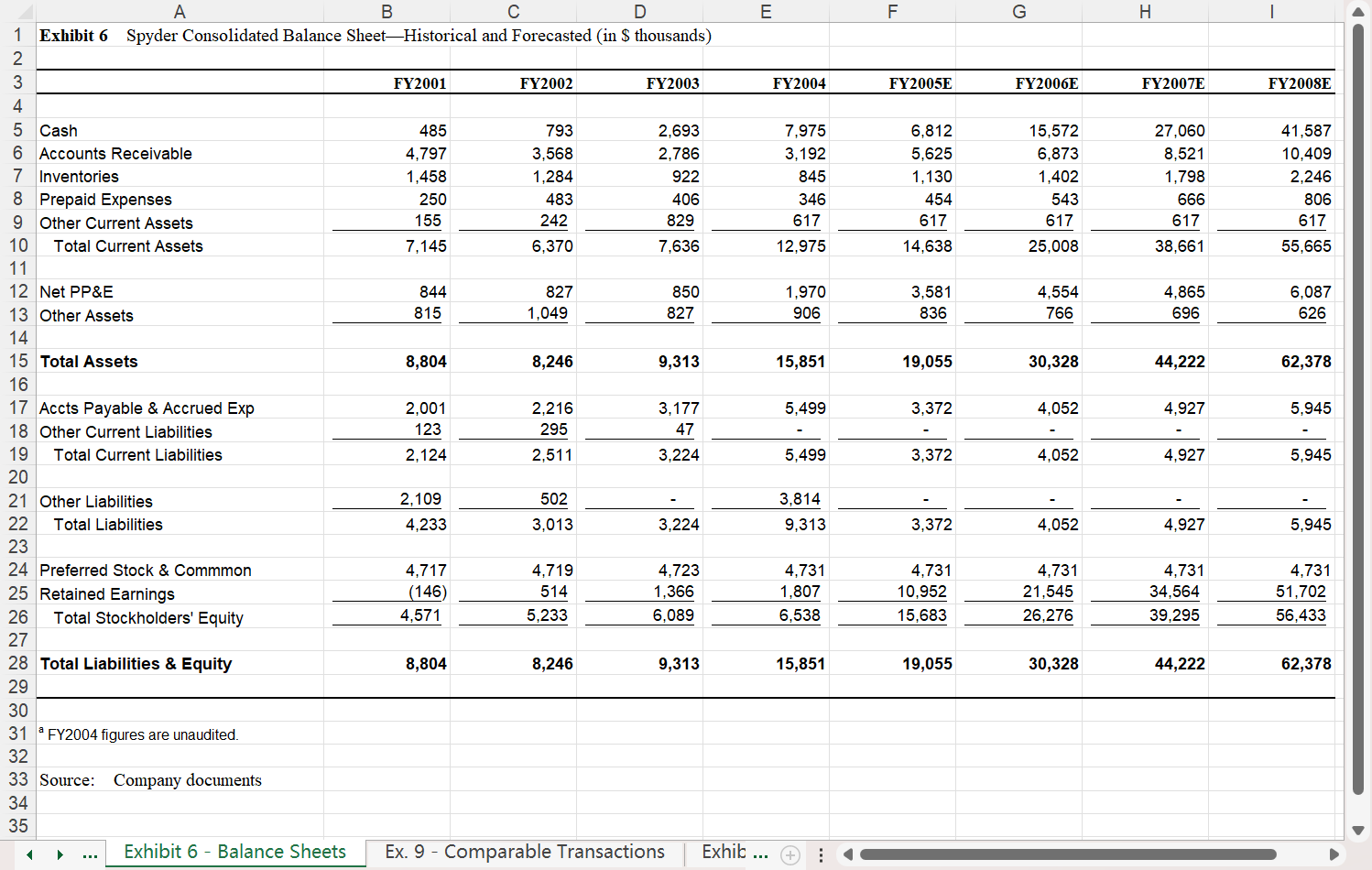

2. Find the equity value of Spyder using trading multiples. a) Use Exhibit 11 on comparable companies. Note that LTM Interest-Bearing Debt stands for net debt (i.e., debt excess cash), so to find enterprise value, you can simply use the sum of columns D and E in Exhibit 11. b) Find the average EV/Sales of comparable companies. c) Find the average EV/EBITDA of comparable companies. d) Use Exhibit 5 and the FY2004 Sales and EBITDA to find the enterprise value of Spyder in 2004 using the two average multiples you found in b) and c). You will get two different answers, one for each multiple. e) Use Exhibit 6 and the FY2004 balance sheet numbers to find the equity value of Spyder (Spyders debt in 2004 is given by the balance sheet item Other Liabilities). You will get two different answers, one for each multiple.

2. Find the equity value of Spyder using trading multiples. a) Use Exhibit 11 on comparable companies. Note that "LTM Interest-Bearing Debt" stands for net debt (i.e., debt - excess cash), so to find enterprise value, you can simply use the sum of columns D and E in Exhibit 11. b) Find the average EV/Sales of comparable companies. c) Find the average EV/EBITDA of comparable companies. d) Use Exhibit 5 and the FY2004 Sales and EBITDA to find the enterprise value of Spyder in 2004 using the two average multiples you found in b) and c). You will get two different answers, one for each multiple. e) Use Exhibit 6 and the FY2004 balance sheet numbers to find the equity value of Spyder (Spyder's debt in 2004 is given by the balance sheet item "Other Liabilities"). You will get two different answers, one for each multiple. 14 : Figures are in U.S. dollars for all companies except for Adidas-Salomon AG and Skis Rossignol SA, which are in Euros 15 b Estimated by 60 -month regression of stock returns on S\&P500 returns 16 'For companies that have dual share classes including one non-traded class, market value of equity is computed as the product of the publicly traded 17 share price by the total number of shares outstanding of all classes 18 'Traded in the Frankfurt stock exchange 19 : Fiscal quarter ending Jan 31, 2004 20 Fiscal quarter ending Feb 29, 2004 21 : Traded in the Paris stock exchange 22 23 Sources: Compiled from Bloomberg LP, accessed [May/2005], http://www.adidas-salomon.com, http://www.rossignolcorporate.com, Standard \& Poor's Compustat data, accessed Exhibit 10 - Comps Description Exhibit 11 - Comps Data 1 Exhibit 6 Spyder Consolidated Balance Sheet-Historical and Forecasted (in \$ thousands) a FY2004 figures are unaudited. Source: Company documents 35 1 - Exhibit 6 - Balance Sheets 1 Exhibit 5 Spyder Consolidated Income Statement and Cash Flow Adjustments-Historical and Forecasted (in $ thousands) a FY2004 figures are unaudited. Source: Company documents \begin{tabular}{c|c} Exhibit 6 - Balance Sheets & Ex. 9-... \end{tabular} 2. Find the equity value of Spyder using trading multiples. a) Use Exhibit 11 on comparable companies. Note that "LTM Interest-Bearing Debt" stands for net debt (i.e., debt - excess cash), so to find enterprise value, you can simply use the sum of columns D and E in Exhibit 11. b) Find the average EV/Sales of comparable companies. c) Find the average EV/EBITDA of comparable companies. d) Use Exhibit 5 and the FY2004 Sales and EBITDA to find the enterprise value of Spyder in 2004 using the two average multiples you found in b) and c). You will get two different answers, one for each multiple. e) Use Exhibit 6 and the FY2004 balance sheet numbers to find the equity value of Spyder (Spyder's debt in 2004 is given by the balance sheet item "Other Liabilities"). You will get two different answers, one for each multiple. 14 : Figures are in U.S. dollars for all companies except for Adidas-Salomon AG and Skis Rossignol SA, which are in Euros 15 b Estimated by 60 -month regression of stock returns on S\&P500 returns 16 'For companies that have dual share classes including one non-traded class, market value of equity is computed as the product of the publicly traded 17 share price by the total number of shares outstanding of all classes 18 'Traded in the Frankfurt stock exchange 19 : Fiscal quarter ending Jan 31, 2004 20 Fiscal quarter ending Feb 29, 2004 21 : Traded in the Paris stock exchange 22 23 Sources: Compiled from Bloomberg LP, accessed [May/2005], http://www.adidas-salomon.com, http://www.rossignolcorporate.com, Standard \& Poor's Compustat data, accessed Exhibit 10 - Comps Description Exhibit 11 - Comps Data 1 Exhibit 6 Spyder Consolidated Balance Sheet-Historical and Forecasted (in \$ thousands) a FY2004 figures are unaudited. Source: Company documents 35 1 - Exhibit 6 - Balance Sheets 1 Exhibit 5 Spyder Consolidated Income Statement and Cash Flow Adjustments-Historical and Forecasted (in $ thousands) a FY2004 figures are unaudited. Source: Company documents \begin{tabular}{c|c} Exhibit 6 - Balance Sheets & Ex. 9-... \end{tabular}